|

|

Post by stockpicker on Dec 23, 2013 5:49:27 GMT 7

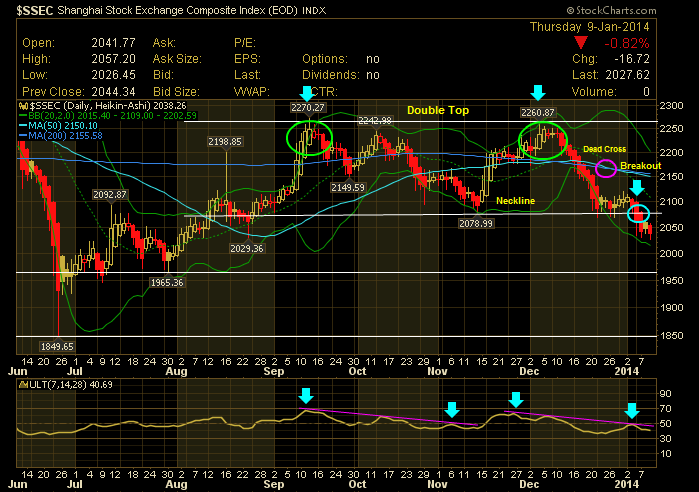

Shanghai is threading on a dangerous path after having failed to cross the 61.8 Fibonacci resistance and also failed to cross the last high, thus forming a lower high and lower low cluster which might lead Shanghai into a spinning low as shown in the following chart. The indicators are weak in the oversold region and may cause a rebounce; however, it may still remain weak unless the MACD can take a abrupt turn, changing the overall landscape from an ugly to a rosy picture. It is understood that there is now a credit crunch causing hikes in interest rates in China at the moment. The Banks are not lending out housing loans and businesses are suffocated. This has pressurized the stock performance and would remain so until China can resolve this credit problem..which may carry forward till 2014. finance.sina.com.cn/china/jrxw/20131223/034017715578.shtmlfinance.qq.com/a/20131222/002757.htmIt is worth noting that the fall of Chinese stock market may affect Hang Seng and at the same time, may affect STI although STI is presently more looking to US and Europe markets for guidance.  |

|

|

|

Post by stockpicker on Dec 23, 2013 6:31:07 GMT 7

|

|

|

|

Post by stockpicker on Dec 23, 2013 7:42:37 GMT 7

This Chinese article is saying that there is actually not shortage of money in China at least not indicated by the M2 supply. The present credit crunch is artificially created, caused by the distorted structure of bank funds, urgent transformation of the economic structure.. it is an economical rather than the banking problem, for which injection of funds by central bank may not help.. only restructuring of the real economy, promote market-oriented interest rate reform, promote the reform of state-owned enterprises and local combination of policies can solve the present credit crunch problem.. finance.qq.com/a/20131223/003126.htm |

|

|

|

Post by candy188 on Dec 24, 2013 9:05:10 GMT 7

Hi stockpicker, appreciate the explanation of the reason for the depressed China stock performance.

China Stock Index Halts Nine-Day Losing Streak as Banks ReboundDec 23, 2013 China’s benchmark stock index rose, led by banks and drugmakers, after a nine-day losing streak for the benchmark index drove valuations down to a four-month low and technical indicators signaled a rebound. The Shanghai Composite Index (SHCOMP) rose 0.2 percent to 2,089.71 at the close. The measure trades at 8.1 times projected profit for the next 12 months, the lowest level since July 31. The 14-day relative strength measure was at 27.4 on Dec. 20. Readings below 30 indicate it may be poised to rise.“A rebound is imminent as valuations and technical indicators are at pretty low levels,” said Wu Kan, a money manager at Dragon Life, which oversees about $3.3 billion. “ The focus is still on money-market rates. Unless they retreat from the current high levels, the rebound may be short-lived.”www.bloomberg.com/news/2013-12-23/china-s-stock-index-futures-rise-as-indicators-signal-rebound.htmlShanghai is threading on a dangerous path after having failed to cross the 61.8 Fibonacci resistance and also failed to cross the last high, thus forming a lower high and lower low cluster which might lead Shanghai into a spinning low as shown in the following chart. The indicators are weak in the oversold region and may cause a rebounce; however, it may still remain weak unless the MACD can take a abrupt turn, changing the overall landscape from an ugly to a rosy picture.  It is understood that there is now a Credit Crunch causing hikes in interest rates in China at the moment. It is understood that there is now a Credit Crunch causing hikes in interest rates in China at the moment.

