|

|

Post by kenjifm on Nov 19, 2014 1:43:13 GMT 7

They already have plans to use Singapore Brand to develop with them to attract overseas investors.

It is easy to attract the money but hard to make them stay.

|

|

|

|

Post by zuolun on Dec 5, 2014 9:49:01 GMT 7

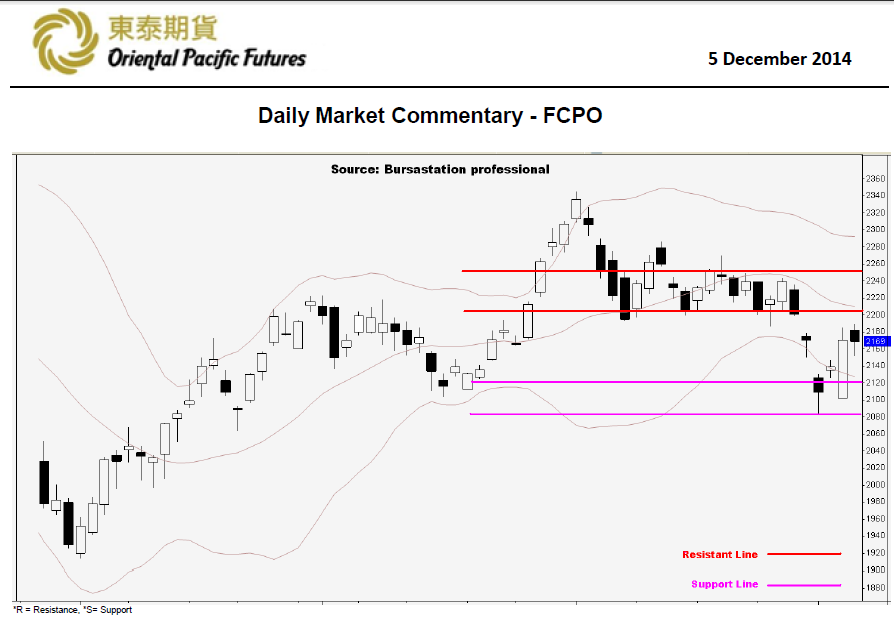

CPO review as at 5 Dec 2014- The FCPO active month contracts closed 3 points lower at 2169 on Thursday by swinging up and down in volatile movement and nearly cover price gap at 2200.

- Based on the daily chart, daily candlesticks are still trying to determine the market movement by breaking both high and low for several times in short period. The direction are still unpredictable while a broken resistance level at 2200 or support level at 2140 may provide us further clues for next trend and market possibly continue to stay in volatile movement.

- First resistance will be 2200-2206, the price gap created during the fall and expected extension of middle Bollinger Band. Second resistance will be 2250, resistance during sideway trend.

- First support will be 2120, the points to be observed and expected extension of lower Bollinger Band. Second support will be 2020-2050.

|

|

|

|

Post by zuolun on Dec 30, 2014 11:12:37 GMT 7

On safe ground — The biggest loser from the floods, FGV (5222.KL) owns more oil palm plantations in the floodprone East Coast — 27 Dec 2014

|

|

|

|

Post by zuolun on Feb 18, 2015 8:03:16 GMT 7

|

|

|

|

Post by zuolun on Mar 28, 2015 6:17:59 GMT 7

|

|

|

|

Post by zuolun on Apr 9, 2015 8:09:23 GMT 7

|

|

|

|

Post by zuolun on May 4, 2015 15:23:33 GMT 7

RAM: CPO prices seen to remain soft on lacklustre demand

By Meena Lakshana

30 Apr 2015

KUALA LUMPUR: Crude palm oil (CPO) prices are expected to remain soft due to concerns of lacklustre demand amid ample supply of rival vegetable oils and weak crude oil prices, RAM Rating Services Bhd said.

In a statement yesterday, the rating agency said the current narrow premium of soyoil to CPO could reduce the appeal of the latter, dampening growth in demand for the commodity as consumers switch to competing oils.

RAM said in the first quarter of 2015 (1Q15), the margin between soyoil and CPO was US$90 per tonne (RM320.41) compared with US$88 per tonne a year ago.

“The price of CPO came in at the lower end of our price forecast of RM2,200 per tonne to RM2,400 per tonne in 1Q15, averaging RM2,204 per tonne,” said RAM.

“A pickup in CPO production, as yields recover after disruptions caused by floods and the effects of dry weather that had depressed CPO production in January and February 2015, may lead to a build-up in Malaysia’s palm oil inventory to over two million tonnes in the near term, further pressuring prices,” it said.

As at end-March 2015, palm oil stocks in Malaysia stood at 1.87 million tonnes, up 10.5% year-on-year and 5.2% month-on-month.

However, the rating agency said it recognised that CPO prices could be uplifted by the successful implementation of Indonesia’s mandate to increase the biofuel content in diesel from 10% to 15%.

“The B15 mandate is estimated to boost CPO demand by two million tonnes in 2015,” it added.

“Although a higher biodiesel subsidy of 4,000 rupiah (RM1.18) per litre and plans to impose levies on the republic’s palm oil exports to fund the B15 programme would be positive to its execution, we remain cautious about the pace of implementation, given that it is still in the preliminary stages and in view of concerns of engine incompatibility with high biodiesel content,” it noted.

RAM also said the Indonesian government’s execution of previously initiated mandates had been marred by pricing, infrastructure and logistical challenges.

The June contract for Brent crude oil is currently trading at US$65.54 per barrel.

Reuters reported that Malaysian palm oil futures fell to their lowest in nearly two weeks on Monday, as a modest increase in export demand was curtailed by the strengthening ringgit and concerns about rising inventory.

The benchmark July contract on Bursa Malaysia closed down 2.1% to RM2,109 a tonne on Monday, just above the intraday low of RM2,107, the weakest since April 14.

|

|

|

|

Post by zuolun on May 17, 2015 7:29:24 GMT 7

|

|

|

|

Post by zuolun on Aug 5, 2015 15:19:44 GMT 7

|

|

|

|

Post by zuolun on Aug 7, 2015 11:22:06 GMT 7

|

|

|

|

Post by zuolun on Sept 20, 2015 8:48:52 GMT 7

|

|

|

|

Post by zuolun on Sept 29, 2015 9:25:14 GMT 7

|

|

|

|

Post by zuolun on Sept 30, 2015 14:46:35 GMT 7

|

|

|

|

Post by roberto on Sept 30, 2015 23:27:35 GMT 7

Who’s funding palm oil?

"Palm oil may be the single most important crop that you never heard of. A vegetable fat that resembles reddish butter at room temperature, palm oil is derived from the fruit of the oil palm tree. Both nutritious and highly versatile, palm oil is now an important component of products ranging from biofuels and food to soaps and cosmetics. Estimates indicate that as much as 50 percent of the products used by the average Western consumer every day contain palm oil or its derivatives... ...Malaysia and Indonesia, the two largest producers of palm oil, which together account for 85 to 90 percent of global production... ...Wilmar, Cargill and Golden-Agri Resources, are among the largest agri-businesses in the world..."

|

|

|

|

Post by zuolun on Oct 2, 2015 17:26:29 GMT 7

|

|