|

|

Post by oldman on Oct 18, 2013 9:17:24 GMT 7

|

|

|

|

Post by oldman on Nov 15, 2013 6:48:43 GMT 7

I like the way Innopac wrote down the value of its investments by pegging the market price of these shares as at 11th November instead of 30th Sept. ---------------- Other operating (expenses) of S$16.0 million in the 9-months 2013 mainly comprised of fair value losses in investments held for trading amounting to S$63.8 million and fair value gains from derivative receivables and other assets of S$47.5 million. In 9-months 2012, the Group had other operating income of S$15.3 million. The Group’s investments held for trading based on the 30 September 2013

market prices had significantly higher value. However, due to the significant fall in the market prices of

the marketable securities in the investments held for trading portfolio, the valuation based on 30

September 2013 market prices is not a fair value as at the date of this announcement. Accordingly, the

Directors of the Company have decided to use the market closing prices as at 11 November 2013 for

the valuation of the marketable securities in the investments held for trading portfolio. infopub.sgx.com/FileOpen/Q3_FY2013.ashx?App=Announcement&FileID=264555 |

|

|

|

Post by zuolun on Nov 15, 2013 8:23:35 GMT 7

|

|

|

|

Innopac

Nov 16, 2013 13:49:14 GMT 7

Post by oldman on Nov 16, 2013 13:49:14 GMT 7

There is a good article in The Edge Malaysia entitled: The price of throwing caution to the wind. In it, there are some comments on Innopac. Do support the publication by subscribing to it. Ends by asking the question whether there is a loophoe in the share lending rules. Quality reporting.  |

|

|

|

Post by candy188 on Nov 16, 2013 16:42:14 GMT 7

There is a good article in The Edge Malaysia entitled: The price of throwing caution to the wind. In it, there are some comments on Innopac. Do support the publication by subscribing to it. Ends by asking the question whether there is a loophoe in the share lending rules. Quality reporting.  Drop the idea of lending my stocks considering the market risk of falling value of securities.   |

|

|

|

Post by oldman on Dec 1, 2013 19:35:34 GMT 7

Quite surprised to see Innopac issuing shares to part pay for an acquisition when their share price had collapsed from over 20cts to just over 3cts. Usually companies issue shares to acquire other companies when they feel that their share price is over valued as otherwise, it makes more commercial sense to pay for such acquisitions using cash.... of course, assuming that the company is able to gain access to the capital markets. ------------------------ The Purchase Consideration of S$17,100,000 shall be partly satisfied in cash (the “Cash Consideration”) and partly by the issuance of 300,000,000 new ordinary shares (the “Consideration Shares”) to the Vendor at an issue price of S$0.033 (the “Issue Price”). The Cash Consideration is S$7,200,000 and the Consideration Shares value is S$9,900,000. infopub.sgx.com/FileOpen/Innopac_Announcement_1_Dec_2013.ashx?App=Announcement&FileID=266310 |

|

|

|

Post by oldman on Apr 3, 2014 9:02:53 GMT 7

Sounds like part of the BAL saga.....

-----------

ORDER TO COMPANY FOR PROVISION OF INFORMATION AND DOCUMENTS

The board of directors (the “Board”) of Innopac Holdings Limited (the “Company”) wishes to

announce that Mr. Wong Chin-Yong, the Chief Executive Officer and executive director of the

Company has been requested by the Commercial Affairs Department (“CAD”) to assist with

investigations in relation to an offence under the Securities and Futures Act (Cap. 68) (the “SFA”).

The CAD has requested for access to, amongst others, all corporate electronic data from 1 January

2011 to-date, information technology equipment and data storage devices (if any) belonging to Mr.

Wong.

However, the CAD has not provided to Mr. Wong or the Company any further information on the

alleged offence (if any) or any other details on their investigations. The Board understands that these

CAD investigations may be protracted and there is no certainty of an outcome. At this juncture, the

Board is unaware if any offence has been committed.

Until such time as the results of the investigations are made complete, Mr. Wong shall continue as the

CEO of the Company.

The business and operations of the Company are not affected by the investigations and will continue

as normal.

The Company will monitor the progress of the investigation and make such further announcements as

required.

BY ORDER OF THE BOARD OF

INNOPAC HOLDINGS LIMITED

Wong Chin Yong

Managing Director & Chief Executive Officer

3 April 2014

|

|

|

|

Post by zuolun on Apr 3, 2014 17:19:55 GMT 7

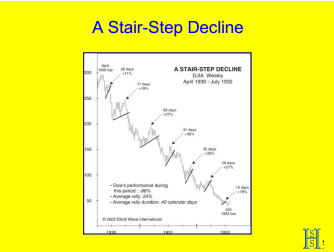

"A Stair-Step Decline" — A bearish longterm downtrend chart pattern  Innopac — A "Stair-Step Decline" chart pattern, expect share price to back down to S$0.008, the record low scored on 6 July 2011 Innopac — A "Stair-Step Decline" chart pattern, expect share price to back down to S$0.008, the record low scored on 6 July 2011

Innopac — The Elliott Wave Pattern as at 26 July 2013 [/quote]

|

|

|

|

Post by oldman on Apr 11, 2014 16:54:05 GMT 7

FURTHER INFORMATION TO THE COMPANY’S ANNOUNCEMENT OF 3 APRIL 2014

The Board of Directors (the “Board”) of Innopac Holdings Limited (the “Company”) wishes to

provide further information to the announcement of 3 April 2014.

