|

|

Post by zuolun on Jul 31, 2015 7:39:40 GMT 7

bro zuolun, noble results on 13 Aug after national day holidays. they will also release the special report then. Any updates on this since it hit your target price of 50 cts le. Many thanks and hope all is well. Regards odie

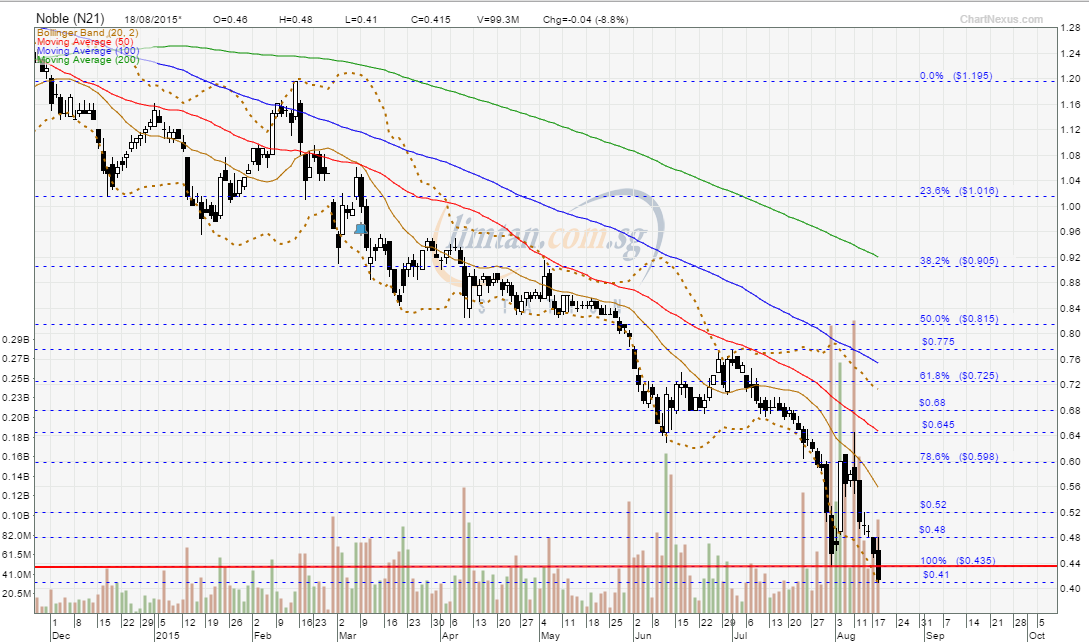

Sometimes, certain things could only be visible on the chart when the share price starts its unusual / volatile movement (up or down all in a row, with or without volume). Bollinger bands are very powerful technical indicator. When using it as a key indicator, volume is not necessarily required, instead, the breakout (upside or downside) at the upper or lower Bollinger band is more important. Likewise, in a downtrend, volume is not required for a downside breakout at support level. However, in an uptrend, volume is necessary for an upside breakout at resistance level. Note: A price drop (or rise) on high volume all in a row is a stronger signal indicating that something in the stock has fundamentally changed. Noble ~ Bearish Bollinger Bands breakout, interim TP S$0.41, next TP S$0.195Noble closed with a long black marubozu @ S$0.52 (-0.07, -11.9%) with extremely high volume done at 138,418m shares on 30 July 2015. Immediate support @ S$0.50, next support @ S$0.465, immediate resistance @ S$0.585, next resistance @ S$0.63. Calm before the storm; expect a tsunami striking... Noble (weekly) Noble (weekly) ~ Classic Mushroom-Of-Death chart pattern, interim TP S$0.41, next TP S$0.195 |

|

|

|

Post by odie on Jul 31, 2015 21:45:15 GMT 7

bro zuolun, noble results on 13 Aug after national day holidays. they will also release the special report then. Any updates on this since it hit your target price of 50 cts le. Many thanks and hope all is well. Regards odie

