|

|

Post by odie on Aug 29, 2014 15:55:24 GMT 7

Company Background

Straco Corporation Limited (“SCLâ€) was incorporated in Singapore in April 2002. It was listed on the Mainboard of the Singapore Exchange on 20 February 2004. Its major shareholders are Straco Holding Pte Ltd and China Poly Group Corporation. SCL is a leading developer and operator of tourism-related assets in China.

SCL's key asset is the Shanghai Ocean Aquarium (“SOAâ€). Built at a cost of US$50 million, it is one of the largest indoor, closed systems aquariums in the world with a total built up area of 20,000 square metres and a designed capacity of 21,000 people per day. The world-class aquarium, situated in the New Pudong Area and next to Shanghai's landmark Oriental Pearl Tower, showcases over 10,000 fishes and exotic marine livestock of over 350 species from all over the world.

SCL also owns and operates Lixing cable-car service at Mount Lishan in Lintong District, Shanxi province. With a total investment of US$5.2 million, it was the first cable car service of international standard in China, with a total distance of 1.44 kilometres. Lixing cable-car has been in operations for more than 10 years, providing a convenient mean of transport to the scenic Mount Lishan.

SCL is currently developing Chao Yuan Ge (“CYGâ€) on Mount Lishan, en-route to the well-known “Terracotta Warrior Museumâ€. CYG will be a historical and cultural theme park showcasing replicas of the unique architectural structures of the Tang Dynasty. Expected to be ready in 2006, CYG will feature actual relics that were unearthed on Lishan Mountain and will employ special high tech effects to recreate “life during the Tang Dynastyâ€.

As a Singapore listed company engaged mainly in the development and operation of tourism-related assets in China, SCL will continue to target high quality tourism and entertainment projects in China and other regions.

source : shareinvestor

|

|

|

|

Post by odie on Aug 29, 2014 15:56:39 GMT 7

Straco: Proposed Acquisition Of Singapore Flyer For S$140 Million.

28 Aug 2014

Straco Corporation Limited wishes to announce that Straco Leisure Pte. Ltd., a subsidiary of the Company, has entered into an agreement dated 28 August 2014 with Singapore Flyer Pte. Ltd., in receivership, and the receivers and managers of certain assets of SFPL. Pursuant to the SPA, the Purchaser will acquire from SFPL the business carried on by SFPL as a going concern, in the form of certain assets including the giant observation wheel which is also known as the "Singapore Flyer" and the lease of the property located at 30 Raffles Avenue, Singapore 039803, for a purchase consideration of S$140,000,000.00. The Acquisition represents an expansion of the Group's core tourism related business.

|

|

|

|

Post by odie on Aug 29, 2014 15:57:34 GMT 7

Bro zuolun, according to businesstimes, this has run up 84% already any views on this? thanks for your insight  |

