|

|

Blumont

Nov 22, 2013 17:19:37 GMT 7

Post by oldman on Nov 22, 2013 17:19:37 GMT 7

Another interesting full page article in the Edge Singapore this week....  |

|

|

|

Post by oldman on Dec 3, 2013 4:39:23 GMT 7

BLUMONT GROUP LTD. (Company Registration No.: 199302554G) (Incorporated in the Republic of Singapore) _____________________________________________________________________________________ UPDATE ON DISPUTE WITH PROSPECT RESOURCES LIMITED _____________________________________________________________________________________ Terms defined in the announcement by Blumont Group Ltd. (博诺有限公司) (the “Company”) dated 11 July 2013 on the proposed subscription for 325,000,000 new shares in Prospect Resources Limited (the “Issuer”) shall bear the same meaning in this announcement unless otherwise defined here. The Company notes that Prospect Resources Limited ("PSC") has announced on 29 November 2013 that PSC has commenced court proceedings against, amongst others, the Company. The Company has not heard from PSC and has yet to be served with any court papers in relation to the court proceedings and will await formal service before taking any further steps in the matter. The Company will make further announcement on the matter, as and when appropriate. By Order of the Board Blumont Group Ltd. James Hong Gee Ho Executive Director 2 December 2013 --------------------  www.asx.com.au/asxpdf/20131129/pdf/42l91n2pvh1r4l.pdf www.asx.com.au/asxpdf/20131129/pdf/42l91n2pvh1r4l.pdf |

|

|

|

Post by zuolun on Dec 3, 2013 15:41:54 GMT 7

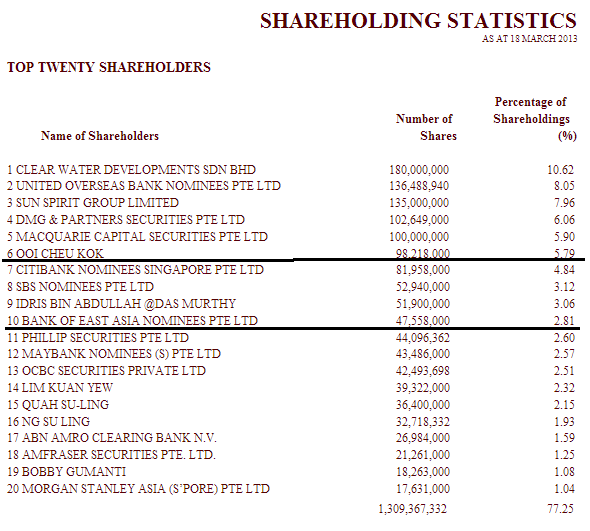

Blumont Top 20 Shareholders as at 18 Mar 2013

Extra notes for Blumont Extra notes for Blumont

- Copper (September 2013): Blumont entered into a concurrent convertible bond and equity placement agreement (the “Placement”) with Discovery Metals Limited (“DML”), a copper exploration and production company listed on the Australian Securities Exchange (“ASX”) and Botswana Stock Exchange, for a total investment consideration of approximately A$116 million. Pursuant to the Placement, Blumont acquired approximately 11.56% of the total issued share capital of DML;

- Thermal Coal (September 2013): Blumont entered into a conditional share subscription agreement to acquire up to 15% of the potential enlarged issued share capital of ASX and Johannesburg Stock Exchange-listed coal mining company, Resource Generation Limited, for a total investment consideration of between A$20.97 million and A$22.11 million;

- Copper (August 2013): Blumont acquired approximately 10.7% of the total issued share capital of ASX-listed Kidman Resources Limited, a company focused on the exploration and development of precious and base metals deposits within Australia;

- Uranium (July 2013): Blumont entered into a conditional sale and purchase agreement to acquire the entire issued and paid up share capital of investment holding company Powerlite Ventures Limited (“Powerlite”) for US$7.88 million (including the assignment of shareholders’ loans of an aggregate of US$4.5 million), giving the Group exposure to uranium projects in Kyrgyzstan and the United States of America through Powerlite’s interests in Azarga Resources Limited (“Azarga”), a major Asia-based uranium development and investment company. On 28 August 2013, the Group announced it was expanding its commitment to the uranium sector by increasing the size of its existing convertible loan facility to Azarga by US$6 million to US$21 million;

