|

|

Post by zuolun on Dec 15, 2013 17:04:38 GMT 7

The last low of IndoAgri @ S$0.72 scored on 21 Aug 2013 may not be the bottom. I bought IndoAgri @ S$0.445 near the bottom in a "meltdown" on 3rd Dec 2008. Should IndoAgri hit S$0.445, I would be a buyer again!

IndoAgri — Symmetrical triangle breakoutImmediate support S$0.835, immediate resistance S$0.92.  IndoAgri (weekly) — Trading in a downward sloping channel IndoAgri (weekly) — Trading in a downward sloping channel

IndoAgri as at 25 Sep 2012 IndoAgri as at 25 Sep 2012 |

|

|

|

Post by odie on Dec 15, 2013 21:06:53 GMT 7

this was my worst buy decision before i learnt any TA

i buy ard 2.3+ to 2.2+ and cut loss during capricorn rally at 1.6+

|

|

|

|

Post by zuolun on Mar 8, 2014 10:46:48 GMT 7

|

|

|

|

Post by zuolun on Jun 5, 2014 18:17:22 GMT 7

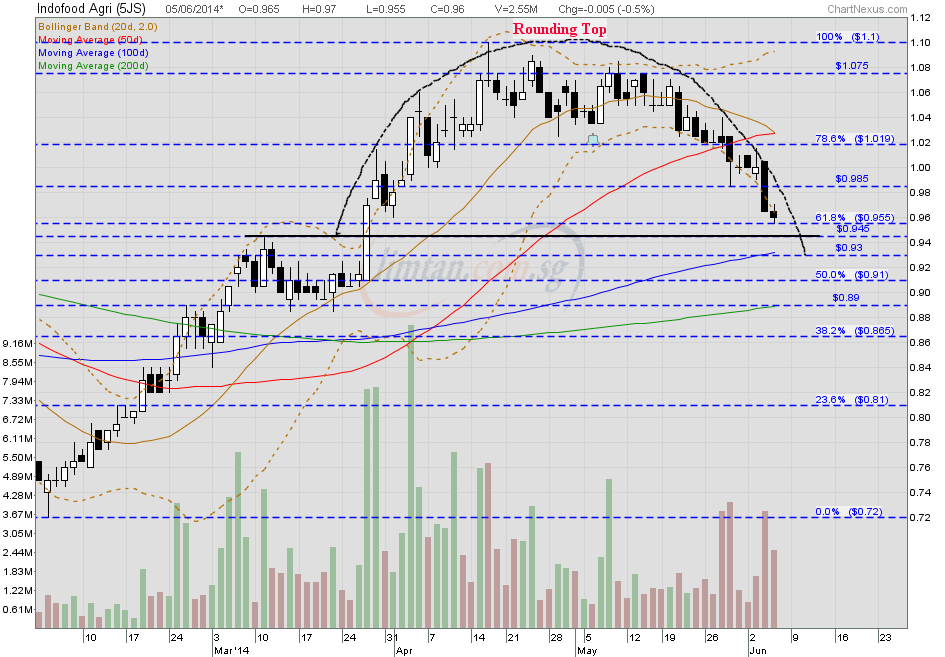

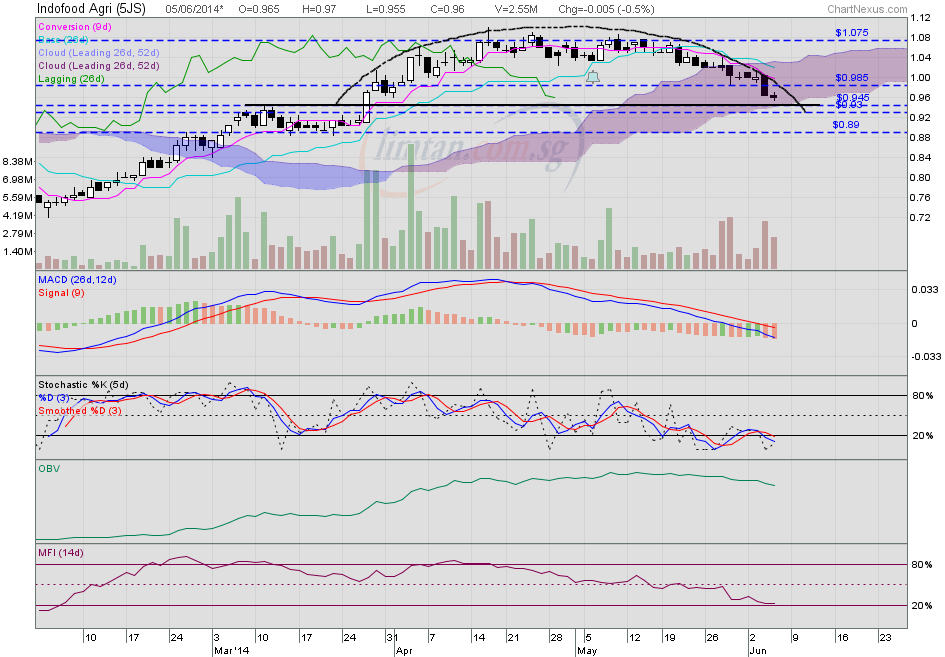

IndoAgri — Rounding Top FormationIndoAgri closed with a spinning top @ S$0.96 (-0.005, -0.5%) on 5 Jun 2014. Immediate support S$0.945, immediate resistance S$0.985.

