|

|

Post by zuolun on Jul 1, 2014 18:13:36 GMT 7

|

|

|

|

Post by odie on Jul 6, 2014 18:40:14 GMT 7

zuolun bro,

noted yingli's last dividends was on Dec 2007

thanks for the charts

|

|

|

|

Post by zuolun on Jul 9, 2014 13:43:22 GMT 7

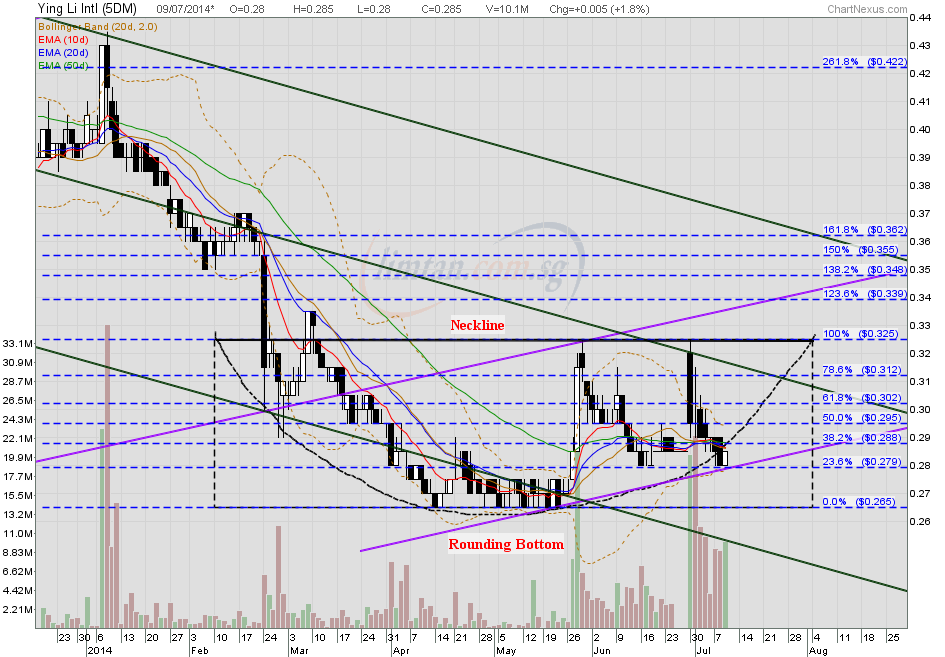

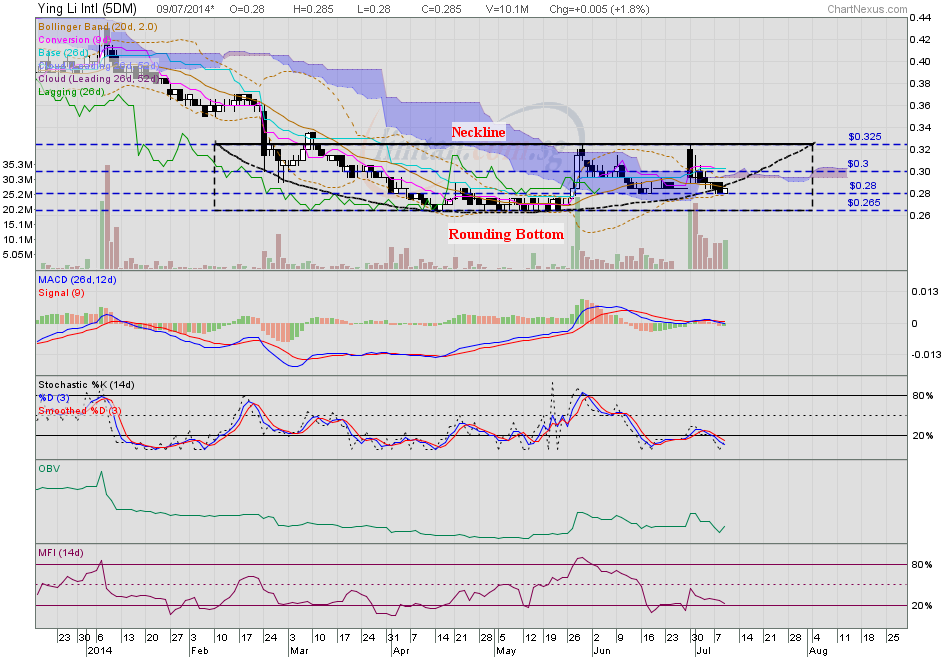

zuolun bro, noted yingli's last dividends was on Dec 2007 thanks for the charts Ying Li had a white marubozu @ S$0.285 (+0.005, +1.8%) with 10m shares done on 9 July 2014 at 2.55pm Strong resistance @ S$0.325, strong support @ S$0.28.    [/quote] |

