Post by zuolun on Aug 14, 2015 15:12:29 GMT 7

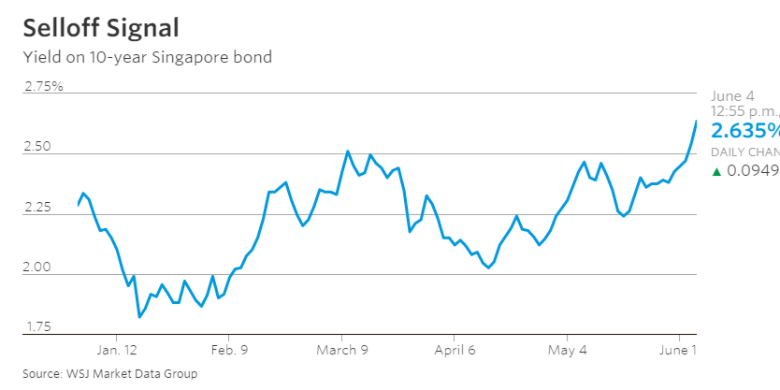

SIBOR climbs to four-month high ~ 13 Aug 2015

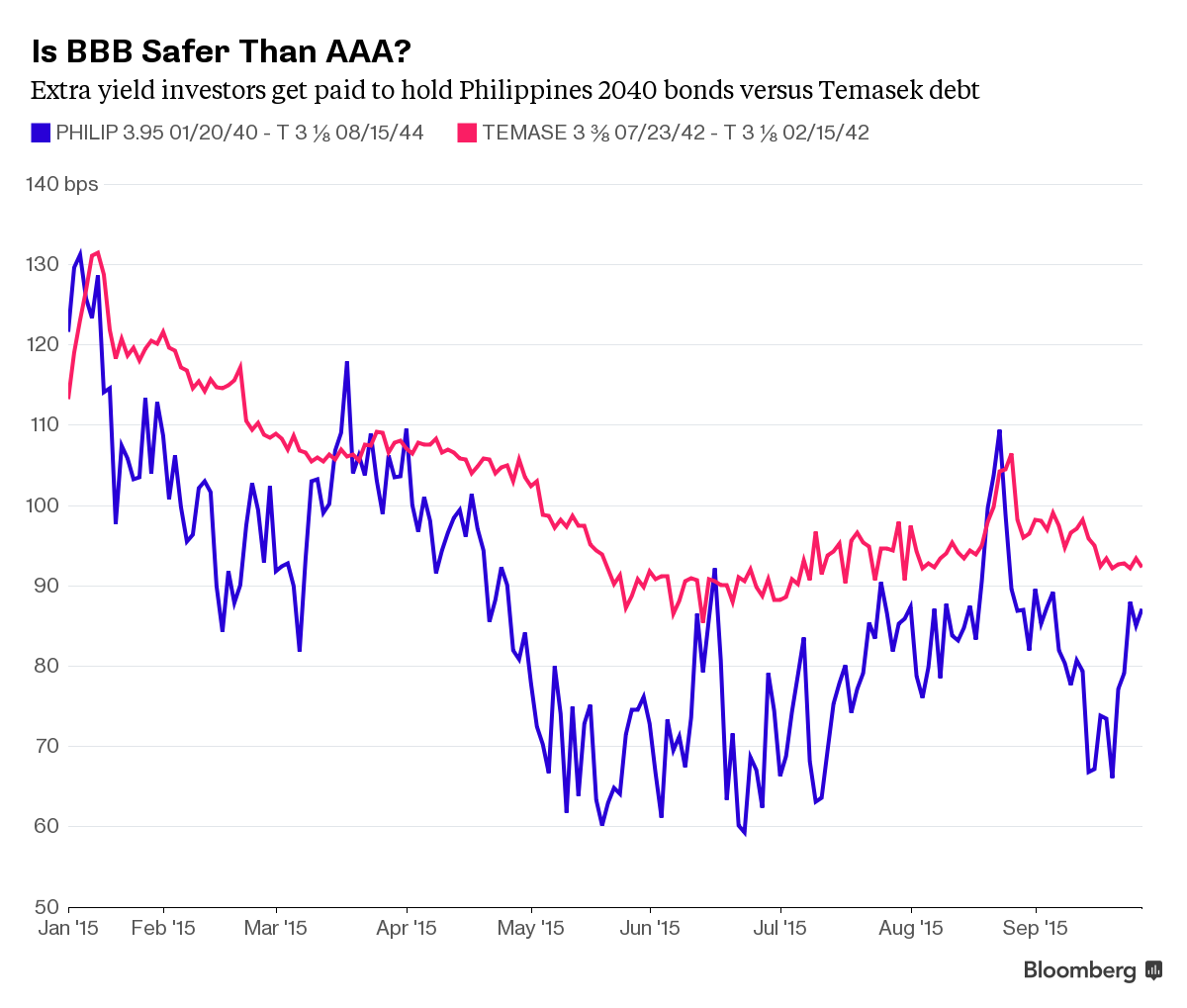

Bonds in conversation: 2008, it was credit. 2015, it is just liquidity ~ 13 Aug 2015

