|

|

Post by zuolun on May 14, 2015 9:17:20 GMT 7

|

|

|

|

Post by zuolun on May 15, 2015 2:40:24 GMT 7

sptl123, 牧羊人理論 ~ The logic to long or short a stock using FA or TA is the same, i.e. when betting to win big on high volume (position sizing), precise timing on entry and exit price is essential; win big lose also big.Examples:Wilmar: Long 500,000 shares @ S$3.30 per share, exit price @ S$3.50COSCO: Short 5,000,000 shares @ S$8.00 per share, exit price @ S$1+Bro Zuolun, it is an excellent video. Many things in there I still don't know. Now I understand why you often post weekly chart. Well said relating to the application of weekly chart : 不识庐山真面目,只缘身在此山中。 It also slapped me hard on what I have been doing wrongly. Master Hu said: it is not the number of winning trades one have but the amount of gain in those winning trades. For me 80% of my trades are winning trades but that 20% kill me pain pain and make me a big loser.  The video reminded that I must improve myself as to how to raid on profit and cut the loss fast.

|

|

|

|

Post by pain on May 15, 2015 13:59:21 GMT 7

Bro Zuolun, Thanks for sharing this video. Agreed too. It is on the winning trades that matters big and not on small losing trades. Hoots big big...loses small small. Patience, Perseverance, Precision sptl123, 牧羊人理論 ~ The logic to long or short a stock using FA or TA is the same, i.e. when betting to win big on high volume (position sizing), precise timing on entry and exit price is essential; win big lose also big.Examples:Wilmar: Long 500,000 shares @ S$3.30 per share, exit price @ S$3.50COSCO: Short 5,000,000 shares @ S$8.00 per share, exit price @ S$1+Bro Zuolun, it is an excellent video. Many things in there I still don't know. Now I understand why you often post weekly chart. Well said relating to the application of weekly chart : 不识庐山真面目,只缘身在此山中。 It also slapped me hard on what I have been doing wrongly. Master Hu said: it is not the number of winning trades one have but the amount of gain in those winning trades. For me 80% of my trades are winning trades but that 20% kill me pain pain and make me a big loser.  The video reminded that I must improve myself as to how to raid on profit and cut the loss fast. |

