|

|

Post by zuolun on Nov 13, 2013 23:04:44 GMT 7

|

|

|

|

Post by oldman on Nov 14, 2013 7:28:04 GMT 7

|

|

|

|

Post by zuolun on Nov 16, 2013 14:51:02 GMT 7

|

|

|

|

Post by zuolun on Nov 20, 2013 9:52:08 GMT 7

|

|

|

|

Post by zuolun on Nov 23, 2013 16:04:25 GMT 7

People who were in privileged positions benefited from the latest news/information but... The mantis stalks the cicada, unaware of the oriole behind 螳螂捕蝉,黄雀在后。Another interesting full page article in the Edge Singapore this week....  |

|

|

|

Post by zuolun on Nov 27, 2013 14:04:16 GMT 7

Third penny stock case against Goldman: Mr James Hong, an executive director at Blumont is suing global bank Goldman Sachs. — 27 Nov 2013 People who were in privileged positions benefited from the latest news/information but... The mantis stalks the cicada, unaware of the oriole behind 螳螂捕蝉,黄雀在后。Another interesting full page article in the Edge Singapore this week....

|

|

|

|

Post by oldman on Nov 30, 2013 6:45:20 GMT 7

|

|

|

|

Post by zuolun on Nov 30, 2013 9:43:46 GMT 7

|

|

|

|

Post by zuolun on Dec 2, 2013 10:38:00 GMT 7

I feel sorry for those investors who did not read the entire press release and thought that the acquisition price was 40cts as this number was frequently mentioned by the press. The acquisition price of Blumont shares is subject to adjustment. The final acquisition price will be the volume weighted average price of the Group’s shares between the date of the agreement and closing of the transaction subject to a floor price of S$0.20 per share and ceiling price of S$0.60 per share. Closing is expected to take place within 30 daysFull press release dated 7th Oct 2013: infopub.sgx.com/FileOpen/BGL_AlexPR.ashx?App=Announcement&FileID=258965-------------- Mr. Molyneux has informed the Company that the parties to the Acquisition have agreed to

extend the completion period of the Acquisition by 30 days. The Acquisition is now expected to

be completed on or before 6 December 2013. — 30 Nov 2013 Successful mining entrepreneur, Alex Molyneux, acquires an interest in 5.2% of Blumont, nominated to lead the Group as Chairman — 7 Oct 2013 Three penny stocks suffer further pounding

No end to woes as Asiasons, Blumont, LionGold are bumped off MSCI index

Goh Eng Yeow, Straits Times 30 November 2013 Asiasons Capital, LionGold Corp and Blumont Capital suffered further selling this week as they were bumped off an international stock index widely tracked by fund managers. All three counters had been components of the MSCI Global Small Cap Index. But on Nov 7, the index provider said it would be dropping the trio from the prestigious market benchmark. . . . . . . Now that Mr Neo’s assets have been frozen, traders are wondering if Mr Molyneux will still be able to consummate the deal when the one-month extension expires next Friday, 6 December 2013.

