|

|

Post by zuolun on Aug 5, 2014 11:56:24 GMT 7

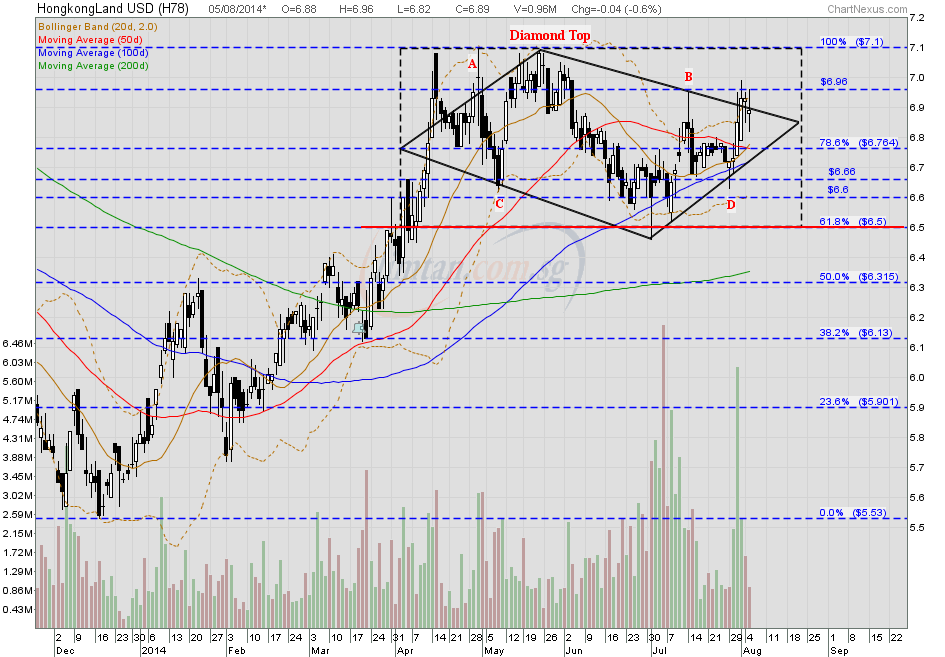

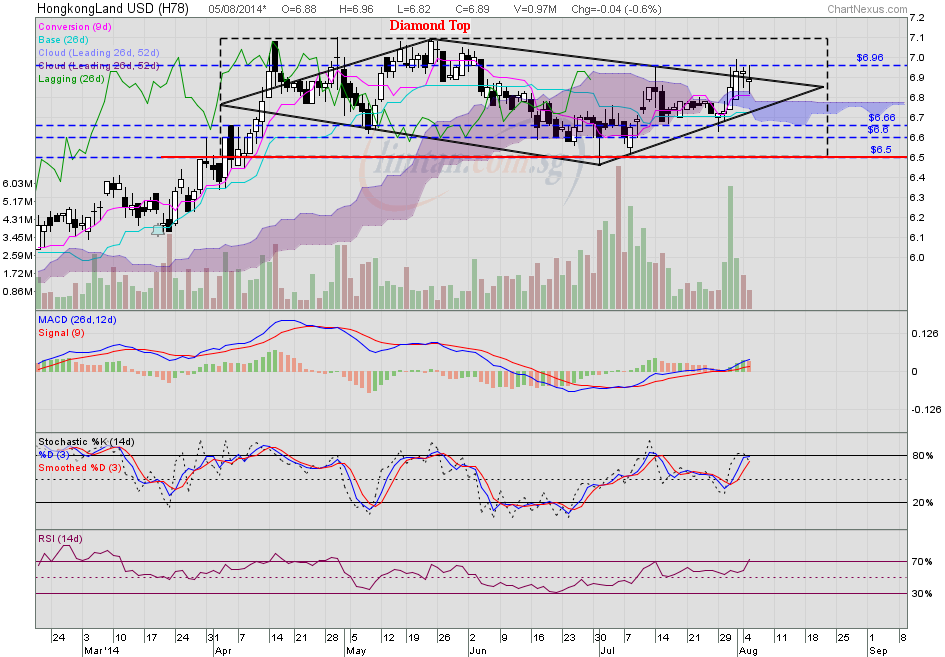

HKLand — Diamond Top Formation; crucial support @ $6.60HKLand had a spinning top @ $6.89 (-0.04, -0.6%) with 960 lots done on 5 Aug 2014 at 12.50 noon.

