|

|

Post by zuolun on Dec 6, 2014 16:22:51 GMT 7

|

|

|

|

Post by zuolun on Dec 12, 2014 12:38:37 GMT 7

|

|

|

|

Post by zuolun on Dec 28, 2014 5:12:35 GMT 7

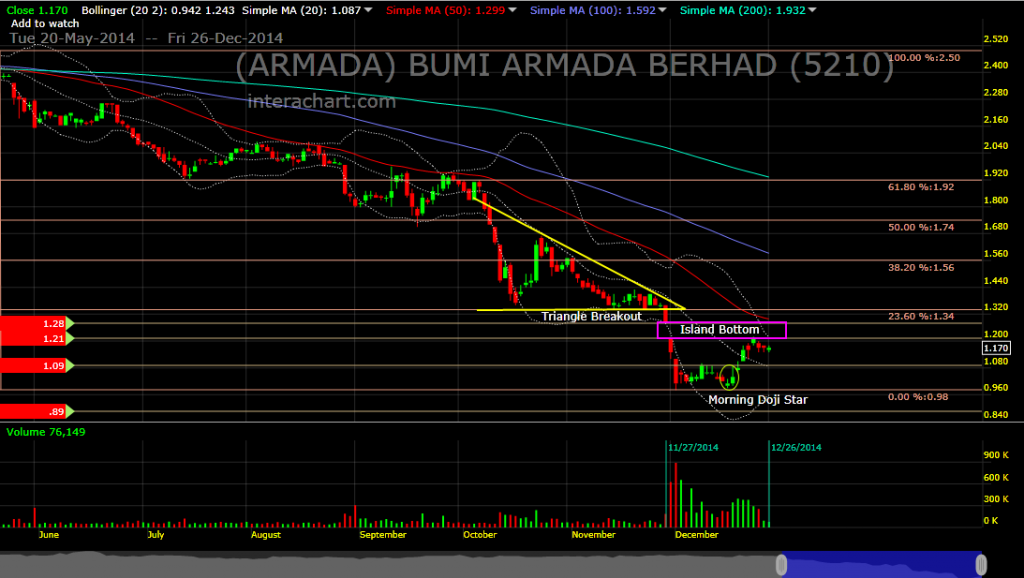

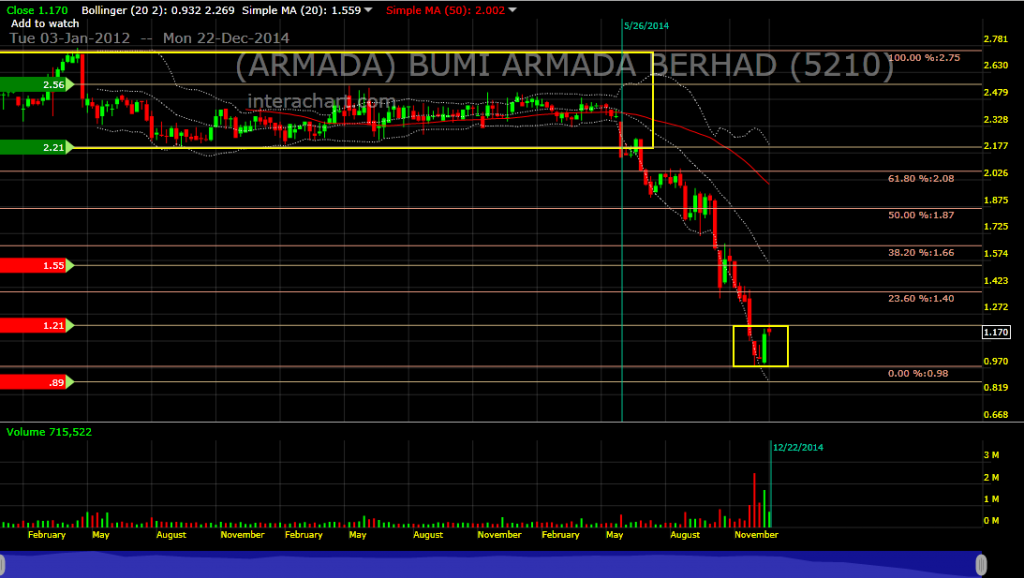

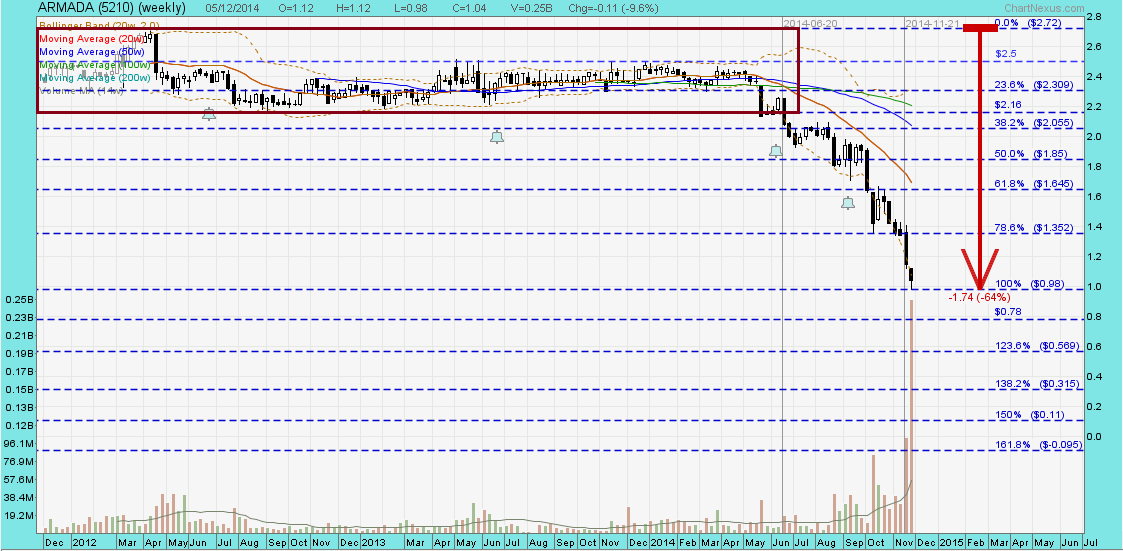

Island Bottom Reversal Bumi Armada signs RM3.98bil contract with Indonesian company Bumi Armada signs RM3.98bil contract with Indonesian company — 12 Dec 2014 Bumi Armada — Potential Island Bottom Reversal; gap bet. 1.21 to 1.28Bumi Armada closed with a doji unchanged @ RM1.17 with 7.6m shares done on 26 Dec 2014. Immediate support @ RM1.09, immediate resistance @ RM1.21.  Bumi Armada (weekly) — Bearish Bollinger Band Breakout Bumi Armada (weekly) — Bearish Bollinger Band Breakout

|

|

|

|

Post by sptl123 on Jun 4, 2015 11:05:13 GMT 7

Bumi Armada trade at RM 1.31 (+RM 0.02, + 1.55%) with high volume of 7.47 million shares done at 11.58HR on 4/6/2015. A Bullish Rounding Bottom Formation on Bumi Armada:  DEFINITION of 'Rounding Bottom' By Investopedia: A chart pattern used in technical analysis, which is identified by a series of price movements that, when graphed, form the shape of a "U". Rounding bottoms are found at the end of extended downward trends and signify a reversal in