|

|

Post by zuolun on Mar 20, 2014 20:34:41 GMT 7

Yes, I hate "1 lot" gang. Whenever I see my order got 1 lot fulfilled and I have to calm my anger by talking to myself to get big profit next time when selling. i am also looking desperately for cheaper min. commission. will share in case I find one.    |

|

|

|

Post by oldman on Mar 20, 2014 20:40:10 GMT 7

Looks like there is a big seller who is not done yet!  |

|

|

|

Post by zuolun on Mar 20, 2014 20:57:15 GMT 7

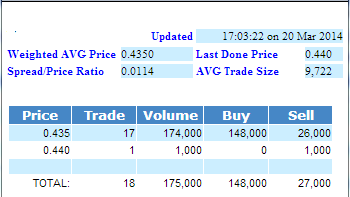

Looks like there is a big seller who is not done yet!  oldman, Thanks for your invaluable opinion.  My friend got caught at 50c based on good FA + coming dividend payment, now he suck thumb and toe... I've been monitoring this 1-lotter "bayi" shorting from high of 60c plus to historical low at 0.435.  |

|

|

|

Post by me200 on Mar 21, 2014 7:48:45 GMT 7

Just thinking ...

If the said stock has good FA and the price now is cheaper, don't we accumulate more?

The key operating word is "Good FA".

Looks like there is a big seller who is not done yet!  oldman, Thanks for your invaluable opinion.  My friend got caught at 50c based on good FA + coming dividend payment, now he suck thumb and toe... I've been monitoring this 1-lotter "bayi" shorting from high of 60c plus to historical low at 0.435.  |

|

|

|

Post by oldman on Mar 21, 2014 8:36:44 GMT 7

|

|

|

|

Post by zuolun on Mar 21, 2014 9:51:47 GMT 7

oldman, Thanks for your invaluable opinion.  My friend got caught at 50c based on good FA + coming dividend payment, now he suck thumb and toe... I've been monitoring this 1-lotter "bayi" shorting from high of 60c plus to historical low at 0.435.  Just thinking ...

If the said stock has good FA and the price now is cheaper, don't we accumulate more?

The key operating word is "Good FA".

My friend and myself have been monitoring the share price falling from 60c since last Oct 2013. He did his homework and based on "Good FA" bought some at 51c, 50c and 49c, while I did mine strictly based on TA. I didn't follow him buying the stock at that price as the chart pattern suggested more downside, so I just KIV then. Although the price now hits record low at 43.5c, my friend didn't cut-loss because he intends to buy more at lower prices and keep it for longterm investment. A distinct difference between a FA and a TA believer is that, the former keeps averaging down when the price is lower because of "Good FA" while the latter will sell immediately once the cut-loss price level is triggered and re-enter again later (based on TA, not necessary at lower prices). |

|

|

|

Post by oldman on Mar 21, 2014 11:48:41 GMT 7

Herein lies the fundamental flaw in fundamental analysis. FA practitioners assume that money and assets in a company will be used wisely and that all management is trustworthy and will not take advantage of minority shareholders. Reality is that this is usually not the case. To succeed as a fundamental investor, one also needs to understand demand and supply and read into the actions of those with big money as they probably know a lot more than you think.  oldman, Thanks for your invaluable opinion.  My friend got caught at 50c based on good FA + coming dividend payment, now he suck thumb and toe... I've been monitoring this 1-lotter "bayi" shorting from high of 60c plus to historical low at 0.435.  Just thinking ...

If the said stock has good FA and the price now is cheaper, don't we accumulate more?

The key operating word is "Good FA".

My friend and myself have been monitoring the share price falling from 60c since last Oct 2013. He did his homework and based on "Good FA" bought some at 51c, 50c and 49c, while I did mine strictly based on TA. I didn't follow him buying the stock at that price as the chart pattern suggested more downside, so I just KIV then. Although the price now hits record low at 43.5c, my friend didn't cut-loss because he intends to buy more at lower prices and keep it for longterm investment. A distinct difference between a FA and a TA believer is that, the former keeps averaging down when the price is lower because of "Good FA" while the latter will sell immediately once the cut-loss price level is triggered and re-enter again later (based on TA, not necessary at lower prices). |