Sometimes, certain things could only be visible on the chart when the share price starts its unusual / volatile movement (up or down all in a row, with or without volume). Bollinger bands are very powerful technical indicator. When using it as a key indicator, volume is not necessarily required, instead, the breakout (upside or downside) at the upper or lower Bollinger band is more important. Likewise, in a downtrend, volume is not required for a downside breakout at support level. However, in an uptrend, volume is necessary for an upside breakout at resistance level. Note: A price drop (or rise) on high volume all in a row is a stronger signal indicating that something in the stock has fundamentally changed. Noble ~ Bearish Bollinger Bands breakout, interim TP S$0.41, next TP S$0.195Noble closed with a long black marubozu @ S$0.52 (-0.07, -11.9%) with extremely high volume done at 138,418m shares on 30 July 2015. Immediate support @ S$0.50, next support @ S$0.465, immediate resistance @ S$0.585, next resistance @ S$0.63. Calm before the storm; expect a tsunami striking...Noble (weekly) ~ Classic Mushroom-Of-Death chart pattern, interim TP S$0.41, next TP S$0.195bro zuolun, thanks for advice nowadays with the market so bad it looks it is cheaper to go on a holiday LOL will give noble a miss and sit on my fingers  |

|

|

|

Post by zuolun on Aug 4, 2015 8:41:23 GMT 7

Share buy-backs: The repurchase revolutionNoble Vs Rio as at 4 Aug 2015 at 0923 hrs.  Noble opened at S$0.49 and closed at S$0.60 (+0.13, +27.7%), up for second day Noble opened at S$0.49 and closed at S$0.60 (+0.13, +27.7%), up for second day ~ 4 Aug 2015 Noble Group's accounting policy woes lead to 28% share price drop ~ 4 Aug 2015 Noble Group shares surge after approaches by investors ~ 4 Aug 2015 Noble Group fields financing offers, refutes rumours on lack of funds ~ 3 Aug 2015 Embattled Noble flags potential suitors; says has ample funds on hand ~ 3 Aug 2015 Noble Group’s drawbridge down; shorts cross moat ~ 30 July 2015 Attacks on Noble Group’s accounting take their toll ~ 22 July 2015 Iceberg Research strikes again in war of words with Noble Group ~ 21 July 2015 Noble Group at risk of being downgraded by S&P to junk status ~ 11 Jun 2015 S&P cuts Noble outlook to 'negative', cites trading risk ~ 11 Jun 2015 Noble signs US$2.3b unsecured revolving loan facilities ~ The Bookrunner Mandated Lead Arrangers were Australia and New Zealand Banking Group Limited, Bank of America, N.A., The Bank of Tokyo Mitsubishi UFJ Ltd., Citigroup Global Markets Asia Limited (lending through its Affiliate, Citibank, N.A., Hong Kong Branch), Commonwealth Bank of Australia, Coöperatieve Centrale Raiffeisen Ltd, Goldman Sachs (Asia) L.L.C., The Hongkong and Shanghai Banking Sanpaolo S.p.A.- Hong Kong Branch, JPMorgan Chase Bank, N.A., Hong Kong Branch, National Bank of Abu Dhabi PJSC, Hong Kong Branch, Société Générale, Standard Chartered Bank (Hong Kong) Limited and United Overseas Bank Limited. ~ 19 May 2015 Lenders back Noble despite Muddy Waters attack ~ 10 Apr 2015 Suitors circle Noble after commodity trader's $1.8 billion plunge ~ 20 Mar 2015 Noble rebuts Iceberg report, asserts that its accounting is “robust”By Benjamin Tan 22 July 2015 Noble issued a short reply on Wednesday emphaising that it has a “robust” accounting process and the support of its stakeholders, in response to criticism by Iceberg Research the previous day that the commodities trader had ordered a financial review simply to buy time. In a 2,028-word blog titled "Confidence in Noble is clearly eroding", Iceberg had said that accountancy firm PwC will work on the valuation framework, rather than the valuation of the portfolio itself. It said that that sooner or later, Noble would have to recognise that its books have been manipulated for years. Iceberg concluded that Noble will need a white knight - one with deep pockets who is willing to invest in a firm with cash outflows and growing debt. Reiterating that its auditing process is well within the official framework, Noble said in its reply, “Our accounting is robust, we are supported by our stakeholders and the third-party Assurance Review of our term contracts by PwC, overseen by an independent board committee and carried out in accordance with the Singapore Standard on Assurance Engagements, offers further transparency to the market.”. The attacks were the first since Iceberg's last update on April 16, when it urged shareholders to challenge Noble's management on accounting and governance issues at its annual general meeting. These alleged issues were first highlighted by Iceberg in February. Since then, Noble has been under public scrutiny, and its share price has fallen 43% in that period. Noble appointed PwC this month to review its term contracts, valuations and the relevant corporate governance framework. At 11.32am, the counter was down 0.5 cent at 66 cents.

