|

|

Post by zuolun on Apr 17, 2014 10:59:33 GMT 7

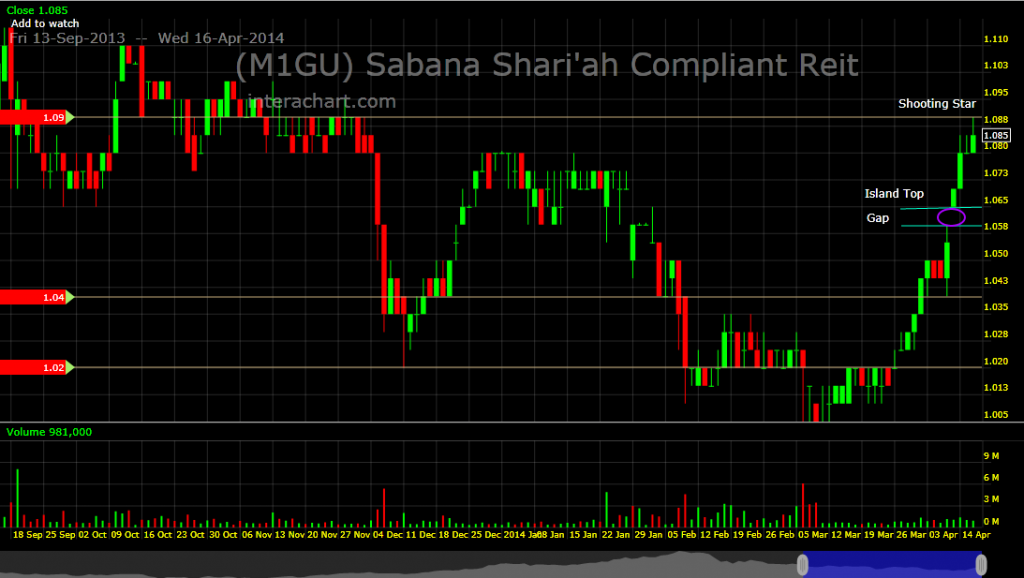

Sabana Reit — Bull Trap  It’s challenging times now for Sabana Reit It’s challenging times now for Sabana Reit — 17 Apr 2014 Sabana Reit's Q1 payout falls 22% on lease conversion — 16 Apr 2014 Sabanar reit registered a 14.2% increase in gross revenue to $24.6 million for the quarter ended 31 March 2014, driven by contribution from its property at 508 Chai Chee Lane, which was acquired in September 2013, and higher income from 151 Lorong Chuan, which was converted into a multi-tenanted lease agreement in 4Q13. However, higher property expenses led to a 9.2 decline in net property income to $18.4 million. Coupled with higher finance costs, net income shrank 28.6% to $9.4 million. This resulted in a 22% fall in distribution per unit for 1Q14 to $0.0188, from $0.0241 a year earlier.

|

|