|

|

Post by zuolun on Apr 21, 2014 12:57:12 GMT 7

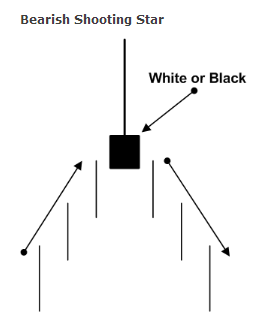

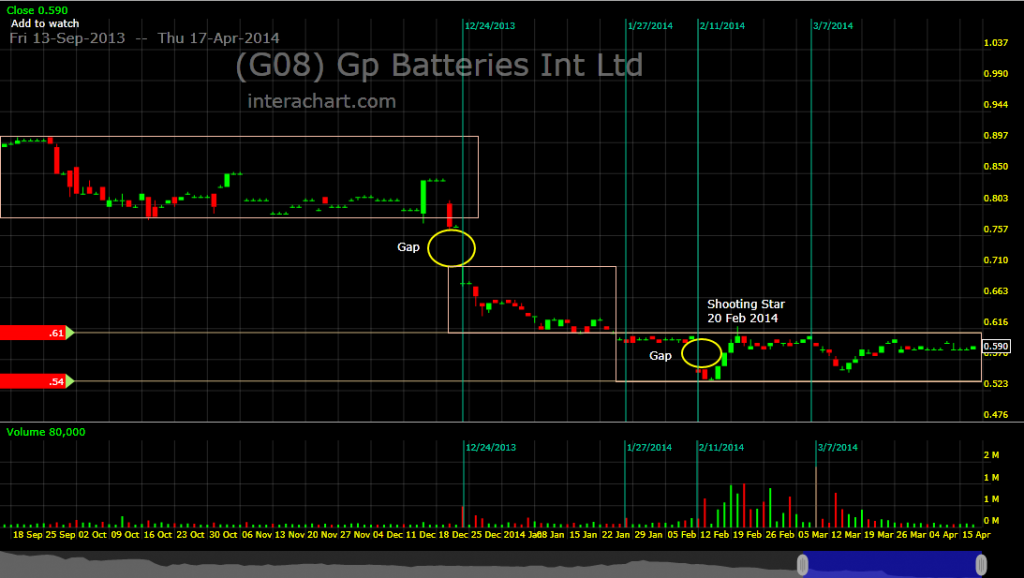

CEO of GP Batteries, Andrew Ng Sung-on jumps to death from Hong Kong office roof — 18 Apr 2014 GP Batteries Insider Trading — Mr. Richard Ku, vice-chairman of the company, has been paring down his stake in GP Batteries on several occasions. From 12 to 24 March 12, he sold a total of 138,000 shares and his direct interest in GP Batteries dropped to 0.09% of the outstanding issued shares. GP batteries last changed hands at S$0.58 on Friday, down 45.41% from the previous year. Based on its latest financial results, it has started to make losses and management has highlighted that they are experiencing difficulties in turning around the company. — 31 Mar 2014 GP Batteries’s unaudited Q3 & 9-month (YTD) results ended 31 Dec 2013 — 27 Jan 2014 GP Batteries Issued Profit Guidance — 6 Dec 2013 GP Batteries — Trading in a downward sloping channelGP Batteries hit low of S$0.56 trading with a spinning top @ S$0.565 (-0.025, -4.2%) with 1.46m shares done on 21 Apr 2014 at 2pm.   GP Batteries is an extremely illiquid stock, it gapped down twice, had a dead cat bounce and thereafter followed by a sudden increase in trading volume. The best opportunity to get out of GP Batteries was on 7 Mar 2014, after a bearish shooting star 1st appeared on 20 Feb 2014. Do not catch a stock falling on high volume or one that is rising on thin volume. Using share price and trading volume as a major trend indicator, for all downtrend stocks, especially illiquid ones, if the share price is down with increasingly high volume, it's a bearish signal indicating that it's in distributing mode. 博弈量能上博弈量能下 GP Batteries — "Stair-Step Decline" chart pattern

|

|

|

|

Post by oldman on Apr 21, 2014 13:31:12 GMT 7

Thanks for the info. Did not know that his death was likely to be a suicide. Guess, if this was the case, the share price is likely to come under increasing pressure....

