Post by zuolun on Sept 16, 2015 14:48:44 GMT 7

U.S. treasuries won't be the first victims of quantitative tightening ~ 16 Sep 2015

Debunking quantitative tightening in one paragraph ~ 14 Sep 2015

Will emerging economies cause global “quantitative tightening”? ~ 13 Sep 2015

Riksbank Stefan Ingves sees flaws in crisis-busting tools ~ 13 Sep 2015

Paying attention to China’s quantitative tightening ~ 11 Sep 2015

The uncertainties of China’s “quantitative tightening” ~ 10 Sep 2015

China is dumping U.S. debt ~ 10 Sep 2015

How ‘quantitative tightening’ could prompt a more dramatic equity exodus ~ 7 Sep 2015

How China’s cash injections add up to quantitative squeezing ~ 7 Sep 2015

Japan should brace for Chinese 'quantitative tightening' ~ 7 Sep 2015

Watch out … Here comes “quantitative tightening” ~ 7 Sep 2015

Quantitative tightening ~ 7 Sep 2015

Meet the evil twin of 'quantitative easing' ~ 6 Sep 2015

'Quantitative tightening' is a myth (But that doesn't mean there isn't a problem) ~ 2 Sep 2015

“Something” just happened! China’s gold stocks, dumping of US treasuries, "quantitative tightening”, oil markets ~ 1 Sep 2015

