|

|

Post by zuolun on May 3, 2014 9:21:20 GMT 7

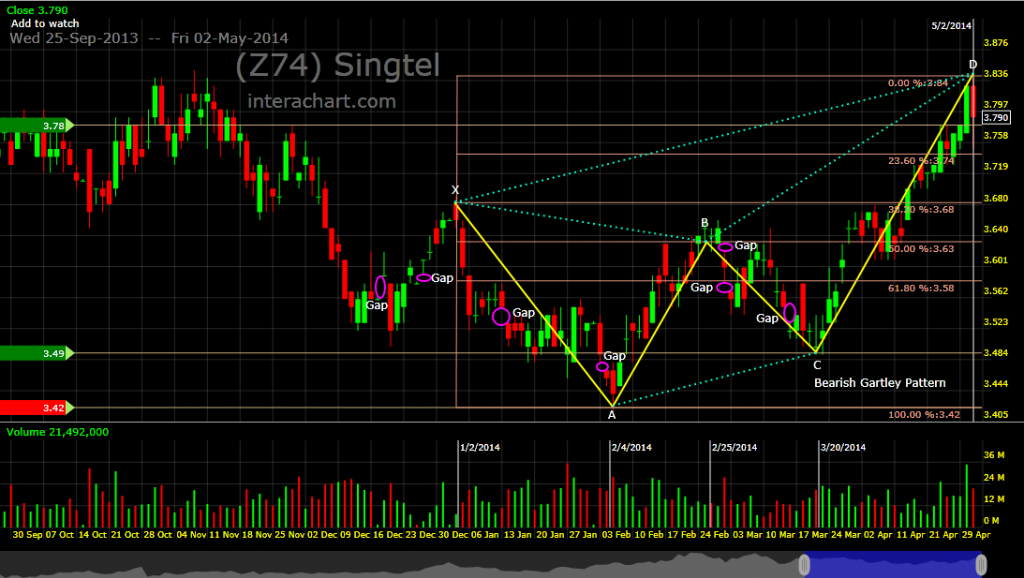

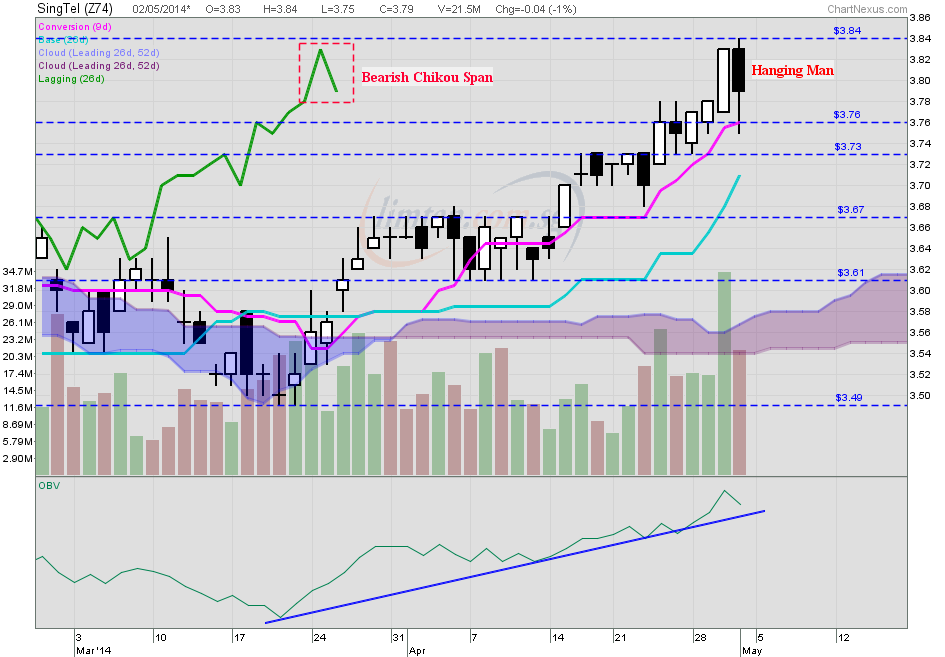

SingTel — Bearish Gartley Pattern, expect more downside than upside SingTel — Bearish Gartley Pattern, expect more downside than upsideSingtel closed with a hanging man @ S$3.79 (-0.04, -1%) with high volume done at 21.5m shares on 2 May 2014. Immediate support @ S$3.76, immediate resistance @ S$3.84.   |

