|

|

Post by zuolun on Nov 23, 2014 13:53:27 GMT 7

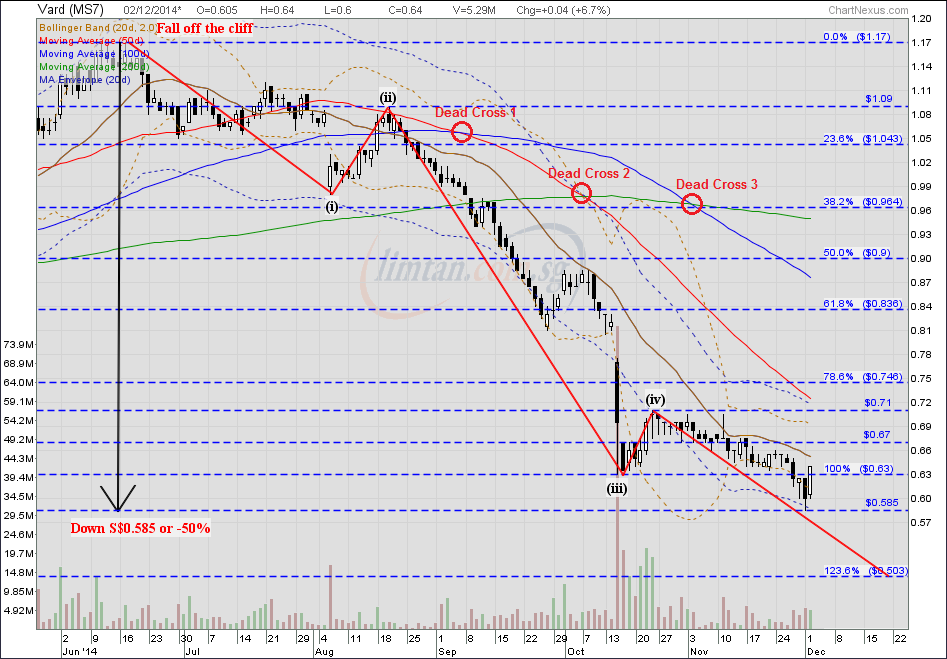

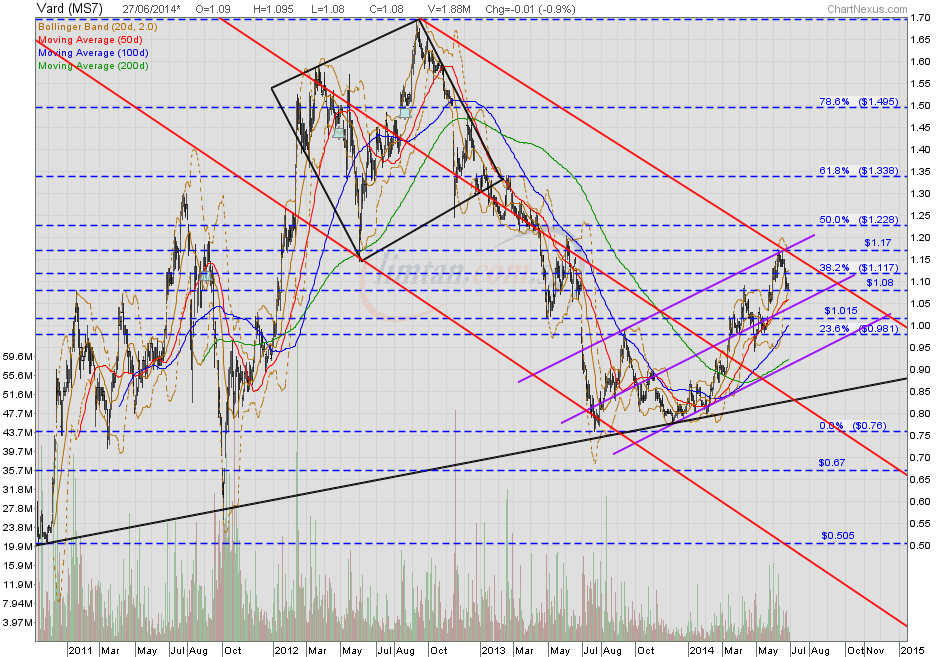

Vard’s deepwater investments take a hit as oil prices plunge — 13 Oct 2014 VARD — A "Waterfall Decline" with 5 waves down, Interim TP S$0.505VARD closed with a hammer @ S$0.655 (+0.01, +1.6%) with 2.97m shares done on 21 Nov 2014. Immediate support @ S$0.63, immediate resistance @ S$0.67.  VARD (weekly) — Longterm downtrend intact, biased to the downside, Interim TP S$0.505, Next TP S$0.375 VARD (weekly) — Longterm downtrend intact, biased to the downside, Interim TP S$0.505, Next TP S$0.375

