|

|

Noble

Jan 11, 2016 9:15:48 GMT 7

Post by zuolun on Jan 11, 2016 9:15:48 GMT 7

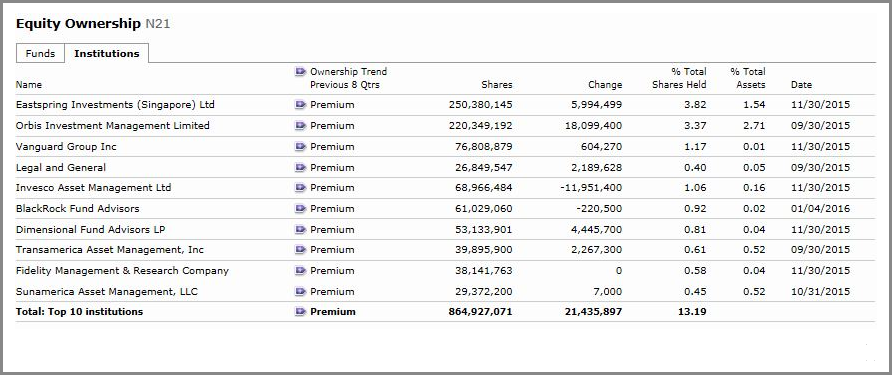

The significant difference bet. price crashing down on low vol. and price crashing down on high vol.Sometimes, certain things could only be visible on the chart when the share price starts its unusual / volatile movement (up or down all in a row, with or without volume). Bollinger bands are very powerful technical indicator. When using it as a key indicator, volume is not necessarily required, instead, the breakout (upside or downside) at the upper or lower Bollinger band is more important. Likewise, in a downtrend, volume is not required for a downside breakout at support level. However, in an uptrend, volume is necessary for an upside breakout at resistance level. Note: A price drop (or rise) on high volume all in a row is a stronger signal indicating that something in the stock has fundamentally changed. ~ 11 Jan 2016 Noble faces scramble for salvation ~ 8 Jan 2016 Noble: Bearish Bollinger Bands breakout, interim TP S$0.195Noble closed with a hammer @ S$0.34 (-0.005, -1.4%) with high volume done at 186m shares on 8 Jan 2016. Immediate support @ S$0.28, immediate resistance @ S$0.34.  Noble: Calm before the storm; expect a tsunami striking... Noble: Calm before the storm; expect a tsunami striking... ~ 30 July 2015 Noble (N21): SSHs from 31 Oct to 30 Nov 2015 |

|

|

|

Noble

Jan 11, 2016 17:19:05 GMT 7

Post by odie on Jan 11, 2016 17:19:05 GMT 7

Ouch looks bad

Thanks bro zuolun for update

Will monitor

|

|

|

|

Noble

Jan 15, 2016 12:49:18 GMT 7

Post by zuolun on Jan 15, 2016 12:49:18 GMT 7

|

|

|

|

Noble

Jan 17, 2016 13:49:25 GMT 7

Post by odie on Jan 17, 2016 13:49:25 GMT 7

Noble Group downgraded to junk status by Standard & Poor’s ~ 7 jan 2016 While based in Asia, Noble has a growing North American oil business and is a major European zinc trader. But some of Noble’s operations have struggled to consistently generate cash, and the company has accumulated net debt of $4.2bn — more than 2.5 times its market value, or 3.6 times its earnings before interest, tax, depreciation and amortisation, according to Moody’s. Trader strives to preserve investment grade rating by raising $500m from investors or asset sale In addition to long-term debt, S&P said Noble had about $360m in bonds maturing in the coming months as well as $2.2bn of short-term credit facilities to renew in May.

