|

|

Post by oldman on Mar 15, 2014 17:24:07 GMT 7

Share price prior to announcement: 5.4cts. Reverse takeover at 2.35cts. Massive dilution resulting in existing shareholders only owning 0.73% after the reverse takeover. 50 for 1 consolidation results in share price of $1.176 post consolidation. Company then buying remaining PCRT units at a premium of 27.27%. Existing business to be distributed in species (one has to read in between the lines....). Surprise that at the same time, they are proposing a placement at 5cts. Not sure who will subscribe to these shares as I would have thought that the share price will fall towards the 2.35cts level in the months ahead and may then fall further..... only time will tell if I am right. I have zero interests. Just exercising the mind. As always, I stand corrected. Details of reverse takeoverInvestor Presentation

Placement |

|

|

|

Post by odie on Mar 16, 2014 19:14:47 GMT 7

oldman,

i am interested in their new company and will keep it under my radar

thanks for updates

|

|

|

|

Post by oldman on Mar 17, 2014 5:38:27 GMT 7

Not surprisingly, they cancelled the placement.  -------------------- SUPPLEMENTAL ANNOUNCEMENT RELATING TO THE PROPOSED ACQUISITION BY ST JAMES HOLDINGS LIMITED 1. The Board refers to: (a) the announcement dated 14 March 2014 in relation to the proposed acquisition by St James Holdings Limited (the “Company” or “St James”) of certain target entities from Perennial Real Estate Holdings Pte Ltd, Mr Ron Sim (the “Key Vendor”) and other parties (the “Acquisition Announcement”); and (b) the announcement dated 14 March 2014 in relation to the proposed placement (“Proposed Placement”) of up to 52,000,000 new ordinary shares in the capital of St James (the “Placement Announcement”). Unless otherwise defined, all capitalised terms and references used in this Announcement shall have the meanings ascribed to them in the Acquisition Announcement and the Placement Announcement respectively. 2. As stated in the Acquisition Announcement, the Issue Price for the Consideration Shares was determined on the assumption that the Company will be placing 52,000,000 Shares pursuant to the Proposed Placement, which was being undertaken on a best endeavours basis, and there would be an adjustment to the Issue Price if less than 52,000,000 Shares were placed. 3. After further consideration, the Board of St James has decided not to proceed with the Proposed

Placement and no new Shares will be placed out pursuant to the Proposed Placement.

4. Accordingly, the Issue Price for the Proposed Acquisition will be adjusted to (i) S$0.0267 for

each Consideration Share to be issued prior to the Proposed Share Consolidation; and (ii)

S$1.3353 for each Consideration Share to be issued after the Proposed Share Consolidation.

5. The financial effects of the Proposed Transactions, prepared on the basis that the Proposed Placement does not take place, are set out in the Appendix to this Announcement. 6. Save as stated herein, there are no material changes to the terms of the Proposed Transactions as set out in the Acquisition Announcement. infopub.sgx.com/FileOpen/Unitu_Supp_Anmt_for_IssuePrice.ashx?App=Announcement&FileID=288742 |

|

|

|

Post by oldman on Mar 17, 2014 8:38:43 GMT 7

Amazingly, the share price is now at 7cts, up 30% on volumes of 35.6 mil shares. Only for the brave....

