|

|

UOB

Dec 10, 2013 23:35:31 GMT 7

Post by odie on Dec 10, 2013 23:35:31 GMT 7

Zuolun bro,

Noted with thanks

Think bloody mkt tmr

Bear market fri rally

|

|

|

|

UOB

Dec 11, 2013 11:09:14 GMT 7

Post by zuolun on Dec 11, 2013 11:09:14 GMT 7

UOB — Bearish symmetrical triangle breakout; interim TP S$20UOB broke the last line of defense, the 200d SMA support, now traded @ S$20.38 (-0.20, -1%) on 11 Dec 2013 at 12.17 noon. Immediate support @ S$20.28, immediate resistance @ $20.60.

|

|

|

|

UOB

Dec 12, 2013 16:48:08 GMT 7

oldman likes this

Post by zuolun on Dec 12, 2013 16:48:08 GMT 7

UOB — Bearish symmetrical triangle breakout; interim TP S$20

|

|

|

|

UOB

Dec 13, 2013 9:24:03 GMT 7

Post by odie on Dec 13, 2013 9:24:03 GMT 7

uob holds 49% of uis UOB proposes winding up of UIS Michelle Quah The Business Times Tuesday, Oct 29, 2013 United Overseas Bank (UOB) has proposed the winding up of its associate, United International Securities (UIS), to avoid more onerous responsibilities that will result from an impending new financial reporting standard (FRS). But the move, which will also give UIS shareholders a chance to realise their investments, was greeted with cheer by the market, which pushed UIS shares up 27 cents at the close on Friday. UOB this week announced the proposed winding up of UIS - in which it is deemed to own 49.4 per cent - because of the greater responsibilities that will be placed on the bank as a result of FRS 110. This comes just days after Singapore Exchange sent out a reminder that FRS 110 would be coming into effect soon, for annual periods beginning on or after Jan 1, 2014. FRS 110 makes control the basis for determining the entities to be included in consolidated financial statements; it is, therefore, expected to change the entities that are consolidated. In UOB's case, UIS will no longer be considered as an associate of the bank and will - under FRS 110 - have to have its accounts consolidated into the financial statements of UOB. UOB sent a letter to the shareholders of UIS, explaining that the consolidation of UIS's accounts would lead to: higher capital charges for UOB; greater operational challenges, in particular, those arising from having to perform internal credit evaluation on all investments held by UIS; and higher compliance costs to monitor the investments of UIS and their impact on UOB, and to consolidate the accounts of UIS. "In view of the impact of FRS 110, UOB has decided to exit its investment in UIS. UOB's decision to exit its investment in UIS should not be taken as any reflection of the viability of the company (UIS) as a going concern, or on the management, business or operations of the company," UOB's letter said. The bank has asked UIS's board of directors to requisition UIS to convene an extraordinary general meeting (EGM) to consider members' voluntary liquidation of UIS. UOB's letter said that the liquidation of UIS "offers an opportunity to all shareholders to realise their investments in UIS at a price closer to the NAV (net asset value) per share". Based on the unaudited consolidated financial statements of UIS for the nine months ended Sept 30, 2013, the consolidated NAV per share was $1.49, as at the end of that period. The consolidated net assets of UIS stood at $297.7 million. UIS shares have traded at between $1.08 and $1.21 for the 12 months prior to Sept 30, 2013, UOB's letter said. UIS shareholders obviously agreed with the benefits proposed by UOB; UIS shares closed 27 cents up on Friday on the news, at $1.395. UOB shares were down 3 cents at $20.79. The bank said that the liquidation of UIS is not expected to have any material impact on the earnings or the net tangible assets of the UOB group for the current financial year. - See more at: business.asiaone.com/news/uob-proposes-winding-uis#sthash.obYcdgCs.dpufinfopub.sgx.com/FileOpen/United%20International%20Securities%20Limited%20Circular%20Dated%2014%20November%202013.ashx?App=Prospectus&FileID=19801 |

|

|

|

UOB

Dec 16, 2013 14:47:41 GMT 7

oldman likes this

Post by zuolun on Dec 16, 2013 14:47:41 GMT 7

UOB @ S$20.07 (-0.17, -0.8%) on 16 Dec 2013 at 3.45pm.

