|

|

Post by zuolun on Jul 25, 2014 20:51:58 GMT 7

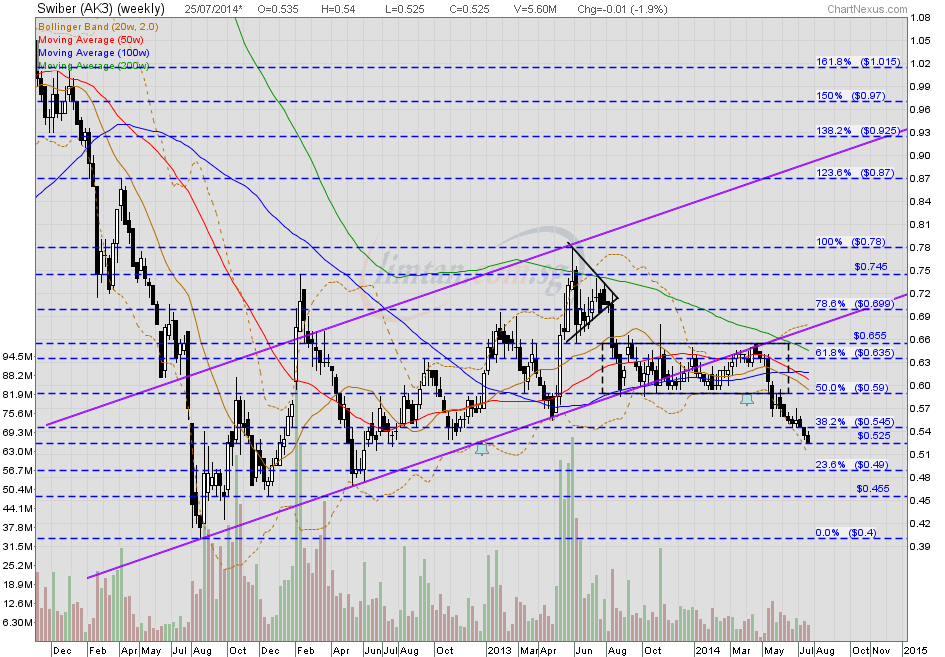

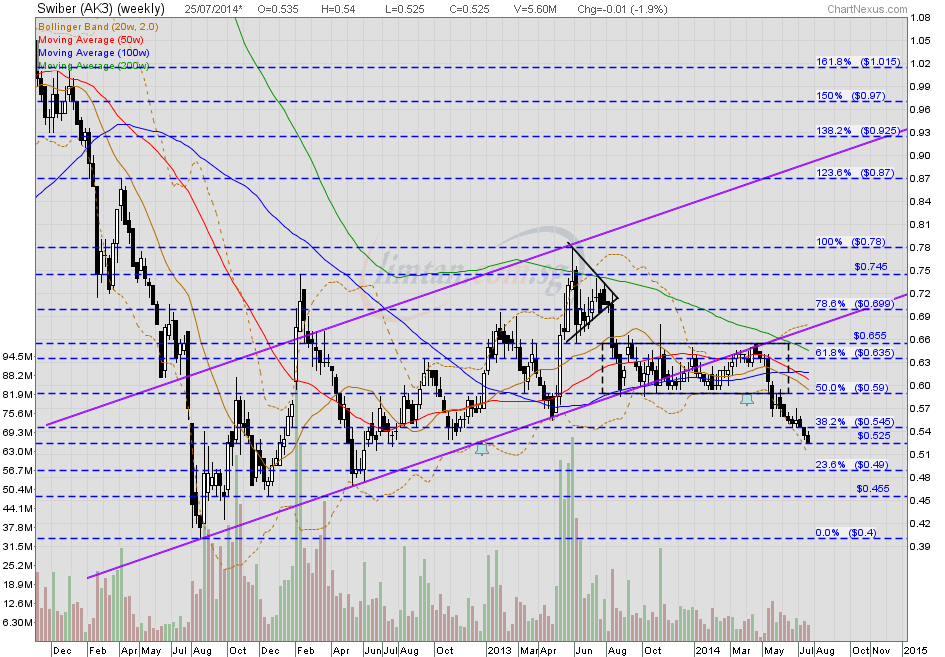

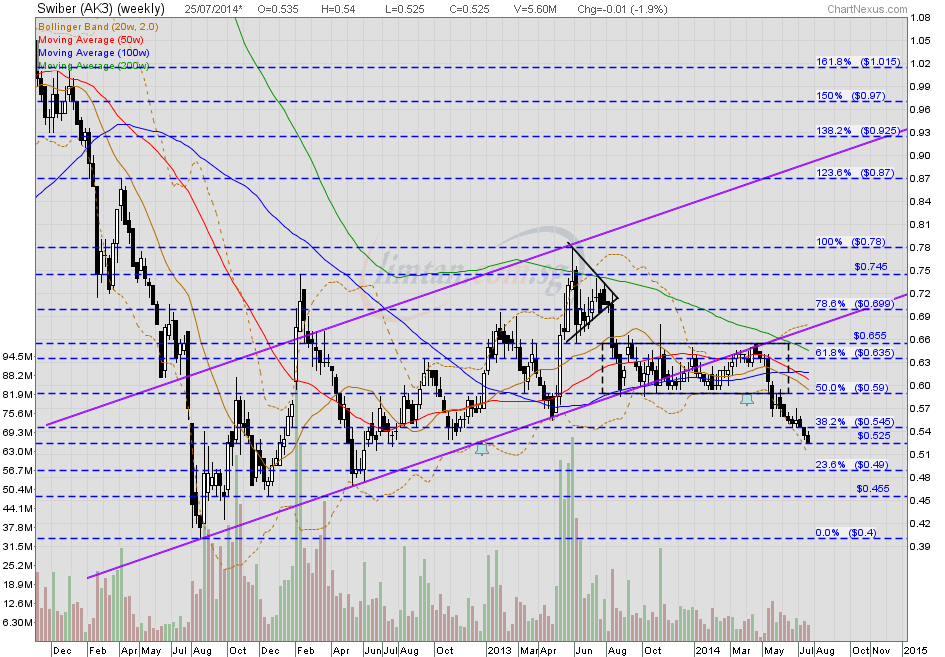

Swiber is at its 52-week low: Should you invest? — 30 Jun 2014 Swiber — Bearish Symmetrical Triangle Breakout, interim TP S$0.495Swiber closed with a black marubozu @ S$0.525 (-0.005, -0.9%) with 1.38m shares done on 25 July 2014.  Swiber (weekly) — Short Term Uptrend is broken, long term downtrend prevails Swiber (weekly) — Short Term Uptrend is broken, long term downtrend prevails

