|

|

UE

Nov 18, 2013 12:53:07 GMT 7

Post by zuolun on Nov 18, 2013 12:53:07 GMT 7

|

|

|

|

UE

Jul 27, 2014 16:15:18 GMT 7

odie likes this

Post by zuolun on Jul 27, 2014 16:15:18 GMT 7

|

|

|

|

UE

Jul 27, 2014 18:37:38 GMT 7

Post by odie on Jul 27, 2014 18:37:38 GMT 7

zuolun bro, this stock cannot trade using cfd sure die pain pain  LOL |

|

|

|

Post by zuolun on Jul 27, 2014 20:34:33 GMT 7

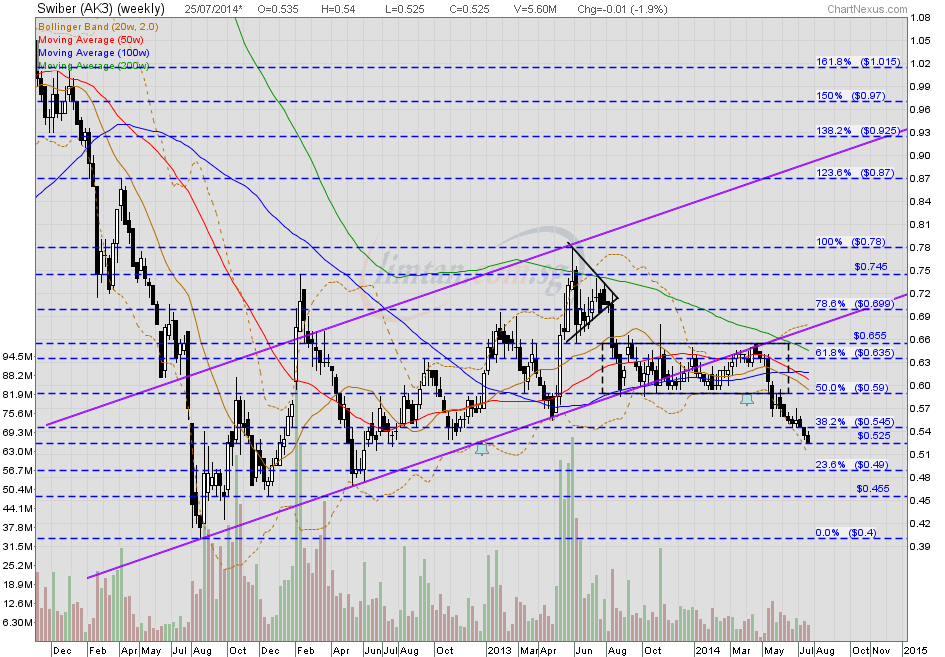

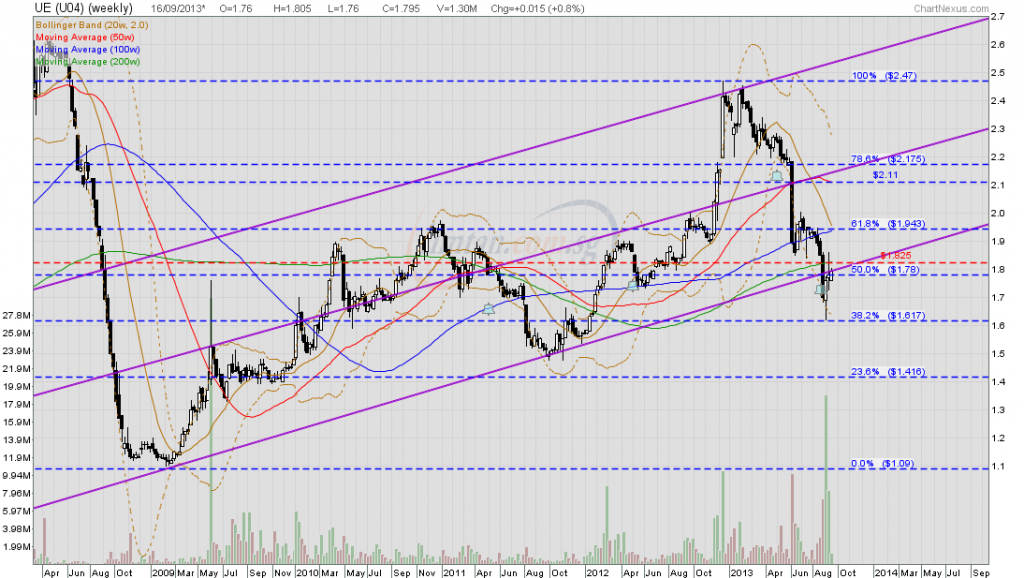

zuolun bro, this stock cannot trade using cfd sure die pain pain  LOL odie, I remembered I was playing Swiber @ S$0.63 when you asked me about UE @ S$1.76 in mid-Sep 2013. I run road on Swiber with only 1-bid profit @ S$0.635 then.  These 2 stocks had similar chart pattern then but they've totally different fate now...one go to hell while the other one go to heaven.     |

|

|

|

UE

Jul 28, 2014 8:01:32 GMT 7

Post by odie on Jul 28, 2014 8:01:32 GMT 7

zuolun bro, i think it is becos of UE returning part of the rights issue monies to the shareholders which is the reason for it to soar higher up i will buy and keep some UE but not at current prices  |

|

|

|

UE

Jul 28, 2014 22:42:16 GMT 7

Post by zuolun on Jul 28, 2014 22:42:16 GMT 7