- Coking Coal (July 2013): Blumont entered into a conditional agreement to acquire approximately 12.75% of the enlarged capital of ASX-listed Cokal Limited (“Cokal”), which focuses on coal exploration and metallurgical coal production, and has interests in coal exploration tenements in Central Kalimantan, Indonesia and Tanzania. On 7 October 2013, Blumont entered into a binding term sheet to extend a loan facility of up to US$8 million in principal amount to Cokal to fund the continuation of development work at Cokal’s projects;

- Gold (July 2013): Blumont led a consortium of three partners to enter into a conditional agreement to acquire approximately 43.47% of the enlarged issued share capital of ASX-listed minerals explorer Prospect Resources Limited;

- Thermal and Coking Coal (March 2013): Blumont acquired approximately 11.5% of the total issued share capital of ASX-listed Celsius Coal Ltd., a coking coal explorer focused on developing coking and thermal coal deposits in the Kyrgyz Republic; and

- Iron Ore (December 2012): Blumont entered into a conditional sale and purchase agreement to subscribe for 2.5 million ordinary shares, representing the entire issued share capital of Hudson Minerals Holdings Pte Ltd., for a purchase consideration of up to S$48.0 million (including the assignment of shareholders’ loans of not less than S$5.5 million).

|

|

|

|

Post by zuolun on Dec 4, 2013 9:34:46 GMT 7

Blumont — Trading in a downward sloping channelOn 4 Dec 2013 at 10.20am.

|

|

|

|

Post by zuolun on Dec 5, 2013 16:54:05 GMT 7

Resource Generation Limited: Update On Placement To Blumont — 5 Dec 2013 Resource Generation LimitedRegistered in Australia under the Corporations Act, 2001 (Cth) with registration number ACN: 059 950 337 ISIN: AU000000RES1 Share Code on the ASX: RES Share Code on the JSE: RSG ("Resgen" or the “Company”) ASX Release Update on placement to BlumontFollowing shareholder approval at the AGM held on 29 November 2013 for the Blumont Group Ltd (Blumont) placement of 102,596,530 shares at 22 cents per share, payment of $22,571,236.60 by Blumont was due on 4 December 2013. The funds have not been received by the Company from Blumont. The Company is taking action to obtain the funds from Blumont. Sydney 5 December 2013 JSE Sponsor Macquarie First South Capital Proprietary Limited Contacts Paul Jury, Managing Director on (02) 9376 9000 or Steve Matthews, Company Secretary on (02) 9376 9000 Media enquiries Anthony Tregoning (02) 8264 1000

|

|

|

|

Post by oldman on Dec 5, 2013 16:59:06 GMT 7

Thanks Zuolun. I really feel sorry for the Blumont management. Everything is hitting them at the same time.

PS - I don't see any Blumont announcement on this yet.

|

|

|

|

Post by oldman on Dec 6, 2013 5:15:44 GMT 7

|

|

|

|

Post by oldman on Dec 6, 2013 9:22:01 GMT 7

Trading of Blumont shares has been halted this morning. Today is the deadline for the acquisition of shares by Mr Molyneux. I will also not be surprised that they clarify the issue with Resource Generation as highlighted by zuolun and BT.

------------

ACQUISITION OF SHARES BY CHAIRMAN DESIGNATE

The Board of Directors of Blumont Group Ltd. (博诺有限公司) (the “Company”) refers to the

announcement by the Company dated 7 October 2013 (the “Initial Announcement”) on the

proposed acquisition by Mr. Alexander Molyneux, Chairman designate of the Company, of 135

million issued ordinary shares (“Shares”) in the Company (the “Acquisition”). All terms used in

this announcement shall bear the same meanings ascribed to them in the Initial Announcement

unless otherwise defined herein.

Mr. Molyneux has informed the Company that the parties to the Acquisition have agreed to

extend the completion period of the Acquisition by 30 days. The Acquisition is now expected to

be completed on or before 6 December 2013.

The Company will update Shareholders on completion of the Acquisition. In the interim, Mr.

Molyneux will remain as Chairman designate of the Company.

On behalf of the Board

Blumont Group Ltd.

James Hong Gee Ho

Executive Director

8 November 2013

|

|

|

|

Post by oldman on Dec 6, 2013 10:14:38 GMT 7

There is an interesting article in The Edge Singapore today. Basically, Mr Molyneux stated that he is still interested in acquiring Nr Neo's stake, it is just a matter of the stake being released by the broker. As for Resource Generation, he says that technically, Blumont has 3 months to pay from the date of approval which was in late Nov and that once Blumont concludes the US$200 mil financing agreement with Platinum Partners, there should be enough money to fund investments.

