|

|

Post by oldman on Apr 3, 2014 13:37:14 GMT 7

Blumont is currently at 4.8cts.... just below its deeply discounted 1 for 2 rights issue at 5cts. I agree with Zuolun that if 4.5cts is broken, the selling pressure may become much stronger. One never knows how long the CAD investigations will take and most investors will stay away during this time....

|

|

|

|

Post by zuolun on Apr 3, 2014 13:59:06 GMT 7

Blumont is currently at 4.8cts.... just below its rights price of 5cts. I agree with Zuolun that if 4.5cts is broken, the selling pressure may become much stronger. oldman, 当局者迷,旁观者清。

It means the accuracy/probable direction of price movement using TA is strictly based on one's ability to correctly read the charts without any emotions. It would be entirely different if one is heavily vested in a stock (long/short), especially the insider players.  (BBs could re-draw the charts anytime when face with opposing forces, example TA showed a huge monkey in OLAM's chart pattern ). The Art and Science of Technical Analysis |

|

|

|

Post by oldman on Apr 8, 2014 17:50:11 GMT 7

Not surprising....

PROPOSED ACQUISITION OF SHARES BY MR ALEXANDER ALAN MOLYNEUX

Unless otherwise defined herein, all terms used in this announcement shall bear the same meanings

ascribed to them in the Previous Announcements (as defined below).

Further to the announcements by Blumont Group Ltd. (博诺有限公司) (the “Company”) dated 7

October 2013, 8 November 2013 and 5 February 2014 (the “Previous Announcements”) on the

proposed acquisition by Mr. Alexander Alan Molyneux, Chairman designate of the Company, of 135

million issued ordinary shares in the Company (the “Acquisition”), the board of directors of the

Company wishes to update shareholders that on 7 April 2014, Mr. Molyneux has informed the

Company that he does not intend to proceed with the Acquisition.

Mr. Molyneux remains as a consultant and key adviser to the board of directors of the Company and

the Nominating Committee will consider the latest developments and seek to meet up with Mr.

Molyneux to make a decision regarding his position as Chairman-designate, as soon as possible.

BY ORDER OF THE BOARD

Blumont Group Ltd.

James Hong Gee Ho

Executive Director

8 April 2014

|

|

|

|

Post by zuolun on Apr 8, 2014 18:41:33 GMT 7

oldman, All the big insider players are trying to squeeze the last drop of blood with smoke screens. Alex Molyneux's interview on 8 Oct 2013 then and today's announcement suggested that he has been employed specifically for damage control only, there is no real money from genuine investors to rescue Blumont. He does not intend to proceed with the acquisition with his own money when the current market price is now so much cheaper at only 4c per share means GAME OVER... Not surprising.... PROPOSED ACQUISITION OF SHARES BY MR ALEXANDER ALAN MOLYNEUX Unless otherwise defined herein, all terms used in this announcement shall bear the same meanings ascribed to them in the Previous Announcements (as defined below). Further to the announcements by Blumont Group Ltd. (博诺有限公司) (the “Company”) dated 7 October 2013, 8 November 2013 and 5 February 2014 (the “Previous Announcements”) on the proposed acquisition by Mr. Alexander Alan Molyneux, Chairman designate of the Company, of 135 million issued ordinary shares in the Company (the “Acquisition”), the board of directors of the Company wishes to update shareholders that on 7 April 2014, Mr. Molyneux has informed the Company that he does not intend to proceed with the Acquisition. Mr. Molyneux remains as a consultant and key adviser to the board of directors of the Company and the Nominating Committee will consider the latest developments and seek to meet up with Mr. Molyneux to make a decision regarding his position as Chairman-designate, as soon as possible. BY ORDER OF THE BOARD Blumont Group Ltd. James Hong Gee Ho Executive Director 8 April 2014 |

|

|

|

Post by oldman on Apr 8, 2014 18:47:15 GMT 7

Poor retail folks. I think it is going to be a freefall towards 3cts when all those who took up the excess rights at 5cts realise that they may have looked smart then but not now. As always, never fight the smart money as they seldom leave money on the table.   oldman, All the big insider players are trying to squeeze the last drop of blood with smoke screens. Alex Molyneux's interview on 8 Oct 2013 then and today's announcement suggested that he has been employed specifically for damage control only, there is no real money from genuine investors to rescue Blumont. |

