|

|

Post by zuolun on Dec 23, 2015 7:57:13 GMT 7

|

|

|

|

Post by odie on Dec 28, 2015 7:41:14 GMT 7

|

|

|

|

Post by odie on Dec 28, 2015 7:43:14 GMT 7

|

|

|

|

Post by zuolun on Feb 8, 2016 7:50:57 GMT 7

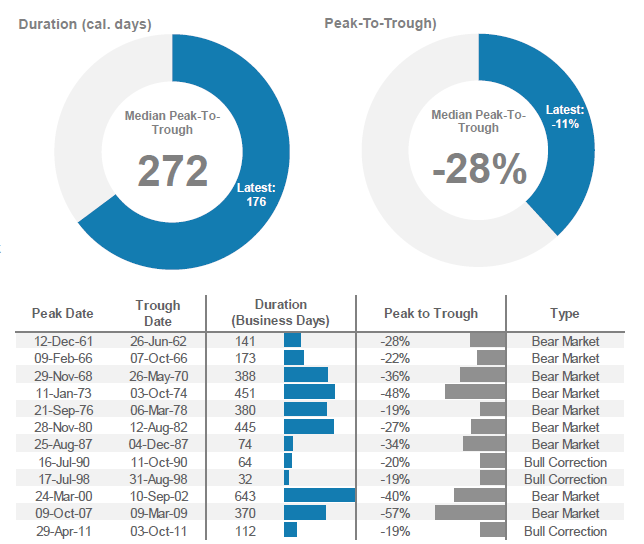

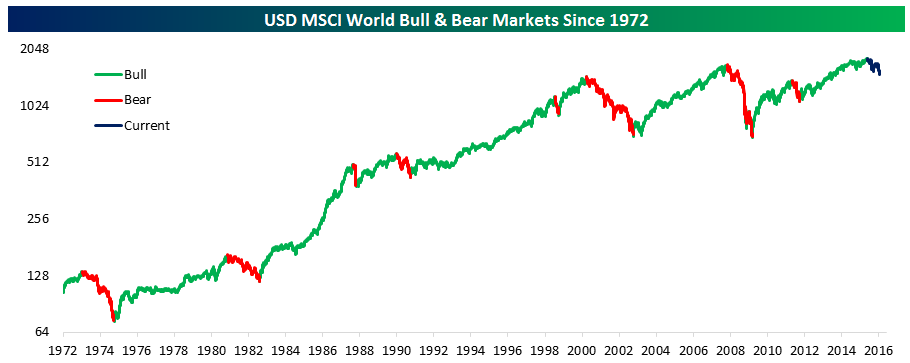

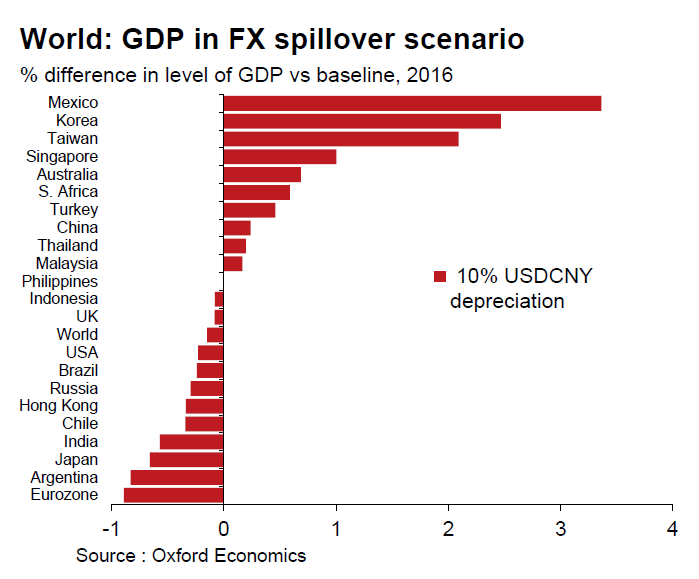

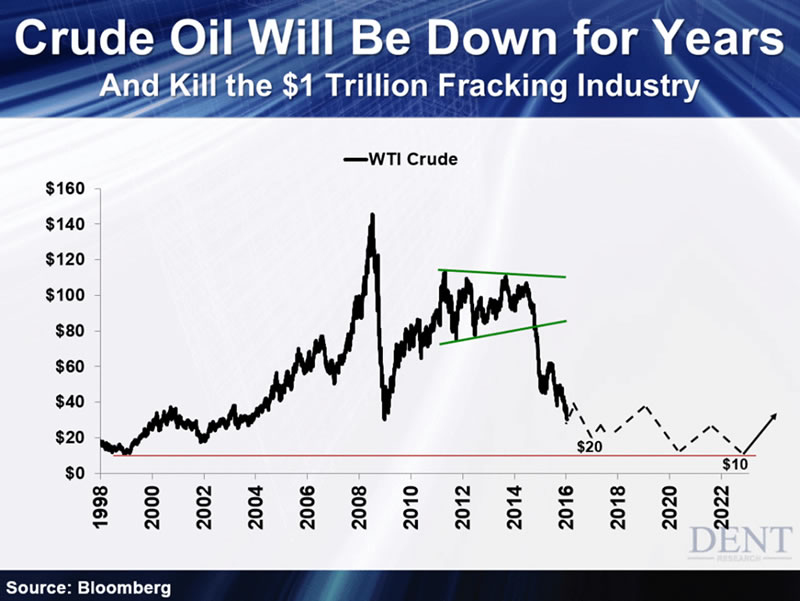

Morgan Stanley analyzed 43 bear markets and here's what it found ~ 22 Jan 2016  Global equities not yet in a bear market Global equities not yet in a bear market ~ 22 Jan 2016  How a further fall in China's Yuan could shake the world How a further fall in China's Yuan could shake the world ~ 22 Jan 2016  U.S. oil import binge: distorted derivatives or shale bust? U.S. oil import binge: distorted derivatives or shale bust? ~ 21 Jan 2016 World stocks enters technical 'bear market', down 20% from 2015 peak ~ 20 Jan 2015 Japanese stocks plunge into bear market as global rout deepens ~ 20 Jan 2016 Global index slides into bear market territory ~ 20 Jan 2016 Crude oil hit $32... but the worst is yet to come ~ 20 Jan 2015  道瓊跌不休..「轉空3訊號」已現? 胡立陽直言不妙背後 道瓊跌不休..「轉空3訊號」已現? 胡立陽直言不妙背後 ~ 20 Jan 2016 Crude oil may fall another $5-$15 per barrel: IMF ~ 23 Dec 2015 Oil prices: Is a historical spike poised to repeat itself? ~ 22 Dec 2015 Extreme oil bears bet on $25, $20 and even $15 a barrel in 2016 ~ 22 Dec 2015 IMF Executive Board concludes 2015 Article IV consultation with Iran ~ 21 Dec 2015 How oil's fall led to ISIS's rise ~ 21 Dec 2015 Goldman eyes $20 oil as glut overwhelms storage sites ~ 19 Nov 2015 OPEC expects North American shale oil output to jump ~ 8 Nov 2013 Goldman predicts oil price crash when storage tanks fill ~ 26 Oct 2015 How low can oil go? Goldman says $20 a barrel is a possibility ~ 11 Sep 2015 Oil-price slump could force U.S., non-OPEC suppliers to make deep cuts ~ 11 Sep 2015 How oil's dramatic plunge has changed the energy equation ~ 18 Feb 2015   The unstoppable downslide: Oil prices hit 5-1⁄2 year low The unstoppable downslide: Oil prices hit 5-1⁄2 year low ~ 31 Dec 2014 Why and how we should break OPEC now ~ 22 Jan 2014 US to surpass Saudi as top oil producer by 2016: IEA ~ 12 Nov 2013 The simple economics of commodity price speculation ~ 2 Apr 2013 The coming oil glut ~ 6 Nov 2012 Oil: The next revolution ~ 1 Jun 2012 The high cost of gambling on oil — "So what caused the huge spike in oil prices? Take a wild guess. Obviously Goldman had help - there were other players in the physical-commodities market - but the root cause had almost everything to do with the behavior of a few powerful actors destined to turn the once-solid market into a speculative casino. Goldman did it by persuading pension funds and other large institutional investors to invest in oil futures - agreeing to buy oil at a certain price on a fixed date. The push transformed oil from a physical commodity, rigidly subject to supply and demand, into something to bet on, like a stock. Between 2003 and 2008, the amount of speculative money in commodities grew from $13 billion to $317 billion, an increase of 2,300%. By 2008, a barrel of oil was traded 27 times, on average, before it was actually delivered and consumed." ~ 10 Apr 2012 John Arnold, the wunderkind gas trader ~ 24 Nov 2009 Goldman good but not that bad — 9 July 2009 Oil falls below $45, Goldman cuts forecast to $30 ~ 12 Dec 2008 An oracle of oil predicts $200-a-barrel crude ~ 21 May 2008 New 'super-spike' might mean $200 a barrel oil ~ 7 Mar 2008

|

|

|

|

Post by zuolun on Feb 10, 2016 13:54:43 GMT 7

|

|