|

|

|

|

Post by zuolun on Sept 14, 2014 12:08:42 GMT 7

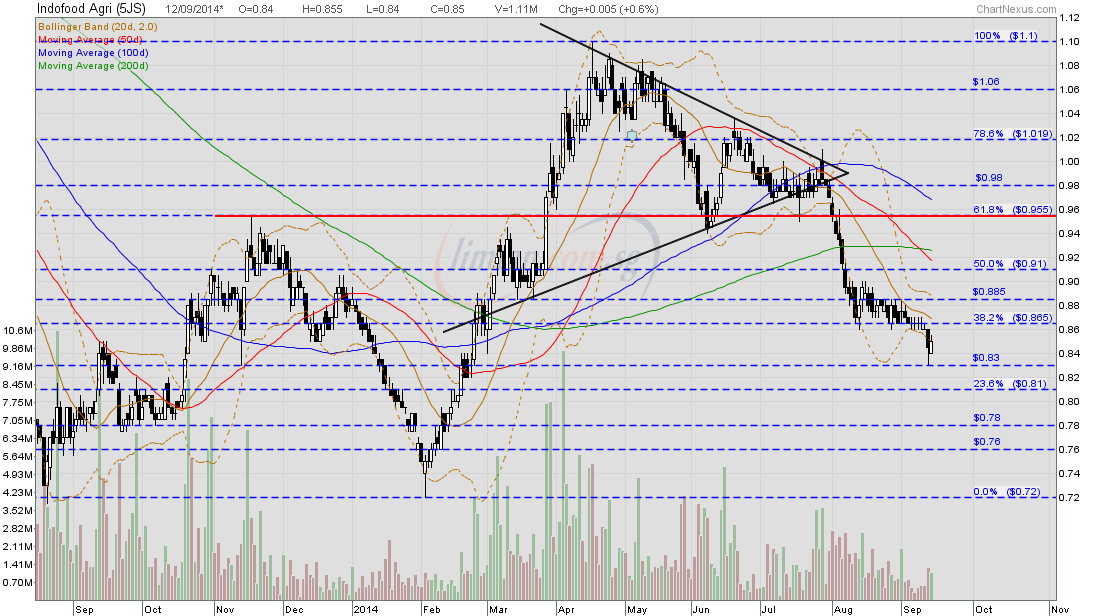

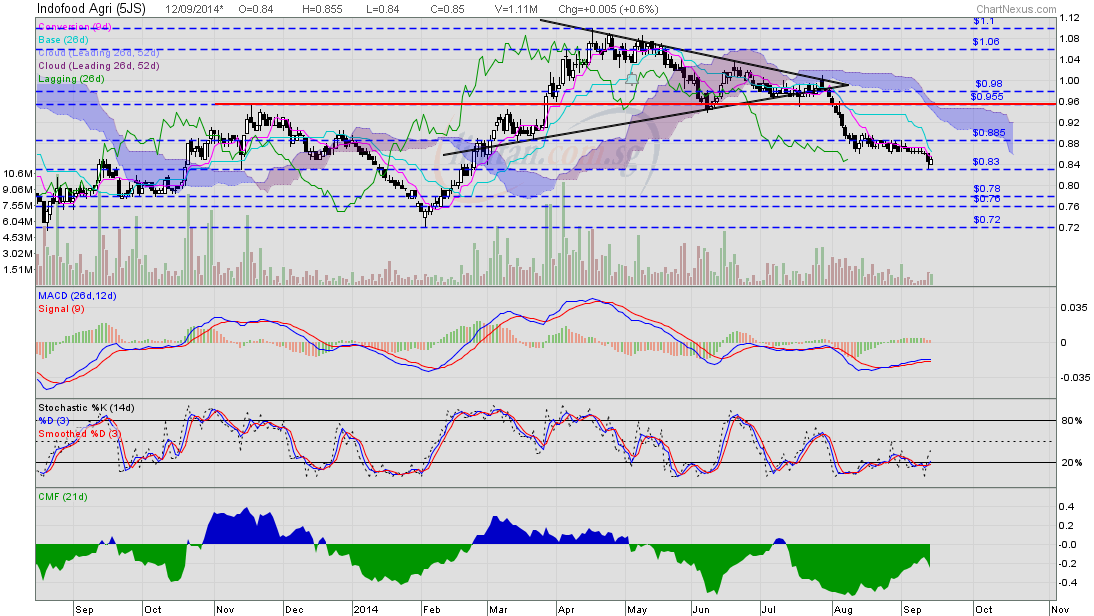

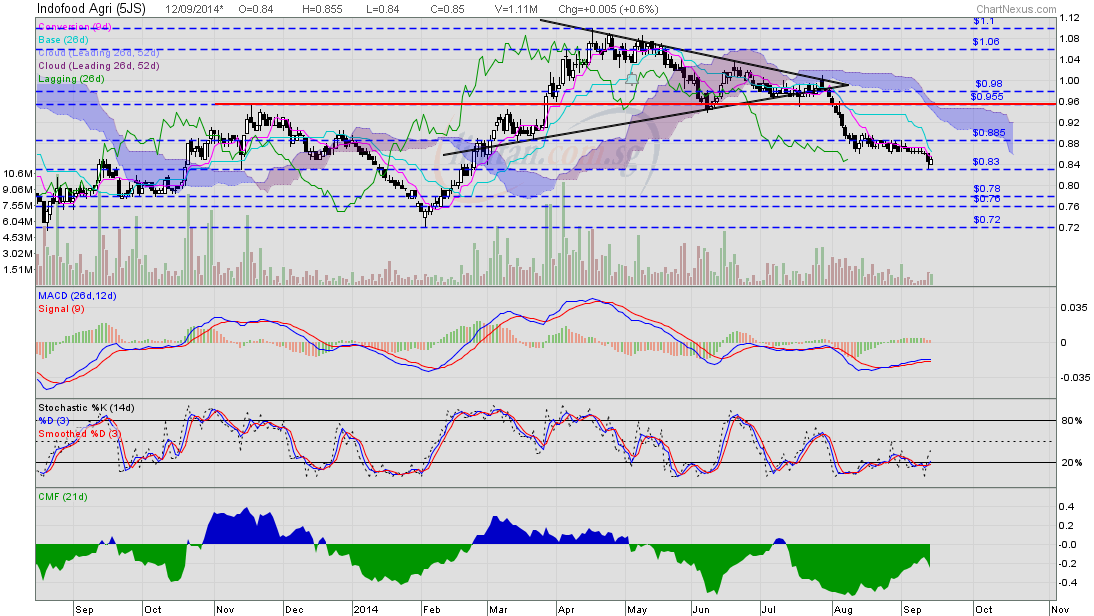

this was my worst buy decision before i learnt any TA i buy ard 2.3+ to 2.2+ and cut loss during capricorn rally at 1.6+ odie, IndoAgri's longterm chart indicates that you did the right thing to cut loss then. Now the share price closing @ S$0.85 on 12 Sep 2014 is 50% discount from your cut loss price @ S$1.6+. I wouldn't be surprised that some longterm retail investors who bought IndoAgri shares at record high @ S$2.90+ are still holding this stock tightly, especially those who know nothing about TA.  IndoAgri — Bearish Symmetrical Triangle Breakout TP S$0.72 IndoAgri — Bearish Symmetrical Triangle Breakout TP S$0.72IndoAgri closed with a piercing pattern @ S$0.85 (+0.005, +0.6%) with 1.11m shares done on 12 Sep 2014. Immediate support S$0.81, immediate resistance S$0.865.   