|

|

|

Post by zuolun on May 7, 2014 14:08:28 GMT 7

|

|

|

|

Post by zuolun on Jul 3, 2014 11:27:44 GMT 7

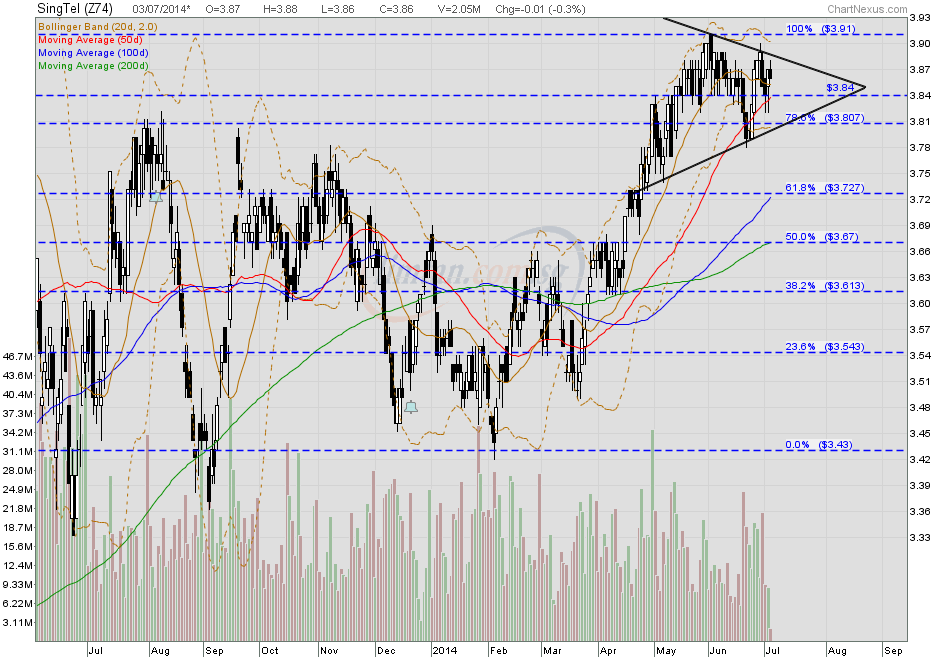

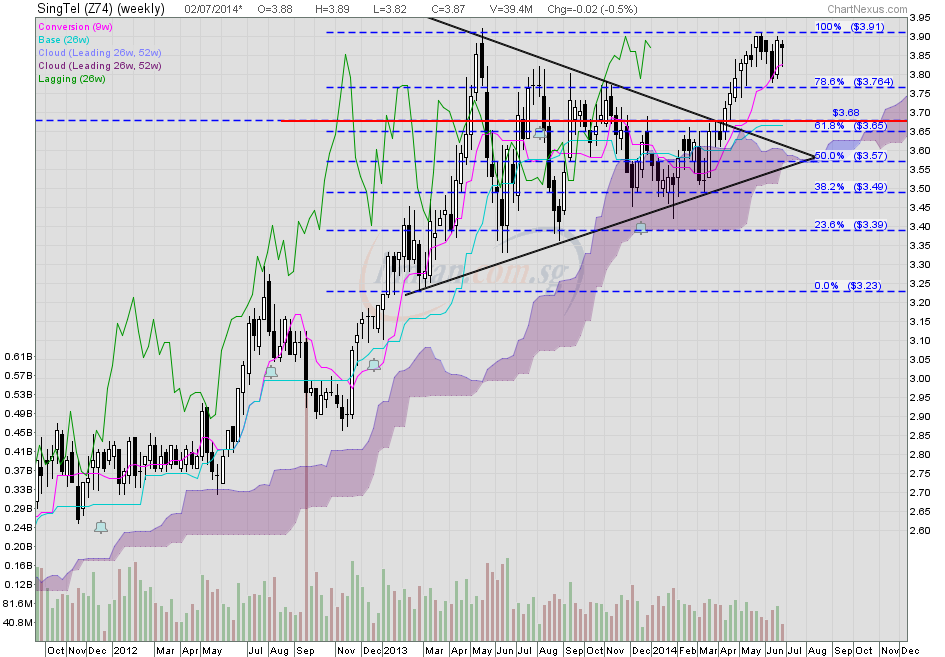

Singtel — Symmetrical triangle FormationSingtel had a spinning top @ $3.86 (-0.01, -0.3%) with volume done at 2.05m shares on 3 July 2014 at 12.15am Immediate support @ S$3.81, strong resistance @ S$3.90.  Singtel (weekly) — Bullish symmetrical triangle breakout Singtel (weekly) — Bullish symmetrical triangle breakout Alternative view:Singtel (weekly) — Bearish Gartley Formation, TP S$3.98 Alternative view:Singtel (weekly) — Bearish Gartley Formation, TP S$3.98

|

|

|

|

Post by zuolun on Jul 25, 2014 14:53:31 GMT 7

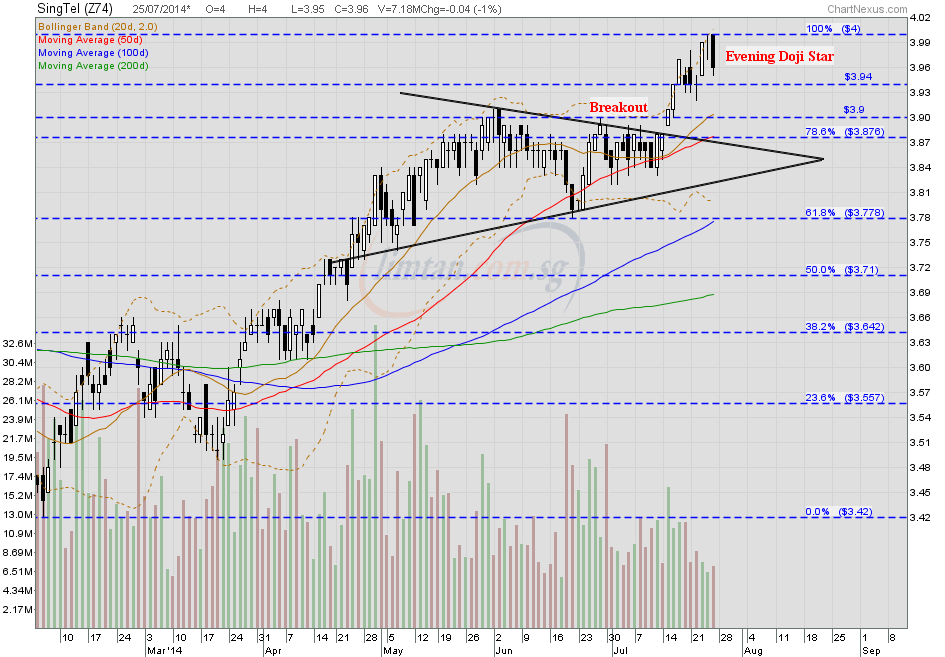

John Templeton said “The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell"...."It makes sense that when most investors are bullish, asset valuations would be high, because everyone has already bought. The opposite is also true. When most investors are bearish, asset valuations are low, because everyone has already sold." “机会总在绝望中诞生,在质疑中成长,在希望中成熟,在疯狂中死亡。” — 邓普顿 SingTel — Extremely overbought, expect a strong pullback SingTel — Extremely overbought, expect a strong pullbackSingTel had a bearish evening doji star @ S$3.96 (-0.04, -1%) with 7.18m shares done on 25 July 2014 at 3.45pm. Crucial support @ S$3.90, immediate resistance @ S$4.00.  Singtel (weekly) — Bearish Gartley Formation, TP S$3.98 |

|

|

|

Post by zuolun on Jul 26, 2014 20:17:49 GMT 7

SingTel — Extremely overbought, expect a strong pullback SingTel — Extremely overbought, expect a strong pullbackSingtel closed with a hanging man @ S$3.98 (-0.02, -0.5%) with 9.86m shares done on 25 July 2014. Immediate support @ S$3.91, immediate resistance @ S$4.00. Chart Pattern Observations:1. The gap created on the 15 July 2014 is yet to be closed. 2. Stochastic hit above 80, RSI crossed above 70 and had hooked down.  |