|

|

|

|

UOB

Dec 16, 2013 15:03:43 GMT 7

Post by odie on Dec 16, 2013 15:03:43 GMT 7

noted with thanks zuolun bro

will continue to eat grass

LOL

|

|

|

|

UOB

Apr 15, 2014 12:11:48 GMT 7

odie likes this

Post by zuolun on Apr 15, 2014 12:11:48 GMT 7

|

|

|

|

UOB

Jul 3, 2014 15:56:50 GMT 7

oldman likes this

Post by zuolun on Jul 3, 2014 15:56:50 GMT 7

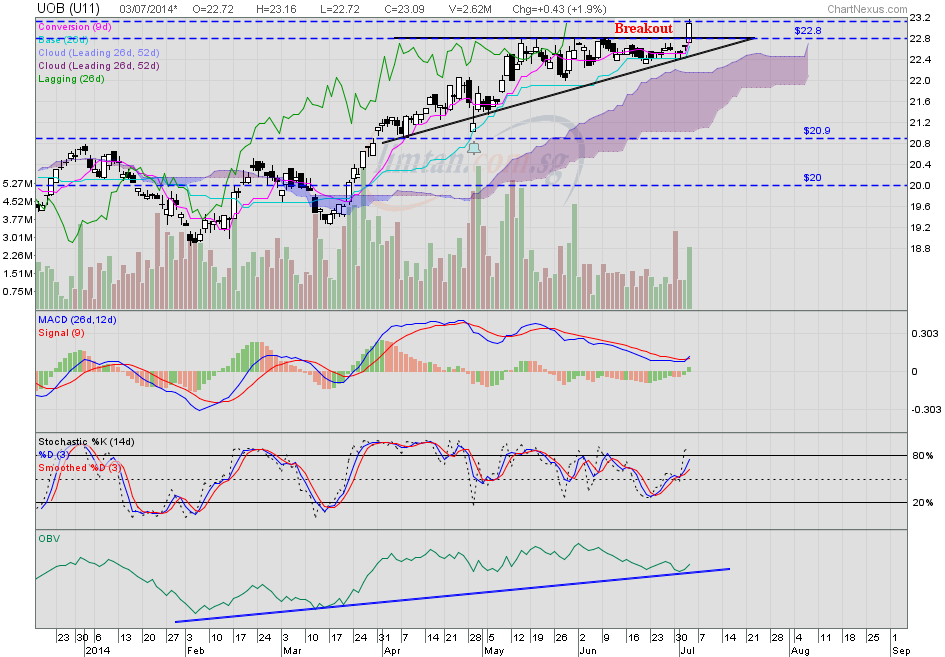

UOB — Blue-sky breakout potential upside interim TP @ S$23.83, next TP @ $24.72UOB had a long white marubozu @ S$23.09 (+0.43, +1.9%) with high volume done at 2.64m shares on 3 July 2014 at 4.40pm. Immediate support @ S$22.81 (resistance-turned-support), next support @ S$22.40, immediate resistance @ S$23.16, next resistance @ S$23.25.

