jays

Junior Member

Posts: 6

|

Post by jays on Nov 14, 2013 11:18:56 GMT 7

2nd day of listing. Now 0.91, close to IPO price at 0.90.

Never really perform.

Going forward, can it perform?

+ve: good profit growth +100%, low PER, oil & gas play

-ve: profit looks good due to sale of assets

|

|

|

|

Post by oldman on Nov 14, 2013 13:04:59 GMT 7

|

|

|

|

Post by oldman on Nov 14, 2013 13:36:29 GMT 7

I spent only 10 min looking quickly at the IPO prospectus and this is not the type of share I am interested in. Hence, I decided not to investigate further. If you read my article on IPO stocks above and see the pictures below, you will understand my reasoning.  --------------------------------------------------------------------------------------  --------------------------------------------------------------------------------------  --------------------------------------------------------------------------------------  IPO prospectus: pacificradiance.listedcompany.com/misc/prospectus_nov_2013.pdf |

|

jays

Junior Member

Posts: 6

|

Post by jays on Nov 15, 2013 12:07:25 GMT 7

Thanks, Oldman

|

|

|

|

Post by zuolun on May 19, 2014 13:15:35 GMT 7

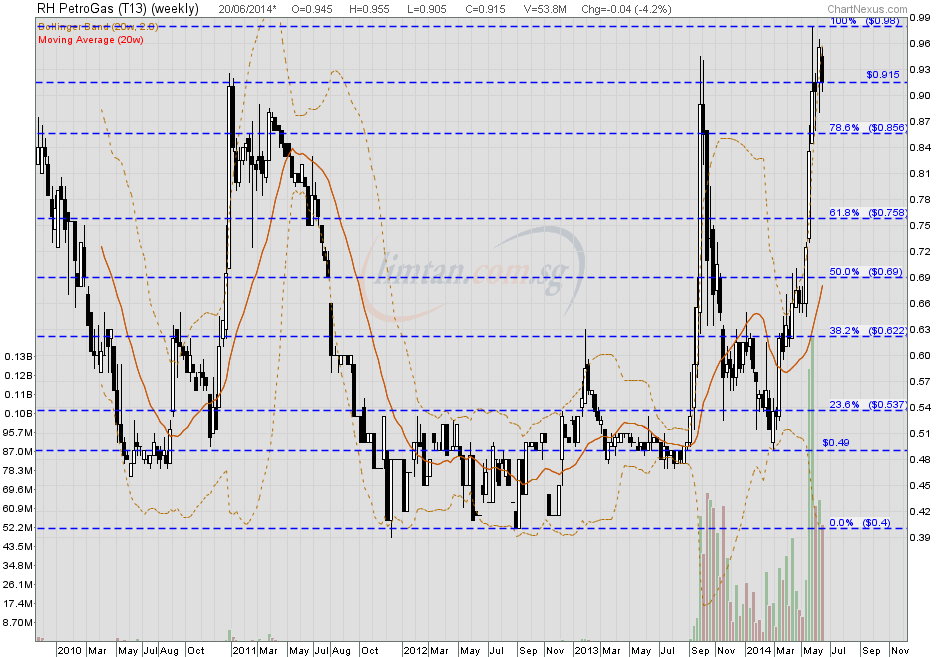

I spent only 10 min looking quickly at the IPO prospectus and this is not the type of share I am interested in. Hence, I decided not to investigate further. If you read my article on IPO stocks above and see the pictures below, you will understand my reasoning. oldman, Chartwise, Pacific Radiance has a strong "cheng Kay" + good gatekeeper since its IPO, any stock price can be "goreng" up up up with these 2 key factors. Same as RH Petrogas; with a strong "cheng Kay" + plenty of good gatekeepers, no -ve impact on the share price even after profit warning issued as it was mainly driven by TA, not FA. These kind of stocks are classified as Bliumont-pattern-stock.  Pacific Radiance — Ascending Triangle breakout Pacific Radiance — Ascending Triangle breakoutPacific Radiance had a shooting star @ S$1.18 (+0.015, +1.3%) with volume done at 2.16m shares on 19 May 2014 at 2.10pm.  |

|

|

|

Post by victor on Sept 4, 2014 22:13:41 GMT 7

Hi

Pacific Radiance result was very good. I understand it is a new stock. So it may not provide much of a information. But can I ask you for a second opinion on this counter. Can we vest here for long term. So far it show it is doing fine so far. Thanks

