jays

Junior Member

Posts: 6

|

JES

Jan 17, 2014 11:40:41 GMT 7

Post by jays on Jan 17, 2014 11:40:41 GMT 7

Any view on this stock?

Was just reading the SGX announcement about this half-dead Chinese shipyard buying into a magnesium mine in Xinjiang that the geology report claim to have $500b mining potential.

|

|

|

|

Post by candy188 on Jan 17, 2014 18:09:19 GMT 7

The fundamentals of JES looks like a leaking boat to me.  ==> Inconsistent revenue & net earning. ==> Inconsistent revenue & net earning.

==> Total cash plunge by 89% from 2011 to 2012. ==> Total cash plunge by 89% from 2011 to 2012.

It is better to heed Warren Buffett's advice:

|

|

|

|

Post by stockpicker on Jan 17, 2014 20:45:48 GMT 7

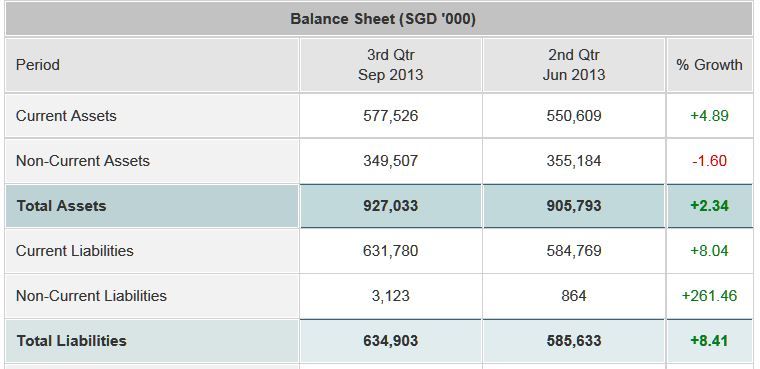

Candy, agreed with your observation. This counter somehow has been "fried" for reasons best known to the fryers. Unless the company can make profit; otherwise, this counter will go nowhere.. presently, it has choked up short term debts in current accounts as shown in the attached. The current ratio was less than 1.0 as if to say that JES is terribly "short of money". But judging from the low long term debts, it would appear that JES can only borrow short term rather than long term loans because of the poor financial results in the last few quarters. With no ready cash in hand, it would have difficulties repaying the short term debts at due dates without raising more capital.  |

|

|

|

JES

Jan 17, 2014 22:12:09 GMT 7

oldman likes this

Post by candy188 on Jan 17, 2014 22:12:09 GMT 7

Hi Stockpicker, Thank you for pointing out the importance of maintaining a healthy current ratio.  Sadly, this is the type of counter that will appeal to the financial illiterate investors searching for quick buck in a bull market.  My friend nearly ended as the greater fool holding one of penny stocks that collapsed, with insider tip My friend nearly ended as the greater fool holding one of penny stocks that collapsed, with insider tip .... thankfully, my advice to be cautious worked... else she will be donating to the Big fish, like what I did decade ago.   Candy, agreed with your observation. This counter somehow has been "fried" for reasons best known to the fryers.

Unless the company can make profit; otherwise, this counter will go nowhere.. presently, it has choked up short term debts in current accounts as shown in the attached. The current ratio was less than 1.0 as if to say that JES is terribly "short of money".  But judging from the low long term debts, it would appear that JES can only borrow short term rather than long term loans because of the poor financial results in the last few quarters. With no ready cash in hand, it would have difficulties repaying the short term debts at due dates without raising more capital.