|

|

|

|

UOB

Jul 4, 2014 14:05:46 GMT 7

oldman likes this

Post by zuolun on Jul 4, 2014 14:05:46 GMT 7

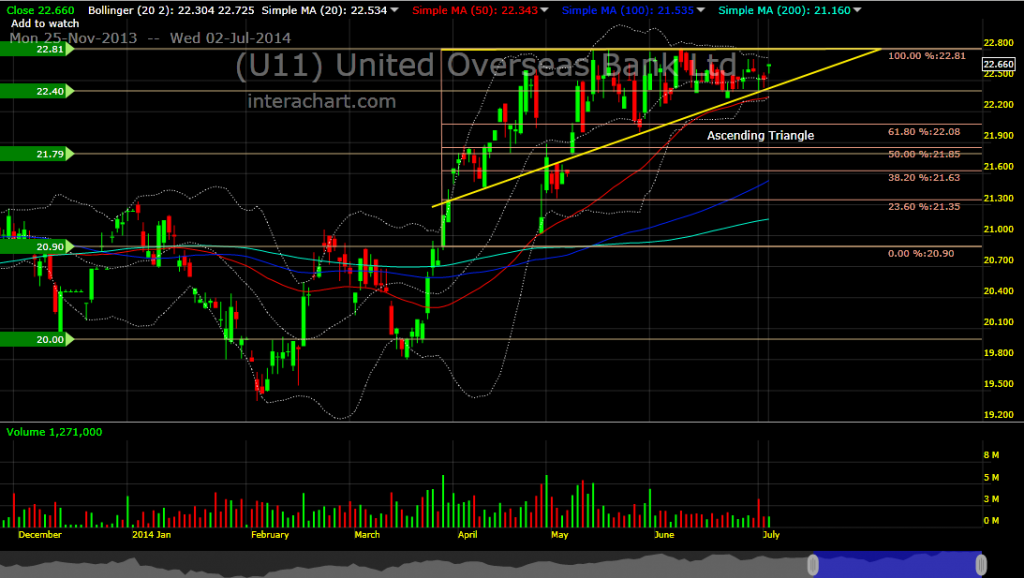

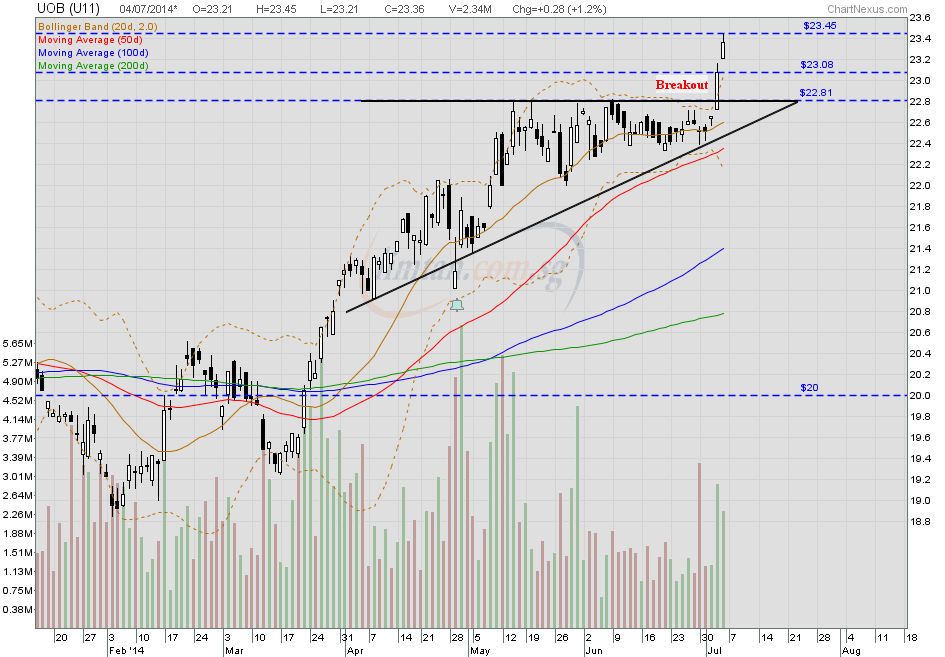

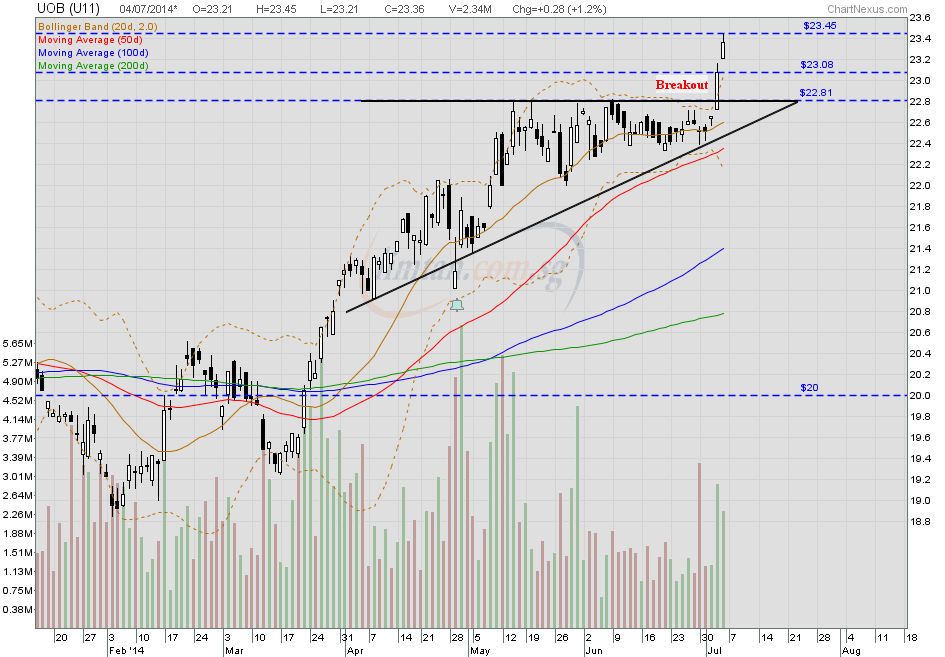

UOB next TP @ $24.72 is based on FIBO levels. However, potential TP may hit S$25 and above as a Blue-sky breakout means "the sky is the limit".  UOB — Bullish Bollinger Bands Breakout; potential upside interim TP @ S$23.83, next TP @ $24.72 UOB — Bullish Bollinger Bands Breakout; potential upside interim TP @ S$23.83, next TP @ $24.72UOB had a white marubozu @ S$23.36 (+0.28, +1.2%) with high volume done at 2.34m shares on 4 July 2014 at 3pm. Immediate support @ S$23.08, immediate resistance @ S$23.54. Chart Pattern Observations:

1) Strongly supported by the 20d SMA. 2) At early opening of the upper Bollinger Bands. 3) Potential "Three White Soldiers" formation.  UOB — Blue-sky breakout potential upside interim TP @ S$23.83, next TP @ $24.72UOB had a long white marubozu @ S$23.09 (+0.43, +1.9%) with high volume done at 2.64m shares on 3 July 2014 at 4.40pm. Immediate support @ S$22.81 (resistance-turned-support), next support @ S$22.40, immediate resistance @ S$23.16, next resistance @ S$23.25.  |

|

|

|

UOB

Jul 5, 2014 9:21:42 GMT 7

oldman likes this

Post by zuolun on Jul 5, 2014 9:21:42 GMT 7

Singapore bank lending up 1.1% in May — 30 Jun 2014 UOB — Bullish Bollinger Bands Breakout; potential upside interim TP @ S$23.83, next TP @ $24.72UOB closed with a white marubozu @ S$23.38 (+0.30, +1.3%) with high volume done at 3.25m shares on 4 July 2014. Immediate support @ S$23.08, immediate resistance @ S$23.54. Chart Pattern Observations:

1) Strongly supported by the 20d SMA. 2) At early opening of the upper Bollinger Bands. 3) Potential "Three White Soldiers" formation. Conclusion: Potential TP may hit S$25 and above as a Blue-sky breakout means "the sky is the limit".

