|

|

Post by odie on Sept 12, 2014 21:13:30 GMT 7

Company Background

The Company was first incorporated as Gold Coin Ltd and was listed on SES in 1975. Following a restructuring exercise in 1992, the Company changed its name to Goldtron Ltd. The principal activity of the Company is that of an investment holding company. The Group’s principal activities are that of electronic manufacturing services (EMS) and marketing and distribution of electronic components.The EMS activities include printed circuit board assemblies and box build of customers’ products. It provides design-input for more efficient production, proto-type run to mass production, and cost-down recommendations/solutions.The marketing and distribution division acts as agent and representative of semiconductor component manufacturers to selected customers as well as buyer from semiconductor component manufacturers to support its end customers. To facilitate such sales, this division adds value through marketing, product promotion, and technical support to customers through their design stages, order and logistics administration till final delivery. The Group has manufacturing plants in Shenzhen (Buji) and Shanghai, and trading offices in Singapore, Malaysia, Thailand, Hong Kong, China and Taiwan.Change of Name:Goldtron Limited to ICP Ltd. Trading under the new name wef 16 October 2012.

source: shareinvestor

|

|

|

|

Post by odie on Sept 12, 2014 21:21:19 GMT 7

In financial year ended 30 June 2014, the Company ceased and disposed the property and assets of the electroplating business. Company's main revenue stream is from time charter of vessels owned by its subsidiaries. On 29 April 2014,the Group announced that 12,758,446,125 rights shares have been allotted and issued pursuant to the rights issue and will be listed and quoted on Catalist on 30 April 2014. On 15 May 2014, the Group announced the completion of the share consolidation of every 10 existing shares held by shareholders of the Company into one (1) ordinary share. On 24 June 2014, the Group through its wholly-owned subsidiary entered into a Sale of Trade Marks Agreement with Travelodge (IP) Pty Limited ( “TIP”) to acquire the registered trade mark rights owned by TIP to the hotel brand name“Travelodge”in 22 territories and countries in the Asia Pacific region excluding Australia and New Zealand for a consideration of A$3,000,000. On 27 June 2014, the Group through its wholly-owned subsidiary entered into a sale and purchase agreement into acquiring a 19.9% interest in Tiaro Coal Limited for A$3,051,000 and to dispose 17.2% interest in Mount Adrah Gold Limited for A$2,000,000. Read below for unaudited 2014 results and announcement infopub.sgx.com/FileOpen/ICP%20-%20FY2014%20final%20announcement%2021Aug2014.ashx?App=Announcement&FileID=310999 |

|

|

|

Post by odie on Sept 12, 2014 21:33:49 GMT 7

zuolun bro, any views ?