|

|

|

Post by odie on Oct 22, 2014 6:57:58 GMT 7

last closed at 24.5

weekly charts not nice

a lot of black candles

|

|

|

|

Post by zuolun on Dec 18, 2014 8:46:48 GMT 7

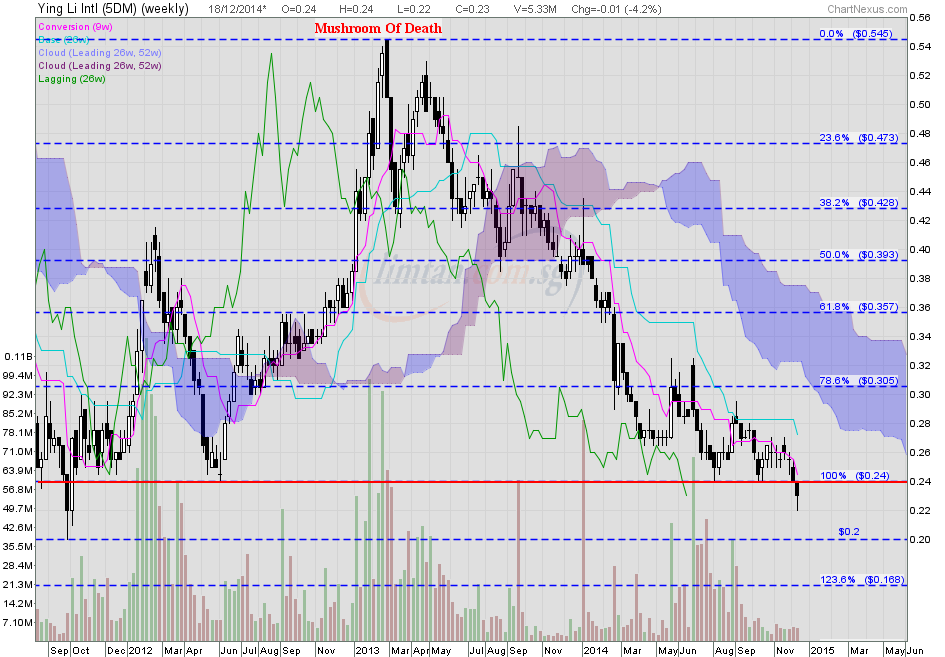

last closed at 24.5 weekly charts not nice a lot of black candles Ying Li had a dragonfly doji unchanged @ S$0.23 with extremely thin volume done at 174 lots on 18 Dec 2014 at 9.40am. Immediate support @ S$0.22, strong resistance @ S$0.24.  Ying Li (weekly) Ying Li (weekly) — Classic MOD chart pattern

|

|

|

|

Post by odie on Dec 28, 2014 11:58:25 GMT 7

bro zuolun,

yingli seems to have stabilised and is now at 24 cts

|

|

|

|

Post by zuolun on Dec 28, 2014 12:24:31 GMT 7

odie, Avoid holding any long positions on S-chips. bro zuolun, yingli seems to have stabilised and is now at 24 cts odie, The classic support and resistance level have already indicated where the price direction is likely to move.  In technical analysis, a stock that has made a new low is to cut-loss and sell on strength if there is a dead cat bounce, not long. In technical analysis, a stock that has made a new low is to cut-loss and sell on strength if there is a dead cat bounce, not long. Ying Li — A "Waterfall Decline", Interim TP S$0.20, Next TP S$0.185Ying Li had a dragonfly doji unchanged @ S$0.23 with extremely thin volume done at 174 lots on 18 Dec 2014 at 9.40am. Immediate support @ S$0.22, strong resistance @ S$0.24.  |

|

|

|

Ying Li

Dec 28, 2014 19:20:30 GMT 7

Post by odie on Dec 28, 2014 19:20:30 GMT 7

thanks zuolun bro for advice will sit on my hands for time being  |

|

|

|

Post by zuolun on Dec 29, 2014 14:43:05 GMT 7

thanks zuolun bro for advice will sit on my hands for time being  odie, The share price will collapse on its own weight with low / no volume.Watch the Cantonese video clip below. "There is no smoke without fire." 无风不起浪,事出必有因。No need TA to understand why the China stock market suddenly spikes; just simple logic on price action and volume, will do. BTW, ignore the speakers' vulgar language in between the conversation because it's raw and uncensored.  5 China property stories to watch for 5 China property stories to watch for — 29 Dec 2014 A股真相,上海人的危机意识及移民潮暗涌 — 13 Dec 2014 |

|

|

|

Ying Li

Apr 16, 2015 22:46:37 GMT 7

Post by hope on Apr 16, 2015 22:46:37 GMT 7

HI Bros

this stock got any Upside?

|

|

|

|

Post by zuolun on Apr 24, 2015 13:09:40 GMT 7

HI Bros this stock got any Upside? The PRC has just started its initial correction in the property sector 1Q2015. Unless Ying Li could hit S$0.335 scored on 7 Mar 2014 and spike higher high, with extremely high volume to S$0.36, the 61.8 Fibo level (see Ying Li's weekly chart) and sits firmly on a solid ground to reverse the major downtrend, else the dead cat bounce offers an opportunity for short-sellers to kill the bottom-picking bulls. A technical rebound or dead cat bounce is a short-term / intermediate bullish trend reversal. In Chinese, it is known as 回光返照。Ying Li ~ Short-term / intermediate bullish trend reversal, interim TP S$0.305Ying Li closed with a gravestone doji unchanged @ S$0.26 with 5.84m shares done on 23 Apr 2015. Longterm horizontal support @ S$0.24, immediate resistance @ S$0.28.  Ying Li (weekly) ~ Trading in a downward sloping channel Ying Li (weekly) ~ Trading in a downward sloping channel |

|