|

|

Post by oldman on Dec 4, 2013 8:40:39 GMT 7

Blumont has fallen 1.5cts to 8.2cts, Asiasons to 11.2cts and LionGold to 15.8cts. I think those stuck are now realising that the game is over. I will not be surprised that these shares move much lower in the months ahead. Pity all those retail investors who are caught in this high stakes game. For me, I rather remain a spectator.

When elephants fight, it is the grass that suffers.

|

|

|

|

Post by oldman on Dec 4, 2013 13:23:08 GMT 7

With so many lawsuits related to the fiasco, maybe instead of the acronym ABL, we should use BAiL!

|

|

|

|

Post by oldman on Jan 13, 2014 6:47:15 GMT 7

There is a very good article in Straits Times today on the role of offshore brokers in the Singapore stock market. Basically, the report by Interactive Brokers suggests that Singaporeans may have opened offshore accounts to 'play' some of these stocks. If one opens an account with a local broker, one has to reveal quite a bit of financial information on yourself. But if one opens an offshore broking account, so long as one is not a Singaporean or residing in Singapore, he does not need to reveal much info. Apparently, it is quite easy to open an offshore broking account using a Malaysian ID and address. For those of us with access to ST Online, the link is here: Offshore broker's role in penny stock crash

--------------- Interactive noted that Algo often accounted for "substantial portions of the volume of total daily trades in LionGold shares, and even exceeded 80 per cent of the total trading volume on certain days".

The same trading pattern exists in Asiasons, where Algo's trading volume "was as much as 67 per cent on some days".

"(Algo) often sold a large block of shares at a given price in one or more of the (parties') accounts, then quickly re-purchased approximately the same number of shares at the same price, putting the accounts back where they started, but giving the market the appearance that the stocks were more heavily traded than they really were," it alleged. |

|

|

|

Post by zuolun on Apr 3, 2014 7:52:57 GMT 7

|

|

|

|

Post by oldman on Apr 3, 2014 13:54:26 GMT 7

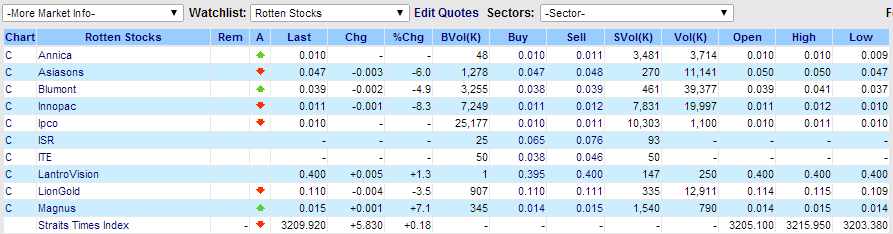

Annica just announced a trading halt. Would not be surprised that this is related to the BAL issue. Companies that have announced trading halts today include IPCO, ISR, ITE, Magnus Energy and Innopac. What an eventful day for the market...

|

|

|

|

Post by zuolun on Apr 3, 2014 15:07:42 GMT 7

|

|

|

|

Post by oldman on Apr 3, 2014 20:08:45 GMT 7

Reminds me of the detective movies where they gather a lot of people and hope that some of them will rush to get their stories out first.... this should be an interesting movie to watch....

|

|

|

|

Post by zuolun on Apr 3, 2014 20:29:06 GMT 7

Reminds me of the detective movies where they gather a lot of people and hope that some of them will rush to get their stories out first.... this should be an interesting movie to watch....   |

|

|

|

Post by oldman on Apr 5, 2014 5:36:31 GMT 7

|

|

|

|

Post by zuolun on Apr 5, 2014 10:15:44 GMT 7

|

|

|

|

Post by oldman on Apr 5, 2014 10:23:41 GMT 7

If you define rotten stocks this way, your list of stocks may well exceed 50 stocks! Without these churning stocks, our markets will be really boring! I must admit that I tikamed LantroVision at one time.  |

|

|

|

Post by zuolun on Apr 5, 2014 10:44:11 GMT 7

If you define rotten stocks this way, your list of stocks may well exceed 50 stocks! Without these churning stocks, our markets will be really boring! I must admit that I tikamed LantroVision at one time.  oldman, LantroVision has the same DNA from the grand master of the Ten (10) rotten stocks. FYI, the top 10 stocks in volume in the SGX are always penny and micro penny stocks. Simply put, the top best trading stocks (penny and micro penny stocks) in the SGX are the most profitable stocks to the house, not the players (big and small). The same logic applies to The world's oldest profession in Singapore...it's the house who reaps the most profits, not the participants (big and small).  |

|

|

|

Post by zuolun on Apr 7, 2014 13:16:42 GMT 7

|

|

|

|

Post by oldman on Apr 9, 2014 10:49:06 GMT 7

Low volumes of these stocks and dwindling share prices may suggest that the smart money may have already left the party....

|

|

|

|

Post by zuolun on Apr 9, 2014 17:42:00 GMT 7

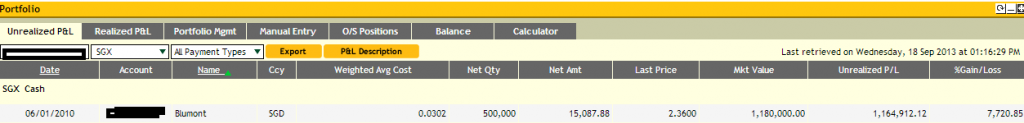

In the stock market, turnaround/bottom-picking play is the toughest gameplay. Retail players love it as it has the highest returns if played correctly = Multibagger Stocks (四两博千金) But the hidden risk is position sizing, i.e. you could win big but also lose big. Example 1: Blumont Cost of shares500,000 shares X S$0.0302 = S$15,087 Market value of shares as at 18 Sep 2013 (Prior to the collapse on 3 Oct 2013)

500,000 shares X S$2.36 = S$1,180,000  Low volumes of these stocks and dwindling share prices may suggest that the smart money may have already left the party....  Ten (10) rotten stocks as at 7 Apr 2014 at 1.25pm Ten (10) rotten stocks as at 7 Apr 2014 at 1.25pm Ten (10) rotten stocks as at 4 Apr 2014 Ten (10) rotten stocks as at 4 Apr 2014 |

|