|

|

|

|

UOB

Jul 5, 2014 17:18:08 GMT 7

oldman likes this

Post by zuolun on Jul 5, 2014 17:18:08 GMT 7

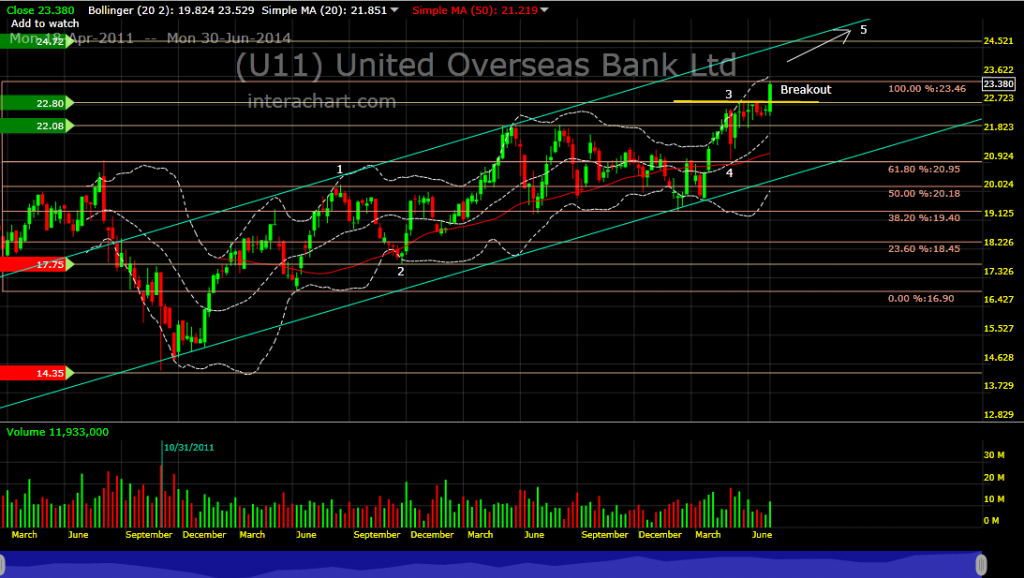

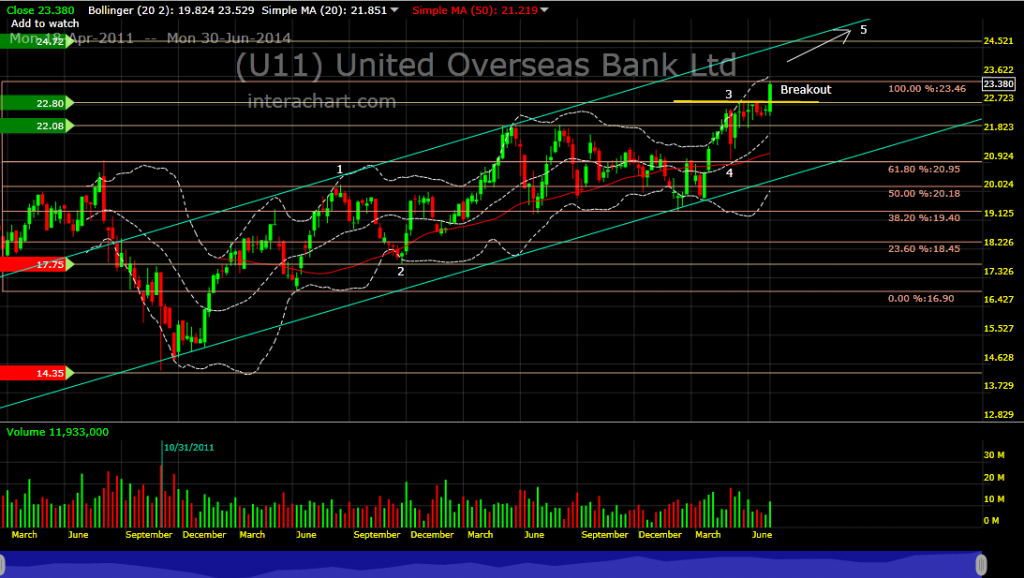

UOB — The Elliott Wave Pattern

|

|

|

|

UOB

Jul 10, 2014 15:42:59 GMT 7