|

|

|

Post by zuolun on Jul 30, 2014 9:14:00 GMT 7

Singtel — Extremely overbought, expect a strong pullback TP S$3.58Singtel closed with a white marubozu @ S$4.00 (+0.02, +0.5%) with 11.13m shares done on 29 July 2014. Immediate support @ S$3.91, immediate resistance @ S$4.00. Chart Pattern Observations:1. The gap created on the 15 July 2014 is yet to be closed. 2. Both the Stochastic and the RSI had already crossed extremely overbought levels. 3. Bearish Rising Wedge + Head and Shoulders Formation (ref. below 3 charts; same scenario as the STI's early stage of H&S formation in May 2013). 4. Should a bearish H&S breakout at the neckline @ S$3.79 with the head @ S$4.00, Singtel's special offer could be a cup of "Kopi-O-Dai-Dai".

|

|

|

|

Post by zuolun on Aug 4, 2014 8:16:37 GMT 7

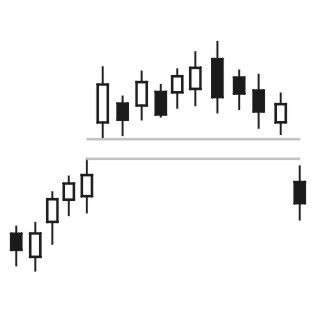

Singtel — Extremely overbought, expect a strong pullback TP S$3.58 Singtel — Extremely overbought, expect a strong pullback TP S$3.58Singtel closed with a "one black crow" pattern @ S$4.01 (-0.06, -1.5%) with 14.6m shares done on 1 Aug 2014. Immediate support @ S$3.95, next support @ S$3.91, immediate resistance @ S$4.08. Characteristics of "one black crow" pattern:- "One Black Crow" is a bearish reversal pattern.

- It appears on charts after a clear uptrend.

- In this pattern, first candle is a long white candle.

- Next candle opens below the closing level of previous candle and it closes below the low level of the white candle.

- Criteria for this pattern is that both the candles should be "long".