|

|

|

|

Post by zuolun on Dec 2, 2013 12:01:34 GMT 7

|

|

|

|

Post by zuolun on Dec 3, 2013 9:27:37 GMT 7

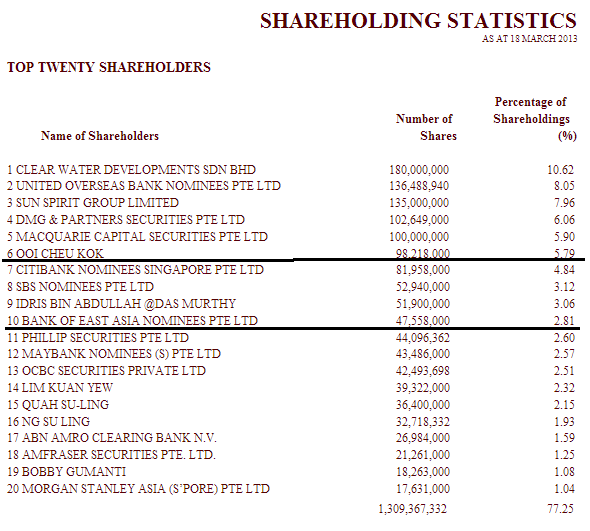

Blumont Group Ltd - Why didn't four of its directors fully subscribe to the rights shares? — 6 Nov 2013 (Goh Boon Kok – the lead independent director of Blumont and an independent director of SuperGroup - is the only director who exercised all of his 1.5 mln rights.)Blumont Group Ltd - Did outgoing chairman make S$16.57 mln just hours before Friday's slump? — 10 Oct 2013 Mr Billy Ooi Cheu Kok was a substantial shareholder of Blumont until he sold down his stake in the mining group to less than 5%. Mr Ooi held 123.26 million shares, or a 4.77% stake, as of Oct 23. (**No. 6 — Ooi Cheu Kok held a substantial stake in Blumont of 9.82% or 169,118,000 shares on Oct 3.) Financial adviser, bank new players in penny stock saga — 30 Nov 2013 Separately, court records show that a unit of The Bank of East Asia has joined the fray. Its Singapore branch has sought the court's permission to change the injunction order which freezes the assets of six individuals and two companies. (**No. 10 — Bank of East Asia Nominees Pte Ltd held a stake in Blumont of 2.81% or 47,558,000 shares on Mar 18.) The eight parties collectively owe Interactive Brokers more than $79 million (see box).

1. Neo Kim Hock: $26,525,072.34 2. Peter Chen Hing Woon: $16,438,225.94 3. Tan Boon Kiat: $15,302,788.95 4. Quah Su-Ling: $10,184,256.75 5. Lee Chai Huat: $4,095,137.49 6. Kuan Ah Ming: $1,460,881.50 7. Sun Spirit Group: $4,779,593.44 8. Neptune Capital Group: $264,372.45 TOTAL: $79,050,328.86**Blumont Top 20 Shareholders as at 18 Mar 2013

|

|

|

|

Post by oldman on Dec 3, 2013 20:02:03 GMT 7

Zuolun, trying to piece the jigsaw together is mind stimulating. One possibility is that they really know how to use other people's money.

They probably pledged shares for cash with Goldman Sachs. When their shares went up in price, they can then get more cash from GS. Let's assume the share price went up 4 times, this means that $1 mil of original shares will get them a loan of $4 mil. They then go to a broker and put this cash in a margin account. They can then have margins of 2.5 times the cash. In other words, the original $1 mil worth of shares may loan them $10 mil. The higher the share price goes, the more loans they can get to buy even more shares and through simple demand and supply, the share price is most likely to continue rising and the cycle continues.

Maybe someone got smart and left the party early....

|

|

|

|

Post by zuolun on Dec 3, 2013 22:26:35 GMT 7

Zuolun, trying to piece the jigsaw together is mind stimulating. One possibility is that they really know how to use other people's money. They probably pledged shares for cash with Goldman Sachs. When their shares went up in price, they can then get more cash from GS. Let's assume the share price went up 4 times, this means that $1 mil of original shares will get them a loan of $4 mil. They then go to a broker and put this cash in a margin account. They can then have margins of 2.5 times the cash. In other words, the original $1 mil worth of shares may loan them $10 mil. The higher the share price goes, the more loans they can get to buy even more shares and through simple demand and supply, the share price is most likely to continue rising and the cycle continues. Maybe someone got smart and left the party early.... oldman, I agreed except the last sentence: "Maybe someone got smart and left the party early...." I believed all the players involved knew the rules & their specific roles in the game, well. The likely scenario maybe due to the commission and/or profit-sharing originally agreed upon, didn't materialize. ==〉 分赃不均窝里反! How do you feel after you had provided loans & professional services to someone but didn't get paid accordingly? |

|

|

|

Post by oldman on Dec 4, 2013 4:33:25 GMT 7

Yes, this is even better than a Chinese soap opera. If all the players are tight lipped, I don't think it is easy for any external party to know how the game is played.  |

|

|

|

Post by oldman on Dec 4, 2013 5:39:53 GMT 7

Penny stock players named in lawsuits

On one side is recently appointed Unionmet (Singapore) chairman and chief executive Tony Li Hua and two companies associated with him: Sunmax Global Capital and Hua Xin Innovation Incubator.

The other side includes Mr Soh; Blumont Group chairman Neo Kim Hock; Ipco International chief executive Quah Su-Ling; Innopac Holdings chief executive Wong Chin Yong; and LionGold Corp director of business and corporate development Peter Chen Hing Woon.

According to court documents, that dispute involved certain loan and extension agreements, among other issues, in which some of the plaintiffs allegedly borrowed from Sunmax Global Capital Fund 1 and pledged shares as security for the loans.

www.singaporelawwatch.sg/slw/index.php/headlines/33995-penny-stock-players-named-in-lawsuits?utm_source=web%20subscription&utm_medium=web

|

|