|

|

Post by zuolun on Mar 6, 2015 2:05:01 GMT 7

|

|

|

|

Post by zuolun on Mar 12, 2015 7:28:17 GMT 7

|

|

|

|

Post by kenjifm on Mar 12, 2015 14:42:39 GMT 7

The Dividend Pay out Ratio already give a Good Hint. Net Earnings keep dropping by huge percentage. Retained Earning Drop gradually too....u can look at my 1st point again. Dividend Yield Drop Gradually too. For this is become a turn around they must really perform well consistently for 5 years, if not from their price, a short seems more logical then buy and invest. thanks for the tag zuolun |

|

|

|

Post by zuolun on Mar 18, 2015 13:58:55 GMT 7

SGX issues 'trade with caution' warning on Civmec ~ 18 Mar 2015 Could Civmec extract value from Australia? ~ 18 Nov 2014 Civmec's share price collapsed fast and furious @ S$0.39 (-0.11, -22%) with 1.23m shares done on 18 Mar 2015 at 2.50pm. Civmec ~ Fall off the cliff   During a market downturn, it is important to be able to distinguish between a falling knife and a possible multi-bagger stock. Given the fall in oil and commodity prices, I am inclined to classify all related stocks as potential falling knives. As I am equally as bearish on Singapore properties, I too will stay away from such stocks. But there are stocks that have been beaten badly and are not in any of these related industries. At the end of the day, the stock market is about supply and demand and if lots more investors want to sell, it is likely that the prices will drift southwards. Investors may have to sell these non related stocks to cover for their losses in the related sectors. There may also be forced selling for those who have bought shares with margin and are currently under margin calls. To bottom fish, one has to read the supply and demand of the stock correctly. I will certainly not be buying any stocks where a major shareholder is liquidating his positions. Yes, it is not easy to read market volume but I feel that all investors (fundamental investors included) must learn this art of deciphering market volume and then making a decision whether the selling volume is temporary or more permanent. Even more important than that, investors must believe in their own analysis and be willing to risk part of their wealth in what they believe in. To me, there is no point just taking a small position in any stock as this will not increase your net worth. It will be more like an ego trip. I invest to increase my net worth and not just to feel good. To be successful as an investor, you must learn to overcome this fear of putting sufficient meat into your investments... otherwise, your game of investing will always remain, just a game. Most of the smaller oil & gas and related company share prices had already collapsed beyond recognition due to oil price decline; chartwise, I totally agree with oldman that "Given the fall in oil and commodity prices, I am inclined to classify all related stocks as potential falling knives." "Given the fall in oil and commodity prices, I am inclined to classify all related stocks as potential falling knives." Hmmm, ... i wonder. During the 2008/09 crisis, oil price was falling off the cliff too. As would be expected during those periods of "falling knives", analysts were keen to join the herd and forecasting lower and lower prices of oil. As oil price were dipping towards $50/bbl, then $40/bbl, analysts and soothsayers were trying their utmost to outdo one another by being the more bearish. CNOOC, 883 HK, understandably crashed thru the roof, hurdling towards sub-HK$5 during the trough. Yet, if one had dilligently accumulated during those times, one would have done very well. Not too long ago when oil price was still at about $100/bbl, CNOOC was trading well above $20. And yes, you guessed it, the same herd of analysts were calling for big buys with target prices gunning towards $25-30/sh! With oil price having seen a sharp correction in the past two months, CNOOC is now barely holding at $10. I am no expert on oil price. Of course, the dynamics of the oil industry also appear to have changed with the advent and success of the shale evolution in recent times. Still, there must be an intrinsic value for oil. The question is finding out what that breakeven cost is, whether between the different exploration companies or between the traditional oil and shale. my point is, classifying all oil-related stocks as falling knives seem rather harsh. Just as spot oil could go up, come down, ... who could say it would not go up again? OPEC could decide to cut supply drastically, demand could pick up, a large number of the shale operators could be out of business. While it would be a tad optimistic to believe oil price could return to $100/bbl anytime soon, surely a price of $70/bbl isn't as out of reach as we think? Recall that when oil was $70/bbl, many of the oil majors would still be very profitable.