IndoAgri (8 Dec 2010 to 12 Sep 2014) — Longterm downtrend, to retest last low @ S$0.72, potential Triple Bottom Formation IndoAgri (8 Dec 2010 to 12 Sep 2014) — Longterm downtrend, to retest last low @ S$0.72, potential Triple Bottom Formation IndoAgri (weekly) — Trading in a downward sloping channel

IndoAgri as at 25 Sep 2012 IndoAgri as at 25 Sep 2012 |

|

|

|

Post by odie on Sept 14, 2014 12:50:19 GMT 7

bro zuolun,

looks like indoagri can hit $0.72 two more times before going to around $0.50

LOL

|

|

|

|

Post by zuolun on Sept 14, 2014 14:38:53 GMT 7

bro zuolun, looks like indoagri can hit $0.72 two more times before going to around $0.50 LOL odie, IndoAgri hitting $0.50 is not impossible but the 3rd bottom @ S$0.72 should have a sharp dead cat bounce 1st as the CMF indicator is slowly sloping upward now. The share price movement is likely to continue consolidating within a rectangle bet. S$0.715 to S$0.83, b4 moving down lower, which will take min. 2 to 3 qtrs. Conclusion: Longterm still bearish but short-term wise; potential Triple Bottom Reversal looks promising @ S$0.72.   The last low of IndoAgri @ S$0.72 scored on 21 Aug 2013 may not be the bottom. I bought IndoAgri @ S$0.445 near the bottom in a "meltdown" on 3rd Dec 2008. Should IndoAgri hit S$0.445, I would be a buyer again!   |

|

|

|

Post by zuolun on Oct 3, 2014 12:52:33 GMT 7

bro zuolun, looks like indoagri can hit $0.72 two more times before going to around $0.50 LOL odie, IndoAgri hitting $0.50 is not impossible but the 3rd bottom @ S$0.72 should have a sharp dead cat bounce 1st as the CMF indicator is slowly sloping upward now. The share price movement is likely to continue consolidating within a rectangle bet. S$0.715 to S$0.83, b4 moving down lower, which will take min. 2 to 3 qtrs. Conclusion: Longterm still bearish but short-term wise; potential Triple Bottom Reversal looks promising @ S$0.72.  IndoAgri had a black marubozu @ S$0.805 (-0.02, -2.4%) with 1.1m shares done on 3 Oct 2014 at 1.50pm. Immediate support @ S$0.775, immediate resistance @ S$0.835.  |