zuolun bro, i think it is becos of UE returning part of the rights issue monies to the shareholders which is the reason for it to soar higher up i will buy and keep some UE but not at current prices  odie, Don’t fall in love with one stock. An article on UE dated 29 May 2014.  |

|

|

|

UE

Nov 20, 2014 21:32:20 GMT 7

Post by odie on Nov 20, 2014 21:32:20 GMT 7

zuolun bro, i think it is becos of UE returning part of the rights issue monies to the shareholders which is the reason for it to soar higher up i will buy and keep some UE but not at current prices  odie, Don’t fall in love with one stock. An article on UE dated 29 May 2014.  zuolun bro, any updates on this UE that Thai tycoon is attracted to? thanks for your insights  |

|

|

|

Post by zuolun on Nov 20, 2014 22:07:27 GMT 7

zuolun bro, any updates on this UE that Thai tycoon is attracted to? thanks for your insights  Odie, 雨过天晴云破处,这般颜色做将来。 UE's Uptrend intact, interim TP S$3.50.  |

|

|

|

UE

Dec 29, 2014 19:00:48 GMT 7

Post by odie on Dec 29, 2014 19:00:48 GMT 7

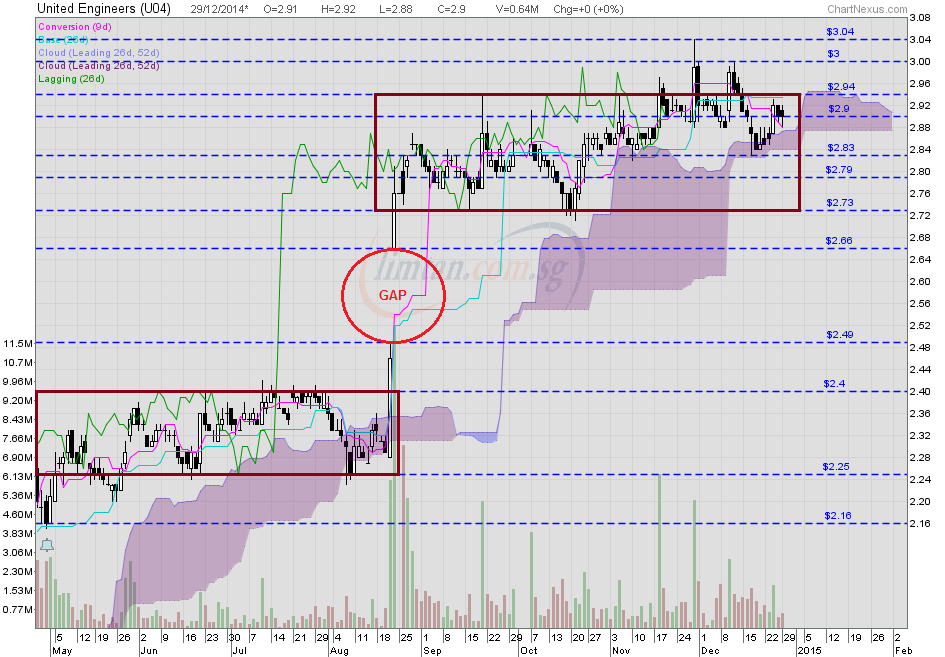

Zuolun bro, Any updates for this conglomerate? Many thanks and wish you and your loved ones good health, wealth and happiness. I jumped onto UE's bed today at 2.89. Hope I don't die.  |

