|

|

Post by zuolun on Dec 18, 2013 13:32:52 GMT 7

AURIC — Rounding Top formation

Immediate resistance @ S$1.30, the 200d EMA. Crucial support @ S$1.22, the neckline of the rounding top.  AURIC (weekly) — Trading in an upward sloping channel AURIC (weekly) — Trading in an upward sloping channel

|

|

|

|

AURIC

Jan 13, 2015 15:13:59 GMT 7

Post by zuolun on Jan 13, 2015 15:13:59 GMT 7

|

|

|

|

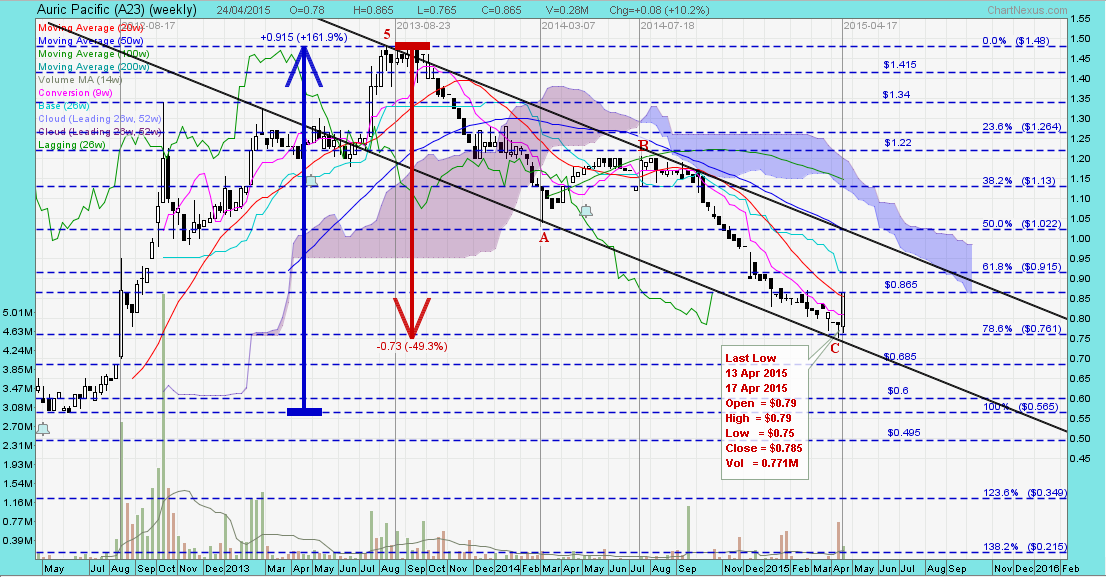

Post by zuolun on Apr 27, 2015 13:43:55 GMT 7

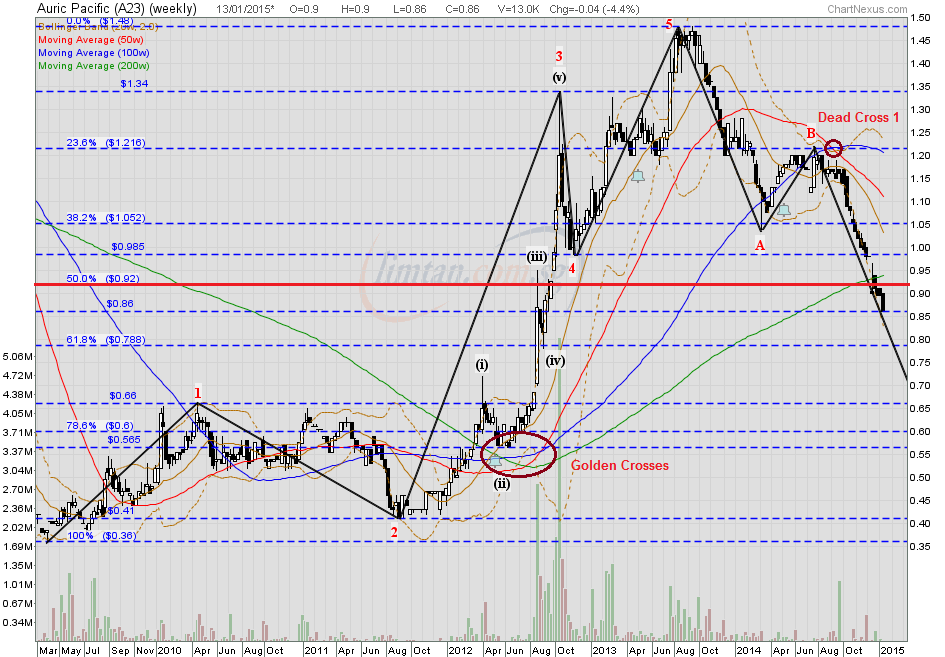

Final dividend S$0.02 ex-date on 5 May 2015, books closure on 8 May 2015 and payment date on 22 May 2015 ~ 14 Apr 2015 Former SMRT chief Saw Phaik Hwa to retire as Auric Pacific CEO w.e.f. 1st May 2015 ~ 28 Jan 2015 AURIC ~ Dead cat bounce, biased to the downsideAuric closed with a white marubozu @ S$0.865 (+0.055, +6.8%) with 34,500 shares done on 23 Apr 2015. Immediate support @ S$0.79, immediate resistance @ S$0.88.  AURIC (weekly) ~ Riding on the corrective Wave-C down AURIC (weekly) ~ Riding on the corrective Wave-C down AURIC peaked @ S$1.48 (dividend adjusted), the last leg of the impulsive Wave-5 up ended on 23 Aug 2013, it is currently riding on the corrective Wave-C down. AURIC — A classic textbook example of the Elliott Wave pattern Auric Pacific swings back to black in FY14 Auric Pacific swings back to black in FY14By PC Lee 27 Feb 2015 SINGAPORE: Auric Pacific Group has posted FY14 earnings of $231,000 from a loss of $21.9 million a year ago. The swing was due to the recognition of a smaller loss from exceptional items of $3.3 million in FY14 compared to loss of $21.6 million which were recognised in FY13 by the group to streamline the non-performing businesses and to re-align the focus on building sustainable business growth and profit generation. The one-off loss of $3.3 million arose from the discontinuation of the loss-making restaurant in China, which helped stem losses in the food retail business. Excluding the exceptional items recognised in FY13 and FY14, the group showed an improvement in profit of $4.4 million, said Auric Pacific. Revenue for the full year increased 6.5% to $424.4 million from $398.5 million due to higher revenue from the wholesale and distribution segment higher revenue from Edmontor Group which operates Delifrance Hong Kong as well as the manufacturing segment which recorded higher revenue in 2014 due to the increase in sales of Sunshine range of products. Operating profit from manufacturing segment increased from $7.3 million in FY13 to $10 million in FY14 largely driven by manufacturing in Singapore due to higher gross profit from growth in sales generated by existing and new products. Food Junction Group's operating performance improved in FY14 over FY13 by $3.7 million was led by improvement in profitability from food courts and restaurant in Hong Kong and closure of non-performing restaurants. Delifrance Singapore also reported lower operating loss, mainly driven by higher sales arising from intensive promotional activities, offset by higher labour costs, rental, marketing and semi-variable costs. Wholesale and distribution segments operating profit for FY14 was $2 million lower than in FY13 due to weaker performance in Malaysia. The group will continue to review its business strategies to strengthen the fundamentals of the businesses and to optimise the use of its resources, said Auric Pacific. Auric Pacific last traded at 84 cents.

|

|