Maybe this is why Asiasons and LionGold share prices rebounded this morning (as Blumont shares halted trading this morning). Regardless, I still rather remain a spectator.

|

|

|

|

Post by zuolun on Dec 6, 2013 10:36:46 GMT 7

There is an interesting article in The Edge Singapore today. Basically, Mr Molyneux stated that he is still interested in acquiring Nr Neo's stake, it is just a matter of the stake being released by the broker. As for Resource Generation, he says that technically, Blumont has 3 months to pay from the date of approval which was in late Nov and that once Blumont concludes the US$200 mil financing agreement with Platinum Partners, there should be enough money to fund investments. Maybe this is why Asiasons and LionGold share prices rebounded this morning (as Blumont shares halted trading this morning). Borrowing from Peter to pay Paul.  Extra notes for Blumont

- Copper (September 2013): Blumont entered into a concurrent convertible bond and equity placement agreement (the “Placement”) with Discovery Metals Limited (“DML”), a copper exploration and production company listed on the Australian Securities Exchange (“ASX”) and Botswana Stock Exchange, for a total investment consideration of approximately A$116 million. Pursuant to the Placement, Blumont acquired approximately 11.56% of the total issued share capital of DML;

- Thermal Coal (September 2013): Blumont entered into a conditional share subscription agreement to acquire up to 15% of the potential enlarged issued share capital of ASX and Johannesburg Stock Exchange-listed coal mining company, Resource Generation Limited, for a total investment consideration of between A$20.97 million and A$22.11 million;

- Copper (August 2013): Blumont acquired approximately 10.7% of the total issued share capital of ASX-listed Kidman Resources Limited, a company focused on the exploration and development of precious and base metals deposits within Australia;

- Uranium (July 2013): Blumont entered into a conditional sale and purchase agreement to acquire the entire issued and paid up share capital of investment holding company Powerlite Ventures Limited (“Powerlite”) for US$7.88 million (including the assignment of shareholders’ loans of an aggregate of US$4.5 million), giving the Group exposure to uranium projects in Kyrgyzstan and the United States of America through Powerlite’s interests in Azarga Resources Limited (“Azarga”), a major Asia-based uranium development and investment company. On 28 August 2013, the Group announced it was expanding its commitment to the uranium sector by increasing the size of its existing convertible loan facility to Azarga by US$6 million to US$21 million;

- Coking Coal (July 2013): Blumont entered into a conditional agreement to acquire approximately 12.75% of the enlarged capital of ASX-listed Cokal Limited (“Cokal”), which focuses on coal exploration and metallurgical coal production, and has interests in coal exploration tenements in Central Kalimantan, Indonesia and Tanzania. On 7 October 2013, Blumont entered into a binding term sheet to extend a loan facility of up to US$8 million in principal amount to Cokal to fund the continuation of development work at Cokal’s projects;

- Gold (July 2013): Blumont led a consortium of three partners to enter into a conditional agreement to acquire approximately 43.47% of the enlarged issued share capital of ASX-listed minerals explorer Prospect Resources Limited;

- Thermal and Coking Coal (March 2013): Blumont acquired approximately 11.5% of the total issued share capital of ASX-listed Celsius Coal Ltd., a coking coal explorer focused on developing coking and thermal coal deposits in the Kyrgyz Republic; and

- Iron Ore (December 2012): Blumont entered into a conditional sale and purchase agreement to subscribe for 2.5 million ordinary shares, representing the entire issued share capital of Hudson Minerals Holdings Pte Ltd., for a purchase consideration of up to S$48.0 million (including the assignment of shareholders’ loans of not less than S$5.5 million).

|

|

|

|

Post by oldman on Dec 6, 2013 11:34:04 GMT 7

I think the Edge Singapore article is more informative than the clarification.......

-----------------

CLARIFICATION OF BUSINESS TIMES ARTICLE DATED 6 DECEMBER 2013

Unless otherwise defined herein, all terms used in this announcement shall bear the same

meanings ascribed to them in the announcement by Blumont Group Ltd. (博诺有限公司) (the

“Company”) dated 16 September 2013 on the Company’s proposed subscription for new shares

in Resource Generation Limited.