|

|

|

Post by zuolun on May 16, 2015 11:34:37 GMT 7

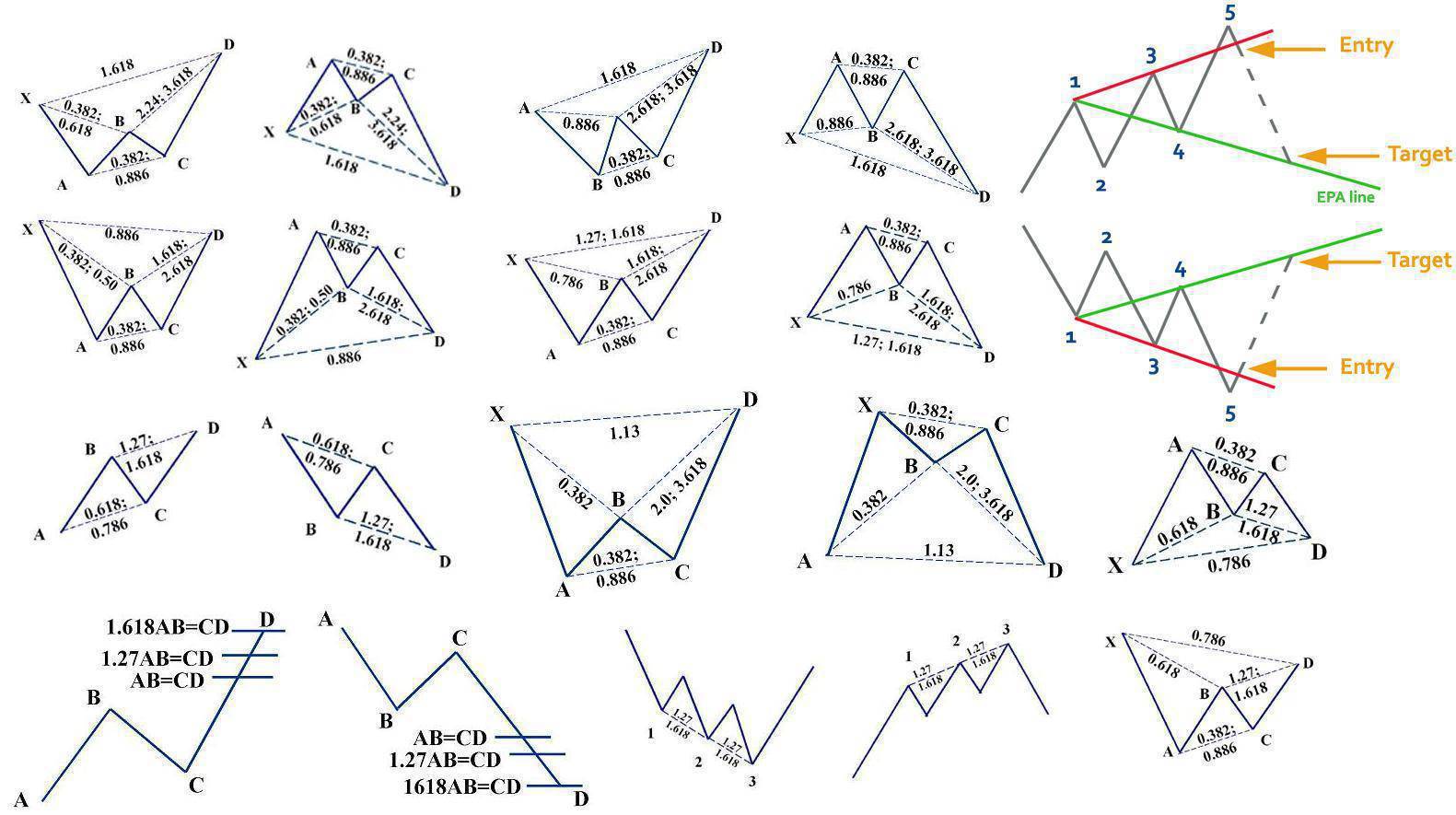

Thank you Bro Zuolun. Monday I run for my life liao.  Thank you for the detailed TA. Your passion for TA and selflessness to share is much appreciated and respected by many. I have been wondering : Zuolun= A person ? OR Zuolun= A team of Zuoluns.  Amazing, you are super fast ! Just today for the many posts you written, I probably take longer time to read them than the time you use to construct those posts .  With my full respect. , You've passed the Fibonacci and Ichimoku with distinctions; it's time to proceed to the Gartley pattern.   |

|

|

|

Post by sptl123 on May 16, 2015 11:42:37 GMT 7

Thank you Bro Zuolun. I started learning Gartley Pattern and surely it is not simple/easy. But I will spend more times and efforts to get a "D" first.  Thank you Bro Zuolun. Monday I run for my life liao.  Thank you for the detailed TA. Your passion for TA and selflessness to share is much appreciated and respected by many. I have been wondering : Zuolun= A person ? OR Zuolun= A team of Zuoluns.  Amazing, you are super fast ! Just today for the many posts you written, I probably take longer time to read them than the time you use to construct those posts .  With my full respect. , You've passed the Fibonacci and Ichimoku with distinctions; it's time to proceed to the Gartley pattern.   |

|

|

|

Post by zuolun on May 16, 2015 12:11:28 GMT 7

|

|

|

|

Post by sptl123 on May 16, 2015 13:00:11 GMT 7

Wow bro Zuolun thirty percent up in two weeks! Surely you have plenty of such big fish all this while. Envy you.  |

|

|

|

Post by zuolun on May 16, 2015 13:03:59 GMT 7

Wow bro Zuolun thirty percent up in two weeks! Surely you have plenty of such big fish all this while. Envy you.  , OSK has 40% upside.  |

|

|

|

Post by sptl123 on May 16, 2015 13:14:35 GMT 7

That'll be great. I have been putting many more eggs in the OSK-basket. I will be taking extra care to look after them.  |

|

|

|

Post by zuolun on May 16, 2015 16:32:13 GMT 7

Bro Zuolun, it is an excellent video. Many things in there I still don't know. Now I understand why you often post weekly chart. Well said relating to the application of weekly chart : 不识庐山真面目,只缘身在此山中。 It also slapped me hard on what I have been doing wrongly. Master Hu said: it is not the number of winning trades one have but the amount of gain in those winning trades. For me 80% of my trades are winning trades but that 20% kill me pain pain and make me a big loser.  The video reminded that I must improve myself as to how to raid on profit and cut the loss fast. , Dare, don't be afraid to make mistakes"Don't worry about making a mistake, but don't repeat it."  |

|

|

|

Post by zuolun on May 16, 2015 16:52:59 GMT 7

Bro Zuolun, Thanks for sharing this video. Agreed too. It is on the winning trades that matters big and not on small losing trades. Hoots big big...loses small small. Patience, Perseverance, Precision  |

|

|

|

Post by sptl123 on May 16, 2015 23:41:51 GMT 7

Bro Zuolun, thank you so much for the encouragement.