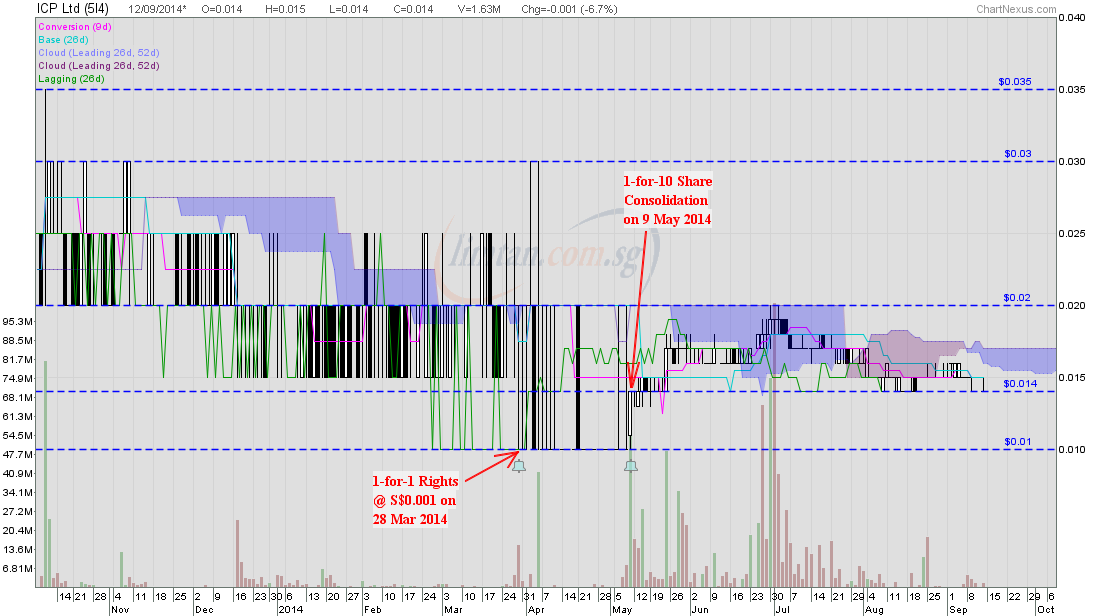

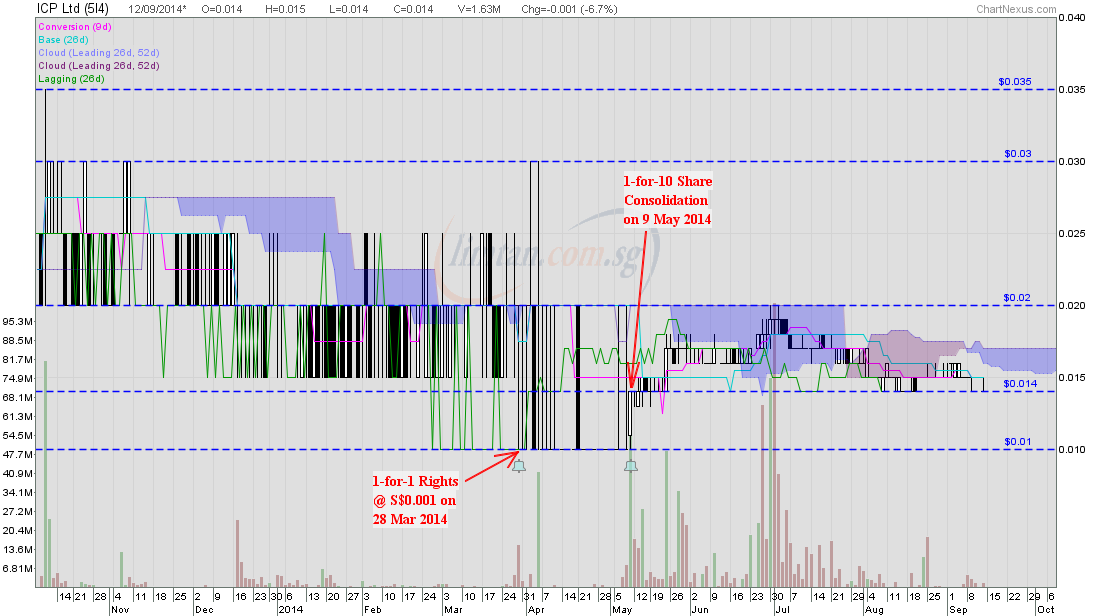

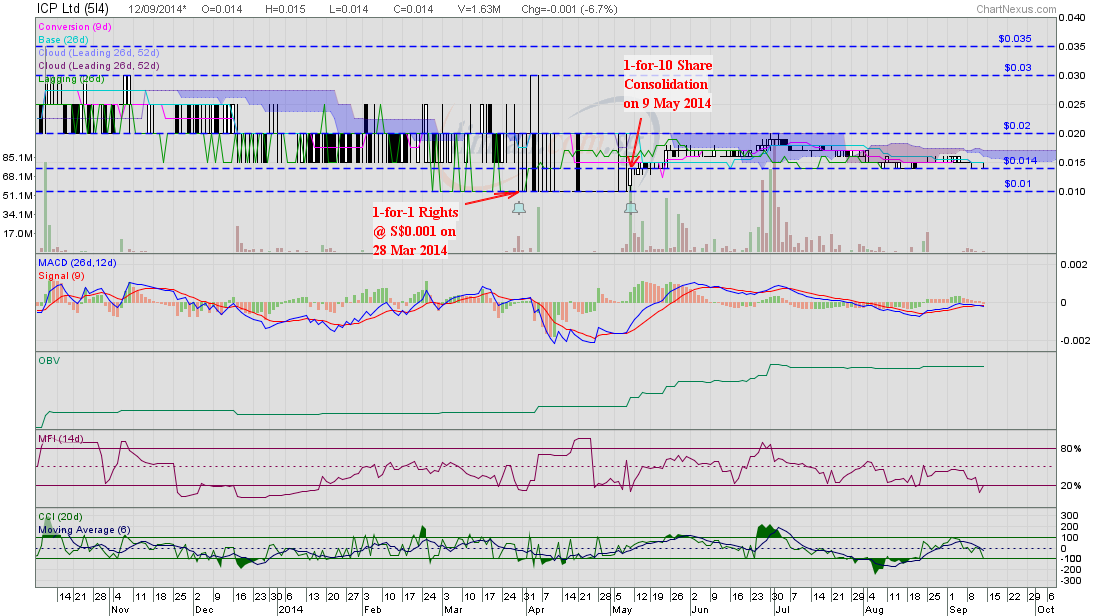

weekly chart shows a descending triangle with support at 1.4 cts

Many thanks and have a great weekend

|

|

|

|

Post by zuolun on Sept 12, 2014 22:41:49 GMT 7

zuolun bro, any views ? weekly chart shows a descending triangle with support at 1.4 cts Many thanks and have a great weekend odie, It won't be easy to make S$0.001 profit from ICP; this is a typical casino stock, the gameplay is the same as that Ah neh neh stock, S i2i Ltd. |

|

|

|

Post by odie on Sept 13, 2014 6:45:41 GMT 7

zuolun bro,

thanks for advice

will stay clear of this

somehow the directors seem to be well paid

LOL

|

|

|

|

Post by zuolun on Sept 13, 2014 6:56:56 GMT 7

zuolun bro, any views ? weekly chart shows a descending triangle with support at 1.4 cts Many thanks and have a great weekend odie, It won't be easy to make S$0.001 profit from ICP; this is a typical casino stock, the gameplay is the same as that Ah neh neh stock, S i2i Ltd.zuolun bro, thanks for advice will stay clear of this somehow the directors seem to be well paid LOL odie, Rotten/Casino stocks always repeat the same modus operandi and it's quite easy to identify them. To understand how these SGX-listed "walking dead" companies return from the dead, one good example is Liang Huat Aluminium Ltd. This SGX-listed company is one of the pioneer rotten/casino stocks where the owner made most of its profits not from normal business operation but by issuing millions of worthless shares to retail investors over the years. fergus said...

Hi, thanks for doing this write up.

Just my point of view.. Previously, liang huat was a relatively big company. At least according to past annual reports I read. There was a time where they were regional, with turnover of 140+ mil per year.

What happened then would probably be the usual construction problems that struck companies like weepoh, csc, yongnam, bbr, l&m, and the other companies, during the 2001-2003 period.