The Commercial Affairs Department (“CAD”) had on 2 April 2014 also served orders to the

Company and 5 of its subsidiaries and a former associate company to handover computers, data

storage devices, files and financial records belonging to these entities. The Company and the

relevant subsidiaries have cooperated fully with the CAD.

The CAD orders are in connection to their investigation into an (alleged) offence under the

Securities and Futures Act, (Chapter 289) (“SFA”), for the period from 1 January 2011 to date.

Further, the Board has also been informed by Mr. Wong Chin Yong, Managing Director and CEO

of the Company, that he has surrendered his passport to the CAD in their investigation into the

offence of false trading and market rigging under Section 197 of the SFA. The CAD has also

informed Mr. Wong that he can apply to travel, if necessary.

At this juncture, the business and operations of the Company are not materially affected by the

investigation. The Company will make such further announcements as necessary.

By Order of the Board

Innopac Holdings Limited

Ong Kah Hock

Independent Director

11 April 2014

|

|

|

|

Post by zuolun on Apr 12, 2014 8:59:35 GMT 7

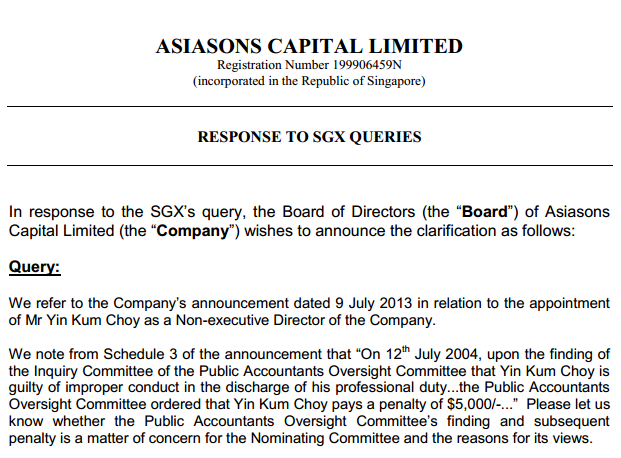

FURTHER INFORMATION TO THE COMPANY’S ANNOUNCEMENT OF 3 APRIL 2014 The Board of Directors (the “Board”) of Innopac Holdings Limited (the “Company”) wishes to provide further information to the announcement of 3 April 2014. The Commercial Affairs Department (“CAD”) had on 2 April 2014 also served orders to the Company and 5 of its subsidiaries and a former associate company to handover computers, data storage devices, files and financial records belonging to these entities. The Company and the relevant subsidiaries have cooperated fully with the CAD. The CAD orders are in connection to their investigation into an (alleged) offence under the Securities and Futures Act, (Chapter 289) (“SFA”), for the period from 1 January 2011 to date. Further, the Board has also been informed by Mr. Wong Chin Yong, Managing Director and CEO of the Company, that he has surrendered his passport to the CAD in their investigation into the offence of false trading and market rigging under Section 197 of the SFA. The CAD has also informed Mr. Wong that he can apply to travel, if necessary. At this juncture, the business and operations of the Company are not materially affected by the investigation. The Company will make such further announcements as necessary. By Order of the Board Innopac Holdings Limited Ong Kah Hock Independent Director 11 April 2014 oldman, One of the top management staffs, Yin Kum Choy, ex-Executive Director of Inno-Pacific Holdings Ltd (“IPH”) from 11 Sept 1998 to 31 May 2001, and ex-Executive Director of Ipco International Ltd from 1 July 1998 to 1 Feb 1999 was appointed as Independent non-executive director of Asiason Capital last year, 9 July 2013 and the SGX had ever queried the employment of such a director who was "guilty of improper conduct in the discharge of his professional duty". I believe the CAD may take a long time to unveil the cobwebs of the Ten (10) rotten stocks because these conpanies as well as their key management staffs are intertwined (past and present). “The Singapore Exchange and MAS have been promoting Singapore as a venue of listings where corporate governance is very high...if nothing is done on these three stocks, it will make a mockery of the Singapore stock exchange as a listing venue of good stocks.” — 4 Apr 2014  |

|

|

|

Post by oldman on Apr 12, 2014 9:23:50 GMT 7

Thanks. Yes, best not touch any of these stocks even at current prices as they are likely to drift lower given the uncertainties.