|

|

|

|

Post by zuolun on Aug 15, 2014 7:42:05 GMT 7

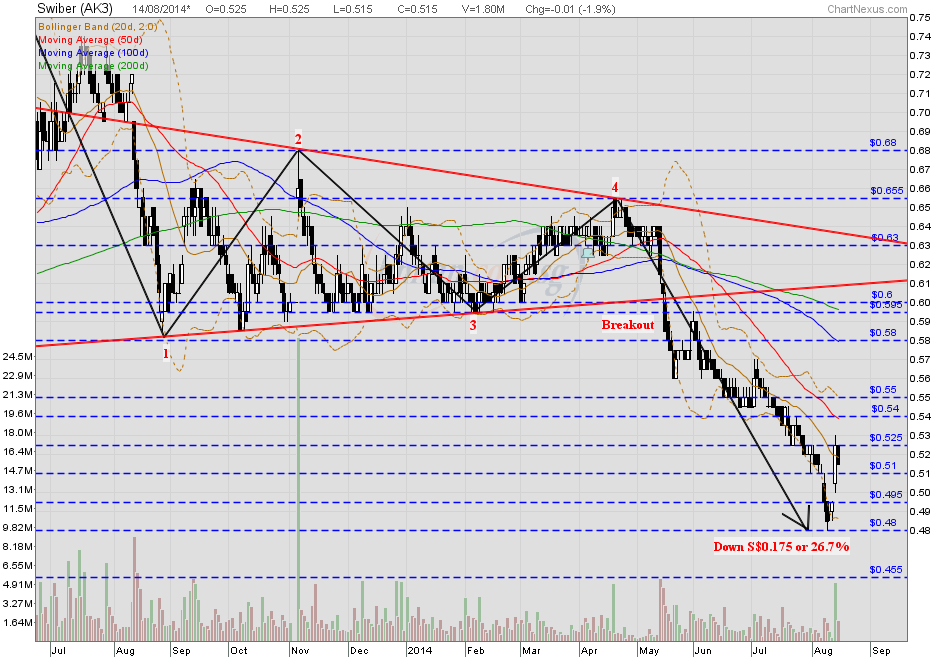

Whack a kitty with One Good Trade   Swiber — Dead Cat Bounce Swiber — Dead Cat BounceSwiber closed with a black marubozu @ S$0.515 (-0.01, -1.9%) with 1.8m shares done on 14 Aug 2014. Immediate support @ S$0.51, immediate resistance @ S$0.54.  The Dead Cat BounceA "Dead Cat Bounce" is a period that refers to when an equity rebounds in price after a very sharp drop. It has been used to refer to the stock market when a stock's price has dropped so fast that even "a dead cat could bounce back". The dead-cat bounce is usually referred to while the market is still dropping and continues to drop even after the supposed bottom of the price has been reached. The term was first cited as far back as 1985 when Malaysian and Singaporean markets seemed to drop off a cliff.

|

|

|

|

Post by zuolun on Sept 18, 2014 23:24:47 GMT 7

Swiber — Bear Flag Formation, biased to the downside TP S$0.40Swiber closed with an inverted hammer @ S$0.455 (+0.005, +1.1%) with 533 lots done on 18 Sep 2014. Immediate support @ S$0.43, strong resistance @ S$0.48.