|

|

|

Post by zuolun on Apr 8, 2014 19:16:35 GMT 7

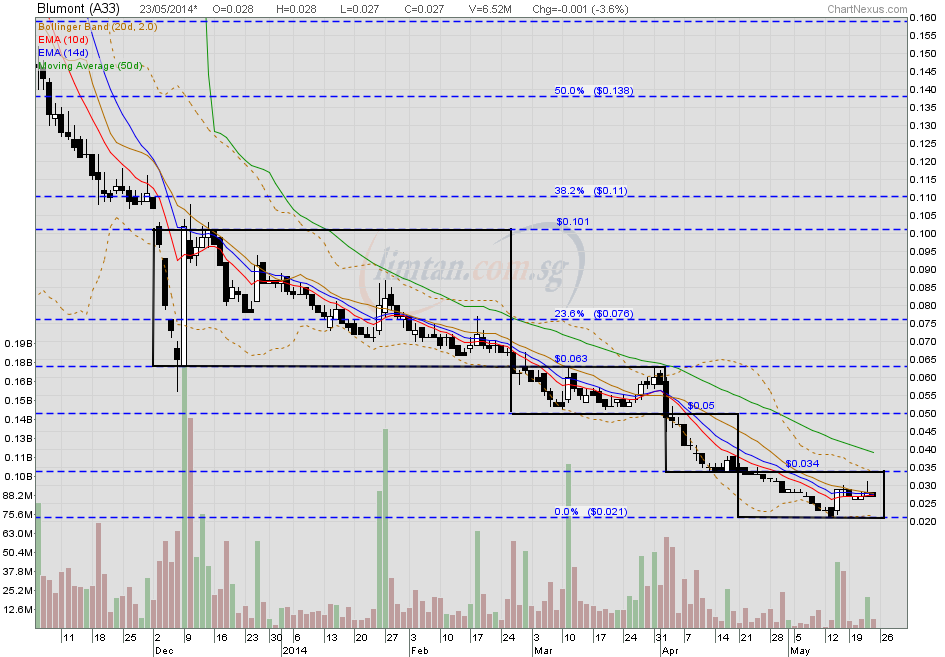

Poor retail folks. I think it is going to be a freefall towards 3cts when all those who took up the excess rights at 5cts realise that they may have looked smart then but not now. As always, never fight the smart money as they seldom leave money on the table.  oldman, The best opportunity/timing to get out of Blumont was the dead cat bounce @ 0.147 on 5 Nov 2013 (based on rights price at 5cts per share). If it's supposed to be a pump-and-dump job right from the beginning, then the big insider players might be the strong hands pushing up the share price for themselves to make a good profit. This is a typical bull-trap setup in most chart patterns.  Blumont — Bull Trap Blumont — Bull Trap me200, it is surprising to see Blumont holding on relatively well. Goes to show that up or down is really anyone's guess. Of course, if you have lots of money, your guess is likely to be more correct than others. Such is the nature of speculative stocks.  For fundamental investors, we look after our downside risks first. If we cannot quantify this or the intrinsic value we calculated is much lower, we rather sit on the sidelines. The trick to building wealth is always to look after your downside first. Another way of putting it is what Warren Buffett always say: Never lose money.... have a margin of safety.  |

|

|

|

Post by oldman on Apr 10, 2014 18:21:46 GMT 7

|

|

|

|

Post by oldman on Apr 17, 2014 14:23:33 GMT 7

|

|

|

|

Post by oldman on Apr 22, 2014 15:19:14 GMT 7

Looks like Blumont is still very keen on acquiring Genesis Resources..... ---------------------- The Company wishes to announce that the Takeover Consideration is to be satisfied by way of an issue and allotment of 9.5 Shares for every 2 GES Shares, up to a maximum of approximately 913,343,965 new Consideration Shares, subject to any fractional entitlements being rounding up to the nearest whole Consideration Share. This represents an increase from the initial Takeover Consideration of 5.3 Shares for every 2 GES Shares. Since the date of the Takeover Announcement, the closing price of the Shares has fallen 52.11% from S$0.071 to S$0.034 on 17 April 2014, being the last practicable date before the date of the Second Supplementary Company’s Statement (the “Applicable Last Practicable Date”). Since the date of the Company’s Statement, the closing price of the Shares has fallen 37.04% from S$0.054 to S$0.034. It is for this reason, amongst others, that the Company has decided to increase the Takeover Consideration. infopub.sgx.com/FileOpen/GES_Takeover%20_lodgement_of_%202nd_Supp_Company_Statement.ashx?App=Announcement&FileID=292420infopub.sgx.com/FileOpen/Second_Supplementary_Bidders_Statement_FINAL_VERSION.ashx?App=Announcement&FileID=292421 |