The Company refers to the article in the Business Times edition of 6 December 2013 titled “Coal

miner seeks payment from Blumont” (the “Article”).

The Company wishes to inform its shareholders that the Company has been in ongoing

discussions with Resource Generation Limited (“RES”) since the evening of 5 December 2013

for a mutually beneficial outcome on its subscription for shares in RES.

The Company will provide further updates on the matter, as and when appropriate. In the

meantime, Shareholders are advised to refrain from taking any action in relation to their shares

of the Company which may be prejudicial to their interests, and to exercise caution when dealing

in the shares of the Company.

BY ORDER OF THE BOARD

BLUMONT GROUP LTD.

James Hong Gee Ho

Executive Director

06 December 2013

|

|

|

|

Post by oldman on Dec 6, 2013 15:44:44 GMT 7

Interesting to see a reclarification of a clarification.......

CLARIFICATION OF BUSINESS TIMES ARTICLE DATED 6 DECEMBER 2013

The Company refers to the announcement by Blumont Group Ltd. ( 博诺有限公司 ) (the

“Company”) dated 16 September 2013 (the “Initial Announcement”) on the Company’s

proposed subscription for new shares in Resource Generation Limited (“RES”), and the article in

the Business Times edition of 6 December 2013 titled “Coal miner seeks payment from Blumont”

(the “Article”). Unless otherwise defined herein, all terms used in this announcement shall bear

the same meanings ascribed to them in the Initial Announcement.

Under the SSA, subject to the fulfillment of certain conditions, payment of A$22,571,236.60 by

the Company to RES for subscription of shares in RES would have been due on 4 December

2013.

The Company wishes to inform its shareholders that the Company has been in discussions with

RES since the evening of 5 December 2013 and is continuing to engage in discussions with

RES for a mutually beneficial outcome on its subscription for shares in RES.

The Company reserves all its rights under the SSA.

The Company will provide further updates on the matter, as and when appropriate. In the

meantime, Shareholders are advised to refrain from taking any action in relation to their shares

of the Company which may be prejudicial to their interests, and to exercise caution when dealing

in the shares of the Company.

BY ORDER OF THE BOARD

BLUMONT GROUP LTD.

James Hong Gee Ho

Executive Director

06 December 2013

|

|

|

|

Post by zuolun on Dec 6, 2013 16:16:34 GMT 7

此地无银三百两。Admitting that there is something fishy, i.e. There's more than meets the eye.  Interesting to see a reclarification of a clarification....... CLARIFICATION OF BUSINESS TIMES ARTICLE DATED 6 DECEMBER 2013 The Company refers to the announcement by Blumont Group Ltd. ( 博诺有限公司 ) (the “Company”) dated 16 September 2013 (the “Initial Announcement”) on the Company’s proposed subscription for new shares in Resource Generation Limited (“RES”), and the article in the Business Times edition of 6 December 2013 titled “Coal miner seeks payment from Blumont” (the “Article”). Unless otherwise defined herein, all terms used in this announcement shall bear the same meanings ascribed to them in the Initial Announcement. Under the SSA, subject to the fulfillment of certain conditions, payment of A$22,571,236.60 by the Company to RES for subscription of shares in RES would have been due on 4 December 2013. The Company wishes to inform its shareholders that the Company has been in discussions with RES since the evening of 5 December 2013 and is continuing to engage in discussions with RES for a mutually beneficial outcome on its subscription for shares in RES. The Company reserves all its rights under the SSA. The Company will provide further updates on the matter, as and when appropriate. In the meantime, Shareholders are advised to refrain from taking any action in relation to their shares of the Company which may be prejudicial to their interests, and to exercise caution when dealing in the shares of the Company. BY ORDER OF THE BOARD BLUMONT GROUP LTD. James Hong Gee Ho Executive Director 06 December 2013

|

|

|

|

Post by oldman on Dec 6, 2013 16:26:44 GMT 7

I think the main difference between the first and second clarifications is the sentence below: Under the SSA, subject to the fulfillment of certain conditions, payment of A$22,571,236.60 by

the Company to RES for subscription of shares in RES would have been due on 4 December

2013.Somehow this sentence does not seem to gel with the Edge Singapore article as summarised in my earlier posting. 此地无银三百两。Admitting that there is something fishy, i.e. There's more than meets the eye.  |

|

|

|

Post by zuolun on Dec 6, 2013 17:08:13 GMT 7

|

|