|

|

|

|

Post by zuolun on Mar 19, 2015 5:43:41 GMT 7

Civmec plunges on sell down ~ 19 Mar 2015 Heavy selling by former employee could be behind Civmec stock plunge ~ 19 Mar 2015 Civmec's share price collapsed fast and furious and closed @ S$0.355 (-0.145, -29%) with 4.91m shares done on 18 Mar 2015. SGX issues 'trade with caution' warning on Civmec ~ 18 Mar 2015 Could Civmec extract value from Australia? ~ 18 Nov 2014 Civmec's share price collapsed fast and furious @ S$0.39 (-0.11, -22%) with 1.23m shares done on 18 Mar 2015 at 2.50pm. Civmec ~ Fall off the cliff   During a market downturn, it is important to be able to distinguish between a falling knife and a possible multi-bagger stock. Given the fall in oil and commodity prices, I am inclined to classify all related stocks as potential falling knives. As I am equally as bearish on Singapore properties, I too will stay away from such stocks. But there are stocks that have been beaten badly and are not in any of these related industries. At the end of the day, the stock market is about supply and demand and if lots more investors want to sell, it is likely that the prices will drift southwards. Investors may have to sell these non related stocks to cover for their losses in the related sectors. There may also be forced selling for those who have bought shares with margin and are currently under margin calls. To bottom fish, one has to read the supply and demand of the stock correctly. I will certainly not be buying any stocks where a major shareholder is liquidating his positions. Yes, it is not easy to read market volume but I feel that all investors (fundamental investors included) must learn this art of deciphering market volume and then making a decision whether the selling volume is temporary or more permanent. Even more important than that, investors must believe in their own analysis and be willing to risk part of their wealth in what they believe in. To me, there is no point just taking a small position in any stock as this will not increase your net worth. It will be more like an ego trip. I invest to increase my net worth and not just to feel good. To be successful as an investor, you must learn to overcome this fear of putting sufficient meat into your investments... otherwise, your game of investing will always remain, just a game. Most of the smaller oil & gas and related company share prices had already collapsed beyond recognition due to oil price decline; chartwise, I totally agree with oldman that "Given the fall in oil and commodity prices, I am inclined to classify all related stocks as potential falling knives."

|

|

|

|

Post by zuolun on Mar 22, 2015 17:06:10 GMT 7

CARING (5245) ~ Fall off the cliff

|

|

|

|

Post by zuolun on Mar 24, 2015 21:53:03 GMT 7

ZL bro, what do you think of civmec? Another dead stock or good to buy? cheers , I had posted this stock, Civmec under the thread "Why fall off the cliff?" earlier merely for the record and did not bother to create a new thread for it. My Civmec charts (daily and weekly) posted then were actually meant to emphasize oldman's invaluable comment: "Given the fall in oil and commodity prices, I am inclined to classify all related stocks as potential falling knives."SGX issues 'trade with caution' warning on Civmec ~ 18 Mar 2015 Could Civmec extract value from Australia? ~ 18 Nov 2014 Civmec's share price collapsed fast and furious @ S$0.39 (-0.11, -22%) with 1.23m shares done on 18 Mar 2015 at 2.50pm. Civmec ~ Fall off the cliff   During a market downturn, it is important to be able to distinguish between a falling knife and a possible multi-bagger stock. Given the fall in oil and commodity prices, I am inclined to classify all related stocks as potential falling knives. As I am equally as bearish on Singapore properties, I too will stay away from such stocks. But there are stocks that have been beaten badly and are not in any of these related industries. At the end of the day, the stock market is about supply and demand and if lots more investors want to sell, it is likely that the prices will drift southwards. Investors may have to sell these non related stocks to cover for their losses in the related sectors. There may also be forced selling for those who have bought shares with margin and are currently under margin calls. To bottom fish, one has to read the supply and demand of the stock correctly. I will certainly not be buying any stocks where a major shareholder is liquidating his positions. Yes, it is not easy to read market volume but I feel that all investors (fundamental investors included) must learn this art of deciphering market volume and then making a decision whether the selling volume is temporary or more permanent. Even more important than that, investors must believe in their own analysis and be willing to risk part of their wealth in what they believe in. To me, there is no point just taking a small position in any stock as this will not increase your net worth. It will be more like an ego trip. I invest to increase my net worth and not just to feel good. To be successful as an investor, you must learn to overcome this fear of putting sufficient meat into your investments... otherwise, your game of investing will always remain, just a game. Most of the smaller oil & gas and related company share prices had already collapsed beyond recognition due to oil price decline; chartwise, I totally agree with oldman that "Given the fall in oil and commodity prices, I am inclined to classify all related stocks as potential falling knives." |