|

|

|

|

Post by zuolun on Aug 5, 2014 18:24:30 GMT 7

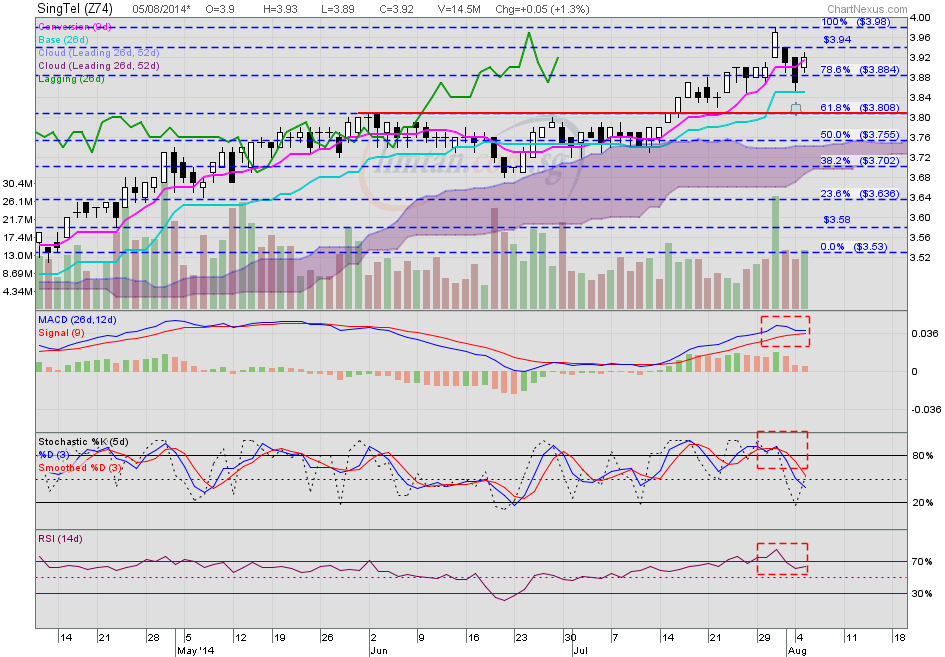

Singtel — Extremely overbought, expect a strong pullback TP S$3.58 Singtel — Extremely overbought, expect a strong pullback TP S$3.58Singtel closed with a white marubozu @ S$3.92 (+0.05, +1.3%) with 14.5m shares done on 5 Aug 2014. Immediate support @ S$3.88, immediate resistance @ S$3.94. Observations: The stochastic (5,3 3) and the RSI indicators showed extremely overbought and had a bearish crossover.  |