How to trade quantitative tightening, according to Deutsche bank ~ 1 Sep 2015

How the Fed leaves margin for error on rate hike ~ 9 Sep 2015

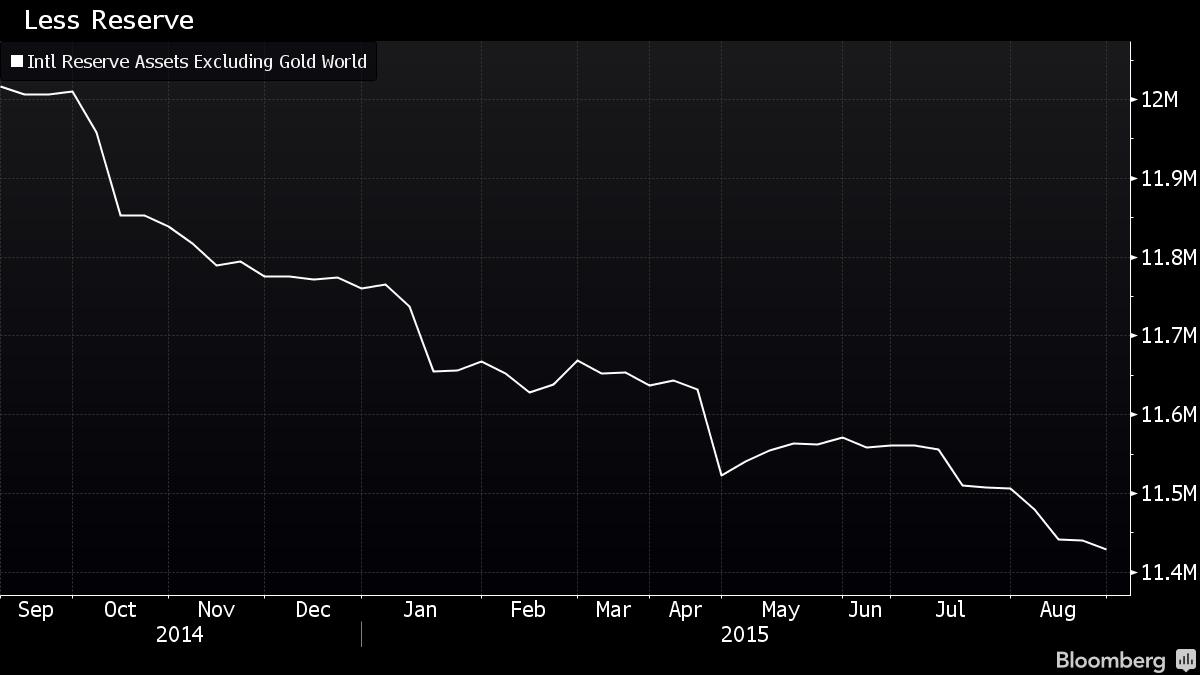

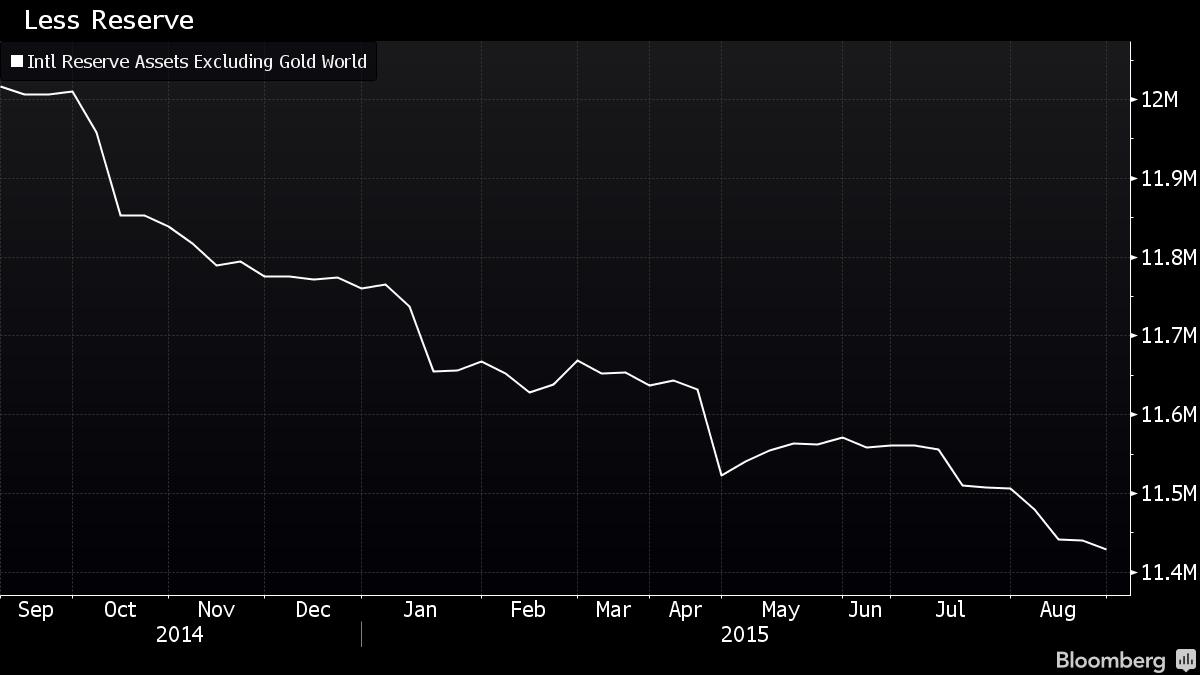

Welcome to “Quantitative Tightening” as $12 trillion reserves fall ~ 2 Sep 2015

The myth of “quantitative tightening” ~ 30 Aug 2015

Now comes “quantitative tightening”: A red dagger pointed at global ‘risk-on’ ~ 29 Aug 2015

Brace for QT, “quantitative tightening”, as China leads FX reserves purge ~ 28 Aug 2015

China's “quantitative tightening” is the real global economic threat ~ 27 Aug 2015

Deutsche Bank: It's Chinese 'quantitative tightening' that's been slamming markets around the world ~ 27 Aug 2015

Forget China, the FED needs to raise rates now ~ 18 Aug 2015

Beware China’s quantitative tightening ~ 17 Sep 2012

Does China really have $3.6tn in foreign reserves?

By Yoichi Takita

2 Sep 2015

Rumors that China is dumping U.S. Treasurys have made market players around the world skeptical about financial conditions in the world's second-largest economy.

The People's Bank of China, the country's central bank, on Aug. 25 cut interest rates and reserve requirement ratios for lenders. Immediately after the move, the People's Daily Online, the mouthpiece for the Communist Party, gave one reason for the bank's looser monetary policy. Given the decline in funds devoted to the purchase of foreign currency, and capital outflows stemming from the cheaper yuan in recent weeks, the lowering of reserve requirements will increase liquidity and help ease upward pressure on interest, the newspaper said in its online edition.

The yuan's devaluation on Aug. 11 has intensified capital outflows from China, making it increasingly difficult for the domestic financial market to raise funds. The People's Daily Online article tacitly acknowledges this problem.