|

|

|

|

Post by zuolun on Apr 21, 2014 16:36:23 GMT 7

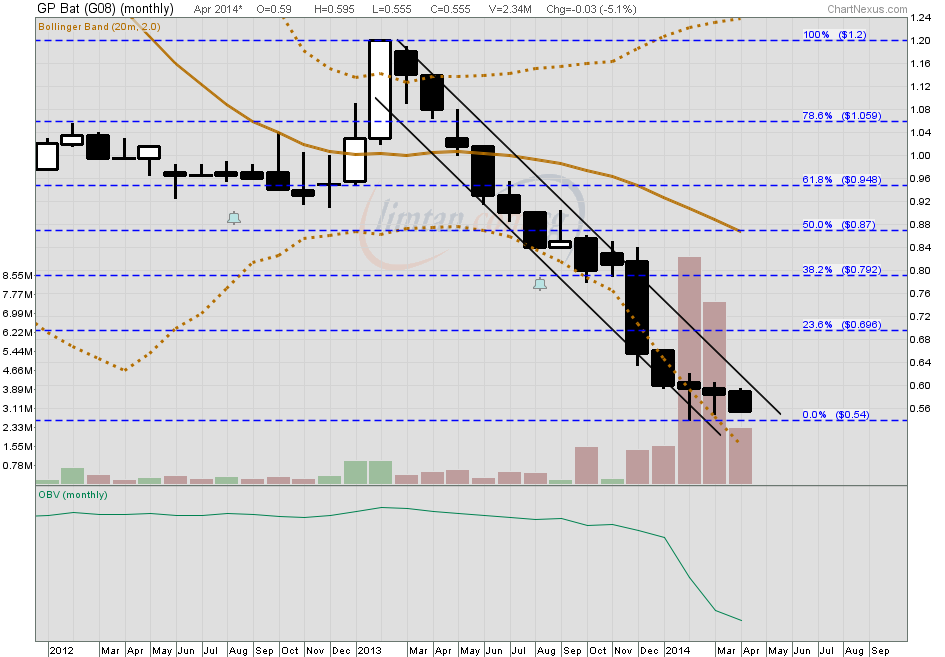

Thanks for the info. Did not know that his death was likely to be a suicide. Guess, if this was the case, the share price is likely to come under increasing pressure.... oldman, After the share price peaked at S$1.20 Feb 2013, GP Batteries's monthly chart is extremely bearish from Mar 2013 till to date. When the share price was trading @ S$0.87, the dividends @ S$0.01 distributed on 5 Aug 2013 might have offered some comfort for investors to continue holding onto the shares then. GP Batteries — Trading in a downward sloping channelGP Batteries closed at day's low with a black marubozu @ S$0.555 (-0.035, -5.9%) with extremely high volume done at 1.74m shares on 21 Apr 2014.   |

|

|

|

Post by oldman on Apr 22, 2014 7:37:28 GMT 7

I think there is value in GP Batteries. Currently, it is at 55.5cts. With 164.8 mil shares, its market cap is around $91 mil. Recently, it raised $26.7 mil from a 1 for 2 rights at 48.6cts. It has quite a number of factory buildings especially in China. However, the downside is that it has bank borrowings of $200 mil compared to its cash of $124 mil and the financials going forward are unlikely to look good. 3rd Q revenues of $176 mil with losses of $24.1 mil after taking into account an impairment loss of $26 mil. Probably better to wait for the full year financials and annual report. I will not be surprised that the shares fall below the recent rights price of 48.6cts. Would not also be surprised in the weeks ahead that it may test its all time low in 2009. Not easy to use TA to predict the lowest level the shares may sink to...... As for its products, I quite like these. I have lots of its rechargeable batteries. Only thing about its non rechargeable batteries is that some of these do leak... hence, I rather stick to the rechargeables.  |