|

|

|

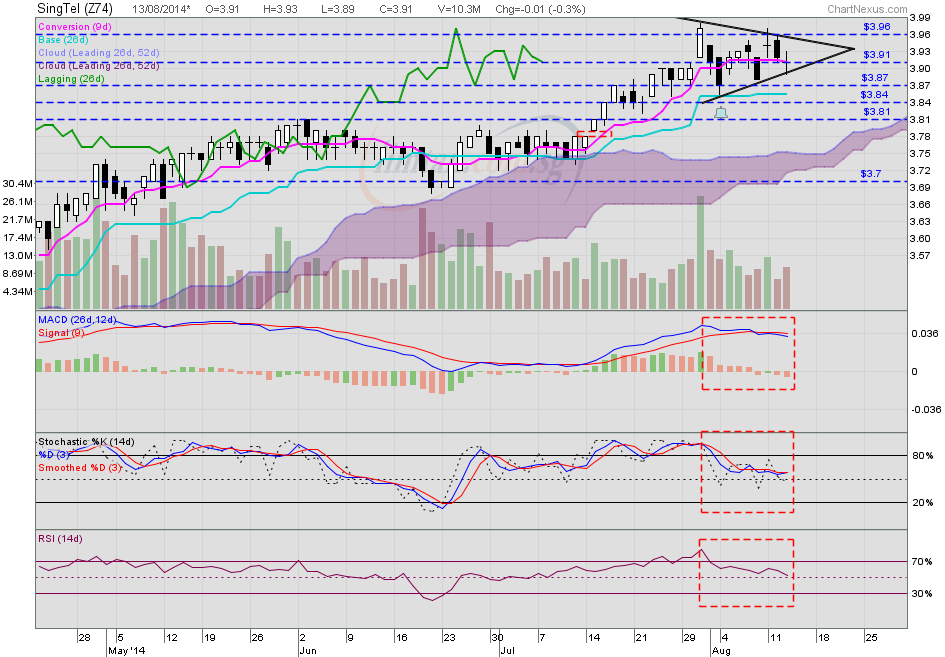

Post by zuolun on Aug 13, 2014 16:58:21 GMT 7

Singtel — On the edge Singtel — On the edge |

|

|

|

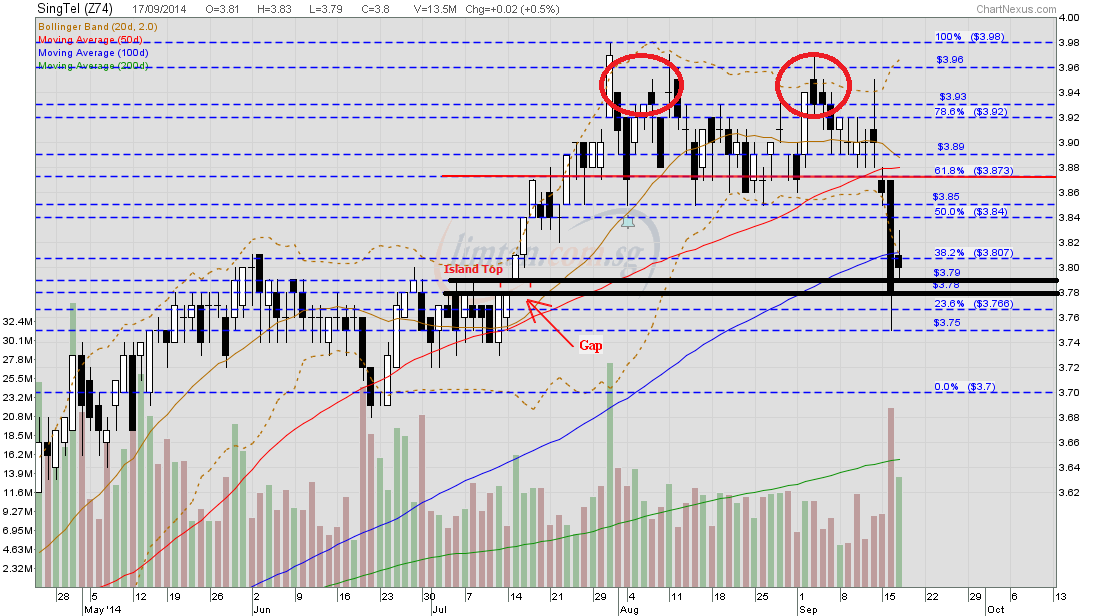

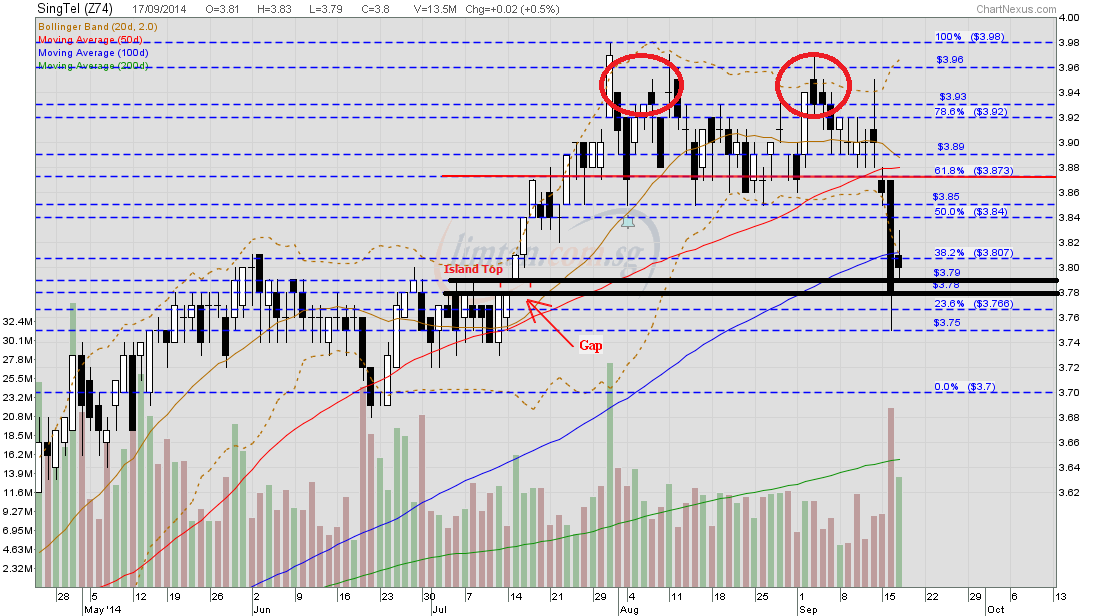

Post by zuolun on Sept 18, 2014 9:50:34 GMT 7

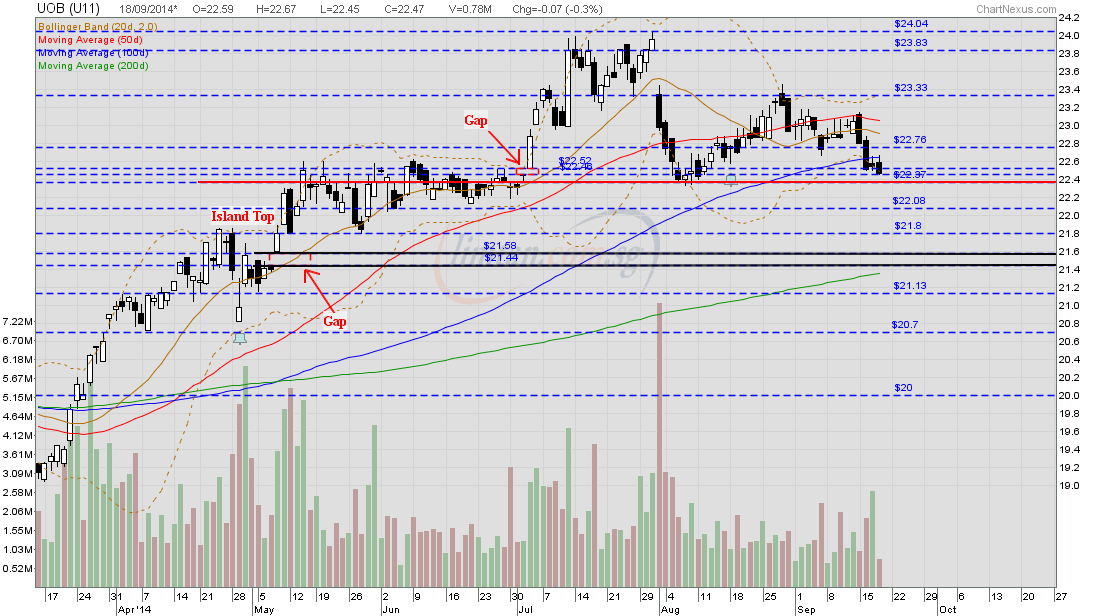

Singtel and UOB both at critical support, the last line of defense is the 200d SMA. Singtel — Double Top Breakout, interim TP S$3.70Singtel had an inside day pattern @ S$3.80 (+0.02, +0.5%) with 13.5m shares done on 18 Sep 2014 at 10.30 am. Chart Pattern Observations:  |

|

|

|

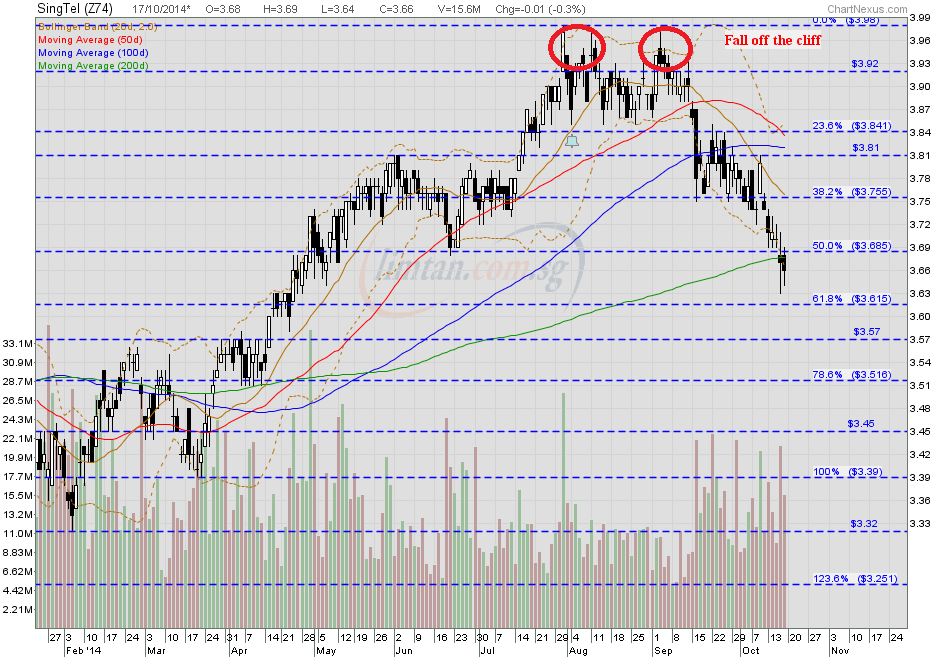

Post by zuolun on Oct 17, 2014 15:27:20 GMT 7

Singtel — Broke the 200d SMA, biased to the downside, interim TP S$3.39 next TP S$3.25 Singtel — Broke the 200d SMA, biased to the downside, interim TP S$3.39 next TP S$3.25Singtel had a spinning top @ S$3.66 (-0.01, -0.3%) with 15.6m shares done on 17 Oct 2014 at 4.30pm. Immediate support @ S$3.62, immediate resistance @ S$3.69.  Singtel and UOB both at critical support, the last line of defense is the 200d SMA. Singtel — Double Top Breakout, interim TP S$3.70Singtel had an inside day pattern @ S$3.80 (+0.02, +0.5%) with 13.5m shares done on 18 Sep 2014 at 10.30 am.  |

