|

|

Post by zuolun on Nov 26, 2014 17:21:10 GMT 7

|

|

|

|

Post by zuolun on Dec 22, 2014 15:43:39 GMT 7

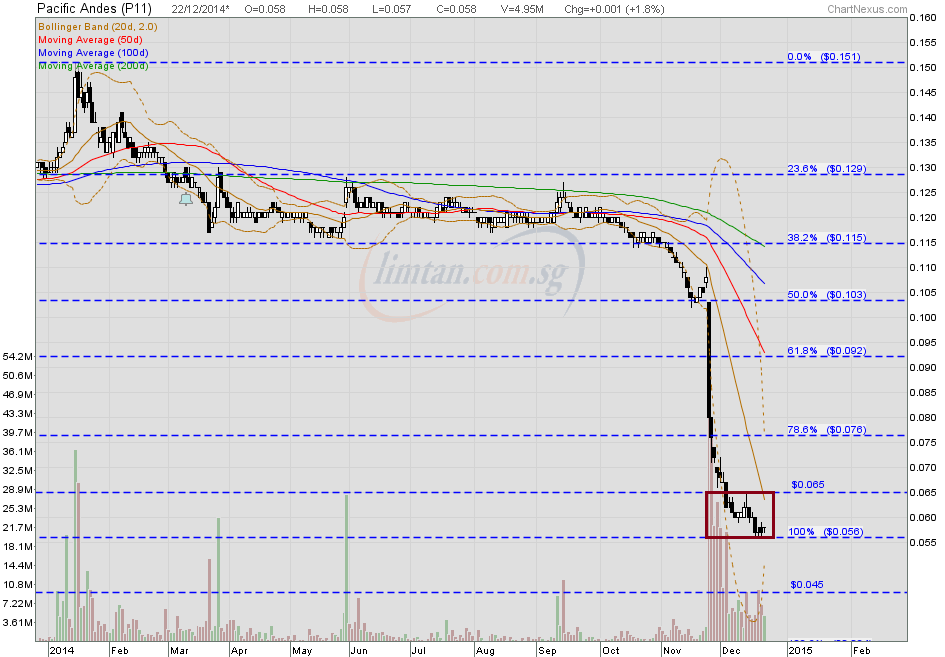

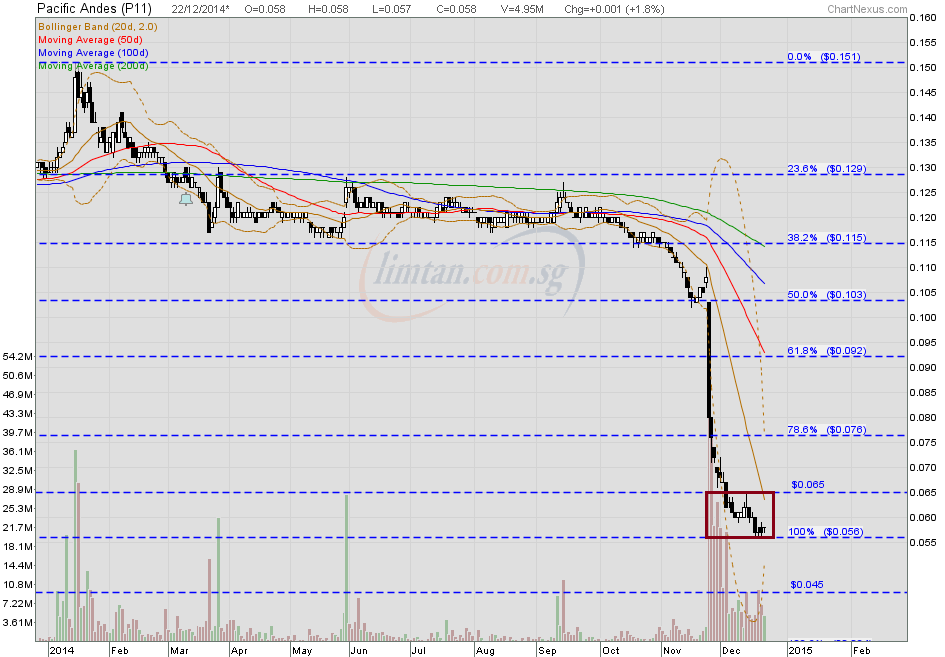

Pacific Andes — A "Waterfall Decline", biased to the downside, Interim TP S$ 0.045Pacific Andes had a dragonfly doji @ S$0.058 (+0.001, +1.8%) with 4.95m shares done on 22 Dec 2014 at 4.30pm. Immediate support @ S$0.056. immediate resistance @ S$0.065.  Pacific Andes — Bearish Rectangle Breakout, biased to the downside, Interim TP S$ 0.058Pacific Andes closed with a long-tailed hammer @ S$0.076 (-0.004, -5%) with extremely high volume done at 39.8m shares on 26 Nov 2014. Immediate support @ S$0.071. immediate resistance @ S$0.08.

|

|

|

|

Post by zuolun on Feb 11, 2015 2:14:13 GMT 7

Pacific Andes's chart pattern indicates a new low of TP S$0.02. Pacific Andes Q1 net profit down 11.7% to HK$128.2m on 25.3% revenue drop ~ 10 Feb 2015 Pacific Andes — A "Waterfall Decline", biased to the downside, Interim TP S$ 0.045Pacific Andes had a dragonfly doji @ S$0.058 (+0.001, +1.8%) with 4.95m shares done on 22 Dec 2014 at 4.30pm. Immediate support @ S$0.056. immediate resistance @ S$0.065.  Pacific Andes — Bearish Rectangle Breakout, biased to the downside, Interim TP S$ 0.058Pacific Andes closed with a long-tailed hammer @ S$0.076 (-0.004, -5%) with extremely high volume done at 39.8m shares on 26 Nov 2014. Immediate support @ S$0.071. immediate resistance @ S$0.08.  |

|

|

|

Post by zuolun on Feb 11, 2015 16:52:05 GMT 7

China Fishery closed @ S$0.186 (-0.074, -28.5%) with 16.58m shares done on 11 Feb 2015. The new rights issue shares priced @ S$0.173 per share showed that China Fishery is very desperate for cash.

Pacific Andes closed @ S$0.051 (-0.004, -7.3%) with 76.7m shares done on 11 Feb 2015.

China Fishery, Pacific Andes dive on news of rights issue

11 Feb 2015

INVESTORS dumped stocks of China Fishery Group and its largest shareholder Pacific Andes Resources Development Ltd on Wednesday on news that China Fishery will undertake a rights issue of up to 1.7 billion new shares priced at 17.3 Singapore cents apiece.