|

|

|

|

Post by simplemind on Dec 2, 2014 12:55:48 GMT 7

ZL bro,

thanks for all the charting effort that you have put in here. Really appreciate them. Vard seem stringer these 2 days, did not drop much compare to Ezra n seem marine.

cheers

|

|

|

|

Post by zuolun on Dec 2, 2014 17:09:52 GMT 7

ZL bro, thanks for all the charting effort that you have put in here. Really appreciate them. Vard seem stringer these 2 days, did not drop much compare to Ezra n seem marine. cheers  VARD (weekly) — Longterm downtrend intact, biased to the downside, Interim TP S$0.505, Next TP S$0.375 VARD (weekly) — Longterm downtrend intact, biased to the downside, Interim TP S$0.505, Next TP S$0.375 VARD VARD — The Elliott Wave Pattern

|

|

|

|

Post by zuolun on Dec 3, 2014 11:53:30 GMT 7

|

|

|

|

Post by simplemind on Jan 12, 2015 18:23:54 GMT 7

ZL bro,

vard breakdown today, to close at 57. Don't look good.

cheers

|

|

|

|

Post by zuolun on Jan 12, 2015 20:04:12 GMT 7

ZL bro, vard breakdown today, to close at 57. Don't look good. cheers simplemind, TP S$0.505 is in sight, next TP S$0.375... Time has proven what oldman said is correct.  |

|

|

|

Post by simplemind on Jan 19, 2015 17:25:53 GMT 7

ZL bro

vard first target of 50.5 reached n moved past!