|

|

|

Post by zuolun on Apr 22, 2014 8:57:12 GMT 7

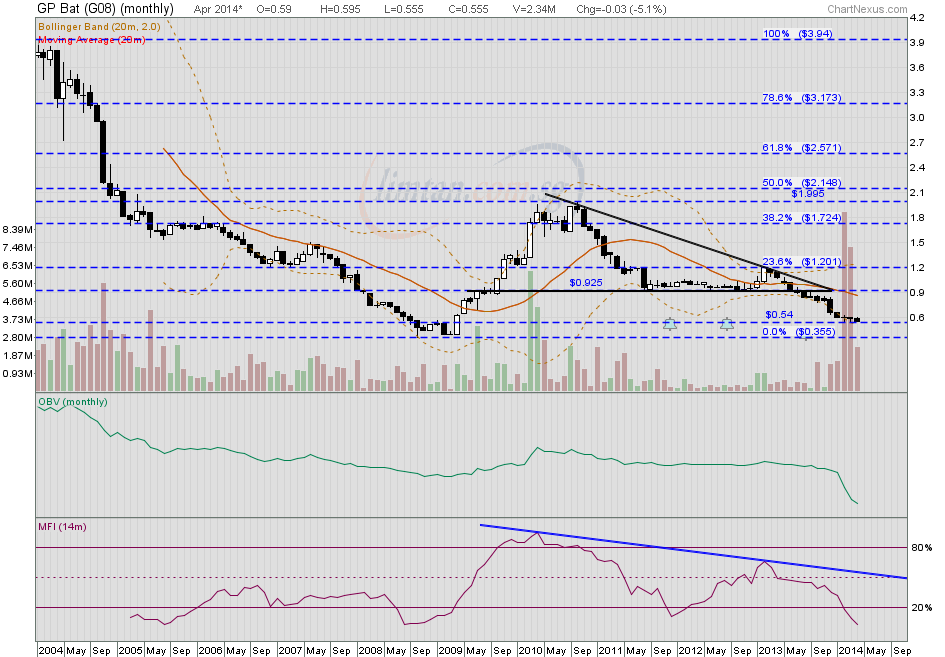

I think there is value in GP Batteries. Currently, it is at 55.5cts. With 164.8 mil shares, its market cap is around $91 mil. Recently, it raised $26.7 mil from a 1 for 2 rights at 48.6cts. It has quite a number of factory buildings especially in China. However, the downside is that it has bank borrowings of $200 mil compared to its cash of $124 mil and the financials going forward are unlikely to look good. 3rd Q revenues of $176 mil with losses of $24.1 mil after taking into account an impairment loss of $26 mil. Probably better to wait for the full year financials and annual report. I will not be suprised that the shares fall below the recent rights price of 48.6cts. Would not also be surprised in the weeks ahead that it may test its all time low in 2009. Not easy to use TA to predict the lowest level the shares may sink to...... As for its products, I quite like these. I have lots of its rechargeable batteries. Only thing about its non rechargeable batteries is that some of these do leak... hence, I rather stick to the rechargeables. oldman, The MFI of GP Batteries monthly chart shows nil support-buying after falling below 20% but intensified selling pressure with extremely high volume. GP Batteries is likely to trade sideway and to retest the last low @ S$0.355 scored on 28 Oct 2008.  |

|

|

|

Post by zuolun on Jul 15, 2014 6:18:30 GMT 7

“机会总在绝望中诞生,在质疑中成长,在希望中成熟,在疯狂中死亡。” — 邓普顿John Templeton said “The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell". "It makes sense that when most investors are bullish, asset valuations would be high, because everyone has already bought. The opposite is also true. When most investors are bearish, asset valuations are low, because everyone has already sold." GP Batteries — Dead Cat Bounce, UP S$0.225 or 42.1%

|

|