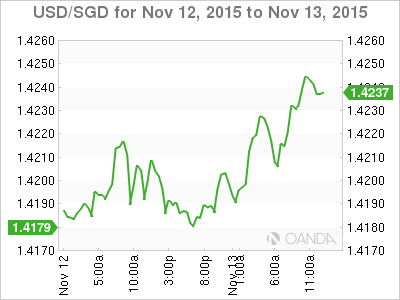

MAS likely to ease policy in October to fire up Singapore’s slowing economy ~ 11 Aug 2015

Singapore’s shrinking economy worsens bank risk as loans slump ~ 11 Aug 2015

Noble buys back and cancels US$735m of its bonds ~ 6 Aug 2015

Singapore Savings Bonds: What fixed deposits need to do to up their game ~ 21 July 2015

Launch of the Singapore Savings Bond Programme ~ 21 July 2015

Singapore primary corporate bond issuances as at 4Q2014

Halcyon went to bondholders to waive interest cover requirements — 6 Jan 2015

Halcyon went to bondholders to waive interest cover requirements — 6 Jan 2015

Linc restructures problem convertible bond — 13 Dec 2014

China Fishery faces bond hurdle on S$1.5 billion debt — 22 Aug 2014

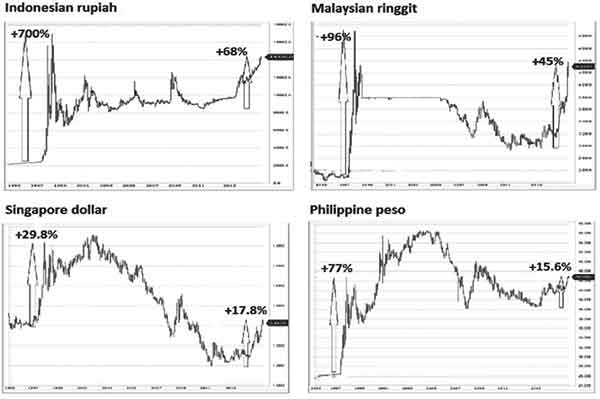

Usury, 0% interest rates, and worthless currencies

Usury, 0% interest rates, and worthless currencies

Zero-coupon bonds are a popular variation on the bond theme for some investors. Since coupon, in bond terminology, means interest, a zero-coupon by definition pays out no interest while the loan is maturing. Instead, the interest accrues, or builds up, and is paid in a lump sum at maturity. You buy zero-coupon bonds at deep discount, or prices far lower than par value. When the bond matures, the accrued interest and the original investment add up to the bond's par value. Bond issuers like zeros because they have an extended period to use the money they have raised without paying periodic interest. Investors like zeros because the discounted price means you can buy more bonds with the money you have to invest, and you can buy bonds of different maturities, timed to coincide with anticipated expenses, such as college tuition bills for example. Zeros have two potential drawbacks. They are extremely volatile in the secondary market, so you risk losing money if you need to sell before maturity. And, unless you buy tax-exempt municipal zeros, you have to pay taxes every year on the interest you would have received had it, in fact, been paid.

Bonds in conversation: 2008, it was credit. 2015, it is just liquidity ~ 13 Aug 2015

MAS likely to ease policy in October to fire up Singapore’s slowing economy ~ 11 Aug 2015

Singapore’s shrinking economy worsens bank risk as loans slump ~ 11 Aug 2015

Noble buys back and cancels US$735m of its bonds ~ 6 Aug 2015

Singapore Savings Bonds: What fixed deposits need to do to up their game ~ 21 July 2015

Launch of the Singapore Savings Bond Programme ~ 21 July 2015

Singapore primary corporate bond issuances as at 4Q2014

- Capitamall Trust issued S$300 million of 10-year bonds

- CapitaLand issued S$500 million of 10-year bonds

- JEM issued S$300 million of seven-year bonds

- Pacific Int'l Lines issued S$300 million of three-year bonds

- Olam issued S$400 million of five-year bonds

- Halcyon Agri issued S$125 million of 5NC3 bonds

- Hyflux issued S$175 million of NC2 perpetuals

- Pacific Andes issued S$200 million of three-year bonds

- KrisEnergy issued S$200 million of four-year bonds

- Nam Cheong issued S$200 million of five-year bonds

Linc restructures problem convertible bond — 13 Dec 2014

China Fishery faces bond hurdle on S$1.5 billion debt — 22 Aug 2014

Zero-coupon bonds are a popular variation on the bond theme for some investors. Since coupon, in bond terminology, means interest, a zero-coupon by definition pays out no interest while the loan is maturing. Instead, the interest accrues, or builds up, and is paid in a lump sum at maturity. You buy zero-coupon bonds at deep discount, or prices far lower than par value. When the bond matures, the accrued interest and the original investment add up to the bond's par value. Bond issuers like zeros because they have an extended period to use the money they have raised without paying periodic interest. Investors like zeros because the discounted price means you can buy more bonds with the money you have to invest, and you can buy bonds of different maturities, timed to coincide with anticipated expenses, such as college tuition bills for example. Zeros have two potential drawbacks. They are extremely volatile in the secondary market, so you risk losing money if you need to sell before maturity. And, unless you buy tax-exempt municipal zeros, you have to pay taxes every year on the interest you would have received had it, in fact, been paid.