|

|

Post by zuolun on Nov 9, 2013 14:24:17 GMT 7

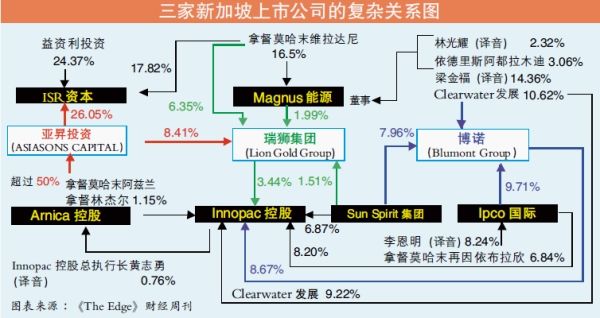

Malaysian's Chinese news, nanyang.com reported on "ABL" dated 13 Oct 2013; the chart is clearer. 新加坡交易所股价暴跌停牌 3“指定股”牵扯苏启文 |

|

|

|

Post by zuolun on Nov 9, 2013 14:46:57 GMT 7

|

|

|

|

Blumont

Nov 12, 2013 20:01:04 GMT 7

Post by oldman on Nov 12, 2013 20:01:04 GMT 7

If I read the document correctly, the loss in market value of its financial assets, through profit or loss is $60.9 mil (average cost of investment minus market value as at 11th Nov 2013), based on today's closing prices. I think these are mainly its investments in the listed Australian mining companies.... though I cannot find a voluntary disclosure between 25th Sept and 12th Nov whence its cost of investment went up from $27.1 mil to $81.17 mil. Blumont also released its 9 month results and it showed a profit of $50.16 mil from fair value gains on financial assets, through profit and loss. This is of course, based on accounts ending 30th Sept 2013. For the 9 months, its total revenues were just $2.938 mil and profits were $42.5 mil after taking into consideration these fair value gains on financial assets. infopub.sgx.com/FileOpen/SGXNET_3rdQ2013_12112013_AfterAC.ashx?App=Announcement&FileID=263948

|

|

|

|

Blumont

Nov 13, 2013 19:53:52 GMT 7

Post by oldman on Nov 13, 2013 19:53:52 GMT 7

Good comments from Kevin Scully: www.nracapital.com/Research/KevinBlog/757His previous comments on Blumont is found here: www.nracapital.com/research/kevinblog/751However, I cannot find the answer to my question.... what investments did Blumont do in between 25th Sept and 12th Nov whence its cost of investments went up from $27.1 mil to $81.17 mil. I had a quick look at all the Aussie stocks that they invested in and these did not fall that significantly to account for the collapse of the market value of its investments from $118.69 mil to $21.58 mil. |

|

|

|

Blumont

Nov 16, 2013 13:27:25 GMT 7

Post by oldman on Nov 16, 2013 13:27:25 GMT 7

Another good write up on the links between the various companies and shareholders in this weekend's edition of The Edge Malaysia. Please support the publication by subscribing to it. Quality reporting as always.  |

|

|

|

Post by hyom on Nov 16, 2013 13:42:35 GMT 7

Hi oldman, For fundamental investors, they will take a quick glance at the financials of Blumont and never take a second look anymore. However, for chartists, Blumont was a great opportunity. The fundamental side of me made me throw Blumont into the rubbish almost instantly in late 2012. However, the chartist side of me tells me Blumont was the greatest wasted opportunity as a momentum tikam play since I started investing. Blumont caught my attention based on its price-volume action in the last quarter of 2012. It had strong momentum. On hindsight, what is so special about its uptrend from Oct 2012 to Oct2013 before the fallout was that there was hardly any pullback. In other words, trend followers who jumped in during late 2012 will hardly be forced to jump out of the trend because the uptrend was so steady and strong. Throughout this period, the only time when momentum players would be shaken out is 17Dec2012 when it dropped 9% but it rebounded 16% the next day. For the rest of the time, trend followers who place a trailing stop(even a tight one) will not be stopped out until 3Oct13 which is almost the top. As usual, several retail investors have blamed the BBs (Big boys) syndicates for manipulating the Blumont share price and made big money at their expense. However, from Blumont's price-volume action, I think the syndicates lost lots of money this time. There were no signs of major dumping by the syndicates from Oct 2012 to Oct2013. If there were dumping or offloading to the retail investors, we should be able to see some price pullback during this period. When the syndicates started the real dumping in early Oct 2013, they were caught by the surprise action of SGX who halted Blumont in the first hour of trading on 3Oct and made it a designated stock. The price collapsed more than 80% when it was allowed to trade on 7Oct13. It can be argued that because of SGX designation action, the syndicates did not have the opportunity to dump their overpriced holdings to innocent retail investors, thereby saving some retail investors who might have bought on the decline as they regretted missing out the early action. The best form of punishment for the price manipulators is to make them lose money. The real winners may be the small-time tikam investors who assumed a tiny liquid position and was able to get out in time when the price decline started. Not me of course. |