|

|

|

Post by zuolun on Apr 13, 2015 11:48:56 GMT 7

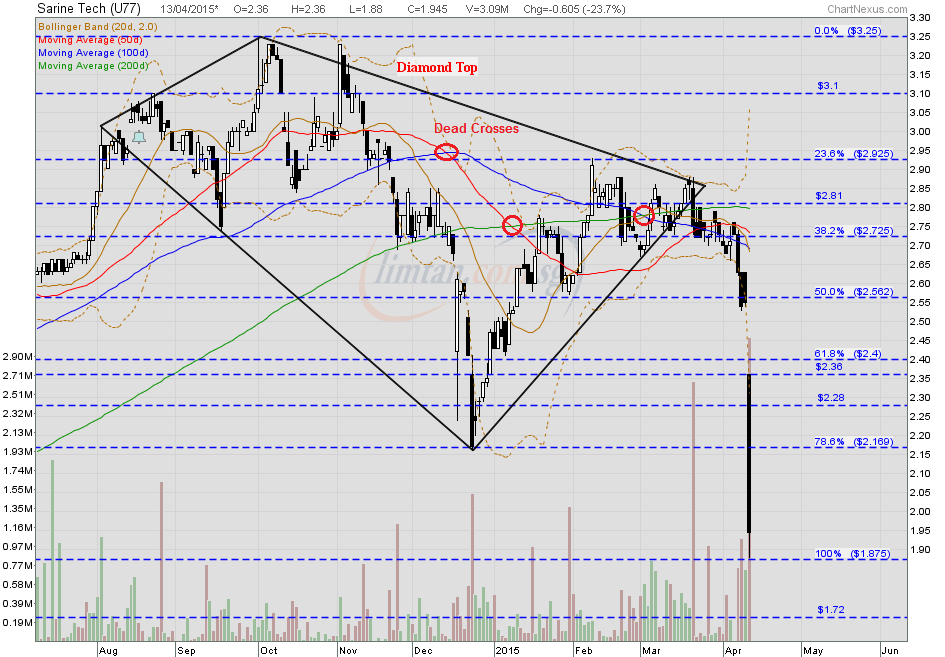

Sarin Tech ~ Bearish Diamond Top Breakout, interim TP S$1.72

|

|

|

|

Post by zuolun on May 14, 2015 15:23:50 GMT 7

ValueMax ~ Fall off the cliff

|

|

|

|

Post by zuolun on Jun 2, 2015 11:07:35 GMT 7

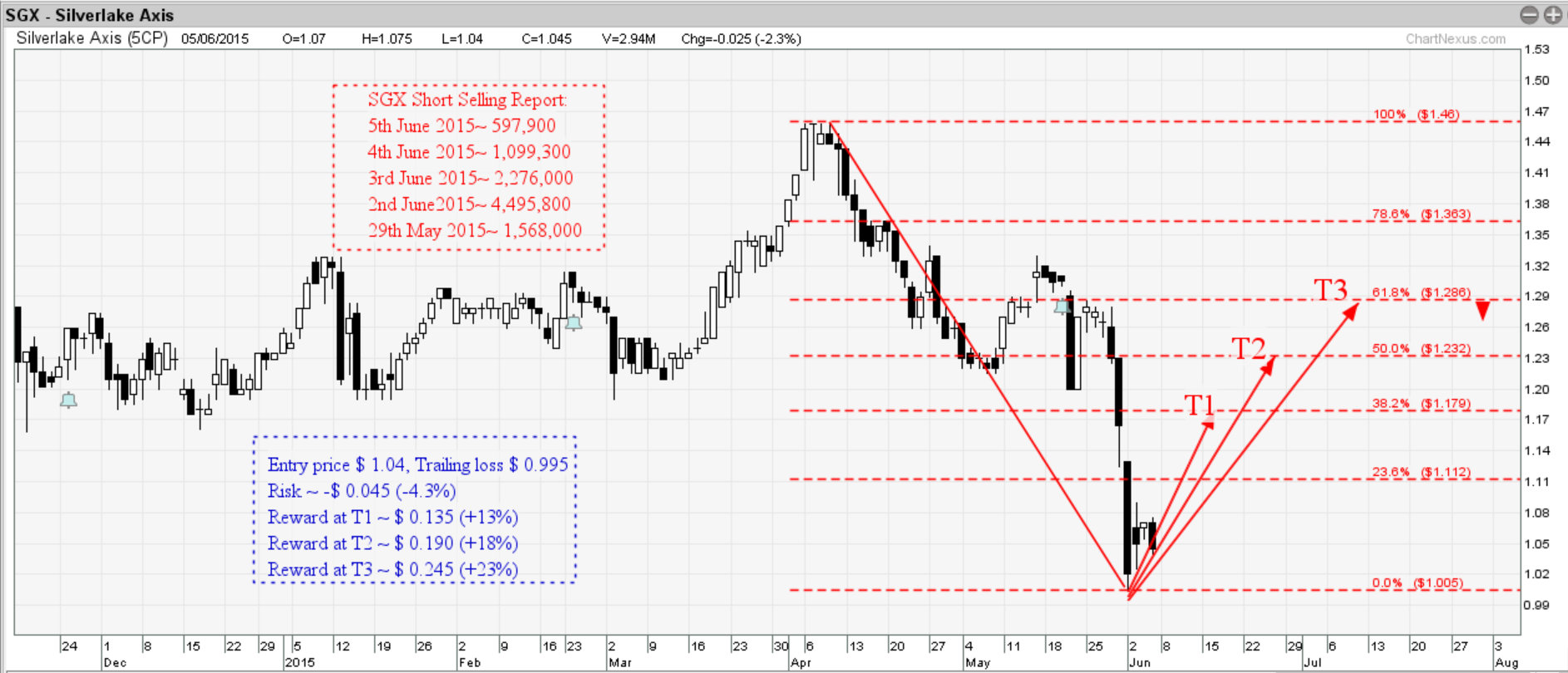