long-term price movements. This pattern's time frame can vary from several weeks to several months and is deemed by many traders as a rare occurrence. Read more: www.investopedia.com/terms/r/roundingbottom.asp#ixzz3c3wLjuuB All the bullishi indicators turned on on Ichimoku chart. Uptrend intact. |

|

|

|

Post by zuolun on Jun 4, 2015 11:36:50 GMT 7

Bumi Armada trade at RM 1.31 (+RM 0.02, + 1.55%) with high volume of 7.47 million shares done at 11.58HR on 4/6/2015. A Bullish Rounding Bottom Formation on Bumi Armada: DEFINITION of 'Rounding Bottom' By Investopedia: A chart pattern used in technical analysis, which is identified by a series of price movements that, when graphed, form the shape of a "U". Rounding bottoms are found at the end of extended downward trends and signify a reversal in long-term price movements. This pattern's time frame can vary from several weeks to several months and is deemed by many traders as a rare occurrence. Read more: www.investopedia.com/terms/r/roundingbottom.asp#ixzz3c3wLjuuB All the bullishi indicators turned on on Ichimoku chart. Uptrend intact. " You need super fast fingers on the keyboard to long Bumi Armada, a longterm downtrend stock and also "zhun zhun" in and out prices to make a good profit.  横看成岭侧成峰,远近高低各不同。 横看成岭侧成峰,远近高低各不同。