Funds available for foreign currency purchases declined because the authorities had to sell Treasurys to meet demand for dollars and other foreign currencies associated with capital flight. "The PBOC has sold at least $106 billion of reserve assets in the last two weeks, including Treasurys, according to an estimate from Societe Generale," U.S. wire service Bloomberg reported Aug. 27.

Still at the top

Surprisingly, however, China's Treasury holdings have not declined much; it is still the largest overseas holder of U.S. government bonds, ahead of Japan. A key to the mystery is the decline in China's Treasury holdings in Belgium and Switzerland. China has been selling off bonds held in trust by Euroclear, a Belgium-based international clearing and settlement organization, and other institutions. China's foreign reserves stood at $3.99 trillion at the end of June 2014, falling to $3.65 trillion at the end of July this year.

The decline is undesirable from the perspective of the Chinese authorities, who see foreign reserves as a symbol of national prestige. Beijing is probably hoping to save face by maintaining its Treasury holdings.

China is still by far the largest holder of foreign reserves, so why is the country's cashflow problem being discussed in the media? The answer lies in the makeup of those reserves.

According to data from the U.S. Treasury Department, China's Treasury holdings -- $1.82 trillion -- were only about 45% of its total foreign reserves, even at their peak at the end of June 2014. Even if the bonds held by Euroclear and other institutions are included, Treasurys only amount to about half the total.

Turning sour

China invests some of that money in Euro bonds, Japanese government bonds and Japanese, U.S. and European stocks, but "it is unknown how China manages at least $1 trillion of foreign reserves," said a veteran market economist.

Another puzzle is that although the country's foreign reserves stood at $3.65 trillion at the end of July, foreign-currency assets held by the central bank amounted to 27.4 trillion yuan ($4.31 trillion). It thus appears the amount of money the bank has on hand exceeds China's foreign reserves, although the difference between the two would be a foreign exchange loss associated with the yuan's previous strength.

Market players are becoming increasingly concerned that China's foreign reserves might have been shifted to sovereign wealth funds and other financial instruments for unexplained purposes. Reserves have also been used to finance the China-led Silk Road Fund and the Asian Infrastructure Investment Bank.

China has aggressively invested in resource development in Africa and Latin America over the past decade or so, which may account for some of the missing cash.

The recent collapse of global commodity prices threatens the profitability of these African and Latin American projects. A substantial chunk of this investment must have been been wasted. That raises questions about whether the numbers on China's foreign reserves and the central bank's foreign-denominated assets are also being fudged.

The European sovereign debt crisis began with Greece's effort to hide its fiscal deficits. Doubts about the level of China's foreign reserves could spark new a financial crisis. Financial market watchers will be keeping a close eye on whether China is unloading U.S. Treasurys.

Yuan devaluation costs Hong Kong retailers ~ 1 Sep 2015

The truth about money (With Cullen Roche) ~ 17 Aug 2015

Debunking quantitative tightening in one paragraph ~ 14 Sep 2015

Will emerging economies cause global “quantitative tightening”? ~ 13 Sep 2015

Riksbank Stefan Ingves sees flaws in crisis-busting tools ~ 13 Sep 2015

Paying attention to China’s quantitative tightening ~ 11 Sep 2015

The uncertainties of China’s “quantitative tightening” ~ 10 Sep 2015

China is dumping U.S. debt ~ 10 Sep 2015

How ‘quantitative tightening’ could prompt a more dramatic equity exodus ~ 7 Sep 2015

How China’s cash injections add up to quantitative squeezing ~ 7 Sep 2015

Japan should brace for Chinese 'quantitative tightening' ~ 7 Sep 2015

Watch out … Here comes “quantitative tightening” ~ 7 Sep 2015

Quantitative tightening ~ 7 Sep 2015

Meet the evil twin of 'quantitative easing' ~ 6 Sep 2015

'Quantitative tightening' is a myth (But that doesn't mean there isn't a problem) ~ 2 Sep 2015

“Something” just happened! China’s gold stocks, dumping of US treasuries, "quantitative tightening”, oil markets ~ 1 Sep 2015

How to trade quantitative tightening, according to Deutsche bank ~ 1 Sep 2015

How the Fed leaves margin for error on rate hike ~ 9 Sep 2015

Welcome to “Quantitative Tightening” as $12 trillion reserves fall ~ 2 Sep 2015

The myth of “quantitative tightening” ~ 30 Aug 2015

Now comes “quantitative tightening”: A red dagger pointed at global ‘risk-on’ ~ 29 Aug 2015

Brace for QT, “quantitative tightening”, as China leads FX reserves purge ~ 28 Aug 2015

China's “quantitative tightening” is the real global economic threat ~ 27 Aug 2015

Deutsche Bank: It's Chinese 'quantitative tightening' that's been slamming markets around the world ~ 27 Aug 2015

Forget China, the FED needs to raise rates now ~ 18 Aug 2015

Beware China’s quantitative tightening ~ 17 Sep 2012

Does China really have $3.6tn in foreign reserves?