victor

|

|

|

|

Post by oldman on Sept 5, 2014 6:41:08 GMT 7

Do see Zuolun's post above. If you like to ride with the momentum, this may be a stock for you. For me, I am a fundamental investor and as stated in my investment book, it is not that difficult for companies going for IPO to show better results in the year of the IPO. Much safer to see the results in the following years before investing your hard earned money. As always, I may be wrong. Do read carefully the chapter in my book on IPO stocks. Hi Pacific Radiance result was very good. I understand it is a new stock. So it may not provide much of a information. But can I ask you for a second opinion on this counter. Can we vest here for long term. So far it show it is doing fine so far. Thanks victor |

|

|

|

Post by victor on Sept 5, 2014 10:17:10 GMT 7

Thank you very much, Oldman. I fully agree with your explanation.

|

|

|

|

Post by zuolun on Sept 6, 2014 5:41:26 GMT 7

Do see Zuolun's post above. If you like to ride with the momentum, this may be a stock for you. For me, I am a fundamental investor and as stated in my investment book, it is not that difficult for companies going for IPO to show better results in the year of the IPO. Much safer to see the results in the following years before investing your hard earned money. As always, I may be wrong. Do read carefully the chapter in my book on IPO stocks. Hi Pacific Radiance result was very good. I understand it is a new stock. So it may not provide much of a information. But can I ask you for a second opinion on this counter. Can we vest here for long term. So far it show it is doing fine so far. Thanks victor oldman, Pacific Radiance's chart pattern indicates that the major cheng kay is getting ready to run road liao...  One of the Elliott Wave rules stated that Wave-3 cannot be the shortest wave. - Rule 1: Wave 2 cannot retrace more than 100% of Wave 1.

- Rule 2: Wave 3 can never be the shortest of the three impulse waves.

- Rule 3: Wave 4 can never overlap Wave 1.

Usually for commodities, Wave-5 will be the longest wave; while for stocks, Wave-3 will be the longest wave and a minimum target for Wave-5 is 100% of Wave-1. Pacific Radiance — Ascending Broadening Wedge, crucial support @ S$1.42  |

|

|

|

Post by zuolun on Sept 7, 2014 10:17:01 GMT 7

I think it is best to avoid all oil and gold related stocks including those that provide services to these firms. There will certainly be opportunities in the future as these are cyclical industries. Just that one has to be patient and pick the stocks up at their lows. Right now, it is a good time to do the research on such stocks and get ready.  oldman, The way you looked at Pacific Radiance's IPO data reminds me of RH Petrogas IPO prospectus and its subsequent rights issues (twice). Someone did a similar FA on RH Petrogas the same way as you did; by tracing back to its IPO data and found something interesting in its IPO prospectus, printed in smaller print.  |

|

|

|

Post by zuolun on Sept 8, 2014 15:24:44 GMT 7

|

|

|

|

Post by zuolun on Sept 16, 2014 16:24:45 GMT 7

Pacific Radiance — Double Top BreakoutPacific Radiance closed with a hammer @ S$1.315 (-0.03, -2.2%) with 1.01m shares done on 16 Sep 2014. Immediate support @ S$1.245, immediate resistance @ S$1.36.  oldman, Pacific Radiance's chart pattern indicates that the major cheng kay is getting ready to run road liao...  One of the Elliott Wave rules stated that Wave-3 cannot be the shortest wave. - Rule 1: Wave 2 cannot retrace more than 100% of Wave 1.

- Rule 2: Wave 3 can never be the shortest of the three impulse waves.

- Rule 3: Wave 4 can never overlap Wave 1.

Usually for commodities, Wave-5 will be the longest wave; while for stocks, Wave-3 will be the longest wave and a minimum target for Wave-5 is 100% of Wave-1. Pacific Radiance — Ascending Broadening Wedge, crucial support @ S$1.42

|

|

|

|

Post by zuolun on Oct 10, 2014 14:08:05 GMT 7

Pacific Radiance's major cheng kay run road liao... Pacific Radiance — Ascending Broadening Wedge Breakout, Interim TP S$0.985Pacific Radiance gapped down with a long black marubozu @ S$1.16 (-0.105, -8.3%) with 2.73m shares done on 10 Oct 2014 at 2.55pm. Immediate support @ S$1.085, immediate resistance @ S$1.25.  |