|

|

|

Post by zuolun on Nov 4, 2014 8:36:55 GMT 7

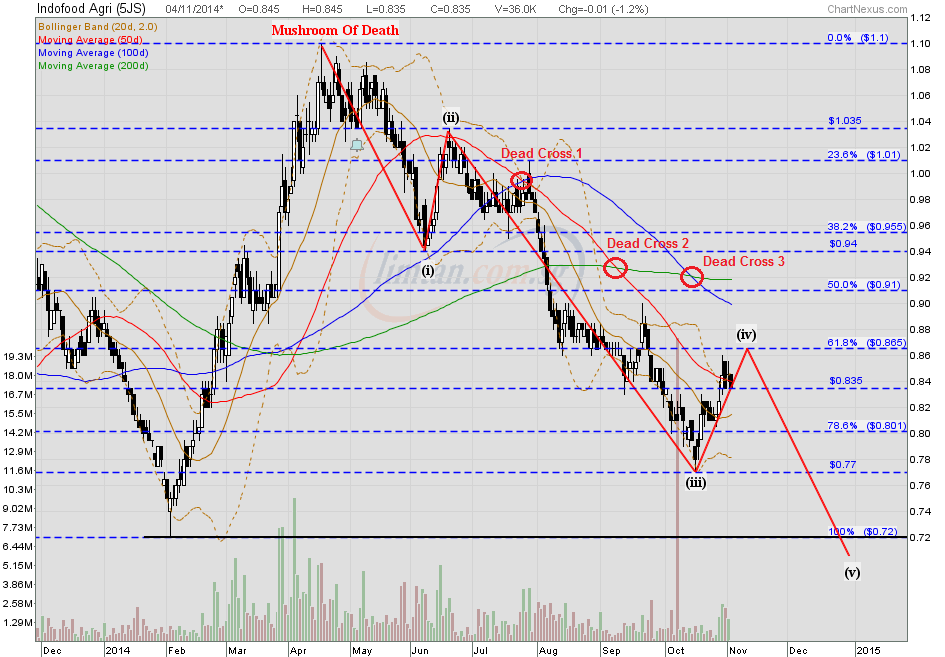

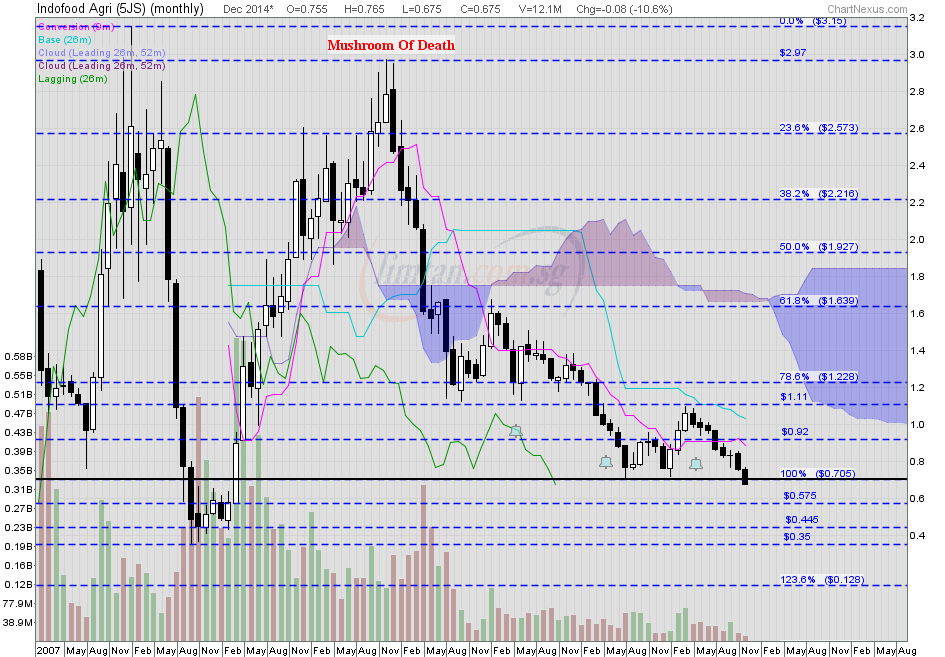

this was my worst buy decision before i learnt any TA i buy ard 2.3+ to 2.2+ and cut loss during capricorn rally at 1.6+ odie, IndoAgri's longterm chart indicates that you did the right thing to cut loss then. Now the share price closing @ S$0.85 on 12 Sep 2014 is 50% discount from your cut loss price @ S$1.6+. I wouldn't be surprised that some longterm retail investors who bought IndoAgri shares at record high @ S$2.90+ are still holding this stock tightly, especially those who know nothing about TA.  —31 Oct 2014 IndoAgri — Classic MOD chart pattern with 5-Wave down, TP S$0.72IndoAgri had a black marubozu @ S$0.835 (-0.01, -1.2%) with extremely thin volume done at 36 lots on 4 Nov Oct 2014 at 9.25m. Immediate support @ S$0.80, immediate resistance @ S$0.865.  IndoAgri (8 Dec 2010 to 12 Sep 2014) — Longterm downtrend, to retest last low @ S$0.72, potential Triple Bottom Formation IndoAgri (8 Dec 2010 to 12 Sep 2014) — Longterm downtrend, to retest last low @ S$0.72, potential Triple Bottom Formation |