|

|

|

|

Post by oldman on Jun 5, 2014 16:58:41 GMT 7

Wonder who the counterparty is. --------------- PROFIT WARNING IN RELATION TO THE AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2013 The Board of Directors of Innopac Holdings Limited (the “Company”) wishes to announce that the Company will be reporting a larger loss in its Audited Group Financial Statements for year ended 31 December 2013 than it had reported in its Preliminary Results announced on 26 February 2014 released on SGXNet. The larger loss is due mainly to the additional provision for a derivative receivable transaction subsequent to the Preliminary Results. The Company had entered into an Agreement on 7 September 2013 to sell certain marketable

securities to a counterparty for a total consideration of about S$65 million. Due to the October 2013

stock market crash in Singapore the market prices of these securities fell significantly and the

counterparty has been unable to fulfil its obligation by 31 December 2013, the agreed completion

date. However, the counterparty has assured the Company that it will fulfil its obligations under the

agreement and in March 2014, the Company and the counterparty entered into a Variation Agreement

to the 7 September 2013 agreement. Pursuant to the Variation Agreement the completion date has

been extended to 31 December 2014 and the counterparty is required to provide collaterals to secure

its obligations. The counterparty has provided collaterals of about S$25 million and about S$34 million

of the obligation due from the counterparty remains unsecured. The directors of the Company have

decided, for prudential considerations, to make a provision of S$34 million for the unsecured amount

under the Agreement. The loss of the Group will increase by about S$34 million from that reported in

the Preliminary Results. This provision will be written back if the obligations of the counterparty are fulfilled and the Company’s profit will correspondingly increase by this amount. The Company expects to release the Annual Report 2013 together with the Audited Group Financial Statements for the year end 31 December 2013 on or about 12 June 2014. The Board of Directors wishes to advise shareholders and investors to exercise caution when dealing in the shares of the Company. By Order of the Board Innopac Holdings Limited Wong Chin Yong Managing Director 5 June 2014 infopub.sgx.com/FileOpen/Innopac_profit_warning.ashx?App=Announcement&FileID=300389 |

|

|

|

Post by oldman on Jun 23, 2014 8:48:24 GMT 7

I will not be surprised that the share price drops towards the 1ct level. Current share price: 1.7cts to buy. --------------------- 1. INTRODUCTION 1.1 The Directors (the “Directors”) of Innopac Holdings Limited (the “Company”) wishes to announce that the Company is proposing a renounceable non-underwritten rights issue of up to 6,930,364,990 new ordinary shares in the capital of the Company (the “Rights Shares”) and up to 3,465,182,495 free detachable warrants (the “Warrants”) (the “Rights cum Warrants Issue”), on the basis of two (2) Rights Shares and one (1) free detachable Warrant for every one (1) issued ordinary share (the “Shares”) in the capital of the Company held by the shareholders (the “Shareholders”), fractional entitlements to be disregarded, as at a books closure date to be determined by the Directors for the purpose of determining the Shareholders’ entitlements (the “Books Closure Date”) Principal Terms The Company is proposing to issue up to 6,930,364,990 Rights Shares, at an issue price of

S$0.01 for each Rights Share (the "Issue Price") and up to 3,465,182,495 free detachable

Warrants, with each Warrant carrying the right to subscribe for one (1) new Share in the capital of

the Company (the "Warrant Share") at an exercise price of S$0.012 (the "Exercise Price") for

each Warrant Share, on the basis of two (2) Rights Share and one (1) free detachable Warrant

for every one (1) issued Share in the capital of the Company held at the Books Closure Date, fractional entitlements to be disregarded. RATIONALE OF THE RIGHTS CUM WARRANTS ISSUE AND PROPOSED USE OF PROCEEDS The Company is undertaking the Rights cum Warrants Issue as a strategic initiative to raise funds to strengthen the financial position of the Group by increasing the Company’s working capital and capital base and to empower the Group with greater financial strength to capitalise on potential growth and acquisition opportunities. The Rights Issue Price of S$0.01 represents a discount of approximately 45% to the closing price of S$0.018 for each Share, based on the trades done on the SGX-ST on 20 June 2014, being the day of the release of this announcement. The Directors are of the view that the Rights Issue Price of S$0.01 for each Rights Share together with the relevant free Warrant is sufficiently attractive, and that there is no minimum amount that must be raised from the Rights cum Warrants Issue taking into consideration the intended use of proceeds set out in paragraph 2.4 below. In view of the foregoing, the Rights cum Warrants Issue will not be underwritten Assuming full subscription of the Rights Shares, the gross proceeds will be approximately

S$69.3million. The estimated net proceeds (the “Net Rights Issue Proceeds”) after deducting estimated expenses of approximately S$0.4 million will be approximately S$68.9million. The Company intends to utilise the Net Rights Issue Proceeds as follows: (a) 90% to fund the expansion and growth of existing businesses, acquisitions and new investments; and (b) 10% for general working capital purposes. infopub.sgx.com/FileOpen/Rights%20issue%20announcement%2020%20Jun%202014.ashx?App=Announcement&FileID=302223 |

|