|

|

|

|

Post by zuolun on Mar 17, 2014 12:09:54 GMT 7

|

|

|

|

Post by zuolun on Mar 17, 2014 18:47:16 GMT 7

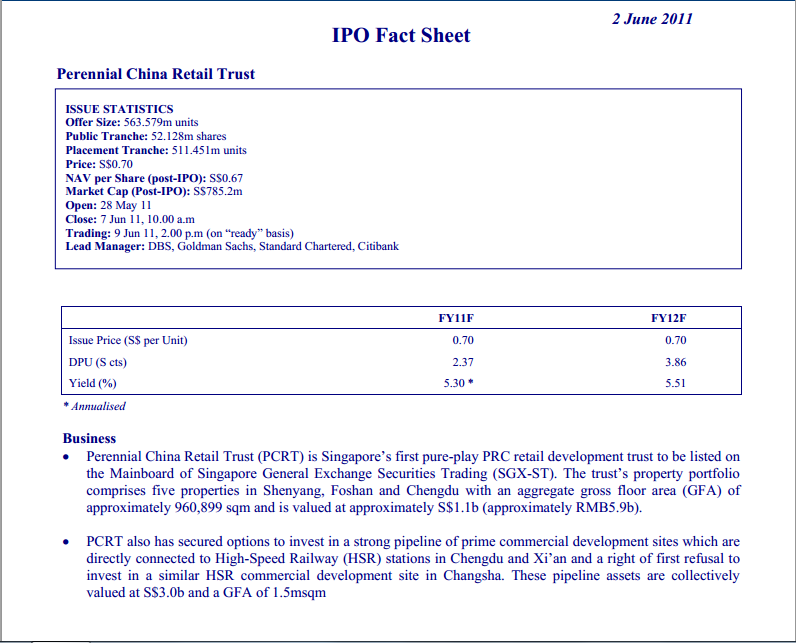

odie, I repeat why I never trust PCRT's top management since day one when it was IPO @ S$ 0.70 per share on Jun 09, 2011. Vernon Martin's reviews on PCRT dated 12 Jun 2011 and 21 Sep 2011 claimed that "the valuation report was based on the false premise that all five properties had been completed and fully leased, when only one building, the Red Star Macalline Furniture Mall, had been completed and opened, and the malls in Foshan and Chengdu had not only not been started, but the land had not yet been acquired by PCRT." These 2 articles may explain why PCRT's share price never trades above S$0.70 for > 2 years, to date. One filthy rich lady once told me: "When a rich woman wears a fake diamond ring, no one doubts it is not real but when a poor woman wears a real diamond ring, no one believes it is not fake." Perennial China Retail Trust (N9LU.SI) 鹏瑞利中国零售信托 — 12 Jun 2011 A Visit to Perennial China Retail Trust’s Assets in Shenyang, China 鹏瑞利中国零售信托 (N9LU) — 21 Sep 2011  |

|

|

|

Post by oldman on Mar 17, 2014 19:03:17 GMT 7

For those who think that buying shares in PCRT is a much cheaper way of getting into the action on St James, you are assuming that the price of St James will remain much higher than 2.67cts when (and if) the deal is done. Do remember that there will be a flood of available shares then as compared to the current thinly traded shares over the past few years. At the end of the day, always remember that the stock market is about supply and demand firstly then technicals and fundamentals. Smart money rarely gives you a free lunch.... more than likely, you may end up paying for lunch to be in the company of smart money.  |

|

|

|

Post by zuolun on Mar 17, 2014 21:30:21 GMT 7

For those who think that buying shares in PCRT is a much cheaper way of getting into the action on St James, you are assuming that the price of St James will remain much higher than 2.67cts when (and if) the deal is done. Do remember that there will be a flood of available shares then as compared to the current thinly traded shares over the past few years. At the end of the day, always remember that the stock market is about supply and demand firstly then technicals and fundamentals. Smart money rarely gives you a free lunch.... more than likely, you may end up paying for lunch to be in the company of smart money.  oldman, St. James and PCRT's chart pattern showed that the smart money had successfully laid big bull-traps to trap the longs. St. James closed with a shooting star @ S$0.064 (+0.01, +18.5%) with extremely high volume done at 67.37m shares on 17 Mar 2014. PCRT closed with a long black marubozu @ S$0.55 (+0.005, +0.9%) with extremely high volume done at 54.5m shares on 17 Mar 2014.   |

|

|

|

Post by odie on Mar 17, 2014 21:33:25 GMT 7

thanks zuolun bro for advice,

will look and wait patiently and do nothing

|

|

|

|

Post by zuolun on Apr 5, 2014 15:44:29 GMT 7

St. James — A big bull-trapSt. James closed with a gravestone doji @ S$0.041 (+0.001, +2.5%) on 4 Apr 2014. The share price has collapsed to low of S$0.038 or -50.6% on 31 Mar 2014 from the peak @ S$0.077 scored on 17 Mar 2014. Immediate support @ S$0.038, immediate resistance @ S$0.043, the 23.6% FIBO retracement.  St. James and PCRT's chart pattern showed that the smart money had successfully laid big bull-traps to trap the longs. St. James closed with a shooting star @ S$0.064 (+0.01, +18.5%) with extremely high volume done at 67.37m shares on 17 Mar 2014.

|

|