|

|

|

|

Post by zuolun on Sept 10, 2014 18:03:55 GMT 7

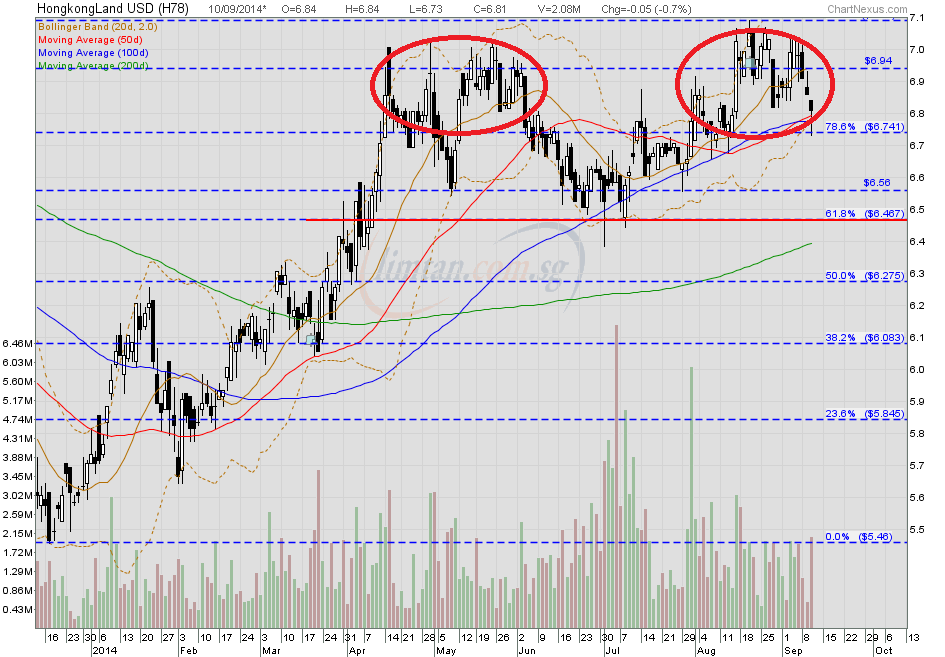

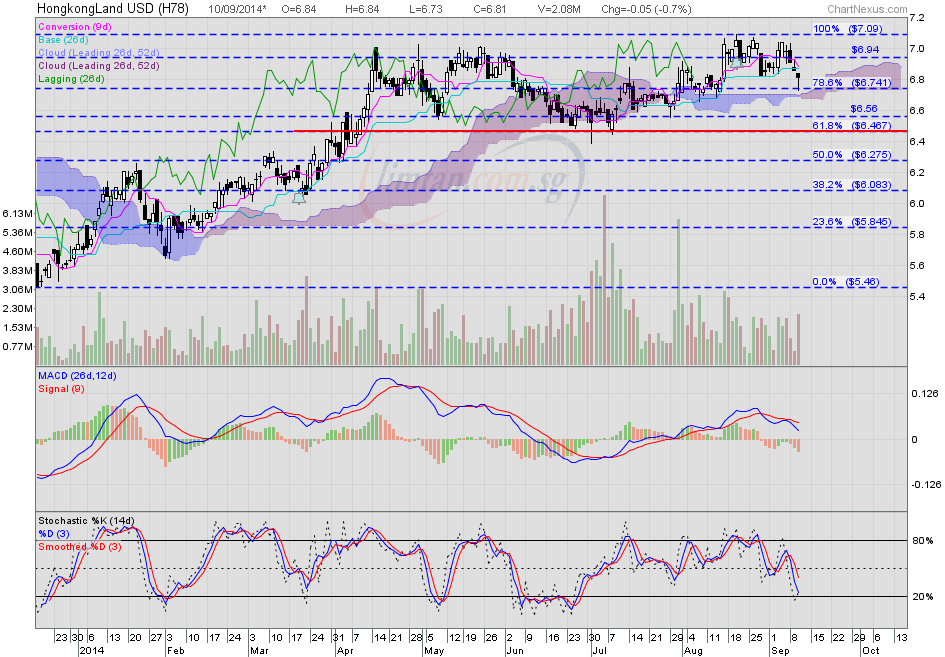

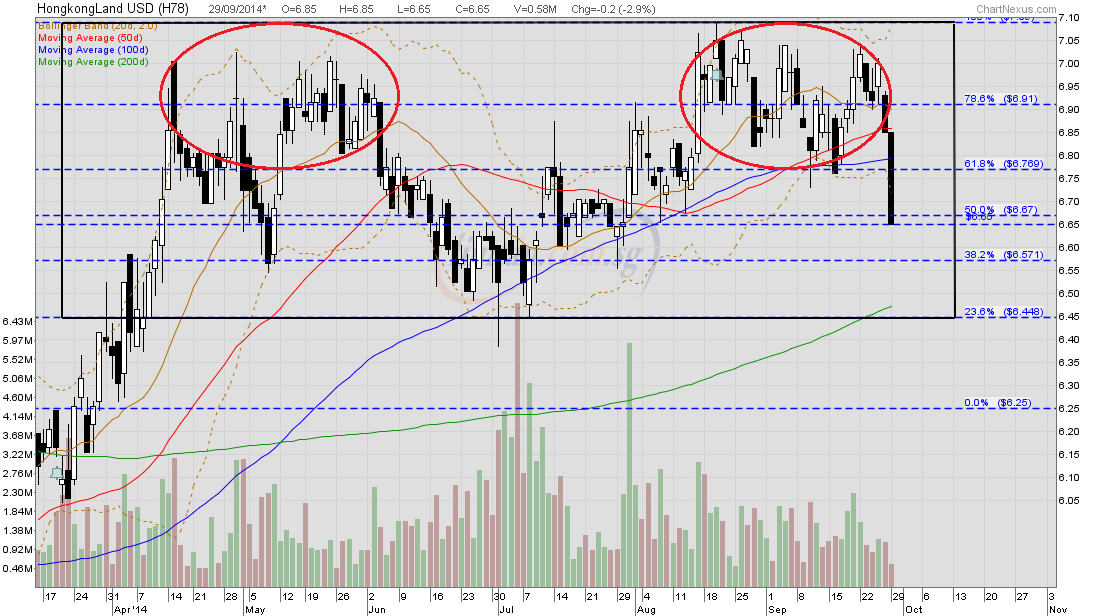

HKLand USD — Double Top FormationHKLand closed with a hammer @ US$6.81 (-0.05, -0.7%) with 2.08m shares done on 10 Sep 2014. Immediate support @ US$6.74, immediate resistance @ US$6.94.

|

|

|

|

Post by zuolun on Sept 29, 2014 8:35:25 GMT 7

Cheng Kay not scared you win money, he only afraid that you stop and quit gambling!

对于庄家而言,不怕你赢钱,就怕你不玩!HKLand USD — Double Top FormationHKLand had a long black marubozu @ US$6.65 (-0.20, -2.9%) with 580 lots done on 29 Sep 2014 at 9.15am. Immediate support @ US$6.57, immediate resistance @ US$6.91.