China Fishery dived 27 per cent to 19 Singapore cents, gravitating towards the rights issue price, on active trade of 11 million shares.

Pacific Andes was the most active stock in early trading, with its share price falling 5.5 per cent to 5.2 Singapore cents after a hefty 63 million shares changed hands by 11.37am.

"The rights issue came as a negative surprise to the market; that's a reason why China Fishery is dumped down," said a dealer at a local brokerage house.

Moreover, two of the eight directors of China Fishery dissented to the terms of the rights issue given the significant discount in the pricing and its dilutive impact on shareholders who cannot subscribe to the rights shares.

"That creates a lot of negative feeling on the rights issue," the dealer noted. When Pacific Andes called for an underwritten rights issue of 3.8 billion new ordinary shares at an issue price of 5.1 cents apiece in November, everyone thought that was the end of any near-term fund-raising, he added.

In its announcement released on Wednesday morning, China Fishery proposed a rights issue on the basis of four rights shares for every five existing ordinary shares.

The pricing of 17.3 cents represents a discount of about 33.5 per cent to the closing price of 26 cents per share on the Singapore Exchange as at Feb 9, the last trading day immediately before the announcement.

With the support of Pacific Andes, which owns a 70.5 per cent stake in China Fishery, the rights issue is likely to go through.

Pacific Andes said that it has, through its subsidiaries, irrevocably undertaken to subscribe in full for their entitlement to the rights shares of China Fishery at an aggregate value of S$199.7 million.

|

|

|

|

Post by zuolun on Feb 12, 2015 10:48:16 GMT 7

|

|

|

|

Post by roberto on Feb 12, 2015 22:25:38 GMT 7

Man, they just keep sucking and sucking. I'm not involved at all here but feel the pain of those affected.

|

|