|

|

|

UE

Dec 30, 2014 4:39:42 GMT 7

oldman likes this

Post by zuolun on Dec 30, 2014 4:39:42 GMT 7

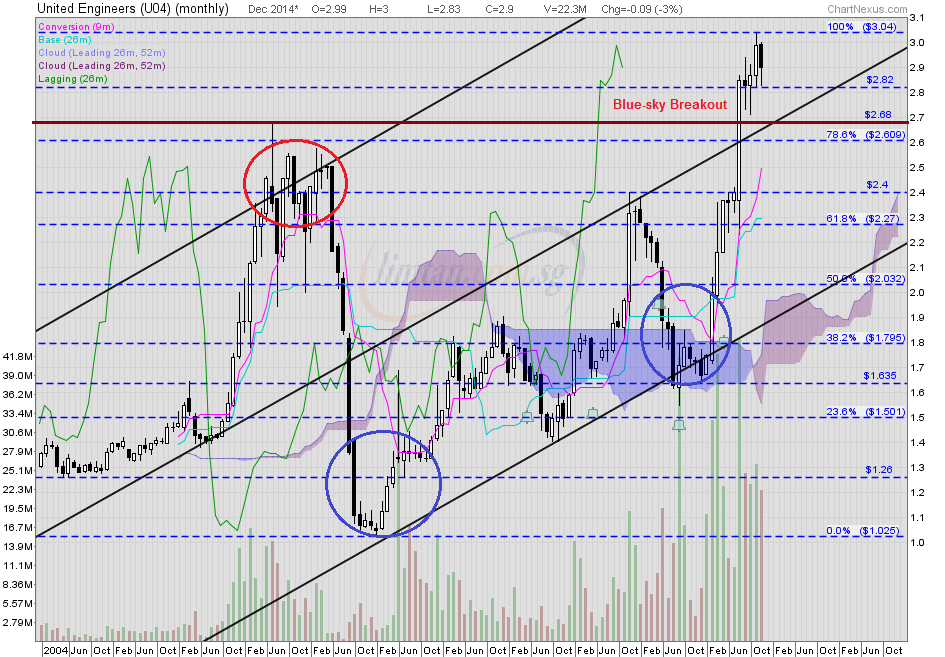

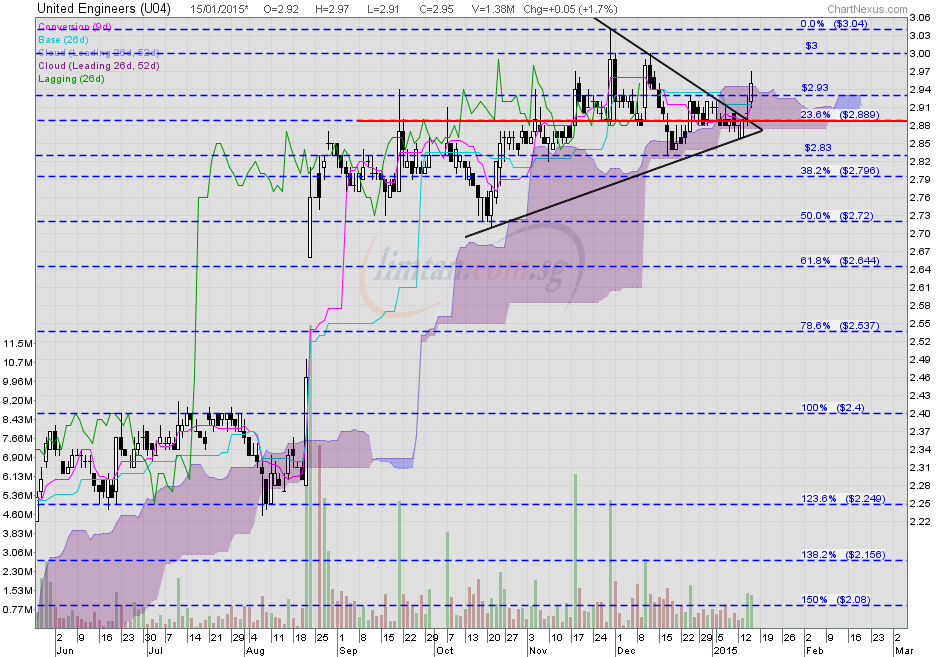

Zuolun bro, Any updates for this conglomerate? Many thanks and wish you and your loved ones good health, wealth and happiness. I jumped onto UE's bed today at 2.89. Hope I don't die.  odie, In an uptrend support holds, in a downtrend support breaks...what's the risk and reward on buying at the last burst of fire? (If there is a 30c or slightly > 10% profit within 1 to 2 months, lock-in partial profit; cut-loss once the key support @ S$2.66 breaks down convincingly with high volume.) Watch the video clip, Playing a blue sky breakout and The Gap Theory. The ichimoku chart indicates that UE is well-supported by the purple cloud; expect a retest of the last peak @ S$3.04. UE is a M&A play, the bet on further upside depends solely on the result of the deal dated 26 Aug 2014. UE — Blue-sky Breakout, interim TP S$3.04, Next TP S$3.50UE closed with a spinning top unchanged @ S$2.90 with 635 lots done on 29 Dec 2014. Immediate support @ S$2.83, immediate resistance @ S$2.94,  UE (monthly 2004 to 29 Dec 2014) — Blue-sky Breakout, interim TP S$3.50 UE (monthly 2004 to 29 Dec 2014) — Blue-sky Breakout, interim TP S$3.50 |

|

|

|

UE

Dec 30, 2014 18:30:38 GMT 7

zuolun likes this

Post by odie on Dec 30, 2014 18:30:38 GMT 7

thanks zuolun bro for advice looks like a good double bottom  |

|

|

|

Post by zuolun on Dec 31, 2014 11:34:21 GMT 7

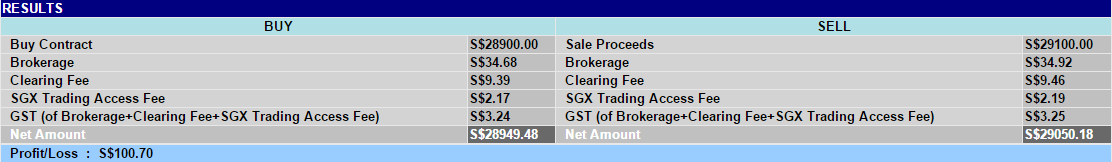