By Yoichi Takita

2 Sep 2015

Rumors that China is dumping U.S. Treasurys have made market players around the world skeptical about financial conditions in the world's second-largest economy.

The People's Bank of China, the country's central bank, on Aug. 25 cut interest rates and reserve requirement ratios for lenders. Immediately after the move, the People's Daily Online, the mouthpiece for the Communist Party, gave one reason for the bank's looser monetary policy. Given the decline in funds devoted to the purchase of foreign currency, and capital outflows stemming from the cheaper yuan in recent weeks, the lowering of reserve requirements will increase liquidity and help ease upward pressure on interest, the newspaper said in its online edition.

The yuan's devaluation on Aug. 11 has intensified capital outflows from China, making it increasingly difficult for the domestic financial market to raise funds. The People's Daily Online article tacitly acknowledges this problem.

Funds available for foreign currency purchases declined because the authorities had to sell Treasurys to meet demand for dollars and other foreign currencies associated with capital flight. "The PBOC has sold at least $106 billion of reserve assets in the last two weeks, including Treasurys, according to an estimate from Societe Generale," U.S. wire service Bloomberg reported Aug. 27.

Still at the top

Surprisingly, however, China's Treasury holdings have not declined much; it is still the largest overseas holder of U.S. government bonds, ahead of Japan. A key to the mystery is the decline in China's Treasury holdings in Belgium and Switzerland. China has been selling off bonds held in trust by Euroclear, a Belgium-based international clearing and settlement organization, and other institutions. China's foreign reserves stood at $3.99 trillion at the end of June 2014, falling to $3.65 trillion at the end of July this year.

The decline is undesirable from the perspective of the Chinese authorities, who see foreign reserves as a symbol of national prestige. Beijing is probably hoping to save face by maintaining its Treasury holdings.

China is still by far the largest holder of foreign reserves, so why is the country's cashflow problem being discussed in the media? The answer lies in the makeup of those reserves.

According to data from the U.S. Treasury Department, China's Treasury holdings -- $1.82 trillion -- were only about 45% of its total foreign reserves, even at their peak at the end of June 2014. Even if the bonds held by Euroclear and other institutions are included, Treasurys only amount to about half the total.

Turning sour

China invests some of that money in Euro bonds, Japanese government bonds and Japanese, U.S. and European stocks, but "it is unknown how China manages at least $1 trillion of foreign reserves," said a veteran market economist.

Another puzzle is that although the country's foreign reserves stood at $3.65 trillion at the end of July, foreign-currency assets held by the central bank amounted to 27.4 trillion yuan ($4.31 trillion). It thus appears the amount of money the bank has on hand exceeds China's foreign reserves, although the difference between the two would be a foreign exchange loss associated with the yuan's previous strength.

Market players are becoming increasingly concerned that China's foreign reserves might have been shifted to sovereign wealth funds and other financial instruments for unexplained purposes. Reserves have also been used to finance the China-led Silk Road Fund and the Asian Infrastructure Investment Bank.

China has aggressively invested in resource development in Africa and Latin America over the past decade or so, which may account for some of the missing cash.

The recent collapse of global commodity prices threatens the profitability of these African and Latin American projects. A substantial chunk of this investment must have been been wasted. That raises questions about whether the numbers on China's foreign reserves and the central bank's foreign-denominated assets are also being fudged.

The European sovereign debt crisis began with Greece's effort to hide its fiscal deficits. Doubts about the level of China's foreign reserves could spark new a financial crisis. Financial market watchers will be keeping a close eye on whether China is unloading U.S. Treasurys.

Yuan devaluation costs Hong Kong retailers ~ 1 Sep 2015

The truth about money (With Cullen Roche) ~ 17 Aug 2015