|

|

|

Post by zuolun on Aug 29, 2014 16:56:45 GMT 7

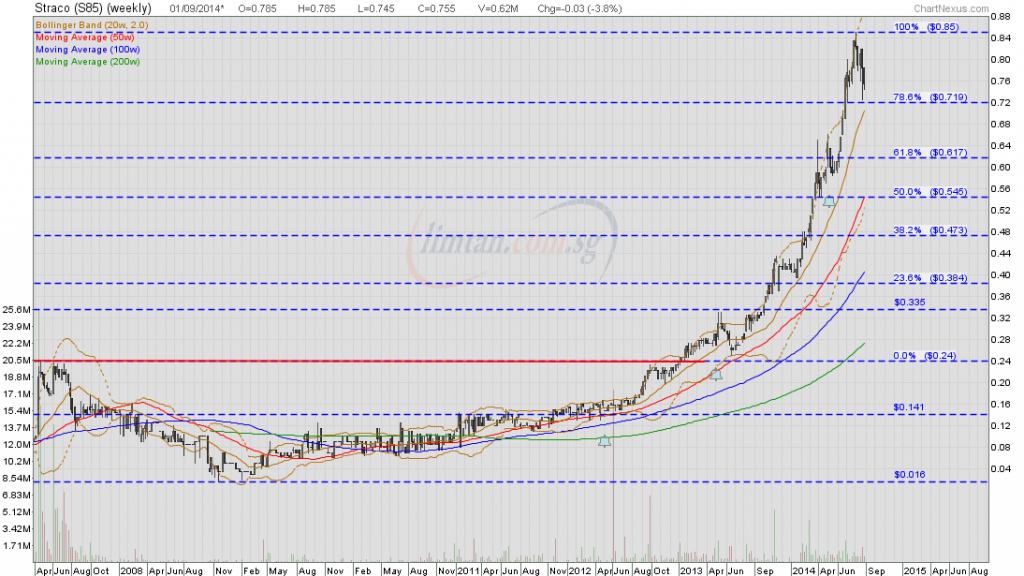

Bro zuolun, according to businesstimes, this has run up 84% already any views on this? thanks for your insight  odie, The ex-owner of the Singapore Flyer had to close shop because it was not able to attract a critical mass of returned visitors (locals and tourists) then. Prior to the closing; I read that the shops there were selling one cup of kopi at S$10+++ due to high rental. With the new owner, Straco, even if one cup of kopi is selling at 50% discount, I believe the locals and tourists are willing to pay for it but only once in a life time.  The chart pattern of Straco should be quite similar to Valuetronics = unsustainable. |

|

|

|

Post by zuolun on Aug 29, 2014 17:22:27 GMT 7

Bishan prawning outlet was bought over by PRC Chinese towkay. Let's obvious which one put up the white flag, 1st...   Bro zuolun, according to businesstimes, this has run up 84% already any views on this? thanks for your insight  odie, The ex-owner of the Singapore Flyer had to close shop because it was not able to attract a critical mass of returned visitors (locals and tourists) then. Prior to the closing; I read that the shops there were selling one cup of kopi at S$10+++ due to high rental. With the new owner, Straco, even if one cup of kopi is selling at 50% discount, I believe the locals and tourists are willing to pay for it but only once in a life time.  The chart pattern of Straco should be quite similar to Valuetronics = unsustainable.

|

|

|

|

Post by odie on Aug 29, 2014 19:50:52 GMT 7

thanks zuolun bro for your valuable insights will not enter  |

|

|

|

Post by odie on Aug 29, 2014 19:51:14 GMT 7

thanks zuolun bro for your valuable insights will not enter  |

|

|

|

Post by zuolun on Aug 30, 2014 15:16:19 GMT 7

|

|

|

|

Post by zuolun on Aug 31, 2014 19:13:07 GMT 7

|

|

|

|

Post by zuolun on Sept 1, 2014 17:30:17 GMT 7

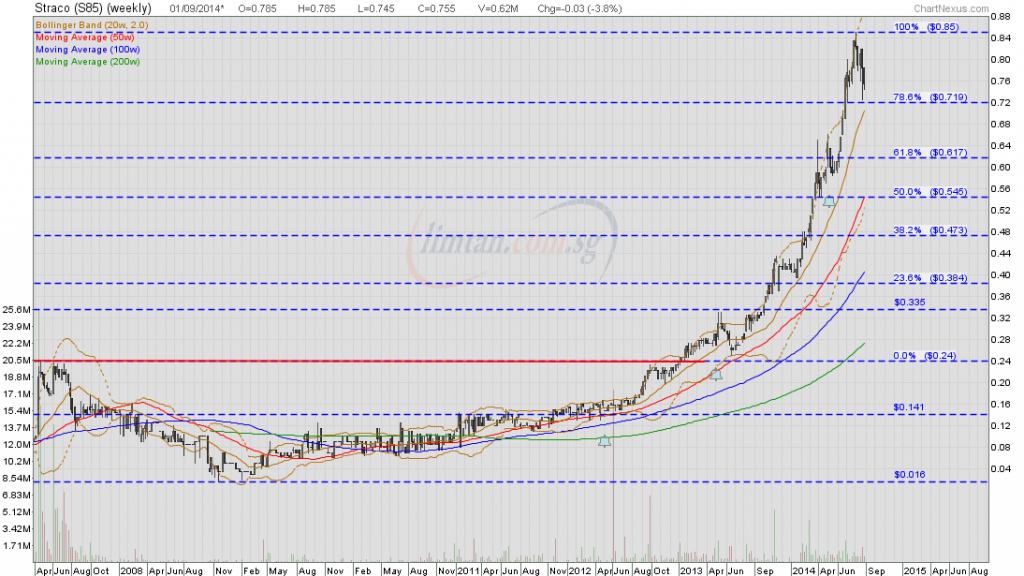

odie, The ex-owner of the Singapore Flyer had to close shop because it was not able to attract a critical mass of returned visitors (locals and tourists) then. Prior to the closing; I read that the shops there were selling one cup of kopi at S$10+++ due to high rental. With the new owner, Straco, even if one cup of kopi is selling at 50% discount, I believe the locals and tourists are willing to pay for it but only once in a life time.  The chart pattern of Straco should be quite similar to Valuetronics = unsustainable.  Valuetronics (weekly) — Nov 2008 to 1 Sep 2014 Valuetronics (weekly) — Nov 2008 to 1 Sep 2014 |

|