|

|

|

Post by oldman on Nov 16, 2013 13:58:18 GMT 7

Hyom, welcome to our forums. Always nice to see a familiar nick. I agree with you. If I were to speculate, I will not want to know the fundamentals as this will cloud my vision, especially if the shares head south. I will find all kinds of reasons to keep holding on to the shares. I know because I have been there. Nowadays, if I speculate, I will just look at the momentum. Most importantly, I will have a cut loss position. No ifs, no buts. Once the shares fall below this price level, I will sell. Not knowing the fundamentals will ensure that I will stick to this cut loss strategy.  Saying all that, I rarely speculate nowadays as I know that I make most of my money with fundamental investing instead. Reason very simply is because I dare to place large bets with fundamental investing as I am confident of my own analysis. I cannot say the same for speculation as the chances of winning is as best 50% and I don't like odds like this! |

|

|

|

Post by hyom on Nov 16, 2013 14:33:37 GMT 7

Hyom, welcome to our forums. Always nice to see a familiar nick. I agree with you. If I were to speculate, I will not want to know the fundamentals as this will cloud my vision, especially if the shares head south. I will find all kinds of reasons to keep holding on to the shares. I know because I have been there. Nowadays, if I speculate, I will just look at the momentum. Most importantly, I will have a cut loss position. No ifs, no buts. Once the shares fall below this price level, I will sell. Not knowing the fundamentals will ensure that I will stick to this cut loss strategy.  Saying all that, I rarely speculate nowadays as I know that I make most of my money with fundamental investing instead. Reason very simply is because I dare to place large bets with fundamental investing as I am confident of my own analysis. I cannot say the same for speculation as the chances of winning is as best 50% and I don't like odds like this! Since tikam stocks have poorer fundamentals, only small bets can be made with them for proper risk management. So, one can end up monitoring too many tikam stocks in the portfolio. I guess tikam stocks are no longer worth your time as a few big fundamental bets takes up lesser monitoring time (maybe even lesser stress) than several small tikam bets. Still, a diversified portfolio of tikam stocks has its use. They keep one in tune with Mr Market's mood swings better than fundamental stocks which move more in tune to specific companies' conditions. |

|

|

|

Post by zuolun on Nov 18, 2013 18:17:07 GMT 7

oldman, There's a Chinese saying: 见好就收 = "Quit while you're ahead." Blumont's EW chart pattern already looked extremely toppish to me in mid-Sep, prior to the collapse on the 3rd of Oct.     |

|

|

|

Post by oldman on Nov 18, 2013 19:12:11 GMT 7

I actually pity the traders who played this counter. They can have all their cut loss strategies in place but when the share price falls so rapidly, I don't think anyone can respond so quickly unless they have placed prior stop loss positions into their broker's system. Perhaps this is one of the few circumstances where a trader really has no control over his risks. I have zero interest in this stock or any of the other related stocks. They are just of academic interest to me.  oldman, There's a Chinese saying: 见好就收 = "Quit while you're ahead." Blumont's EW chart pattern already looked extremely toppish to me in mid-Sep, prior to the collapse on the 3rd of Oct. |

|

|

|

Blumont

Nov 18, 2013 20:38:20 GMT 7

Post by oldman on Nov 18, 2013 20:38:20 GMT 7

|

|

|

|

Post by zuolun on Nov 20, 2013 9:19:44 GMT 7

|

|

|

|

Post by oldman on Nov 20, 2013 11:26:01 GMT 7

|

|

|

|

Post by zuolun on Nov 20, 2013 11:49:07 GMT 7

|

|

|

|

Post by oldman on Nov 21, 2013 16:35:42 GMT 7

|

|