|

|

|

Post by zuolun on Apr 22, 2014 18:47:07 GMT 7

Looks like Blumont is still very keen on acquiring Genesis Resources..... ---------------------- The Company wishes to announce that the Takeover Consideration is to be satisfied by way of an issue and allotment of 9.5 Shares for every 2 GES Shares, up to a maximum of approximately 913,343,965 new Consideration Shares, subject to any fractional entitlements being rounding up to the nearest whole Consideration Share. This represents an increase from the initial Takeover Consideration of 5.3 Shares for every 2 GES Shares. Since the date of the Takeover Announcement, the closing price of the Shares has fallen 52.11% from S$0.071 to S$0.034 on 17 April 2014, being the last practicable date before the date of the Second Supplementary Company’s Statement (the “Applicable Last Practicable Date”). Since the date of the Company’s Statement, the closing price of the Shares has fallen 37.04% from S$0.054 to S$0.034. It is for this reason, amongst others, that the Company has decided to increase the Takeover Consideration. infopub.sgx.com/FileOpen/GES_Takeover%20_lodgement_of_%202nd_Supp_Company_Statement.ashx?App=Announcement&FileID=292420infopub.sgx.com/FileOpen/Second_Supplementary_Bidders_Statement_FINAL_VERSION.ashx?App=Announcement&FileID=292421 Cut-loss decisively without hesitation or bleed to death. |

|

|

|

Post by oldman on Apr 30, 2014 17:07:04 GMT 7

Announced today. No wonder the shares took a beating. Blumont last traded at 2.8cts today, down 0.3cts. Mr. Neo Kim Hock has informed the Company that, due to his personal commitments, Mr. Neo has

decided not to stand for re-election following his retirement. Accordingly, Resolution 3 of the AGM

Notice was withdrawn from consideration at the AGM and Mr. Neo Kim Hock has ceased to act as a

Director of the Company and Chairman of the Board with effect from the conclusion of the AGM held

today. The relevant information in relation to such cessation referred to in Rule 704(7) of the Listing

Manual of the SGX-ST are contained in a separate announcement made today on SGXNET.

infopub.sgx.com/FileOpen/ResultsofAGM_30Apr14.ashx?App=Announcement&FileID=294715 |

|

|

|

Post by oldman on May 25, 2014 20:25:55 GMT 7

|

|

|

|

Post by odie on May 25, 2014 22:02:51 GMT 7

dear all, pls avoid all such stocks at all costs don't average whatever these 2 say |

|

|

|

Post by zuolun on May 25, 2014 22:35:59 GMT 7

oldman, That mining company, Discovery Metals Limited, which Blumont purchased @ A$0.12 per share is worth much less now. DML's closing price @ A$0.034 per share on 23 May 2014 is moving in lockstep with Blumont's closing price @ S$0.027 per share on 23 May 2014.   |

|

|

|

Post by oldman on May 26, 2014 8:56:25 GMT 7

zuolun, I am equally as surprised with the interview as Blumont even at 2.8cts is valued at $72 mil. From the annual report for FY ended Dec 2013, it only had cash of $2.53 mil and borrowings of $4 mil. Agree with you that its financial assets are likely to be impaired further and one then has to work out whether the mining assets are worth so much. To me, there are lots of much cheaper mining companies listed on ASX. Hence, I am not keen at this price. Maybe at 1ct, I will relook.  As stated in my book, when a stock falls significantly in price, this does not mean that the stock is undervalued. It may be significantly overvalued in the first place and even at its current price, it may still be overvalued. The only way to determine if a stock is undervalued is to look at its current assets and peg a value to each of its assets to determine its fair market value. For me, I require a significant discount to fair market value before I risk any of my money.... especially so when there are now 7,820 shareholders (as at 28 Mar 2014) as compared to 2,192 shareholders (18 Mar 2013).

|

|