|

|

|

|

Post by zuolun on Nov 6, 2014 14:33:33 GMT 7

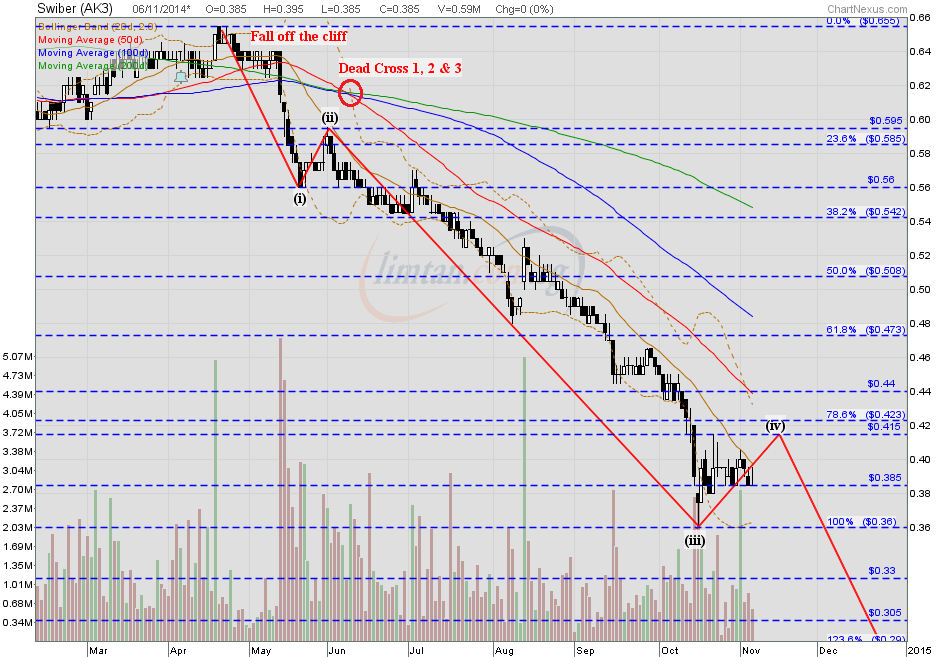

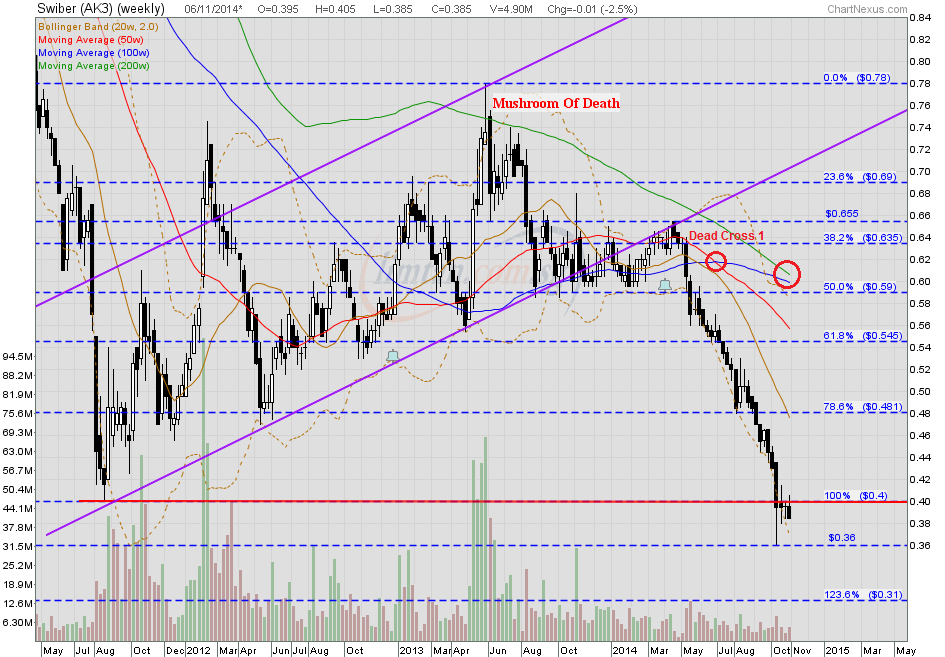

Swiber's longterm downtrend intact, the share price will collapse on its own weight with low / no volume.Swiber — A "Waterfall Decline" with 5-Wave down, Interim TP S$0.33Swiber had a gravestone doji unchanged @ S$0.385 with extremely thin volume done at 588 lots on 6 Nov 2014 at 3.15pm. Immediate support @ S$0.36, strong resistance @ S$0.415.  Swiber (weekly) Swiber (weekly) — Classic MOD chart pattern TP S$0.31 Swiber (weekly) — Short Term Uptrend is broken, long term downtrend prevails

|

|

|

|

Post by zuolun on Dec 16, 2014 13:19:10 GMT 7

|

|

|

|

Post by zuolun on Jan 3, 2015 15:28:34 GMT 7

|

|

|

|

Post by hope on Jan 3, 2015 16:22:37 GMT 7

Bro zuolun I noticed that you have alerted us to many stocks whose price keeping dropping lower and lower. It's so scary that I don't dare to buy for few months liao....seems like many stock are heading south except the banks and telco.... I also don't know what to do or maybe not doing anything is better now.  |