人言胆識胆識,缺一不可. 有胆没識,有識没胆皆不能取得成功.

I am a roaster, a fighting cock.

One of my broker often say I have gut. But so what? I merely 有胆没識 and my "rewards" were losing trades.

I am fortunate to have joined Pertama and to learn from you Bro Zuolun.

I am learning hard to becoming 有胆有識.

Hope I could soon share with you the joy of catching a big fish.

PS: Bro Zuolun doesn't need any fishes as he has plenty of them and his fridge is pretty full.

|

|

|

|

Post by westerndidi on May 17, 2015 17:04:35 GMT 7

Dear Shifus, May I know what is 波段投资 and 短线? Thanks, Di sptl123, 牧羊人理論 ~ The logic to long or short a stock using FA or TA is the same, i.e. when betting to win big on high volume (position sizing), precise timing on entry and exit price is essential; win big lose also big.Examples:Wilmar: Long 500,000 shares @ S$3.30 per share, exit price @ S$3.50COSCO: Short 5,000,000 shares @ S$8.00 per share, exit price @ S$1+Bro Zuolun, it is an excellent video. Many things in there I still don't know. Now I understand why you often post weekly chart. Well said relating to the application of weekly chart : 不识庐山真面目,只缘身在此山中。 It also slapped me hard on what I have been doing wrongly. Master Hu said: it is not the number of winning trades one have but the amount of gain in those winning trades. For me 80% of my trades are winning trades but that 20% kill me pain pain and make me a big loser.  The video reminded that I must improve myself as to how to raid on profit and cut the loss fast. |

|

|

|

Post by zuolun on May 18, 2015 5:15:12 GMT 7

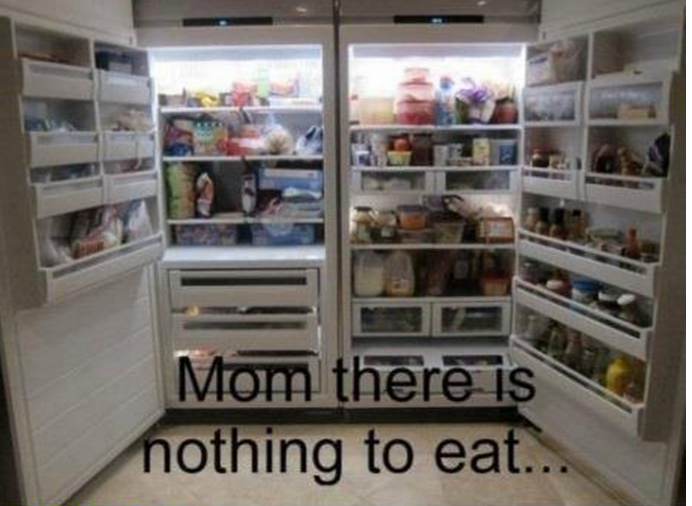

Dear Shifus, May I know what is 波段投资 and 短线? Thanks, Di , 波段投资 and 短线 are the same, it means swing trading; read the following article for detailed explanation. 什么是波段操作,炒股如何波段操作?

波段操作就是指投资股票的人有价位高时卖出股票,在低位时买入股票的投资方法.

波段操作是针对目前国内股市呈波段性运行特征的有效的操作方法,波段操作虽然不是赚钱最多的方式,但始终是一种成功率比较高的方式。这种灵活应变的操作方式还可以有效回避市场风险,保存资金实力和培养市场感觉。

波段炒作比找黑马更为重要,在每一年的行情中都有主峰和主谷,峰顶是卖出的机会;波谷是买入的机会。 波段炒作很容易把握,这是对于大盘而言。很多个股具有一定的波段,我们对一些个股进行仔细研判,再去确定个股的价值区域,远远高离价值区域后,市场会出现回调的压力,这时候再卖出;当股价进入价值低估区域后,再在低位买入,耐心持有,等待机会,这样一般都会获取较大收益。

选股技巧。比较适合波段操作的个股,在筑底阶段会有不自然的放量现象,量能的有效放大显示出有主力资金在积极介入。因为,散户资金不会在基本面利空和技术面走坏的双重打击下蜂拥建仓,所以,这时的放量说明了有部分恐慌盘正在不计成本出逃,而放量时股价保持不跌恰恰证明了有主流资金正在乘机建仓。因此,就可以推断出该股在未来行情中极富有短线机会。