不识庐山真面目,只缘身在此山中。ARMADA (weekly) ~ Double Bottom formation, a potential intermediate bullish trend reversal  |

|

|

|

Post by zuolun on Mar 10, 2016 6:57:32 GMT 7

Armada — Trading in a downward sloping channelArmada closed with a spinning top @ RM0.80 (+0.005, +0.6%) with 19.7m shares done on 9 Mar 2016. Immediate support @ RM0.79, immediate resistance @ RM0.85.  Bumi Armada (weekly) ~ Bearish Bollinger Band Breakout Bumi Armada (weekly) ~ Bearish Bollinger Band Breakout Bumi Armada (weekly as at 5 Dec 2014) ~ Bearish Bollinger Band Breakout Bumi Armada (weekly as at 5 Dec 2014) ~ Bearish Bollinger Band Breakout Contract termination a setback for Armada Contract termination a setback for Armada ~ 9 Mar 2016 Cut in earnings forecast affects Armada, shares fall 21 sen ~ 8 Mar 2016 Armada says charter contract expires only in 2018 ~ 8 Mar 2016 Armada shares down 21% ~ 8 Mar 2016 Armada to challenge Woodside's termination of Armada Claire FPSO deal ~ 7 Mar 2016 Armada seeks compensation for FPSO termination ~ 5 Mar 2016 Armada to initiate legal proceedings against Woodside over FPSO termination ~ 4 Mar 2016 Bumi Armada crashes 20.5%Macquarie Research 8 Mar 2016 In a filing to the exchange on 4 March 2016, Bumi Armada announced that it had received a termination notice from Woodside Energy Julimar to one of its Floating Storage and Offloading vessels (FPSO) units. This cancellation has brought about a knee-jerk reaction to Bumi Armada’s share price, ending the day 20.5% lower to RM0.79. Macquarie Equities Research (MER) released a report early this morning, highlighting the impact of the terminated FPSO contract has on the company. Excerpts are below... Event- MER retains their Outperform recommendation on Bumi Armada (BAB MK) with a revised target price (TP) of RM1.26 (prev RM1.30) following an announcement that Woodside Petroleum (WPL AU) is looking to terminate the contract on its FPSO Armada Claire, ahead of schedule. While the early termination is not a total surprise, it will still impact MER’s 16-17E earnings per share (EPS) estimates by 23%-24%. However, the impact on valuations is much smaller at 3%. Going forward, MER sees the expansion in free cash flow (FCF) from three new FPSOs starting 2017, and firming in oil prices driving a rerating of its shares, which offer a 17E FCF yield of >20%.

Impact- Negative tones on the termination of Armada Claire FPSO charter. BAB has received a termination notice from Woodside Petroleum purporting to terminate the charter contract of Armada Claire FPSO, which is operating in the Balnaves field. BAB has opined that the notice of termination is not valid and intends to initiate legal proceedings against WPL for what it believes is its unlawful purported termination of the contract.

- All is not lost. MER believes that WPL is prepared to settle the remaining payment obligations under the FPSO leases. In its 2015 Annual Report, WPL stated under Onerous Lease – “provision is made for the loss making component of non-cancellable operating leases. During the period, a US$128 million provision was recognised (in other provisions) for the remaining payment obligations under the Balnaves FPSO lease, which ends in 2018”.

- FPSO business fundamentals are largely intact. Notwithstanding an impending legal battle, MER believes that BAB’s FPSO business fundamentals are largely intact. WPL’s provisioning for non-cancellable operating leases signifies the strong contract termination clause during firm period. However, the payment amount may be disputable under a disorder termination.

Earnings and target price revision- Significant hit to EPS (-23% to -24%) but impact on TP is muted (-3%). MER cuts their 16-17E EPS estimates by 23%-24% to account for the contract termination, which will see lower revenues without corresponding reductions in depreciation and interest expense. MER’s discount cash flow (DCF)-derived price target is reduced to RM1.26 from RM1.30 in these cuts mitigated by MER’s assumption of US$197m in gross compensation.

Price catalyst- 12-month price target: RM1.26 based on a Sum of Parts methodology.

- Catalyst: Timely commissioning of three new FPSOs by end-2016.

Action and recommendation

|

|