thanks zuolun bro for advice looks like a good double bottom  odie, To win back the market share lost to the foreign offshore brokerage firms; the local ones need to revise the current brokerage fee structure. For a daytrader to make a profit of 2-bid on any mid-cap stocks based on brokerage fees @ 0.12% + other charges per order via a CCT account, the reward will be much more attractive if the brokerage fees is lowered to directly compete with those who charge @ S$15 nett per trade size.An example of a swing-trade on UE (Long, cash a/c):

Quantity: 10 lots Brokerage: 0.12% Buy price: S$2.89 Sell price: S$2.91 Profit: S$100.70 (2c or 2-bid)   |

|

|

|

UE

Jan 2, 2015 16:02:41 GMT 7

odie likes this

Post by zuolun on Jan 2, 2015 16:02:41 GMT 7

odie, 2nd Jan 2015 price action and volume done suggest that there're many daytraders in UE targeting a profit of 2-3 bids.

|

|

|

|

UE

Jan 3, 2015 14:20:20 GMT 7

Post by odie on Jan 3, 2015 14:20:20 GMT 7

odie, 2nd Jan 2015 price action and volume done suggest that there're many daytraders in UE targeting a profit of 2-3 bids.  zuolun bro, i have become a patient greedy pig hoping to make more than 2 bids  |

|

|

|

UE

Jan 15, 2015 10:15:59 GMT 7

odie likes this

Post by zuolun on Jan 15, 2015 10:15:59 GMT 7

zuolun bro, i have become a patient greedy pig hoping to make more than 2 bids  , UE is wearing the purple bra again!   UE — Bullish Symmetrical Triangle Breakout UE — Bullish Symmetrical Triangle BreakoutUE had a spinning top @ S$2.95 (+0.05, +1.7%) with 1.38m shares done on 15 Jan 2015 at 11.20am. Immediate support @ S$2.89, immediate resistance @ S$3.00.  |

|