|

|

|

|

Noble

Aug 8, 2015 7:09:49 GMT 7

odie likes this

Post by zuolun on Aug 8, 2015 7:09:49 GMT 7

|

|

|

|

Post by zuolun on Aug 14, 2015 9:17:43 GMT 7

|

|

|

|

Post by zuolun on Aug 17, 2015 16:26:58 GMT 7

|

|

|

|

Post by zuolun on Aug 18, 2015 21:44:40 GMT 7

You can check the Daily Short Sell Report on Noble, hereNoble still on shaky ground ~ 18 Aug 2015 What would drive up Noble’s price? ~ 18 Aug 2015 Noble approached for possible partnerships ~ 18 Aug 2015 Noble CEO says challenges this year make it a better company ~ 18 Aug 2015 Noble is one of the stocks under UOBKH's watchlist counters ~ 18 Aug 2015 Noble goes full-court press on critics, to limited effect ~ 18 Aug 2015 Phillips Securities imposes online trading restrictions on Noble ~ 17 Aug 2015 Noble open to selling core businesses to boost confidence ~ 17 Aug 2015 Noble still on shaky ground ~ 15 Aug 2015 Noble resumes share buyback after PwC report; shares down 12% ~ 12 Aug 2015 OCBC maintained HOLD on Noble, FV @ S$0.60 ~ 11 Aug 2015 Noble accounts cleared but jobs to be cut ~ 11 Aug 2015 Noble profit drops while PwC finds no accounting fault ~ 10 Aug 2015 Noble ~ Bearish Bollinger Band Breakout, interim TP S$0.41, next TP S$0.195Noble closed with a black marubozu @ S$0.415 (-0.04, -8.8%) with 99.3m shares done on 18 Aug 2015. Immediate support @ S$0.37, immediate resistance @ S$0.435.  Noble shares drop to a fresh 7-year low Noble shares drop to a fresh 7-year low18 Aug 2015 It's the hope that kills you. Noble Group dropped almost 10 per cent to a fresh 7-year low of S$0.41 a share on Tuesday, despite initially rallying by more than 5 per cent after yesterday's special investor day. The Singapore-listed commodity trader, which is Asia's largest energy and metals dealer by volume, had sought to put concerns about its accounting behind it with a marathon 4.5 hour meeting with shareholders and analysts on Monday, David Sheppard writes. But it appears to have done little to scare off waves of short-selling. Funds betting against the company are estimated to hold at around 15 per cent of the company's stock, according to Noble chief executive Yusuf Alireza. Nobles share price is now down by more than 65 per cent since February when an entity calling itself Iceberg Research first raised questions about how Noble values some assets and books profits on long-term supply deals. "The meeting was 4.5 hours long but nothing new came out, not even the perspective of an investor to save this company," Iceberg Research said in emailed comments late on Monday. "We heard the same misleading arguments. What Noble needs is a no-nonsense CEO who makes courageous decisions (massive impairments) and tries to right the ship before it sinks." Noble, which has robustly denied any wrongdoing and dismissed Iceberg as a "manipulator", "blogger" and a disgruntled former employee, said yesterday it was talking with possible 'white knight' investors. For the first time it also said it is potentially open to selling even 'core' parts of its business in order to shore up its balance sheet and restore investor confidence. Mr Alireza said the company will soon start generating more cash flow. The Hong Kong head quartered trader's stock eventually finished down 9 per cent at S$0.415, having swung from a intraday high of S$0.48. |

|

|

|

Noble

Sept 30, 2015 9:05:53 GMT 7

odie likes this

Post by zuolun on Sept 30, 2015 9:05:53 GMT 7

|

|

|

|

Noble

Oct 13, 2015 12:55:35 GMT 7

odie likes this

Post by zuolun on Oct 13, 2015 12:55:35 GMT 7

|

|

|

|

Noble

Oct 13, 2015 14:48:54 GMT 7

Post by odie on Oct 13, 2015 14:48:54 GMT 7

zuolun bro, commodities companies make profit from trading price differences of commodities. so, imho, there is only the worry of them unable to repay their loans and becoming bankrupt |

|

|

|

Noble

Oct 13, 2015 15:40:25 GMT 7

odie likes this

Post by zuolun on Oct 13, 2015 15:40:25 GMT 7

zuolun bro, commodities companies make profit from trading price differences of commodities. so, imho, there is only the worry of them unable to repay their loans and becoming bankrupt , To understand how these BBs trade commodities, use crude oil as an example. Major players can hedge their physical oil (can be copper or any commodities) in the real market by placing big short positions in the oil futures market. The bankers won't pull the plug as they can earn big fat commission from their clients' active trading activities, in high volume. The key word: "But what if the underlying asset upon which the short is constructed – both its availability and amount – is under your control? What if you are shorting your own product?" OPEC shorts are driving down the crude oil price ~ 24 July 2015 |