oldman likes this

Post by zuolun on Jul 10, 2014 15:42:59 GMT 7

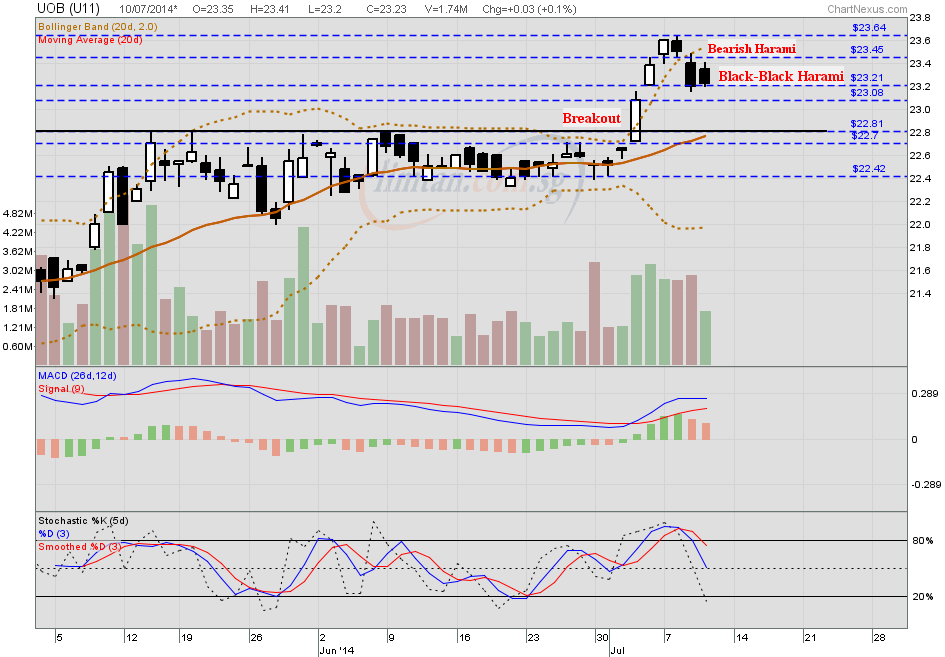

UOB — Black-Black Harami UOB had an unusual Black-Black Harami @ S$23.23 (+0.03, +0.1%) with 1.74m shares done on 10 July 2014 at 4.35pm.