|

|

|

|

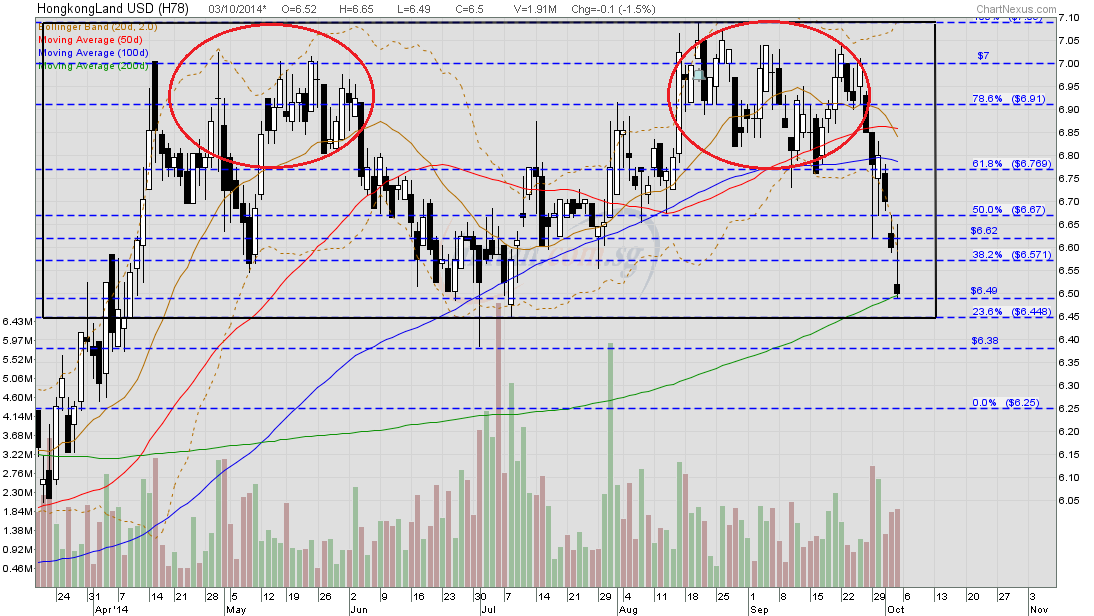

Post by zuolun on Oct 3, 2014 10:46:15 GMT 7

Cheng Kay not scared you win money, he only afraid that you stop and quit gambling!

对于庄家而言,不怕你赢钱,就怕你不玩!HKLand USD — Double Top Formation, last line of defense at the 200d SMAHKLand had an inverted hammer @ US$6.50 (-0.10, -1.5%) with 1.91m shares done on 3 Oct 2014 at 10.35am. Immediate support @ US$6.45, immediate resistance @ US$6.65.

|

|

|

|

Post by zuolun on Jan 18, 2015 21:54:32 GMT 7

|

|

|

|

Post by zuolun on Jan 22, 2015 11:08:00 GMT 7

HKLand — Bearish Trend Reversal, expect a pullback to a lower high TP @ $7.02 HKLand — Bearish Trend Reversal, expect a pullback to a lower high TP @ $7.02HKLand had a black marubozu @ $7.56 (-0.08, -1%) with extremely thin volume done at 199 lots on 22 Jan 2015 at 12pm. Immediate support @ $7.45, immediate resistance @ $7.65.  |