|

|

|

Post by zuolun on Dec 16, 2014 10:00:21 GMT 7

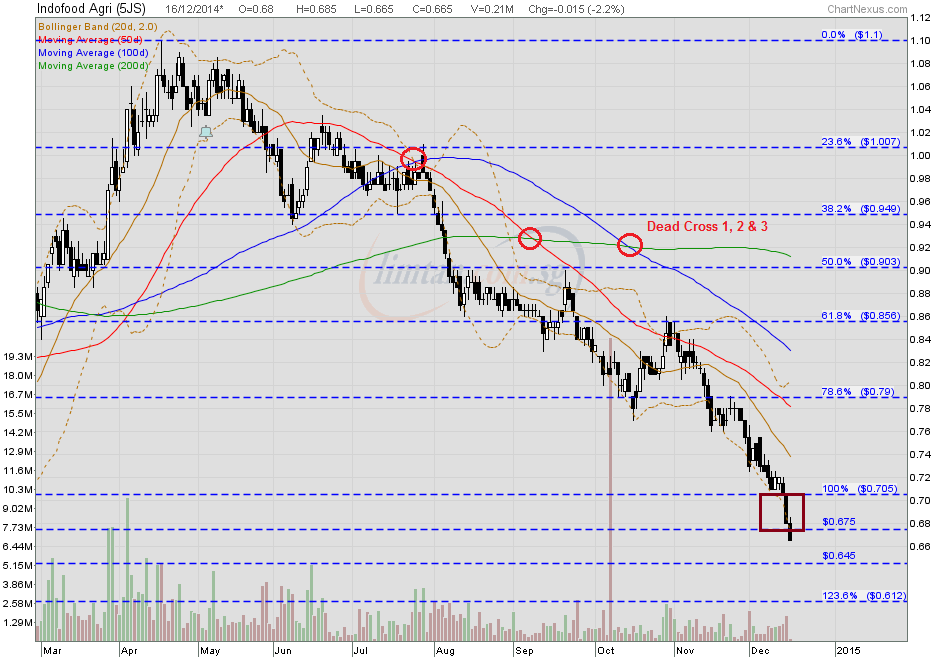

zuolun , I am one terrible investor as I will only buy when the business comes for free and the company has net cash above its market cap. Ideally, it has no borrowings and has manageable cashflow. Yes, I am damn demanding as an investor, especially for the current oil related stocks. , If a fundamentally strong stock collapsed into uncharted territory, I'll normally reassess the survival strength of the co's management staffs (past and present)...when my charts fail to give me a decisive buy signal / confirmation on when to buy. Malaysian Chinese Business: Who Survived the Crisis? — Oct 2003 The last low of IndoAgri @ S$0.72 scored on 21 Aug 2013 may not be the bottom. I bought IndoAgri @ S$0.445 near the bottom in a "meltdown" on 3rd Dec 2008. Should IndoAgri hit S$0.445, I would be a buyer again!   IndoAgri had a black marubozu @ S$0.665 (-0.015, -2.2%) with 210 lots done on 16 Dec 2014 at 10.55am. Immediate support @ S$0.645, immediate resistance @ S$0.705.  IndoAgri (monthly) IndoAgri (monthly) — Classic MOD chart pattern |