|

|

|

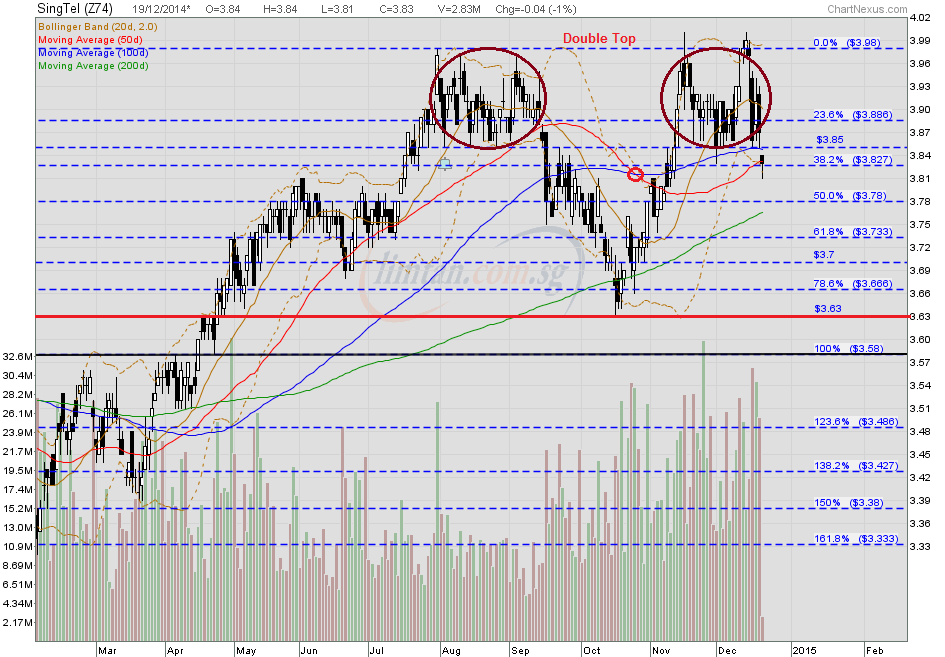

Post by zuolun on Dec 19, 2014 8:27:09 GMT 7

The sustainability of the current dead cat bounce (with weak volume) on the STI depends a lot on a wild card, Singtel. Singtel — Double Top FormationSingTel gapped down with a hammer @ S$3.83 (-0.04, -1%) with 2.83m shares done on 19 Dec 2014 at 9.20am. Immediate support @ S$3.78, immediate resistance @ S$3.85.  STI — Bearish Diamond Top Breakout, Interim TP 3122, Next TP 3065STI gapped down and closed with a long black marubozu @ 3215.09 (-79.05, -2.4%) on 16 Dec 2014. Immediate support @ 3180, immediate resistance @ 3237.  |

|

|

|

Post by zuolun on Apr 8, 2015 6:37:15 GMT 7

|

|

|

|

SingTel

Jun 23, 2015 10:10:34 GMT 7

Post by roberto on Jun 23, 2015 10:10:34 GMT 7

Singtel CEO earned S$5.6m for FY 2014/2015"Singtel's chief executive officer Chua Sock Koong took home about S$5.6 million in total remuneration in the financial year ended Mar 31, 2015. ... The telco's five other key management staff took home a total of S$14.42 million. " Singtel CEO’s pay rose 19% to $5.6 million in FY2015"Singapore Telecommuncations’ CEO Chua Sock Koong’s pay packet rose by 18.8% to $5.6 million in the financial year ended March, according to the company’s annual report released today. ..."

|

|

|

|

SingTel

Jun 23, 2015 10:14:16 GMT 7

Post by roberto on Jun 23, 2015 10:14:16 GMT 7

Credit to Singtel's leadership for their overseas ventures. Have been doing well, and I think will pay off significantly in the years to come. This is on my shopping list should its price fall irrationally for whatever reason.

|

|