|

|

Post by odie on Aug 31, 2014 9:10:13 GMT 7

IPO at $0.21 on 24 Aug 2001

Share Consolidation 1 for 4 on 19/01/09

Company Background

Koyo Group is one of the leading homegrown mechanical and electrical (M&E) engineering specialist service providers and provides quality service to all industries, including those in the construction, marine, oil and gas, industrial and pharmaceutical industries as well as to the public sector.

The Company was incorporated in Singapore on 4 January 2001 under the name of Cyber Village Holdings Limited. It changed its name to Koyo International Limited upon the completion of Reverse Take-Over (RTO) of Koyo Group on 21 January 2009.

Koyo Group, with over 26 years of experience in providing M&E engineering services, had established track records and successfully completed more than 150 projects to date. These include consulting, design, procurement, fabrication and construction projects. Koyo Group is able to provide integrated, design-and-build services and offers full suite of M& E services from design to execution and maintenance as well as facilities management services.

Source: shareinvestor

|

|

|

|

Post by odie on Aug 31, 2014 9:11:48 GMT 7

AVSC AWARDED L6 GRADE (UNLIMITED) FOR THE SUPPLY OF

RECLAMATION SAND UNDER SUPPLY HEAD SY01C

The Board of Directors of Koyo International Limited (the “Company” and together with its

subsidiaries, the “Group”) is pleased to announce that AVSC Technologies Pte Ltd (“AVSC”),

an indirect wholly-owned subsidiary of the Company, has been issued, by the Building and

Construction Authority, the L6 grade for the supply of reclamation sand under the supply

head of SY01C for other basic construction material.

With an L6 grade, AVSC would be able to tender for government projects of unlimited value

for the supply and delivery of reclamation sand. Shareholders should note that the award is

not an indication of any successful tenders to date and the Company would make further

announcements to update shareholders of any material developments.

Interests of Directors and Substantial Shareholders

Save for their respective shareholdings in the Company, none of the directors, controlling

shareholders or substantial shareholders of the Company has any interest, whether directly or

indirectly, in the above arrangement contemplated herein.

By order of the Board of

Koyo International Limited

Mdm Goh Hwee Hiong

Chief Financial Officer

29 August 2014

|

|

|

|

Post by odie on Aug 31, 2014 9:44:24 GMT 7

Bro zuolun, can shed some light on what you see in your crystal ball for Koyo? Thanks and have a good day.  |

|

|

|

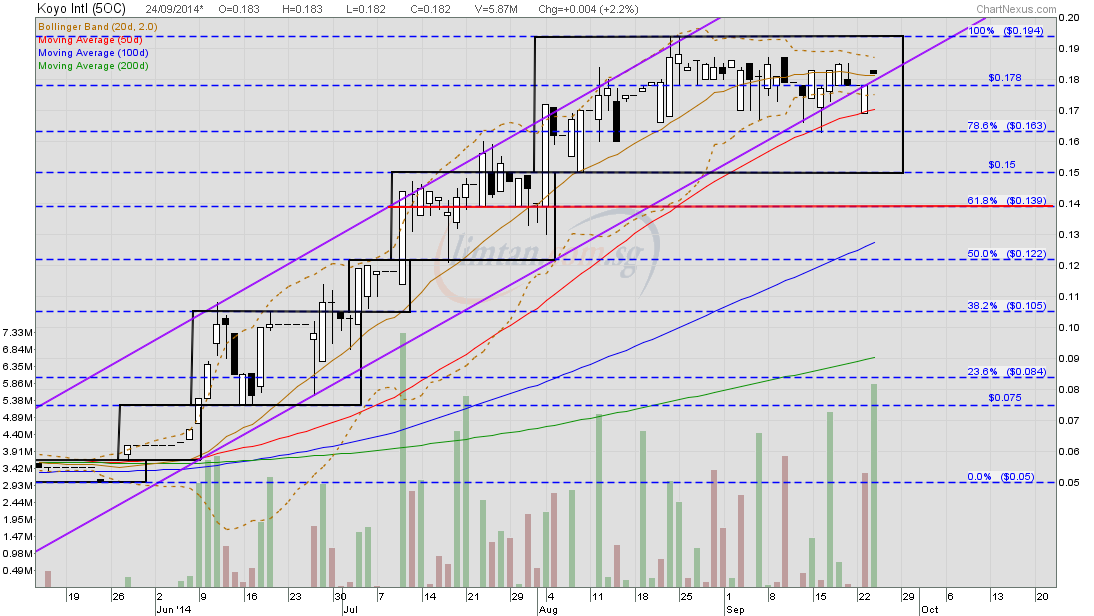

Post by zuolun on Aug 31, 2014 10:31:17 GMT 7

Bro zuolun, can shed some light on what you see in your crystal ball for Koyo? Thanks and have a good day.  A picture is worth a thousand words.  Koyo — Symmetrical Triangle Formation; crucial support @ S$0.139 Koyo — Symmetrical Triangle Formation; crucial support @ S$0.139  |

|

|

|

Post by odie on Aug 31, 2014 10:45:18 GMT 7

thanks zuolun bro for insight will monitor and wait  |

|

|

|

Post by zuolun on Aug 31, 2014 11:40:48 GMT 7

thanks zuolun bro for insight will monitor and wait  odie, Koyo's chart pattern, price and volume indicate that the major cheng kay is getting ready to run road. - The stock is strongly supported by the 20d SMA.

- If the share price goes below the 20d SMA to hit lower low or below the 50d SMA with extremely high volume...

- It's time to kiss goodbye...

A picture is worth a thousand words.  Koyo — Symmetrical Triangle Formation; crucial support @ S$0.139 Koyo — Symmetrical Triangle Formation; crucial support @ S$0.139 |

|

|

|

Post by odie on Aug 31, 2014 11:54:39 GMT 7

thanks bro zuolun, will wait for good show  |

|

|

|

Post by zuolun on Sept 24, 2014 11:09:00 GMT 7

thanks bro zuolun, will wait for good show   odie, The share price hardly moves if there is no Cheng Kay manipulating it. When there is a Cheng Kay manipulating a stock, you see the price moves very fast and orderly. Look at the CMF indicator in Koyo's chart, it clearly shows the power of the Cheng Kay and all its goalkeepers; swim or sink @ S$0.139.  Koyo — Trading in a rectangle, crucial support @ S$0.139 Koyo — Trading in a rectangle, crucial support @ S$0.139  |

|