|

|

|

Post by zuolun on Jan 3, 2015 17:44:00 GMT 7

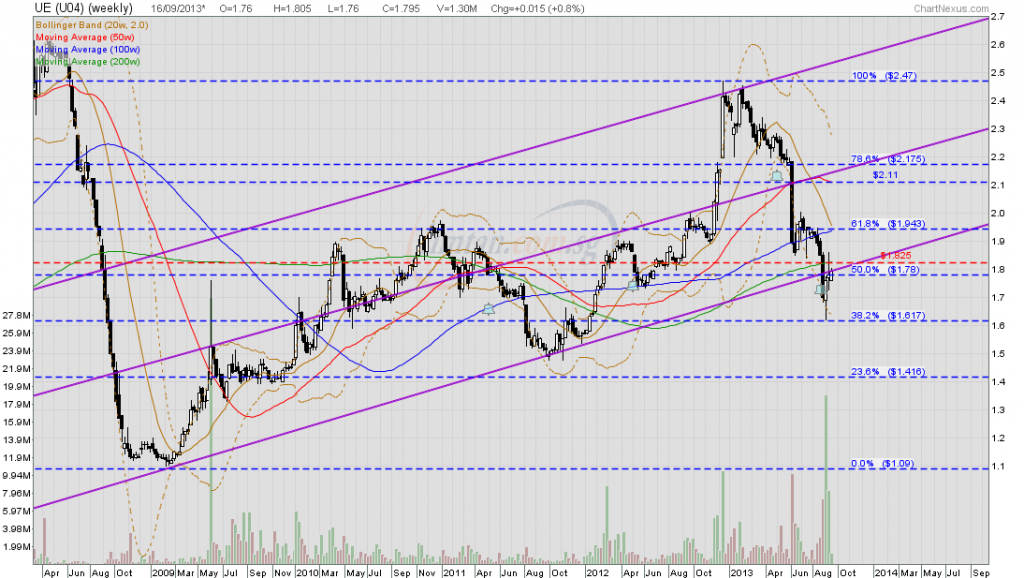

Bro zuolun I noticed that you have alerted us to many stocks whose price keeping dropping lower and lower. It's so scary that I don't dare to buy for few months liao....seems like many stock are heading south except the banks and telco.... I also don't know what to do or maybe not doing anything is better now.  hope, I've a habit to check and follow-up with charts on certain stocks which I had vested b4. I never expect Swiber to collapse to low of S$0.26 when I sold my 100 lots Swiber shares @ S$0.635 in mid-Sep 2013, then.  odie, I remembered I was playing Swiber @ S$0.63 when you asked me about UE @ S$1.76 in mid-Sep 2013. I run road on Swiber with only 1-bid profit @ S$0.635 then.  These 2 stocks had similar chart pattern then but they've totally different fate now...one go to hell while the other one go to heaven.     |

|

|

|

Post by zuolun on Jan 8, 2015 15:44:53 GMT 7

|

|

|

|

Swiber

Jan 14, 2015 9:32:35 GMT 7

Post by zuolun on Jan 14, 2015 9:32:35 GMT 7

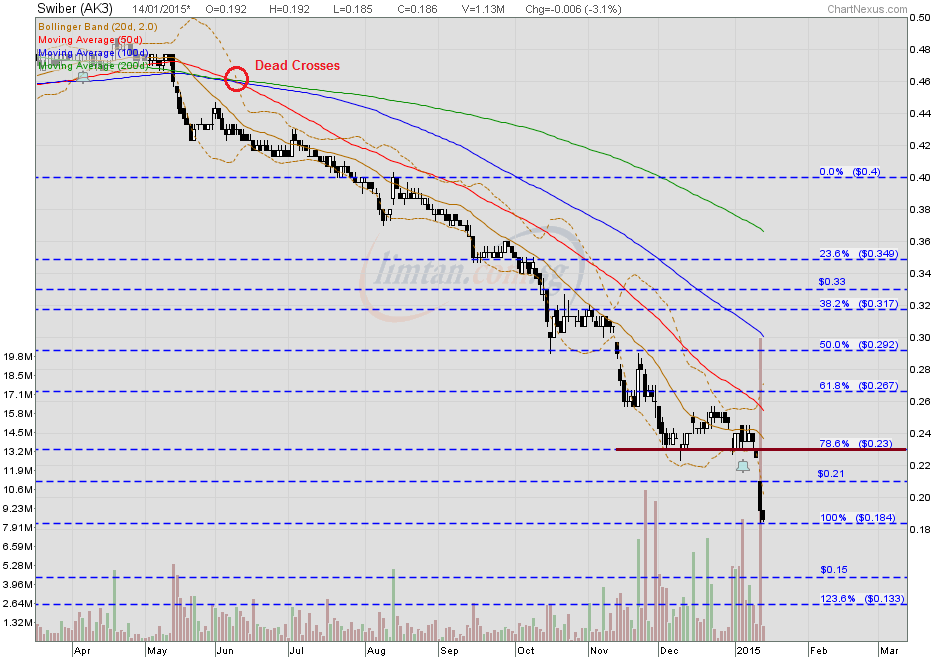

Swiber — A bearish inverted Cup and Handle Breakout, TP S$0.133 Swiber — A bearish inverted Cup and Handle Breakout, TP S$0.133Swiber had a black marubozu @ S$0.186 (-0.006, -3.1%) with 1.13m shares done on 14 Jan 2015 at 10.25am. Critical support @ S$0.15, strong resistance @ S$0.21.  |