|

|

|

Post by zuolun on Dec 29, 2014 8:59:50 GMT 7

|

|

|

|

Post by zuolun on Apr 8, 2015 6:42:16 GMT 7

|

|

|

|

Post by zuolun on Aug 4, 2015 13:38:09 GMT 7

|

|

|

|

Post by zuolun on Aug 8, 2015 6:28:32 GMT 7

|

|

|

|

Post by zuolun on Oct 26, 2015 14:10:03 GMT 7

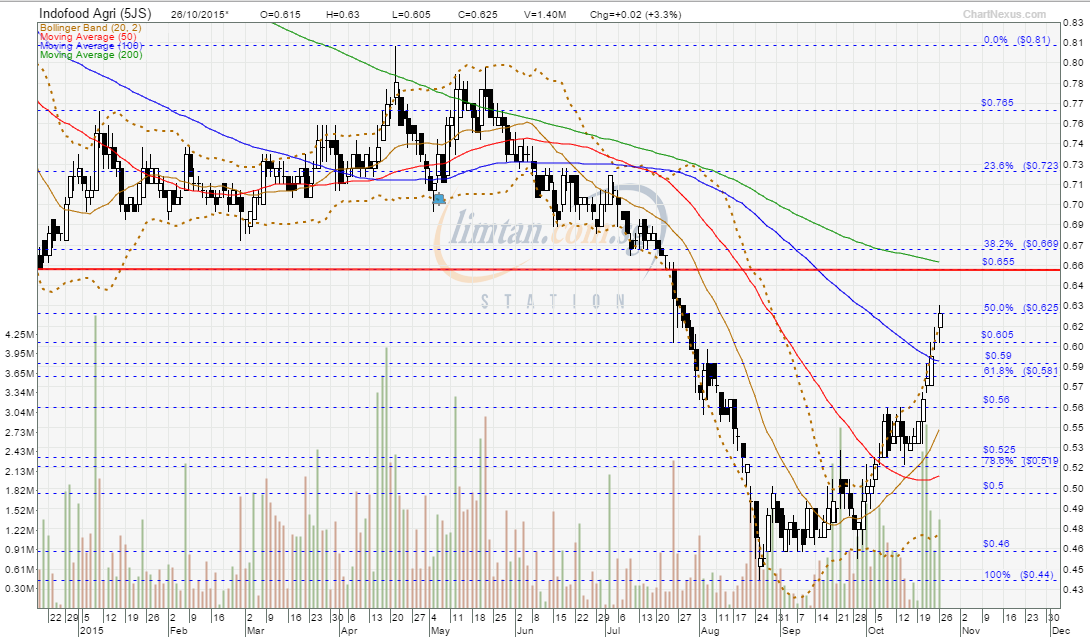

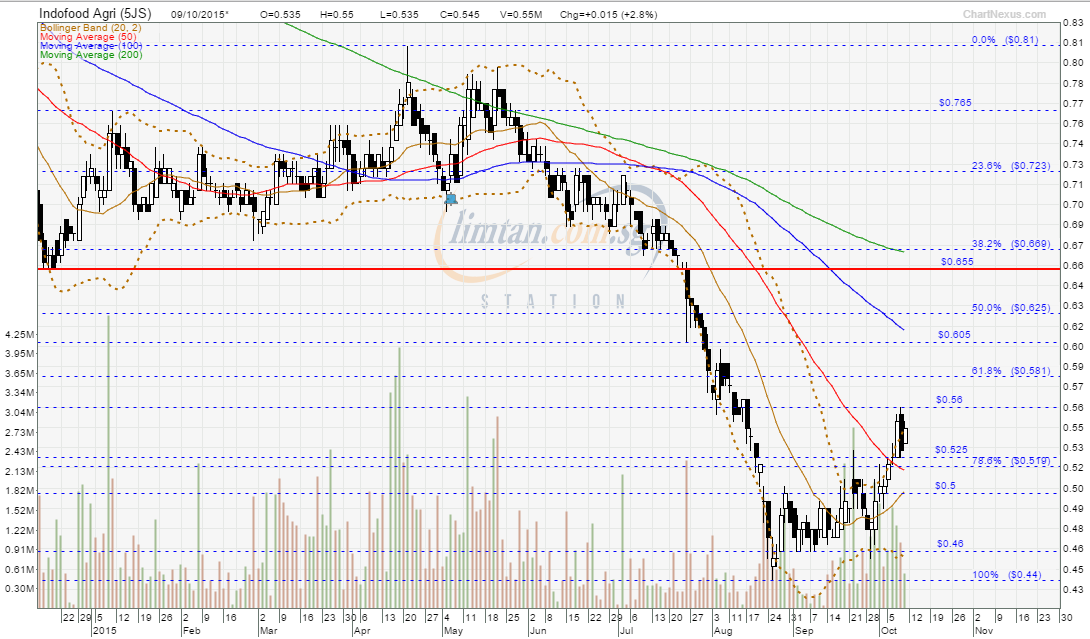

Stocks that exhibit certain chart patterns (Cup and Handle, Double Bottom and Flat Base) can lead to strong price appreciation when they breakout on strong volume.  Agriculture stocks 'may enjoy cyclical upturn'IndoAgri ~ Rounding Bottom formation Agriculture stocks 'may enjoy cyclical upturn'IndoAgri ~ Rounding Bottom formationIndoAgri had a spinning top and traded @ S$0.625 (+0.02, +3.3%) with 1.4m shares done 26 Oct 2015 at 1450 hrs. Immediate support at the 50d SMA @ S$0.59, immediate resistance @ S$0.655.   |

|