|

|

Post by stockpicker on Jul 28, 2014 9:25:12 GMT 7

The mini stimulus package introduced by PBOC in April 2014 appears to have effect on the Shanghai Index when the index recently rally and now broke the symmetrical triangle that has enclosed it since early 2013. Bearing unforeseen circumstances, it is looking ahead for more upside..  |

|

|

|

Post by zuolun on Jul 28, 2014 12:57:51 GMT 7

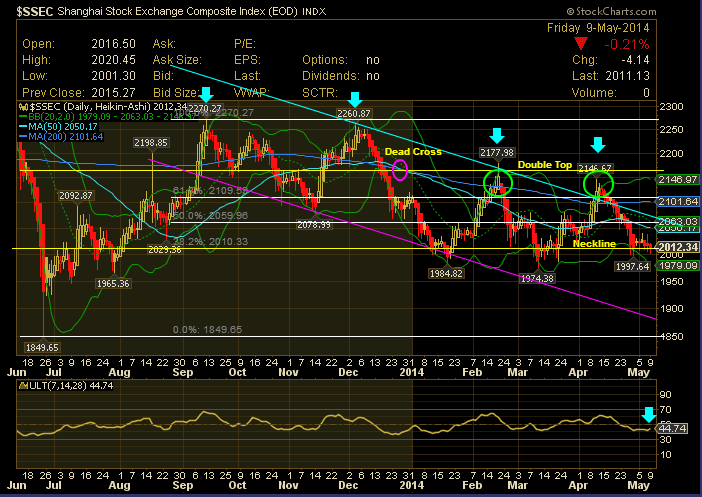

SSE — Dead Cat BounceSSE closed @ 2126.61 (+21.55, +1.02%) on 25 July 2014. Immediate support @ 2113, immediate resistance @ 2176, strong resistance @ 2195. In a bull market support holds; in a bear market support breaks. Expect SSE to retest 1849.65 to form a double bottom. Observations: 1. Based on the primary downtrend (bear market), SSE had 2 rare diamonds macam 2 rolling rocks falling off the cliff.  2. Turn bullish on SSE only when the key resistance @ 2260 is poked through.

|

|

|

|

Post by stockpicker on Jul 28, 2014 14:43:17 GMT 7

This metastock chart with the latest EOD showed a very bullish trend with SSEC clearly breaking away from the symmetrical triangle today. It has also cleared well above the 200-day MA. Though the volume traded today is a bit muted but the increasing volume appears to support the bullish movement so far. Whether this bullish movement will be dragged down by what is going to happen in the US and the Europe markets and therefore, form a false breakup subsequently is another observation to be speculated.  |

|

|

|

Post by zuolun on Jul 30, 2014 13:34:47 GMT 7

SSE's symmetrical triangle breakout reminds me of YOMA's descending triangle breakout, the latter suddenly spiked with extremely high volume; clearing the 20d, 50d, 100d and 200D SMA, all in one go.   |

|

|

|

Post by zuolun on Aug 1, 2014 8:42:57 GMT 7

SSE — Dead Cat Bounce: Diamond / Inverted H&S FormationSSE closed @ 2201.56 (+20.32, +0.93%) on 31 July 2014. Immediate support @ 2195, immediate resistance @ 2260.

|

|

|

|

Post by zuolun on Aug 4, 2014 3:22:51 GMT 7

|

|

|

|

Post by stockpicker on Aug 4, 2014 14:50:43 GMT 7

Shanghai SSE climbed another 1.7% today despite the Global market shedding its gains in response to the dismayed performance in US market last week. SSE climbed recently mainly due to mini stimulus packaged offered by PBOC who has learnt from previous mistakes of injecting too much money in 2010/11 causing overheating in the economy. Then SSE plunged more than 1,000 points and continued to fall until recently and the core inflation rate climbed from negative 1 to positive 2.5 as shown in the attached. Although the inflation rate is somewhat muted recently due to cooling in housing sector etc but the core inflation rate remains rather high although it is stabilizing at around 1.5%. It is not too sure what will be the limit of core inflation rate in China, but from the last lesson learnt, it would appear 2.5% would be the limit. If that being the case, as long as the core inflation stays below 2.5%, PBOC may continue with the mini stimulus and the SSE may continue to show positive response until otherwise, threatened by other stock market developments.  |

|

|

|

Post by zuolun on Aug 7, 2014 17:22:53 GMT 7

|

|

|

|

Post by zuolun on Aug 8, 2014 5:46:25 GMT 7

SSE — Triple Top Formation, strong resistance @ 2260SSE closed @ 2,187.67 (-29.80, -1.34%) SSE — Triple Top Formation, strong resistance @ 2260SSE closed @ 2,187.67 (-29.80, -1.34%) on 7 Aug 2014. Observations: 1. SSE's primary trend is down (bear market). 2. In a bull market support holds; in a bear market support breaks. 3. Expect SSE to retest its low @ 1850 to form a double bottom. 4. Turn bullish on SSE only when the key resistance @ 2260 is poked through.   SSE as at 19 Nov 2012 SSE as at 19 Nov 2012 |

|

|

|

Post by kenjifm on Sept 30, 2014 15:15:14 GMT 7

When HSI is facing a downside, we are seeing ShangHai Composite maintaining upside like nothing bad is happening in this world. You can read the HSI reply here: pertama.freeforums.net/thread/301/hsi |

|

|

|

Post by zuolun on Oct 17, 2014 16:34:03 GMT 7

|

|

|

|

Post by zuolun on Nov 24, 2014 16:03:20 GMT 7

|

|

|

|

Post by me200 on Dec 4, 2014 12:58:17 GMT 7

|

|

|

|

Post by me200 on Dec 9, 2014 20:44:49 GMT 7

|

|

|

|

Post by zuolun on Jan 2, 2015 6:20:37 GMT 7

|

|