From what I read, essentially the negative equity is due to the huge bank loans, primarily from uob and maybank..

Also, the earnings turnaround part has been fudged a little.. To be exact, the other operating income during 2007 and the other items during 2006.. This should be cancelled off, because 2007 was a write back of the provision done in 2006.. Even with that removed, its somewhat like a turnaround from loss to profit.. Not as remarkable as -1.22 to 1.1 of course.

The reason for the insider sales, is not because they want to sell, but because the upper management shares has been pledged to the creditors (uob and maybank) as collateral. So uob and maybank has the right to sell them to get back cash. Thats unfortunate for the major shareholder.

The return from the dead part, is part of this large controversial topic in channelnewsasia forum. Generally because there was a 10 to 1 consolidation and new shares issued to creditors and investors.

Basically, the result is,

1) current shareholders have their stakes cut by 10

2) liabilities of loans have been converted to shares, thus no more negative equity.

3) according to the offer information statement, the EPS for FY2006 would have been changed from -1.22cents to 4cents instead.

4) new majority shareholder with 70% stake. (possible RTO?)

5) large share overhang, as creditors may not want a vested interest in the company, so they may sell off their debt converted shares.

That said, I would think the valuation is very difficult to do. The key reason is because of any business injection or some improvement in its business prospects. (which may be possible with a new shareholder)

caveat emptor.

|

|

|

|

Post by odie on Sept 13, 2014 11:57:05 GMT 7

|

|

|

|

Post by zuolun on Sept 14, 2014 11:22:19 GMT 7

odie, Chartwise, ICP is likely to hit lower to retest S$0.01, i.e. back to the share price, prior to the 1-for-1 rights issues and the 1-for-10 share consolidation. |