|

|

|

Post by zuolun on Feb 16, 2015 15:56:04 GMT 7

Swiber closed @ S$0.185 (-0.002, -1.1%) with 5.26m shares done on 16 Feb 2015 Don't get your hopes up on Swiber's $422m contract: Maybank Kim EngBy Frankie Ho 12 Feb 2015 The US$310 million ($422 million) contract announced by Swiber Holdings this morning may be the second-largest in its history, and comes at a time when weak oil prices are prompting oil companies to cut spending. But as far as Maybank Kim Eng analyst Yeak Chee Keong is concerned, there really is no reason for cheer as the offshore engineering and construction firm is not likely to make much money out of it. "We are not positive," he wrote in a note. "Swiber won by bidding aggressively," he said, citing a report by oil and gas paper Upstream. The second-lowest bidder for the project was Larsen & Toubro, which offered US$449 million, while the third-lowest bid was US$458 million, he said. The highest bid was US$512 million. "We believe Swiber is eager to end its order drought decisively in a weak environment. It could be looking to just cover cash costs." Swiber's order book reached a four-year low of US$526 million in 3Q2014, Yeak noted, before getting a boost in December, when the company bagged a US$710-million project in West Africa. The US$310-million contract, awarded by a repeat customer, requires Swiber to work on eight new platforms and pipelines. These are needed for the development of a new offshore gas field in South Asia. The project, which lifts Swiber's order book to US$1.6 billion, is expected to be completed in March 2017. Swiber shares rose 1.1% to 18.5 cents at 11:17am (0317 GMT). |

|

|

|

Post by zuolun on Mar 4, 2015 22:14:12 GMT 7

Swiber Holdings: Ceasing coverage4 Mar 2015 - Cutting costs

- More funds may be needed

- Ceasing coverage

FY14 – a year to forgetSwiber Holdings reported a 30.1% fall in revenue to US$726.5m and a 65.1% drop in net profit to US$21.7m in FY14, the latter boosted by the sale of Kreuz in the year. Excluding such one-off items, core net loss was around US$68m in FY14, close to our forecast of US$62.8m. There was a loss on the gross level in 4Q14, bringing full year gross margin to only 2.4% vs 16.4% in FY13. FY15 does not look too good eitherAs at 27 Feb 2015, the group had an order book of US$1.4b, supported by recent contract wins. However, we are less certain about the margins, especially for the newer contracts in which the group bid relatively aggressively. Looking ahead, there is likely to be intensified competition among contractors as oil majors shelve projects in view of the lower oil price environment. Embarking on cost saving initiativesSwiber has terminated and restructured certain existing vessels that were previously under various leasing arrangements, and it believes this strategy would lower its leasing expenses and enhance the profitability of its operations in future. In addition, Swiber plans to work on optimizing its administrative structure to yield cost savings. Share price has declined ~70% in the past 12 monthsFrom S$0.53 a year ago, Swiber’s share price has declined about 70%. Though the stock is now trading at less than 0.2x P/B, any potential acquirer has to keep in mind the substantial net debt position the group is in (US$990m). In addition, more funds may also be needed to support its higher order book. Meanwhile, refinancing risk is also increasing; S$95m (~US$71.6m) of notes are due in Jun this year, followed by S$130m in Jun 2016, S$75m in Jul 2016, S$100m in Oct 2016 and four more notes payable in 2017-2018. Interest rates for the notes range from 5.13% to 7.75%. With a re-allocation of resources, we are now ceasing coverage on Swiber. Low Pei Han, CFA +65 6531 9813 lowph@ocbc-research.com www.ocbcresearch.com

|

|

|

|

Swiber

Mar 4, 2015 23:58:16 GMT 7

Post by hope on Mar 4, 2015 23:58:16 GMT 7

Bro zuolun, tks for update.

This share like quite jialat...OCBC stop covering.

|

|

|

|

Swiber

Mar 5, 2015 5:35:58 GMT 7

Post by odie on Mar 5, 2015 5:35:58 GMT 7

Bro zuolun, tks for update. This share like quite jialat...OCBC stop covering. keep this on radar and do nothing LOL |

|