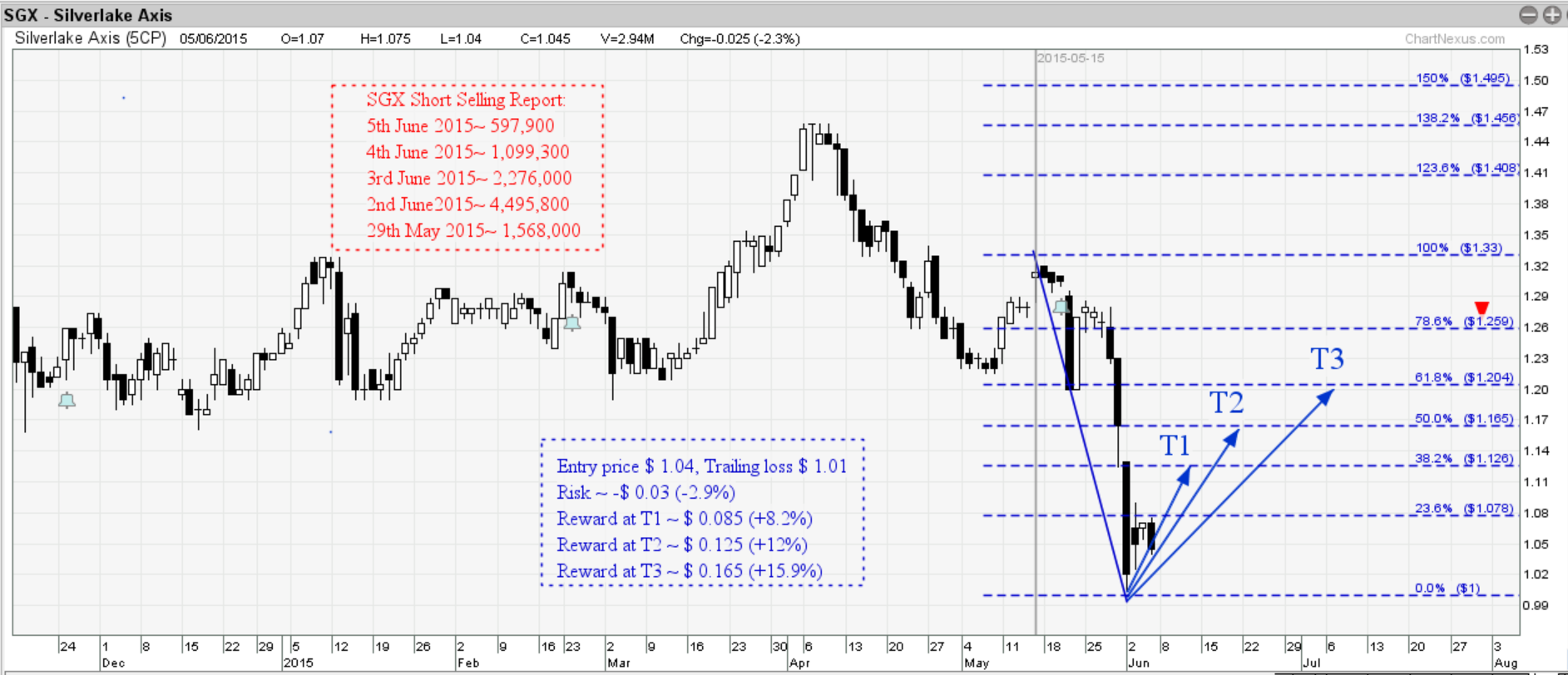

Silverlake ~ Fall off the cliff

|

|

|

|

Post by zuolun on Jun 3, 2015 8:41:00 GMT 7

|

|

|

|

Post by zuolun on Jun 3, 2015 13:52:53 GMT 7

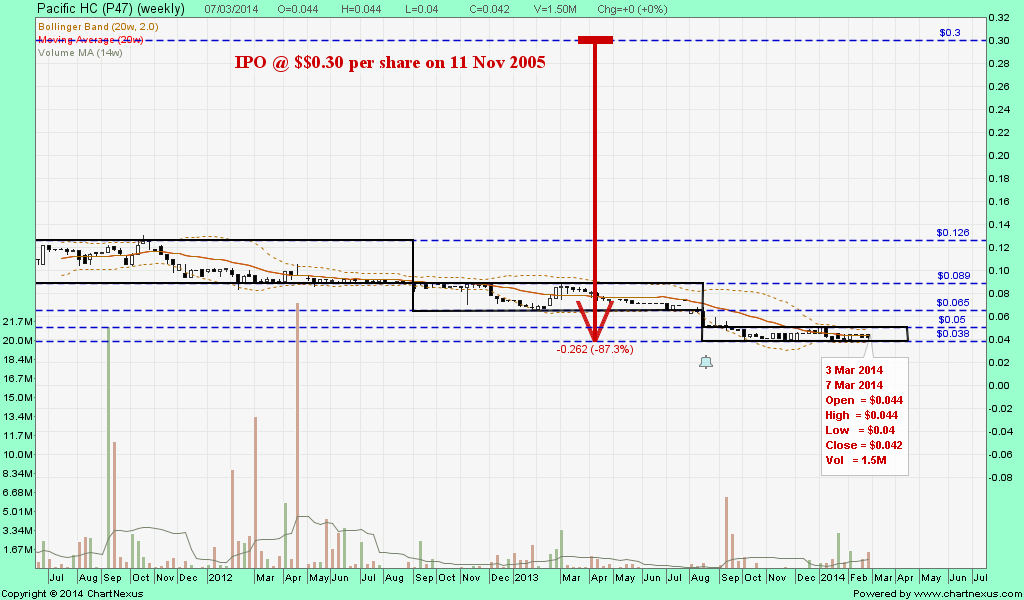

Pacific Healthcare ~ Fall off the cliff In Singapore, medical professionals (GPs and Specialists) except dentists need to be partial or fully attached to public/private hospitals in order to do well. The turnover of small private clinics is extremely high in shopping malls and HDB estates (normal and 24/7 ones) due to high operating costs. This reminds me of one SGX-listed healthcare company, Pacific Healthcare Holdings; it's business model is similar to Mary Chia Holdings...