The Banks are not lending out housing loans and businesses are suffocated. This has pressurized the stock performance and would remain so until China can resolve this credit problem..which may carry forward till 2014.finance.sina.com.cn/china/jrxw/20131223/034017715578.shtmlfinance.qq.com/a/20131222/002757.htmIt is worth noting that the fall of Chinese stock market may affect Hang Seng and at the same time, may affect STI although STI is presently more looking to US and Europe markets for guidance.

|

|

|

|

Post by zuolun on Dec 24, 2013 10:52:54 GMT 7

SSE — Trading in a downward sloping channel, longterm horizontal support @ 1000 pointsSSE @ 2106.29 (+16.58, +0.79%) on 24 Dec 2013 at 11.25am.  SSE as at 19 Nov 2013 SSE as at 19 Nov 2013 SSE Jan 1995 to Sep 2012 SSE Jan 1995 to Sep 2012

|

|

|

|

Post by zuolun on Dec 24, 2013 21:52:50 GMT 7

|

|

|

|

Post by zuolun on Dec 25, 2013 10:21:46 GMT 7

|

|

|

|

Post by odie on Dec 25, 2013 20:12:12 GMT 7

zuolun bro,

looks like yanlord will follow SSE under pressure

|

|

|

|

Post by zuolun on Dec 26, 2013 15:58:24 GMT 7

zuolun bro, looks like yanlord will follow SSE under pressure odie, SSE under extremely strong selling pressure closing @ 2073.10 (-33.25, -1.58%) on 26 Dec 2013. It plunged right from the opening till closing.   SSE as at 24 Dec 2013 SSE as at 24 Dec 2013 |

|

|

|

Post by odie on Dec 26, 2013 19:24:24 GMT 7

zuolun bro,

this will also affect shares like Perennial china and other chinese like Yingli and HK shares like HK land

|

|

|

|

Post by oldman on Dec 30, 2013 17:14:43 GMT 7

|

|

|

|

Post by zuolun on Jan 10, 2014 8:10:19 GMT 7

SSE — Double top breakout, TP 1896SSE broke the neckline support @ 2078 and closed @ 2027.62 (-16.72, -0.82%) on 9 Jan 2014. Immediate resistance @ 2078 (support-turned-resistance). Immediate support @ 2010, the 38.2% Fibonacci retracement, next support @ 1965.

|

|

|

|

Post by stockpicker on Jan 19, 2014 23:33:32 GMT 7

It is understood that there is now a credit crunch causing hikes in interest rates in China at the moment. The Banks are not lending out housing loans and businesses are suffocated. This has pressurized the stock performance and would remain so until China can resolve this credit problem..which may carry forward till 2014.... This article clearly pointed out that the credit crunch in China is getting more serious in Jan 2014.. There were many reasons for the shortage of money being speculated; broadly, they can be classified into 3 groups:= 1. The first group claimed that the Central Bank did it on purpose to control the shadow banking industries. They are not injecting enough money purposely to "kill" the shadow banking which are getting out of hand; this group called for more money to be injected into the banking system; 2. The second group claimed that Central Bank has injected enough money as can be clearly seen from the M2 supply. They claimed that the banks are tightening up their own controls in response to the many interventions by the Government and the Central Banks to ensure proper control of the banking industries; 3. The 3rd group claimed that the Banks are in trouble; better run road.. We all know that PBOC,in trying to control or get rid of shadow banking business, tightened the money supply in early 2013. This caused the June 2013 credit crisis which was eased only after PBOC abandoned its grips and started to release money into the 5 big banks. It would therefore appear to suggest that group 2's reasoning is more creditable. The banks are tightening up their controls; invariably cutting off the supply to the shadow banks and other smaller banks who are willing to offer much higher rate to secure the needed loans. |

