|

|

Post by victor on Oct 12, 2014 1:39:55 GMT 7

James Pang was saying Pacific Radiance have their own shipyard and are building and maintaining better then nam cheong when audience asked them on competitive edge. If one never do their homework and study the company, all hope are gone. By homework, do you means going through the balance sheet? But like someone point out, the balance sheet could be manipulated to look good . So how are we gg to base our homework on. We have seen Enron who balance sheet had bluff investers for years. Can share then how one should do their homework? What should we base on? Thanks |

|

|

|

Post by kenjifm on Oct 12, 2014 2:42:33 GMT 7

1. Circle of Competence - you need to know how the company operates to make money with what you are familiar with/without economic moat

2. Understand the cycle of the market - This will lead you to a top down approach or a bottom up approach.

3. The chosen approach must be justify with the annual report for at least 5 years.

4. Your objective in this business for the justified result - long, short or mid? dividend and/or growth?

5. Money Management from your chosen objective.

|

|

|

|

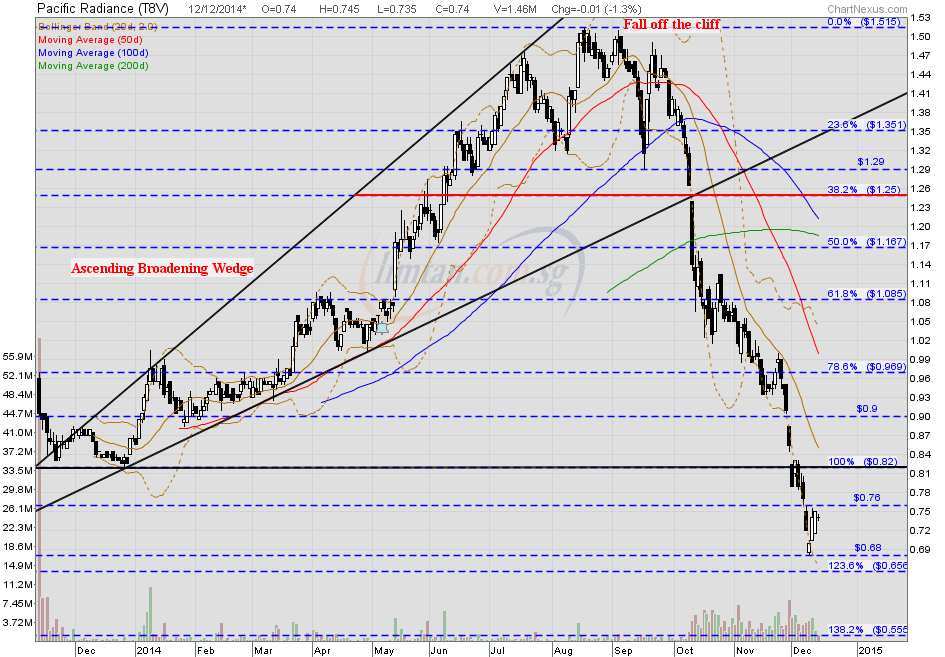

Post by zuolun on Dec 12, 2014 9:27:30 GMT 7

Pacific Radiance — Blumont-pattern-stock, interim TP S$0.555Pacific Radiance had a bearish harami cross @ S$0.74 (-0.01, -1.3%) with 1.46m shares done on 12 Dec 2014 at 10.20am. Immediate support @ S$0.68, immediate resistance S$0.76.  I spent only 10 min looking quickly at the IPO prospectus and this is not the type of share I am interested in. Hence, I decided not to investigate further. If you read my article on IPO stocks above and see the pictures below, you will understand my reasoning. oldman, Chartwise, Pacific Radiance has a strong "cheng Kay" + good gatekeeper since its IPO, any stock price can be "goreng" up up up with these 2 key factors. Same as RH Petrogas; with a strong "cheng Kay" + plenty of good gatekeepers, no -ve impact on the share price even after profit warning issued as it was mainly driven by TA, not FA. These kind of stocks are classified as Bliumont-pattern-stock.  Pacific Radiance — Ascending Triangle breakout Pacific Radiance — Ascending Triangle breakoutPacific Radiance had a shooting star @ S$1.18 (+0.015, +1.3%) with volume done at 2.16m shares on 19 May 2014 at 2.10pm.

|

|

|

|

Post by zuolun on Apr 13, 2015 14:36:14 GMT 7

Pacific Radiance ~ Potential Complex Bottom ReversalPacific Radiance closed with a spinning top @ S$0.69 (+0.015, +2.2%) with volume done at 5.18m shares on 10 Apr 2015. Immediate support @ S$0.66, immediate resistance @ S$0.73.

|

|