|

|

|

Post by zuolun on Feb 27, 2015 7:08:28 GMT 7

|

|

|

|

Post by zuolun on Mar 17, 2015 15:52:51 GMT 7

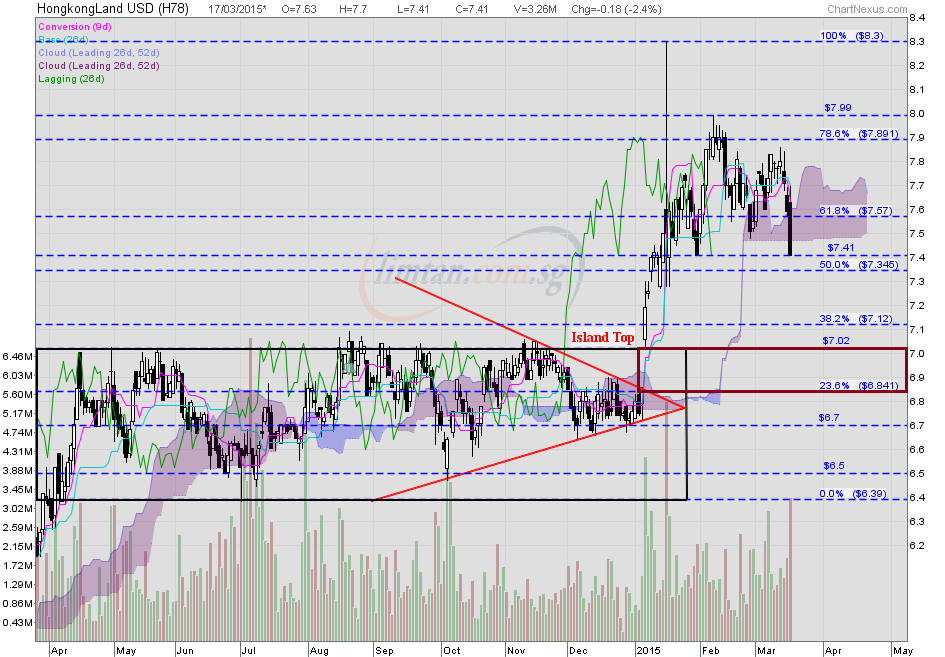

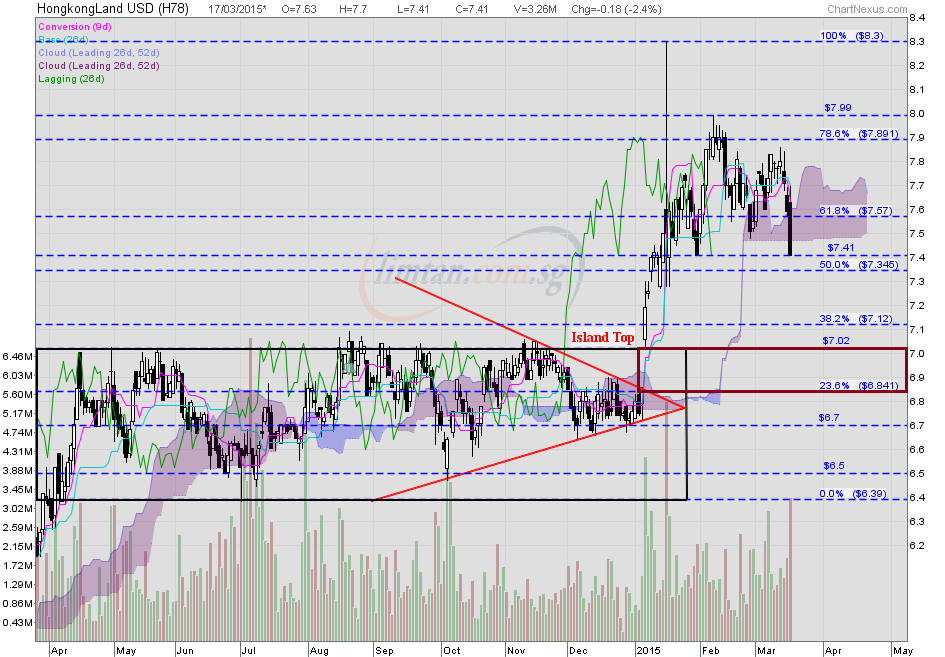

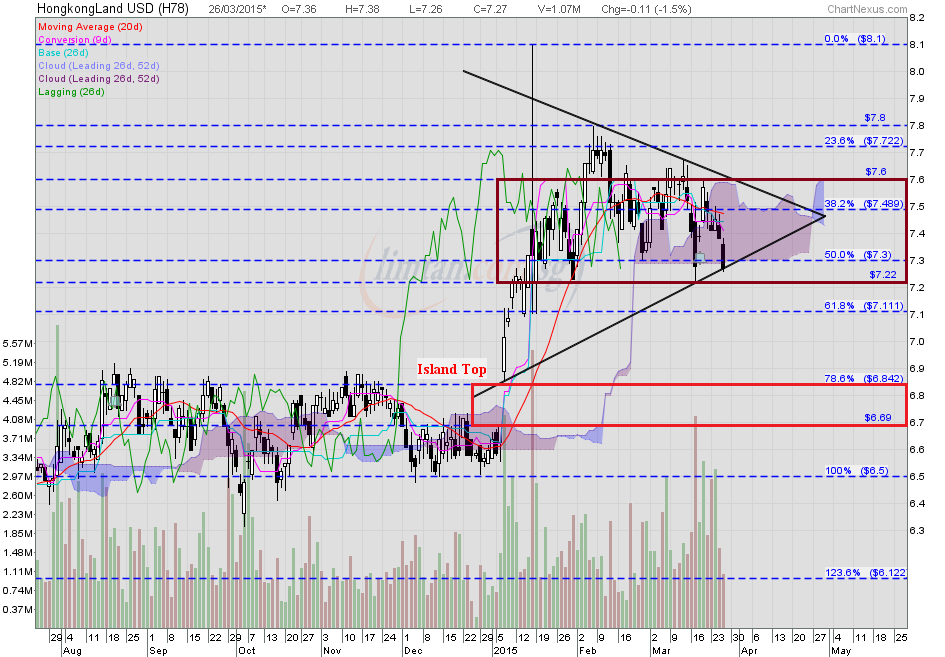

HKLand — Island Top Reversal, interim TP @ US$7.02 HKLand — Island Top Reversal, interim TP @ US$7.02HKLand traded @ US$7.41 (-0.18, -2.4%) with 3.26m shares done on 17 Mar 2015 at 4.30pm.  |

