|

|

Post by zuolun on Nov 25, 2013 9:16:04 GMT 7

|

|

|

|

Post by zuolun on Nov 26, 2013 14:56:04 GMT 7

|

|

|

|

Post by zuolun on Dec 6, 2013 4:01:45 GMT 7

SingTel — Bearish symmetrical triangle breakout; interim TP S$3.44.Crucial support @ S$3.65, the 200d SMA.  odie, KepCorp is consolidating in a long rectangle; properties stocks, especially CDL & Capitaland are trading lower low. The STI is now left with Singtel & the 3 banks as the last line of defense. If crucial supports of these stocks are broken convincingly with extremely high volume, they're prime targets for SHORT, not LONG. ( Note: Singtel's crucial support is @ S$3.65, the 6.8c dividends XD date is on 19 Dec 2013.) STI (Feb 2008 to Aug 2013) — The Elliott Wave pattern as at 28 Aug 2013

|

|

|

|

Post by zuolun on Dec 6, 2013 15:53:35 GMT 7

SingTel — Bearish symmetrical triangle breakout; interim TP S$3.44SingTel has a black marubozu @ S$3.61 (-0.04, -1.1%) on 6 Dec 2013 at 4.55pm. The 200d SMA crucial support @ S$3.65 is broken convincingly, expect more downside than upside.

|

|

|

|

Post by zuolun on Dec 7, 2013 11:16:31 GMT 7

SingTel — Expect a Three Black Crows chart pattern; interim TP S$3.44

Immediate support S$3.56, immediate resistance S$3.65, the 200d SMA.

|

|

|

|

Post by zuolun on Dec 9, 2013 10:27:06 GMT 7

|

|

|

|

Post by zuolun on Dec 10, 2013 12:26:00 GMT 7

SingTel — Expect a Three Black Crows chart pattern; interim TP S$3.44

Immediate support S$3.56, immediate resistance S$3.65, the 200d SMA. — Six (6) black marubozu in a roll (六连阴) Chart pattern is more negative than the bearish Three Black Crows (三只黑乌鸦). SingTel @ S$3.57 (-0.05, -1.4%) on 10 Dec 2013 at 1.20pm

Three Black Crows

|

|

|

|

SingTel

Dec 11, 2013 12:47:46 GMT 7

Post by zuolun on Dec 11, 2013 12:47:46 GMT 7

|

|

|

|

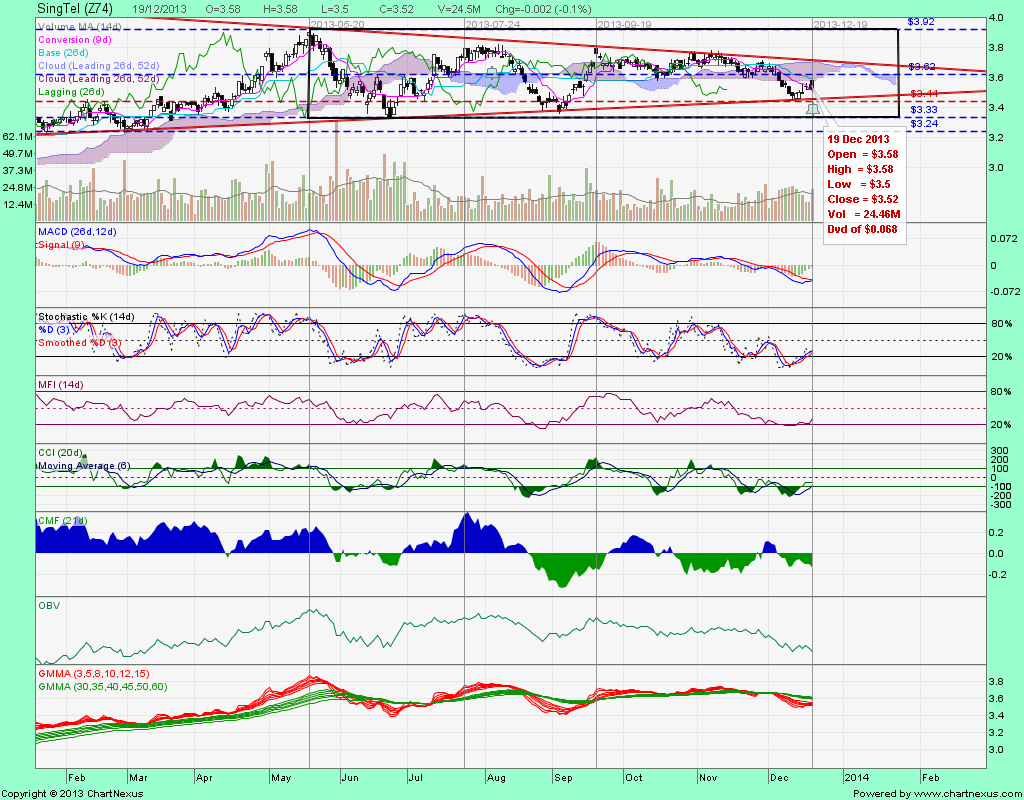

Post by zuolun on Dec 19, 2013 12:32:46 GMT 7

odie, KepCorp is consolidating in a long rectangle; properties stocks, especially CDL & Capitaland are trading lower low. The STI is now left with Singtel & the 3 banks as the last line of defense. If crucial supports of these stocks are broken convincingly with extremely high volume, they're prime targets for SHORT, not LONG. ( Note: Singtel's crucial support is @ S$3.65, the 6.8c dividends XD date is on 19 Dec 2013.)

SingTel — Bearish symmetrical triangle breakout; interim TP S$3.44SingTel has a black marubozu and traded at 3.50 (-0.09, -2.5%) on 19 Dec 2013 the XD date, at 1.42pm. Immediate support S$3.53, immediate resistance S$3.61, the 200d EMA.  |

|

|

|

Post by zuolun on Dec 19, 2013 17:25:09 GMT 7

SingTel 10-year chart 2003 to 2013

|

|

|

|

SingTel

Dec 19, 2013 18:30:14 GMT 7

Post by odie on Dec 19, 2013 18:30:14 GMT 7

thanks zuolun bro for singtel update

$2.90 is a good price to buy singtel

|

|

|

|

Post by zuolun on Dec 19, 2013 22:57:52 GMT 7

thanks zuolun bro for singtel update $2.90 is a good price to buy singtel odie, Singtel is oversold but selling pressure > buying strength. Should Singtel break $3.44 convincingly with higher volume than today's 24.5m shares, next support @ $3.33.  |

|

|

|

Post by odie on Dec 20, 2013 2:54:25 GMT 7

Noted with thanks zuolun bro

I am expecting big boys to collect scrips of Singtel and thus a bounce for Singtel before they continue to short

|

|

|

|

Post by zuolun on Dec 20, 2013 5:12:59 GMT 7

Noted with thanks zuolun bro I am expecting big boys to collect scrips of Singtel and thus a bounce for Singtel before they continue to short odie, The dead cat bounce was already done, BBs had re-initiated shorts on SingTel with volume spiked to 24.5m, yesterday 19 Dec 2013. Watch the EOD closing on 20 Dec 2013, if volume is higher than 24.5m + share price down, it means no short-covering yet.  |

|

|

|

Post by zuolun on Feb 5, 2014 15:20:27 GMT 7

Singtel — Trading below the 200d SMA with a confluence of 3 dead crosses hanging on topSingTel traded @ S$3.44 (-0.02, -0.6%) on 5 Feb 2014 at 4.15pm.

|

|