|

|

|

|

UOB

Jul 11, 2014 12:12:00 GMT 7

oldman likes this

Post by zuolun on Jul 11, 2014 12:12:00 GMT 7

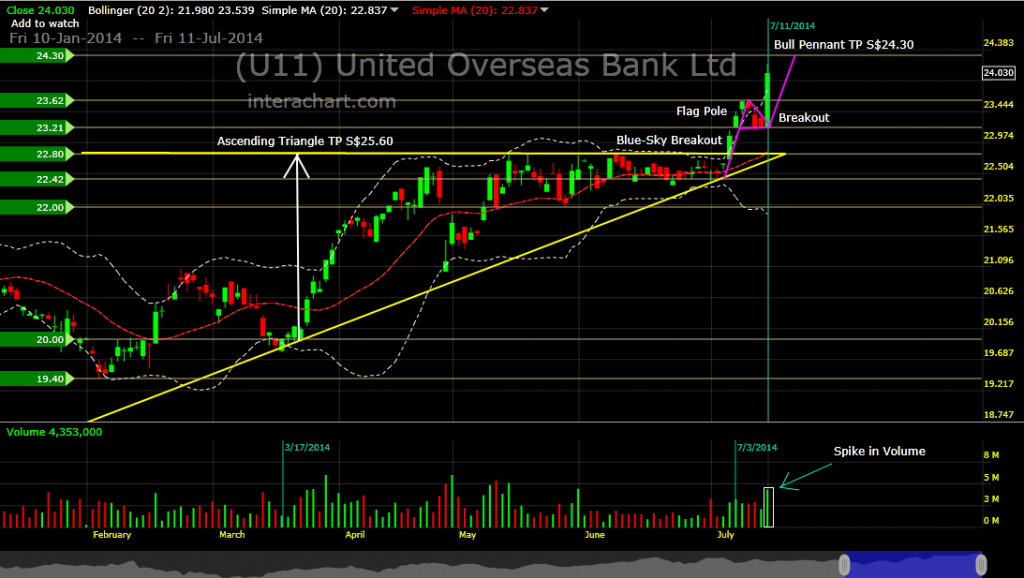

The Black-Black Harami, an unusual two candlesticks chart pattern formed yesterday was technically a potential short-term bearish trend reversal in an uptrend which signaled a probable continual pullback, after the sudden spike on UOB's Blue-sky breakout @ S$22.81 on 3 July 2014. However, today's price action and trading volume with a long white marubozu, the 3rd candle formed had negated the supposedly black-black harami pullback and confirmed a bull pennant breakout, instead. In short, it's a bear trap due to severe short-squeeze on the latest new bears past 3 days dated 8th, 9th and 10th of July 2014; expect more upside than downside. UOB — Bull Pennant Breakout, potential interim TP $24.30, next TP @ $24.72UOB had a long white marubozu @ S$24.06 (+0.86, +3.7%) with 2.58m shares done on 11 July 2014 at 1.30pm.  UOB next TP @ $24.72 is based on FIBO levels. However, potential TP may hit S$25 and above as a Blue-sky breakout means "the sky is the limit".  UOB — Bullish Bollinger Bands Breakout; potential upside interim TP @ S$23.83, next TP @ $24.72 UOB — Bullish Bollinger Bands Breakout; potential upside interim TP @ S$23.83, next TP @ $24.72UOB had a white marubozu @ S$23.36 (+0.28, +1.2%) with high volume done at 2.34m shares on 4 July 2014 at 3pm. Immediate support @ S$23.08, immediate resistance @ S$23.54. Chart Pattern Observations:

1) Strongly supported by the 20d SMA. 2) At early opening of the upper Bollinger Bands. 3) Potential "Three White Soldiers" formation.  |

|

|

|

UOB

Jul 13, 2014 6:53:11 GMT 7

oldman likes this

Post by zuolun on Jul 13, 2014 6:53:11 GMT 7

UOB — The Power of the 20d SMAUOB closed with a long white marubozu @ S$24.03 (+0.83, +3.6%) with high volume done at 4.35m shares on 11 July 2014. Immediate support @ S$23.62, strong support @ S$22.80, immediate resistance @ S$24.25, next resistance @ S$24.72. Chart Pattern Observations:

- Strongly supported by the 20d SMA; price is tightly hugging the upper Bollinger Bands.

- Based on the Elliott Wave pattern, it is currently riding on the sub-wave (i) of wave-5 up.

- Bull pennant breakout potential TP S$24.30; ascending triangle breakout potential TP S$25.60.

- A Blue-sky breakout means "the sky is the limit", potential TP may hit much higher.

- “I can calculate the motion of heavenly bodies but not the madness of people.” ― Isaac Newton

|

|

|

|

UOB

Jul 13, 2014 20:13:29 GMT 7

Post by odie on Jul 13, 2014 20:13:29 GMT 7

zuolun bro,

there is a gap up on 4 July for UOB

Hope it is not an island top

|

|