|

|

|

Post by sptl123 on Mar 17, 2015 21:39:21 GMT 7

HKLand — Island Top Reversal, interim TP @ US$7.02 HKLand — Island Top Reversal, interim TP @ US$7.02HKLand traded @ US$7.41 (-0.18, -2.4%) with 3.26m shares done on 17 Mar 2015 at 4.30pm.  Bro Zuolun you have sharp eye to spot an Island Top  . With reference to the 2 following charts, I have 2 questions: On the daily chart: Is XYZ a Head and Shoulder? On the weekly chart: Is AB a bear flag?   |

|

|

|

Post by zuolun on Mar 22, 2015 16:14:37 GMT 7

Bro Zuolun you have sharp eye to spot an Island Top  . With reference to the 2 following charts, I have 2 questions: On the daily chart: Is XYZ a Head and Shoulder? On the weekly chart: Is AB a bear flag? , An island top chart pattern usually forms a rounding top b4 the price moves down fast and furious, and it takes time and patience to wait for the right price level to short for a bigger profit margin. However, if you've fast nimble fingers and keen to play among the daytraders scalping for afew bids of profit intraday (long and short), you must use the hourly/minute chart for quick-in-quick-out trades as the price is currently ranging bet. US$7.60 to US$7.22 (play the 38c trading range within a rectangle). To short-sell HKLand aggressively, it's advisable to piggyback on the Algo trading program, i.e. wait for a long black marubozu / the Algo traders to trigger @ US$7.22, for a decisive short-sell confirmation. (See Algo traders @ S$3.70 in Super Group.) Based on HK Land's ichimoku chart, once the critical support @ US$7.22 is broken convincingly with extremely high volume (2X of 4.2m shares), HKLand is likely to hit TP US$6.85 to close the big gap created on 7 Jan 2015 and go much further down. HK Land ~ Island Top formation, biased to the downside, interim TP @ US$6.85HK Land closed with a bearish harami pattern @ HK$7.48 (-0.09, -1.2%} with 1.83m shares done on 20 Mar 2015. Critical support @ US$7.22, immediate resistance @ US$7.60. Adjust your charting program for dividends payment to reflect the latest share prices on all stocks; see below the adjusted HKLand chart. How to use divergences as leading indicators How to use divergences as leading indicators Hong Kong's decade-long property boom could be ending: Chart Hong Kong's decade-long property boom could be ending: Chart ~ 16 Mar 2015  |

|

|

|

Post by sptl123 on Mar 22, 2015 17:21:05 GMT 7

Bro Zuolun, My jaw really drop when reading just this HK Land post. In it, there are so many things I still do not know but have the opportunity to learn. I salute you and my full appreciation and respect to you General Zuolun.     Bro Zuolun you have sharp eye to spot an Island Top  . With reference to the 2 following charts, I have 2 questions: On the daily chart: Is XYZ a Head and Shoulder? On the weekly chart: Is AB a bear flag? , An island top chart pattern usually forms a rounding top b4 the price moves down fast and furious, and it takes time and patience to wait for the right price level to short for a bigger profit margin. However, if you've fast nimble fingers and keen to play among the daytraders scalping for afew bids of profit intraday (long and short), you must use the hourly/minute chart for quick-in-quick-out trades as the price is currently ranging bet. US$7.60 to US$7.22 (play the 38c trading range within a rectangle). To short-sell HKLand aggressively, it's advisable to piggyback on the Algo trading program, i.e. wait for a long black marubozu / the Algo traders to trigger @ US$7.22, for a decisive short-sell confirmation. (See Algo traders @ S$3.70 in Super Group.) Based on HK Land's ichimoku chart, once the critical support @ US$7.22 is broken convincingly with extremely high volume (2X of 4.2m shares), HKLand is likely to hit TP US$6.85 to close the big gap created on 7 Jan 2015 and go much further down. HK Land ~ Island Top formation, biased to the downside, interim TP @ US$6.85HK Land closed with a bearish harami pattern @ HK$7.48 (-0.09, -1.2%} with 1.83m shares done on 20 Mar 2015. Critical support @ US$7.22, immediate resistance @ US$7.60. Adjust your charting program for dividends payment to reflect the latest share prices on all stocks; see below the adjusted HKLand chart. How to use divergences as leading indicators How to use divergences as leading indicators Hong Kong's decade-long property boom could be ending: Chart Hong Kong's decade-long property boom could be ending: Chart ~ 16 Mar 2015  |