|

|

|

|

Noble

Jan 17, 2016 14:12:39 GMT 7

Post by odie on Jan 17, 2016 14:12:39 GMT 7

|

|

|

|

Noble

Jan 19, 2016 18:53:58 GMT 7

Post by odie on Jan 19, 2016 18:53:58 GMT 7

|

|

|

|

Noble

Jan 19, 2016 22:26:33 GMT 7

odie likes this

Post by zuolun on Jan 19, 2016 22:26:33 GMT 7

|

|

|

|

Noble

Jan 22, 2016 15:35:39 GMT 7

odie likes this

Post by zuolun on Jan 22, 2016 15:35:39 GMT 7

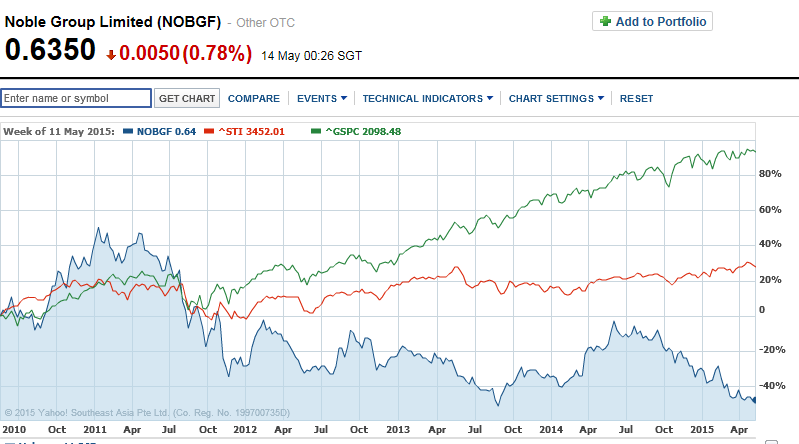

Noble ~ Bearish Bollinger Bands breakout, interim TP S$0.195Noble had a spinning top and traded @ S$0.295 (+0.015, +5.4%) with 65.4m shares done on 22 Jan 2016 at 1625 hrs. Immediate support @ S$0.265 immediate resistance @ S$0.315.  Why I exited Noble Group last year Why I exited Noble Group last year ~ 15 May 2015 Lesson learnedFortunately I did not lose any money on Noble Group. Had I been less patient and sold earlier I would have nearly doubled my money on this investment. Unfortunately I succumbed to hoping, praying and wishing for things to improve. What I should have done was to sell out much earlier when it became clear that the company performance was deteriorating.

|

|

|

|

Noble

Jan 24, 2016 14:06:57 GMT 7

odie likes this

Post by zuolun on Jan 24, 2016 14:06:57 GMT 7

|

|

|

|

Noble

Jan 27, 2016 20:28:43 GMT 7

via mobile

Post by odie on Jan 27, 2016 20:28:43 GMT 7

Iceberg Research to write 4th report on Noble Group Jan 27, 20163:36 PM ICEBERG Research, the little known group that raised questions on Noble Group's accounting practices a year ago, is preparing a fourth report on the commodity trader. It did not state when the report is expected to be published, but in a post on its website announcing this, said most of its earlier arguments are already recognised by the markets. These include a target price of 10 Singapore cents for the group, which Iceberg said is "partially validated" and that Noble's investment grade rating "has always been an anomaly" which will be corrected. Noble's ratings at Standard & Poor's and Moody's have been cut to junk, while Fitch has reaffirmed its investment grade status. Iceberg noted that its claim of Noble overstating at least US$3.8 billion in fair values has not yet been validated, but has "absolutely no doubt" that this - the most important remaining argument in its view - will be "recognised as fact as well". Noble declined to comment on the matter. The commodity trader will be holding a special general meeting on Thursday to seek shareholders' approval for the sale of its remaining 49 per cent in Noble Agri to Cofco International. The counter was trading at 28.5 cents at 3.26pm, up 3.6 per cent from its previous close.

|

|

|

|

Noble

Jan 30, 2016 11:07:28 GMT 7

odie likes this

Post by newshui on Jan 30, 2016 11:07:28 GMT 7

Hi Bro Zuolun, is noble forming a Morning star, noble weekly chart seems like a bullish reversal pattern ? the sky seems like clearing up for this sti counter...  |

|

|

|

Noble

Jan 31, 2016 6:16:50 GMT 7

Post by odie on Jan 31, 2016 6:16:50 GMT 7

Franklin Resources, Inc. buy 2.5m shares @ 28.5cts

their interest increase from 4.99% to 5.03%

|

|

|

|

Post by zuolun on Jan 31, 2016 6:55:02 GMT 7

Hi Bro Zuolun, is noble forming a Morning star, noble weekly chart seems like a bullish reversal pattern ? the sky seems like clearing up for this sti counter...  No, it's not. Dedicating this song to Noble.  【鹹魚】 【鹹魚】 |

|

|

|

Noble

Jan 31, 2016 10:35:24 GMT 7

Post by newshui on Jan 31, 2016 10:35:24 GMT 7

LOL...

hmmm...somehow feel like noble is going for a technical rebounce to 0.380

|

|

|

|

Noble

Feb 1, 2016 6:21:50 GMT 7

Post by zuolun on Feb 1, 2016 6:21:50 GMT 7

|

|