|

|

|

Noble

Oct 13, 2015 16:15:26 GMT 7

Post by odie on Oct 13, 2015 16:15:26 GMT 7

zuolun bro, commodities companies make profit from trading price differences of commodities. so, imho, there is only the worry of them unable to repay their loans and becoming bankrupt , To understand how these BBs trade commodities, use crude oil as an example. Major players can hedge their physical oil (can be copper or any commodities) in the real market by placing big short positions in the oil futures market. The bankers won't pull the plug as they can earn big fat commission from their clients' active trading activities, in high volume. The key word: "But what if the underlying asset upon which the short is constructed – both its availability and amount – is under your control? What if you are shorting your own product?" OPEC shorts are driving down the crude oil price ~ 24 July 2015 zuolun bro, luckily singapore banks now only want liquid assets such as a company's fixed or time deposits or a director's personal property or the company's factory property as collateral. they no longer use inventory as collateral unlike chinese banks.  |

|

|

|

Noble

Oct 14, 2015 6:32:46 GMT 7

odie likes this

Post by zuolun on Oct 14, 2015 6:32:46 GMT 7

zuolun bro, luckily singapore banks now only want liquid assets such as a company's fixed or time deposits or a director's personal property or the company's factory property as collateral. they no longer use inventory as collateral unlike chinese banks.  , If a desperate owner or any substantial shareholder of a listed company resorts to playing the endgame in the stock market, the biggest casualties are the brokerage firms and ultimately the banks involved will also be negatively impacted as the company assets will be frozen / under investigation for a long period of time. Turns out the former Chinese billionaire whose solar company just imploded was shorting his own stock ~ 23 May 2015 Singapore's AmFraser Securities, one of the casualties of the S$8 billion (US$6.4 billion) losses from the "ABL" saga Singapore's AmFraser Securities to be sold to Taiwan's KGI Securities for S$38m (US$30.4m) KGI Securities said the purchase of AmFraser is likely to be completed by end January 2015 upon obtaining the relevant regulatory approval. 25 Aug 2014 SINGAPORE: Taiwan's KGI Securities Co will buy AmFraser Securities for around S$38 million as it continues to grow its presence in Singapore. AmFraser is one of Singapore's oldest stockbroking firms, with a history that dates back to 1873. Earlier this year, KGI Securities had bought local futures broker Ong First Tradition for US$50 million, which it subsequently renamed KGI Ong Capital. The Taiwanese firm also has operations in Hong Kong, China and Thailand. KGI Securities, the wholly-owned securities division of Taiwan-listed China Development Financial Holding, said the purchase of AmFraser is likely to be completed by the end of January 2015 upon obtaining the relevant regulatory approval. .......................................................................................................................................................... Penny stock fiasco cost AMFraser 'up to $47m'By Goh Eng Yeow Nov 16, 2013 Singapore brokerage AmFraser Securities has ended weeks of market speculation by revealing that it faces potential losses of up to almost $47 million over the recent penny stock fiasco. The firm's parent, AMMB Holdings, cleared the air on Tuesday, ahead of its results briefing today, although some market watchers feel there is still more red ink to be seen. AMMB noted in a statement to Bursa Malaysia that "AmFraser's clients had a gross exposure of circa RM120 million ($46.7 million) to these three stocks - Blumont Group, LionGold Corp and Asiasons Capital". The Malaysian bank also revealed that it had "proactively provided RM40 million" in provisions, which were well in advance of regulatory requirements. Its clarification followed a report by Malaysian newspaper The Star, which suggested that the firm had a far bigger exposure to the three counters. AMMB said "recovery efforts are progressing to expectations" but failed to offer any details as to whether the exposure was due to trading by AmFraser's clients or positions taken by the securities house itself. Traders expect the bank to shed more light on its wholly-owned Singapore brokerage's position when it releases its second-quarter results today. Mr Cheah King Yoong, analyst with KL-based Alliance Research, said in a note: "Even though the gross financial exposure of RM120 million remains high, it is significantly lower than the speculated amount of RM384.6 million. This should help to ease investors' concern." But one remisier, who declined to be named, said: "I expect AmFraser to progressively increase the provision it has to make on its exposure to the three counters as it finds that clients and remisiers are unable to make good on their losses." But Tuesday's statement did serve to remove a load from the shoulders of remisiers who have been fielding anxious calls from clients after market talk intensified about AmFraser's exposure to Blumont, LionGold and Asiasons. About six weeks ago, the three counters suddenly crashed just after opening bell, forcing the Singapore Exchange (SGX) to suspend trading. When they were allowed to resume trading, the SGX banned contra trading and short-selling on them for two weeks in order to remove the speculative froth. However, all three counters continued to plunge in price, leaving them up to 95 per cent below their pre-crash levels. Plenty of investors were caught in the fallout, including Mr Wira Dani Abdul Daim, the son of former Malaysian finance minister Daim Zainuddin. Mr Wira Dani's LionGold shares were force-sold by banks. There is also the question of the size of the losses that may be sitting on the balance sheet of banks which provided margin-financing to clients pledging shares of the three counters as collateral. Remisier Thomas Lee said: "Traders who used margin-financing to trade Blumont, Asiasons and LionGold were badly hit when they sank to prices which were far below the usual stop-loss levels after they resumed trading. The total losses must have been staggering." One hard-hit player is US discount broker Interactive Brokers Group, which has disclosed that it had suffered a deficit of about US$68 million (S$85 million) due to clients' exposure to the three counters. "That might just be the tip of the iceberg. Private banks might be even worse hit," said Mr Lee. AmFraser managing director Ho Chee Kin and executive director Lee Wing How could not be reached for comment on Wednesday. |