买入技巧:在波谷时买入。波谷是指股价在波动过程中所达到的最大跌幅区域的筑底行情往往会自然形成某一中心区域,投资者可以选择在大盘下跌、远离其筑底中心区的波谷位置买入。从技术上看,波谷一般在以下的位置出现:BOLL布林线的下轨线;趋势通道的下轨支撑线;成交密集区的边缘线; 投资者事先制定的止损位;箱底位置等等。

卖出技巧:波峰是指股价在波动过程中所达到的最大涨幅区域。从技术上看,波峰一般出现在以下位置:BOLL布林线的上轨线;趋势通道的上轨趋势线; 成交密集区的边缘线;投资者事先制定的止盈位;箱顶位置。

持股技巧:根据波长而定。波长是指股价完成一轮完整的波段行情所需要的时间。股市中长线与短线孰优孰劣的争论由来已久,其实片面的采用长线还是短线投资方式,都是一种建立在主观意愿上,与实际相脱钩的投资方式。投资的长短应该以客观事实为依据,当行情波长较长,就应该采用长线;当行情波长较短,就应该采用短线;要让自己适应市场,而不能让市场来适应自己。 整体来看,市场总是处于波段运行之中,投资者必须把握波段运行规律,充分利用上涨的相对顶点,抓住卖出的机会;充分利用基本面的转机,在市场悲观的时候买入,每年只需做几次这样的操作,就会获取良好的效益。

在运用波段操作时必须要根据波段行情的运行特征,制定和实施波段操作的方案和计划,具体来说要把握好波段空间中六要素:波轴、波势、波谷、波峰、波长、波幅。

波轴

波轴是指波段行情中多空相对平衡位置。波轴是波段操作的核心要素,以中轴线指标AXES为衡量标准,当股价位于中轴线AXES之下时,投资者可以予以关注,股价接近波段行情的波谷区域时可以择机买入;当股价位于中轴线AXES之上时,投资者要保持观望,在股价接近波段行情的波峰区域时择机卖出。

波势

波势是指波段行情的整体运行趋势和方向。多数情况下,波段行情的运行趋势是保持一定斜率的向上或向下运行,绝对水平的波段行情比较少见。当股价水平运行而且波幅极小时,往往是行情即将突破的前兆,此时,除非有相当的把握,否则尽量保持静观其变为好。

波段操作中关键是要讲究顺势而为,要根据波段行情的不同运行方向,包括不同的运行斜率,分别采用不同的波段操作方法,如:波段行情在向上运行时,投资者要在基本不丢失筹码的前提下,进行波段操作;而在向下运行趋势的波段行情中,投资者应该以做空的方式波段操作。

波谷与波峰

波谷是指股价在波动过程中所达到的最大跌幅区域。波峰是指股价在波动过程中所达到的最大涨幅区域。波谷与波峰属于波段操作中的买卖进出区域,主要由以下一些条件组成:

1、箱体运动的箱型顶部和底部位置;

2、BOLL布林线的上轨线和下轨线;

3、趋势通道的上轨趋势线和下轨支撑线;

4、成交密集区的边缘线;

5、投资者事先制定的止赢位或止损位;

6、股价以轴线之间的平均偏离值的位置;

波长

波长是指股价完成一轮完整的波段行情所需要的时间。股市中长线与短线孰优孰劣的争论由来已久,其实片面的采用长线还是短线投资方式,都是一种建立在主观意愿上,与实际相脱钩的投资方式。投资周期的长短应该以客观事实为依据,惟市场趋势马首是瞻,当市场趋势波动周期长,就应该采用长线;当市场趋势波动周期短,就应该采用短线;投资者要让自己适应市场,而不能让市场来适应自己。

波幅

波幅是指股价在振动过程中偏离平衡位置的最大距离。由于交易成本因素的制约,波段操作必须要有一定的获利空间才可以进行,如果股价的上下波动幅度过小,投资者就不宜采用波段操作。虽然,近年来印花税和佣金都有所下降,绝大多数投资者的一次完整交易费用不会超过1%,但考虑实际操作中的正常误差,股价的波幅必须达到3%~5%以上时,才是波段操作的最佳环境。

投资者在制定波段操作计划时必须重点考虑这些要素,具体而言,投资者需要做到以下方面:

1、依据波轴决定投资取向。

2、依据波势决定具体操作方式。

3、依据波谷与波峰决定买卖时机。

4、依据波幅决定介入程度

5、依据波长决定操作周期十周均线 长线制胜法宝 ~ 不识庐山真面目,只缘身在此山中。 |

|

|

|

Post by westerndidi on May 18, 2015 13:31:32 GMT 7

Thank you Zuolun!

|

|