|

|

|

Post by stockpicker on Jan 20, 2014 6:53:02 GMT 7

These articles said that China is not lack of money supply as it has injected more than 100 trillion Yuan since 2006. This amount is more than 1.5 of US, 1.7 times of Japanese and even 20 trillion yuan more than the Euro zone's money supply. Its M2/GDP ratio has risen 200% in the last decade. The money supply has boosted what they called "the trinity", i.e. the debts of local government, the housing bubble and the shadow banking. It is believe the new team of the Chinese Government is determined to control this "trinity" and would not change its policy and direction that easy although they might relax the pace every now and then if there appear to be a credit crisis developing. Henceforth, many analysts predicted that there will be more money crunches down the road, may be as often as two to four a year. This credit crunches will affect the stock market development. economictimes.indiatimes.com/news/international/business/china-dwarfs-us-money-sloshing-around-chinas-economy-tripled-since-2006/articleshow/28879166.cmsblog.sina.com.cn/s/blog_467a66b00102edkh.html?tj=fina |

|

|

|

Post by stockpicker on Jan 20, 2014 10:04:17 GMT 7

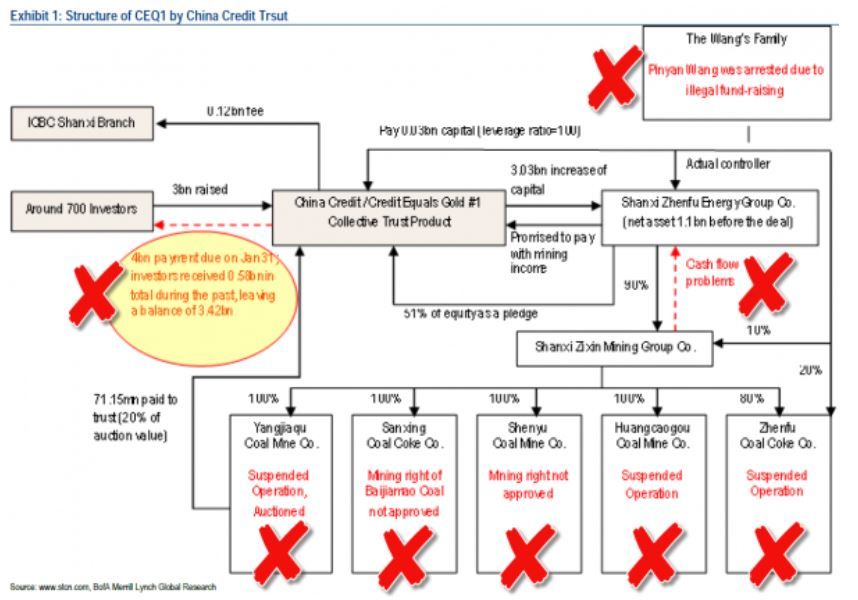

A Chinese report disclosed last Friday that investors have been warned by China Credit Trust Co. that they may not be repaid when one of its wealth management products matures on January 31, the first day of the Year of the Horse. The Industrial and Commercial Bank of China (ICBC) sold the China Credit Trust product to its customers in inland Shanxi province. This bank, the world’s largest by assets, on Thursday suggested it will not compensate investors, stating in a phone interview with Reuters that “a situation completely does not exist in which ICBC will assume the main responsibility. www.forbes.com/sites/gordonchang/2014/01/19/mega-default-in-china-scheduled-for-january-31/The trust sold under the brand "2010 China Credit-Credit Equals Gold #1" to mainly investors in the inland. Its structure is quite complex as can be seen from this graphic  Bank of America (BOA) apparently is involved in such products and now actively preparing for the default to take place. www.zerohedge.com/news/2014-01-19/bank-america-actively-preparing-chinese-january-31-trust-default |

|