|

|

Post by zuolun on Jan 12, 2015 17:54:45 GMT 7

|

|

|

|

Post by zuolun on Jan 19, 2015 13:35:16 GMT 7

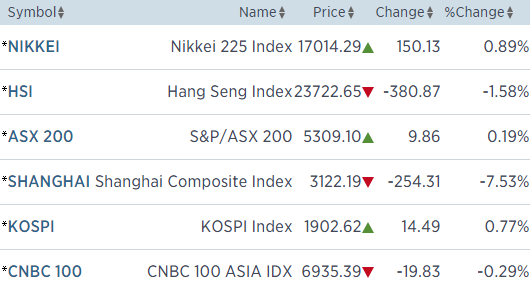

Shanghai Composite sinks as financial, property stocks decline — 19 Jan 2015 at 2.18pm SSE sank 7.1% to 3,138.59 at 1:59pm, local time — 19 Jan 2015 at 2.03pm. SSE : China stocks plunge as much as 6% to 3,175.16 at 9:36am, local time — 19 Jan 2015 at 9:47am  In any stock market, it's all about supply and demand. From a chartist's point of view; buy stocks with good momentum and volume, which can reward you a good profit. Do not buy stocks with low or no volume and sit on them, these stocks are dead and dire cheap for a reason. (Bottom-fishing is the toughest gameplay in the stock market.) Watch the video clip and listen carefully from 1:50 to 1:59... the speaker has revealed an important fact about the stock market gameplay. "In the stock markets today, there are good companies that are overpriced and there are worthless companies that are overpriced. If you are going to be a fool and pay absurd prices because you think that a greater fool will appear in the future, make sure you buy a goat and not a monkey." Do not buy stocks that even worms also won't grow on them!

|

|

|

|

Post by zuolun on Mar 30, 2015 7:07:36 GMT 7

|

|

|

|

Post by zuolun on Apr 12, 2015 23:11:51 GMT 7

|

|

|

|

Post by zuolun on Jun 2, 2015 15:06:46 GMT 7

|

|

|

|

Post by sptl123 on Jun 2, 2015 20:15:16 GMT 7

Peter Schiff thinks that the US$ is over-priced. His clientis are using the US$ to buy asset on sales all over the world before the US$ bubble burst…. I really hope he is wrong and what he said do not ever come thru; if and when the US$ bubble were to burst, it will be tsunami for the world economy and most individual and company will surely die-pain-pain....  |

|

|

|

Post by zuolun on Jun 10, 2015 6:16:58 GMT 7

|

|

|

|

Post by zuolun on Jun 10, 2015 20:15:19 GMT 7

|

|

|

|

Post by roberto on Jun 12, 2015 7:31:54 GMT 7

If these aren't signs of a potential bubble then I don't know what is. A short write up on yesterday's Today paper quoted some Chinese 60 year old lady saying she is buying stocks with the hope that the "blind cat catches the mouse". |

|

|

|

Post by zuolun on Jun 14, 2015 10:58:57 GMT 7

|

|

|

|

Post by roberto on Jun 14, 2015 14:34:38 GMT 7

There isn't an ETF listed on SGX that tracks the SSE right? Anyone knows the closest substitute for such a product?

|

|

|

|

Post by me200 on Jun 14, 2015 17:10:14 GMT 7

UETF SSE50China

|

|

|

|

Post by zuolun on Jun 15, 2015 19:54:09 GMT 7

|

|

|

|

Post by roberto on Jun 15, 2015 20:16:44 GMT 7

"Value of stocks rises above $10t" . Pretty insane. Really puts the SG market in its place. SG bourse value probably around $700b-800b. Although if one wants to compare using geographical size, or population size, it can be said SG is already punching pretty hard. |

|

|

|

Post by zuolun on Jun 16, 2015 8:13:31 GMT 7

|

|