|

|

|

Post by odie on Sept 14, 2014 13:06:38 GMT 7

On 27 June 2014, the Group through its wholly-owned subsidiary entered into a sale and purchase agreement into acquiring a 19.9% interest in Tiaro Coal Limited for A$3,051,000 and to dispose 17.2% interest in Mount Adrah Gold Limited for A$2,000,000. The Share Acquisition will be a catalyst for a strategic relationship with China Qinfa Group Limited(“Qinfa”),a group that has coal trading and coal mining assets in China, which may bring further opportunities in the development of coal resources across Asia and Australia. Qinfa currently owns 19.9% of Tiaro Coal and 33.6% of Paragon Coal infopub.sgx.com/FileOpen/ICPLtd_Annoucement%20Tiaro%20and%20Gossan%20transactions.ashx?App=Announcement&FileID=303097 Established in 1996, China Qinfa Group Limited (HKEx Stock Code: 00866.HK) is a leading non-state-owned coal operator in China. We are principally engaged in the coal operation business involving the purchase, filtering, blending, storage, transportation, sales and shipping of coal. In 2007, we were ranked the largest non-state-owned coal operator in China in terms of business scale. www.qinfagroup.com/en/Default.htmlCHINA QINFA (00866.HK) -0.005 (-1.408%) reported interim fiscal results. Turnover rose 0.33% yearly to RMB4.457 billion. Loss expanded to RMB382 million. LPS was RMB0.18. www.aastocks.com/en/stocks/news/aafn-content/NOW.625651/result-announcementwww.aastocks.com/en/ltp/rtquote.aspx?symbol=00866 |

|

|

|

Post by odie on Sept 14, 2014 13:25:21 GMT 7

odie, Chartwise, ICP is likely to hit lower to retest S$0.01, i.e. back to the share price, prior to the 1-for-1 rights issues and the 1-for-10 share consolidation.thanks bro zuolun, won't be punting this as i believe micro pennies have elephant queues LOL |

|

|

|

Post by zuolun on Sept 14, 2014 14:26:21 GMT 7

thanks bro zuolun, won't be punting this as i believe micro pennies have elephant queues LOL odie, ICP's ichimoku indicates a clear downside, below the purple cloud and the CCI indicator also clearly shows a downside continuation. Chartwise, ICP is likely to hit lower to retest S$0.01, i.e. back to the share price, prior to the 1-for-1 rights issues and the 1-for-10 share consolidation.  |

|

|

|

Post by zuolun on Sept 19, 2014 0:07:59 GMT 7

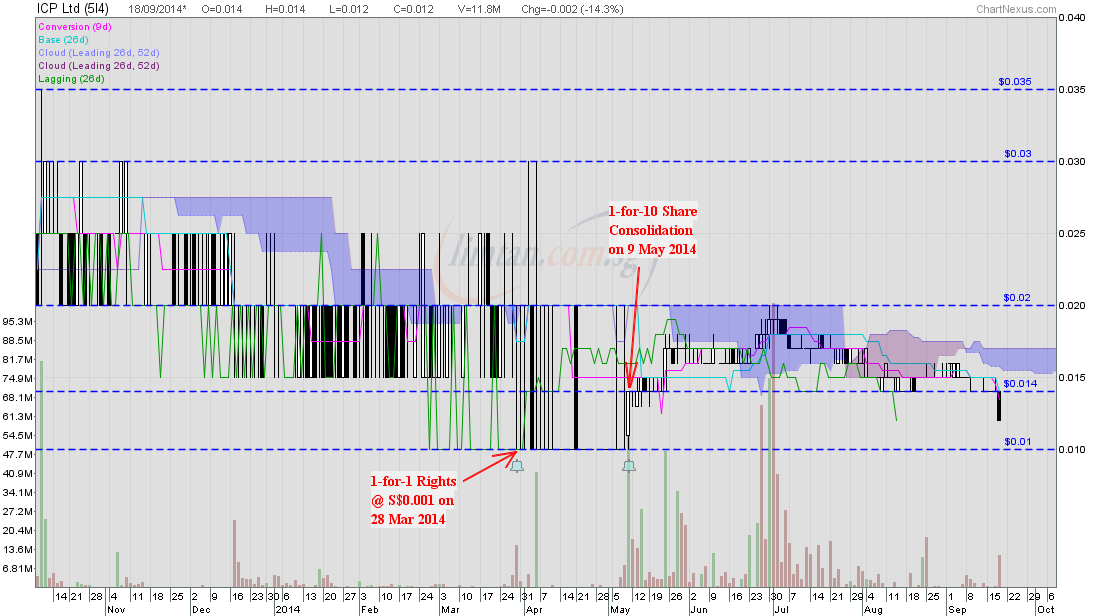

odie, ICP's Cheng kay served black mee rebus liao...  ICP closed with a long black marubozu @ S$0.012 (-0.002, -14.3%) with 11.8m shares done on 18 Sep 2014.  |

|

|

|

Post by odie on Sept 19, 2014 7:13:14 GMT 7

zuolun bro, heng never touch this  i heard that my friend bought this at $1.60 but it never recovered he is still holding |

|