|

|

|

|

Post by zuolun on Apr 7, 2014 17:04:40 GMT 7

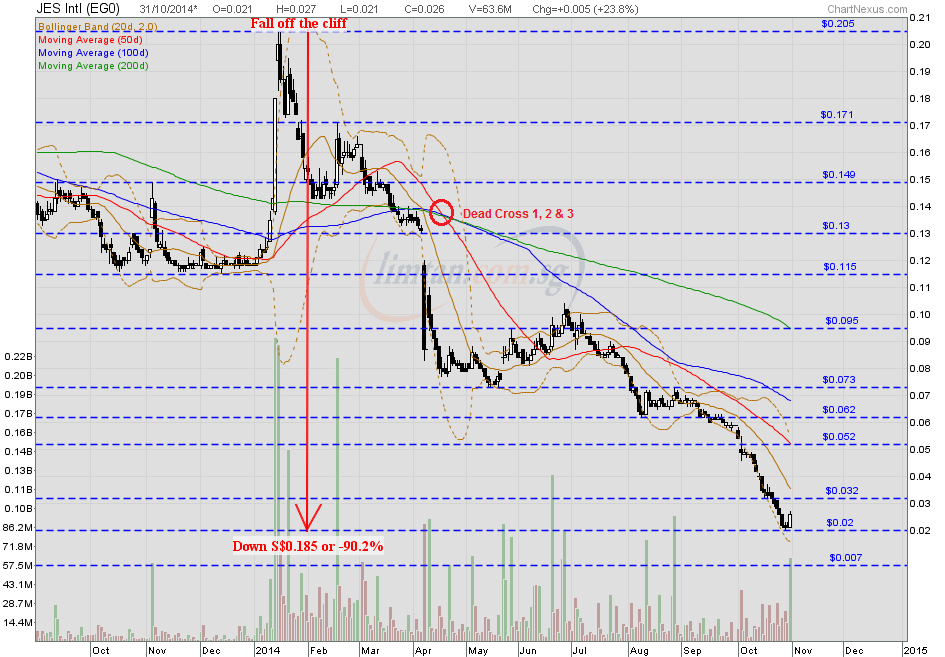

JES — A big bull trapJES plunged with a long black marubozu to low of S$0.083 and closed @ S$0.087 (-0.044, -33.6%) with extremely high volume done at 89.2m shares on 7 Apr 2014. The stock is likely to test the historical low @ S$0.06 scored on 17 Mar 2009.  JES — Bearish rectangle breakout JES — Bearish rectangle breakout JES (monthly) — Nov 2008 to Mar 2014 JES (monthly) — Nov 2008 to Mar 2014

|

|

|

|

JES

Oct 25, 2014 12:15:18 GMT 7

oldman likes this

Post by zuolun on Oct 25, 2014 12:15:18 GMT 7

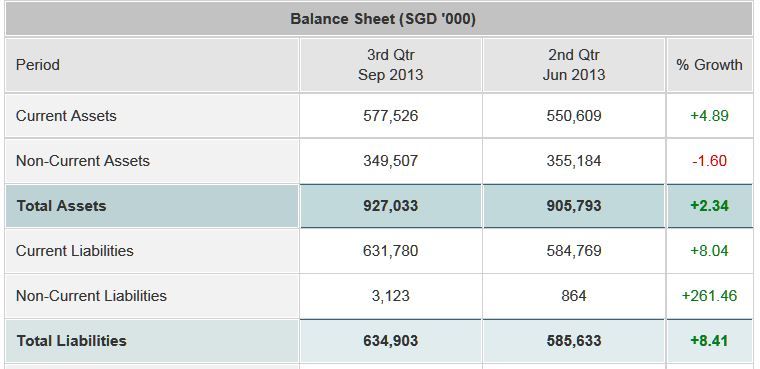

JES — A "Waterfall Decline" chart pattern, biased to the downside, TP S$0.007JES closed with a black marubozu @ S$0.028 (-0.002, -6.7%) with 29.5m shares done on 24 Oct 2014. Immediate support @ S$0.023, immediate resistance @ S$0.042.  JES — A big bull trapJES plunged with a long black marubozu to low of S$0.083 and closed @ S$0.087 (-0.044, -33.6%) with extremely high volume done at 89.2m shares on 7 Apr 2014. The stock is likely to test the historical low @ S$0.06 scored on 17 Mar 2009.