|

|

|

Post by zuolun on Oct 10, 2014 15:46:44 GMT 7

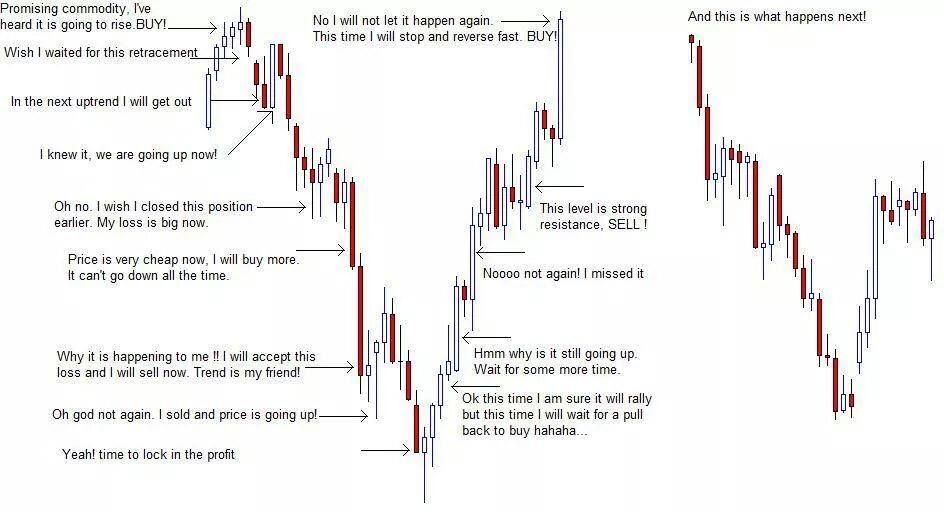

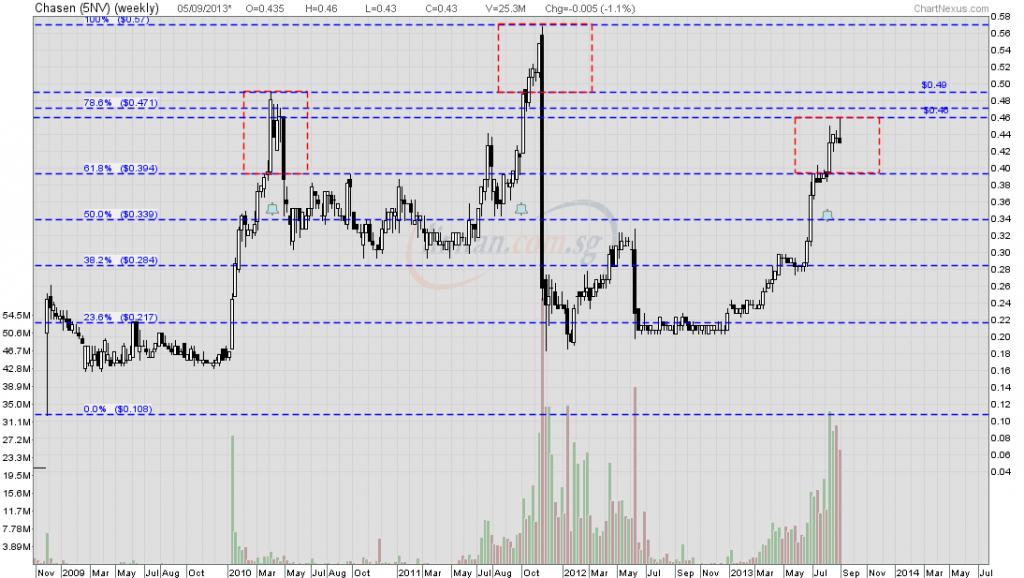

I was at a lim and tan seminar and Pacific Radiance was recommended. I hope no one follow blindly. Based on the chart and trading volume pattern, Pacific Radiance's major cheng kay and all its gatekeepers had already run road liao... Those who went in near or at the peak kena stuck high and dry...got to suck thumb now. These kind of stocks are classified as Blumont-pattern-stock.  Below is one naked chart showing how the "cheng kay" plays the game, well. As long as he/she has a major stake-on-hand, the chart pattern is drawn according to his/her position (buy/sell). If retail players dare go against him/her, be prepared to lose big in the game.  This type of chart pattern always appears when there is only one single major "cheng kay" in full control of a stock. Examples: RH PetroGas and Chasen (See below).   |

|

|

|

Post by kenjifm on Oct 10, 2014 16:06:06 GMT 7

James Pang was saying Pacific Radiance have their own shipyard and are building and maintaining better then nam cheong when audience asked them on competitive edge.

If one never do their homework and study the company, all hope are gone.

|

|