|

|

|

Post by zuolun on Mar 22, 2015 19:45:33 GMT 7

|

|

|

|

Post by sptl123 on Mar 22, 2015 22:55:58 GMT 7

|

|

|

|

Post by zuolun on Mar 24, 2015 9:19:22 GMT 7

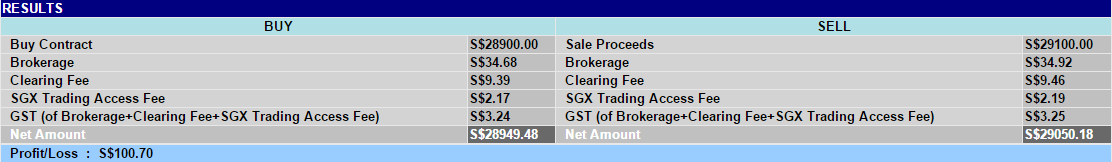

sptl123. HKLand ~ Trading in a rectangle between US$7.22 to US$7.60HK Land closed with an inverted hammer @ US$7.41 (-0.07, -0.9%) with 2.94m shares done on 23 Mar 2015.  To win back the market share lost to the foreign offshore brokerage firms; the local ones need to revise the current brokerage fee structure. For a daytrader to make a profit of 2-bid on any mid-cap stocks based on brokerage fees @ 0.12% + other charges per order via a CCT account, the reward will be much more attractive if the brokerage fees is lowered to directly compete with those who charge @ S$15 nett per trade size.An example of a swing-trade on UE (Long, cash a/c):

Quantity: 10 lots Brokerage: 0.12% Buy price: S$2.89 Sell price: S$2.91 Profit: S$100.70 (2c or 2-bid)

|

|

|

|

Post by zuolun on Mar 26, 2015 11:50:07 GMT 7

An island top chart pattern usually forms a rounding top b4 the price moves down fast and furious, and it takes time and patience to wait for the right price level to short for a bigger profit margin. However, if you've fast nimble fingers and keen to play among the daytraders scalping for afew bids of profit intraday (long and short), you must use the hourly/minute chart for quick-in-quick-out trades as the price is currently ranging bet. US$7.60 to US$7.22 (play the 38c trading range within a rectangle). To short-sell HKLand aggressively, it's advisable to piggyback on the Algo trading program, i.e. wait for a long black marubozu / the Algo traders to trigger @ US$7.22, for a decisive short-sell confirmation. (See Algo traders @ S$3.70 in Super Group.) Based on HK Land's ichimoku chart, once the critical support @ US$7.22 is broken convincingly with extremely high volume (2X of 4.2m shares), HKLand is likely to poke thru TP US$6.85 and hit US$6.69 to close the big gap created on 7 Jan 2015 and go much further down.

HK Land ~ Island Top formation, biased to the downside, interim TP @ US$6.85HK Land traded @ US$7.27 (-0.11, -1.5%) with 1.07m shares done on 26 Mar 2015 at 1.10pm. Critical support @ US$7.22, immediate resistance @ US$7.60.  HKLand — Bearish Trend Reversal, expect a pullback to a lower high TP @ $7.02HKLand closed with a bearish shooting star unchanged @ $7.50 with extremely high volume done at 5.45m shares on 16 Jan 2015. Immediate support @ $7.27, immediate resistance @ $8.30.  |

|