|

|

|

|

Post by zuolun on Nov 2, 2014 7:09:12 GMT 7

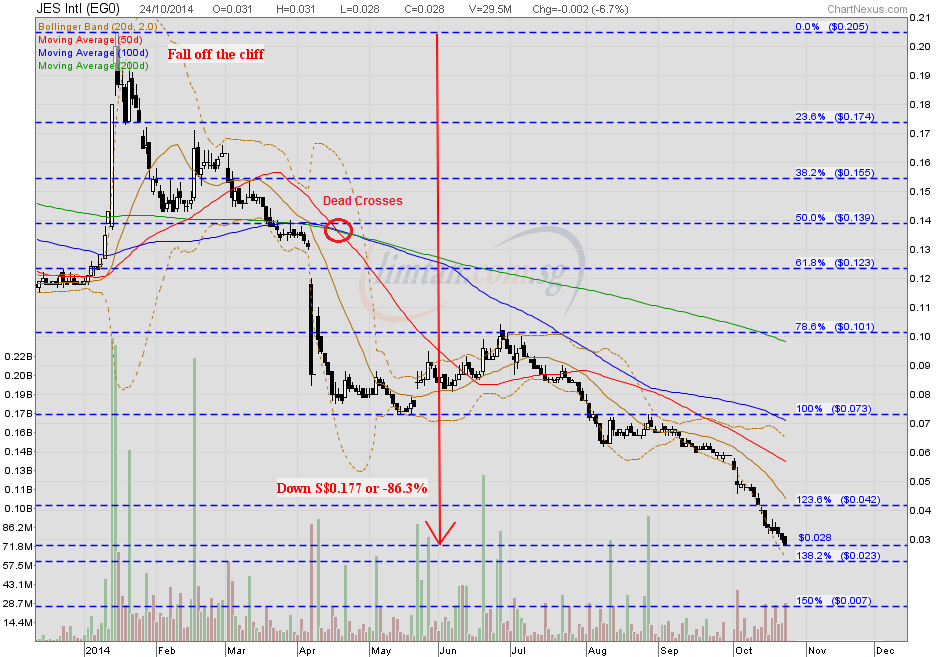

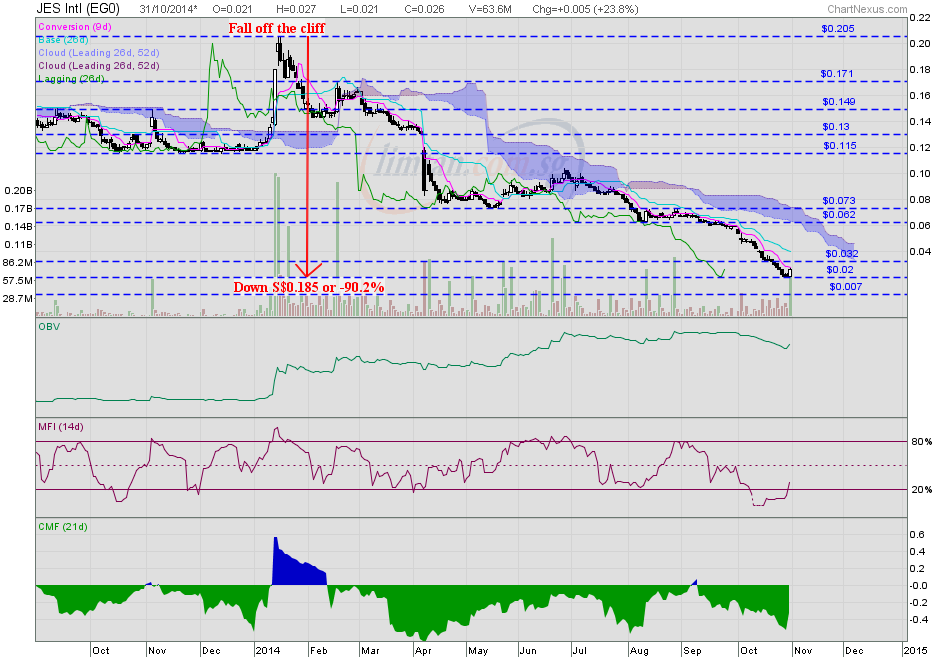

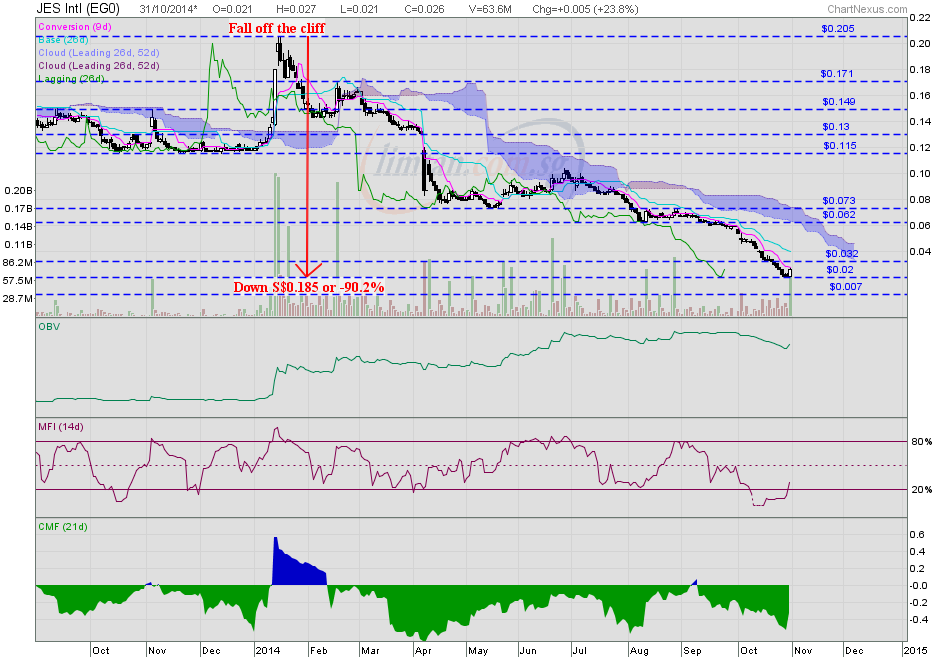

JES — A "Waterfall Decline" chart pattern, biased to the downside, TP S$0.007JES closed with a long white marubozu @ S$0.026 (+0.005, +23.8%) with high volume done at 63.6m shares on 31 Oct 2014. Immediate support @ S$0.02, immediate resistance @ S$0.032. Alternative +ve view:- JES plunged S$0.185 or 90.2% from S$0.205.

- Although the price trend is down but the MFI is now above 20 and the OBV has been rising since Feb 2014 (bullish divergence).

- Should the share price hit the 20d SMA @ S$0.052 and move higher to S$0.073 with extremely high volume of 100m shares and above; expect a short-term bullish trend reversal.

|

|

|

|

JES

Nov 16, 2014 12:24:03 GMT 7

oldman likes this

Post by zuolun on Nov 16, 2014 12:24:03 GMT 7

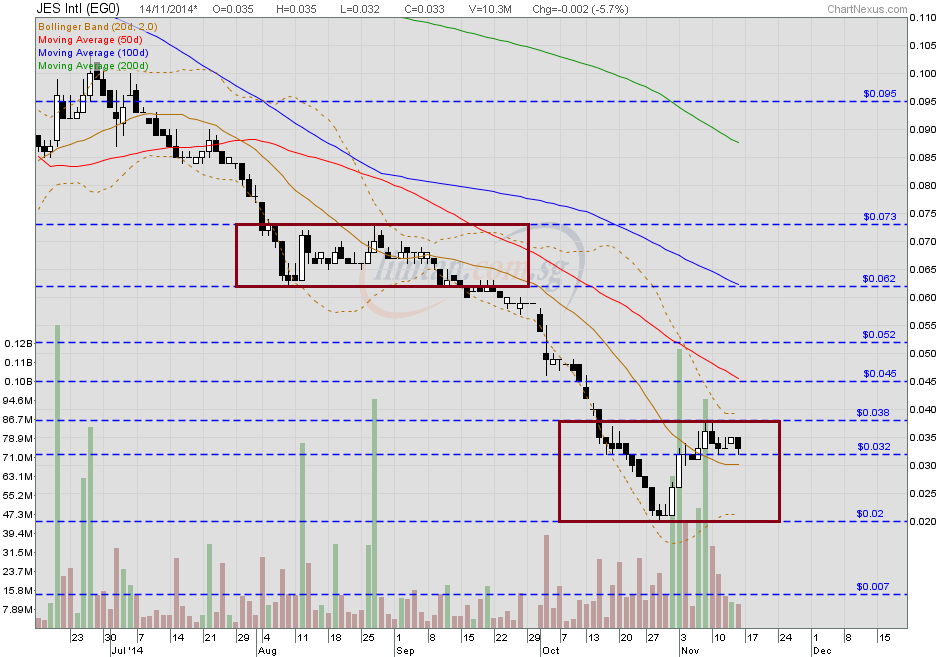