|

|

|

|

Post by sptl123 on Jun 6, 2015 17:43:40 GMT 7

Bro Zuolun, " 已有的事,后必再有。已行的事,后必再行。日光之下并无新事。"  Silverlake Axis Closes with a long black bearish candlestick @ 1.045(-$0.025,-2.34%) with 2.942 million traded on 5th June 2015. [Dow Jones 27 May] DBS Vickers Securities downgrades Silverlake Axis (5CP.SG) to fully valued from hold and cuts its target price to S$1.08 from S$1.35. DBS says it downgraded the IT firm on "valuation grounds." DBS notes that the company rejected allegations in a media report that it may have engaged in irregular financial reporting in the past. Silverlake Axis down -18% since the DBS downgrades report or -21.5% from the recent high on 15th May 2015. Short sellers in the last 4 days drying out. Play the re-bounce? Entry price, trailing loss and exit points are indicated on the following two charts; the first one is more aggressive than the 2nd chart. Based on risk/reward is a Go-Go ( -4.3% up to +23%) However, Bro Zuolun, need your wisdom and advices before Go-Go-Go.  Retracment from 9th April 2015 Retracment from 9th April 2015 Retracment from 15Th May 2015 Retracment from 15Th May 2015 Silverlake ~ Fall off the cliff |

|

|

|

Post by zuolun on Aug 3, 2015 13:23:26 GMT 7

|

|

|

|

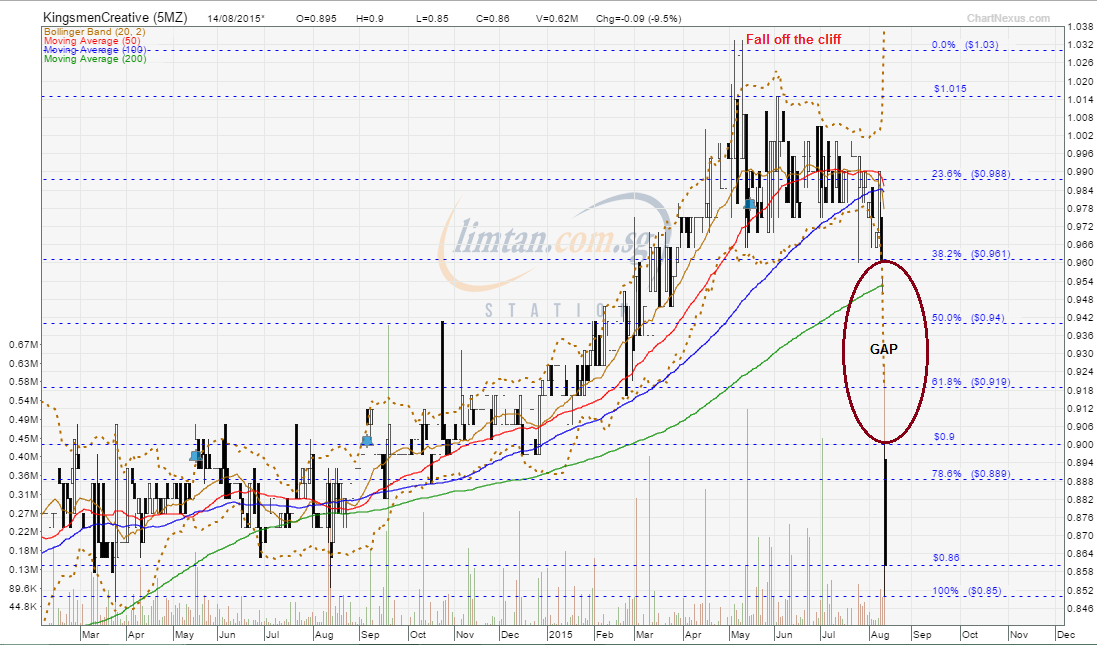

Post by zuolun on Aug 14, 2015 11:19:51 GMT 7

KingsmenCreative ~ Fall off the cliff

|

|