|

|

|

Post by zuolun on Mar 25, 2014 8:27:37 GMT 7

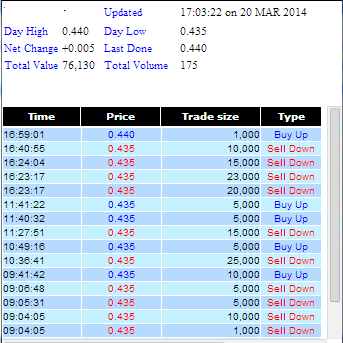

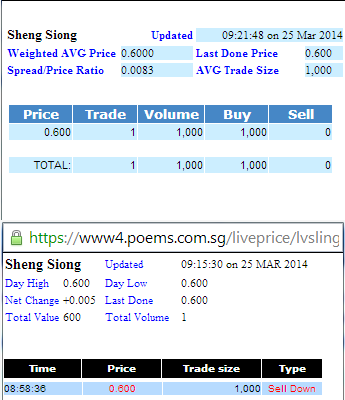

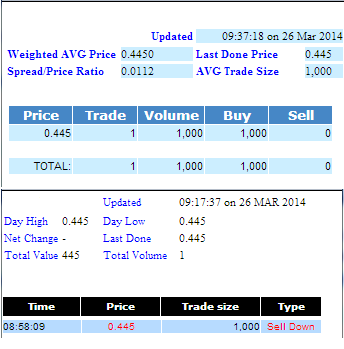

It was only recently that I realised that Lim & Tan accepts advance orders. I like this feature a lot as I do not have to key in buy and sell orders every morning. Instead, I key in the order as a GTM order. Lim & Tan describes this as Good to Maximum but most of us will remember this as Good to Month orders as these orders will stay in the system for 30 days. Do note that if any of these orders are partially filled, the order still remains in the system for a month till this is completely filled. The other good thing about this type of order is that it is usually entered into the SGX trading system as soon as this is available for entry. This way, your queues are usually right in front of others. Yes, the less people know the better! Hence, not highlighting this post in facebook! Yes, the minimum commission for Lim & Tan is $25 while some like DBS Vickers cash upfront account charges $18 minimum commission and 0.18% commission for orders above this minimum amount. For me, I use a number of brokers as I don't like putting all my orders through just one broker.  Info on the Lim & Tan advance orders: www.limtan.com.sg/page/site/public/faq-advance-order.jspwww.limtan.com.sg/page/site/public/pdf/AdvancedOrdersUserGuide_v4.pdfSheng Siong is one of the penny stocks with plenty of 1-lotters doing the daily routine stabilization job of 1-lot buy-ups/sell-downs. If you're queuing to buy/sell illiquid penny or micro penny stocks via the GTM order system and once your order is partially filled with just 1 lot done at pre-opening or EOD, you'll be pissed off by these nuisance players.  1-lotter @ pre-opening 1-lotter @ pre-opening   |

|

|

|

Post by oldman on Mar 25, 2014 11:06:25 GMT 7

The trick if you are given a 1 lotter is to play the same game by buying a one lotter upwards. At least you now have bought 2 lots. Most likely, the 1 lotter will reappear and give you another lot and it goes on. Of course, this will only work if you don't mind pushing up the last done price. Yes, there are lots of other reasons to play the 1 lotter as I must admit that sometimes I do it as well.  Once you are thrown a 1 lotter in a stock, it is likely that you will be thrown more 1 lotters in the future. Hence, better to withdraw your buy or sell queues in the days and weeks ahead.  |

|

|

|

Post by zuolun on Mar 25, 2014 11:34:38 GMT 7

The trick if you are given a 1 lotter is to play the same game by buying a one lotter upwards. At least you now have bought 2 lots. Most likely, the 1 lotter will reappear and give you another lot and it goes on. Of course, this will only work if you don't mind pushing up the last done price. Yes, there are lots of other reasons to play the 1 lotter as I must admit that sometimes I do it as well.  Once you are thrown a 1 lotter in a stock, it is likely that you will be thrown more 1 lotters in the future. Hence, better to withdraw your buy or sell queues in the days and weeks ahead.  haha...if you play the same 1-lotter game, you may end up playing with Algo traders who use trading programs to trade.  When one of the major strong hands run road at the peak @ S$5.03, big and small "bayi" players in SuperGroup were trapped high and dry after the share price suddenly collapsed. Normally these trapped losers could get out (break even or make some profit) if the gullible retail players buy at higher than their cost price to bail them out. The only trick is to convince (hard sell) everyone to believe in the continual growth story of SuperGroup.  SuperGroup's neckline support @ S$3.70 was triggered by Algo Trading program at 2.57pm.   |

|

|

|

Post by zuolun on Mar 26, 2014 8:47:23 GMT 7

If you're queuing to buy/sell illiquid penny or micro penny stocks via the GTM order system and once your order is partially filled with just 1 lot done at pre-opening or EOD, you'll be pissed off by these nuisance players.    |

|

|

|

Post by stevenlsf on Apr 2, 2014 21:21:28 GMT 7

Yes I learnt my lesson. If you are thrown 1 lotter the chance is high that you will get more in the future. Normally I will adjust my queue price to even lower or temporary withdraw

|

|

|

|

Post by odie on Apr 16, 2014 13:51:57 GMT 7

i was recently hit by a 1 lotter then my GTM expired and i have to re-queue behind 1000 lots  |

|

|

|

Post by odie on Apr 16, 2014 14:11:35 GMT 7

i am not sure if i shld buy back my 1 lot of oue c reit

LOL

|

|

|

|

Post by zuolun on Apr 24, 2014 12:22:07 GMT 7

|

|