JES — A typical dead cat bounce JES — A typical dead cat bounceJES closed with a hammer @ S$0.033 (-0.002, -5.7%) with 10.3m shares on 14 Nov 2014. Immediate support @ S$0.032, immediate resistance @ S$0.038.   |

|

|

|

JES

Jan 11, 2015 15:29:45 GMT 7

oldman likes this

Post by zuolun on Jan 11, 2015 15:29:45 GMT 7

Alternative +ve view:- JES plunged S$0.185 or 90.2% from S$0.205.

- Although the price trend is down but the MFI is now above 20 and the OBV has been rising since Feb 2014 (bullish divergence).

- Should the share price hit the 20d SMA @ S$0.052 and move higher to S$0.073 with extremely high volume of 100m shares and above; expect a short-term bullish trend reversal.

JES has potential to hit TP @ S$0.064 or point D if the resistance @ S$0.042 is convincingly poked thru with extremely high volume of 200m shares and above. JES — Bearish Gartley FormationJES closed with a black marubozu @ S$0.036 (-0.002, -5.3%) with 13.1m shares done on 9 Jan 2015. Immediate support @ S$0.033 immediate resistance @ S$0.042.    |

|

|

|

JES

Mar 5, 2015 15:18:37 GMT 7

oldman likes this

Post by zuolun on Mar 5, 2015 15:18:37 GMT 7

|

|