|

|

|

Noble

Oct 15, 2015 14:12:48 GMT 7

odie likes this

Post by zuolun on Oct 15, 2015 14:12:48 GMT 7

Don't compare Noble to Glencore, analyst says ~ 15 Oct 2015 Resource investors, be wary...By Matt Badiali, editor, Stansberry Resource Report Wednesday, October 14, 2015 It's one of the biggest news stories in the resource market right now. And it's an example of the massive destruction of value that can happen in this sector... In 1974, Glencore was founded as a metals trading house in London. When it went public in 2011, it said it marketed 60% of the world's zinc output, 50% of its copper, and 45% of its lead. But Glencore's loud, gunslinging CEO, Ivan Glasenberg, had bigger plans. Shortly after the 2011 peak of the resource bull market, Glencore raised more debt to invest in commodities. For example, in February 2012, Glencore announced it was merging with miner Xstrata (the primary products of which were coal, copper, and zinc) to become one of the world's largest metals producers. Glencore spent more than $40 billion on the purchase. But then commodities prices declined. The prices of coal and copper are down 28% and 26%, respectively, since the deal closed in May 2013. Zinc has stayed nearly flat over this period. And now, Glasenberg is trying to stave off bankruptcy. Thanks to all of its commodities investments, Glencore has $50 billion of debt, while its current market cap is $17 billion. Its debt is already more than five times its earnings before interest, taxes, depreciation, and amortization (EBITDA), so raising more debt isn't an option. To pay back this debt, the company is in the process of selling several assets – like its Australian and Chilean copper mines – for much less than it paid to acquire them. So far, it has sold $2.5 billion of equity for a fraction of what it could have received just a few months ago. Glencore is cutting capital expenditures and costs. The company is also looking for "streaming" deals in which it exchanges future delivery of precious metals for an up-front lump-sum payment from streaming (also known as royalty) companies. In September, Glencore even announced it was scrapping its dividend. South African investment bank Investec noted that Glencore could see all of its equity become worthless if commodities prices stay weak. As a result of its struggles, Glencore shares were cut in half twice from their year-to-date high at the end of April. Overall, since closing at 314.9 pence (equal to $4.83) on April 28, they're down more than 60%.  To be clear, Glencore still has one big positive that smaller commodities companies don't... It owns a lot of assets. Glencore can generate a lot of cash by selling assets. This will help ensure it has enough cash to survive – for now. But it's selling at the bottom of the market. This doesn't create long-term value... it locks in losses. And selling assets hasn't been enough for Glencore to prop up its share price. Glencore isn't the only resource company in this situation today... As I showed you last week, Big Oil companies like ExxonMobil, Royal Dutch Shell, Chevron, and BP are all struggling to produce oil at a profit, reward shareholders, and pay back their massive debts. These names are all down around 20% since oil peaked in June 2014. And like Glencore, they could fall much further. In short, Glencore is an example of what can happen to big resource companies with too much debt during a period of low commodities prices. If you're a resource investor, be wary of any company that has racked up debt over the past few years. Until commodities prices turn around, companies like Glencore are going to struggle to pay it back.

|

|

|

|

Post by odie on Jan 9, 2016 13:21:15 GMT 7

|

|