|

|

|

|

Post by zuolun on Jan 19, 2015 19:53:38 GMT 7

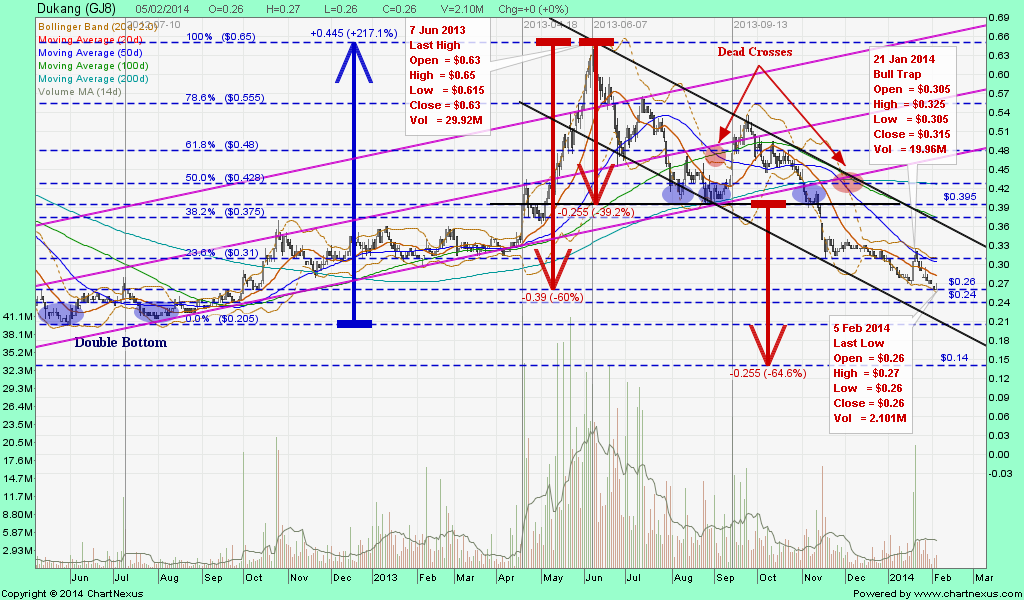

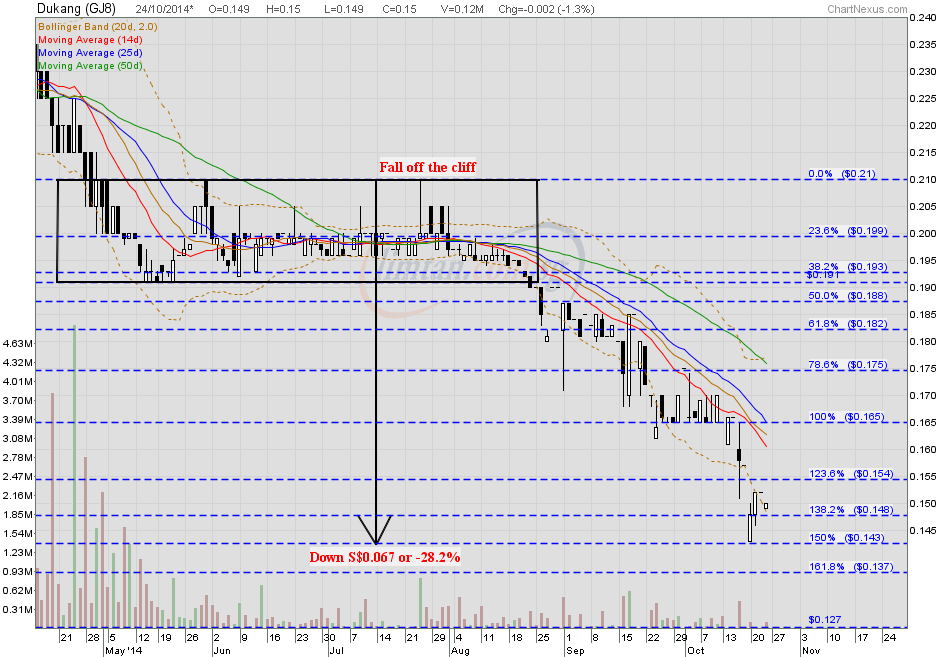

ZL bro vard first target of 50.5 reached n moved past! simplemind, VARD and Dukang have the same type of major cheng kay, both of them graduated from the same school. VARD — TP S$0.375, next TP S$0.35. In technical analysis, a stock that has made a new low is one that must be treated with caution and to be avoided buying for longterm investment.VARD — The W-shaped reversal chart pattern on VARD is eerily similar to Dukang.     |

|

|

|

Post by simplemind on Mar 14, 2015 14:38:37 GMT 7

ZL bro,

How do you see vard? Just announce 2 contracts cancelled due to clients insolvents.

Cheers.

|

|

|

|

Post by sptl123 on Mar 14, 2015 23:15:02 GMT 7

Bro Zuolun, I learning TA: Am I right to say AB is a bear flag ? With the announcement of contracts cancellation, do you also think it is an idea candidate for shorting? If so, what else to watch? Thank you.  |

|

|

|

Post by zuolun on Mar 15, 2015 4:49:18 GMT 7

ZL bro, How do you see vard? Just announce 2 contracts cancelled due to clients insolvents. Cheers. Bro Zuolun, I learning TA: Am I right to say AB is a bear flag ? With the announcement of contracts cancellation, do you also think it is an idea candidate for shorting? If so, what else to watch? Thank you. ab is a channel / bullish short-term trend reversal = sub-wave-4 of Wave-C. - Expect a retest of the last low @ S$0.485 scored on 20 Jan 2015, similar to the WTI oil chart.

- Watch the last leg of sub-wave-5 of Wave-C, it will sink the price down fast and furious.

Vard's FY14 earnings dips 2.2% to $61.8m ~ 27 Feb 2015 VARD ~ A "Waterfall Decline", major bearish trend reversal with 5-Wave down, 1st TP S$0.505, 2nd TP S$0.375, 3rd TP S$0.345. VARD HOLDINGS LIMITED VARD HOLDINGS LIMITED(Incorporated in the Republic of Singapore) (Registration No. 201012504K) TERMINATION OF CONTRACTSThe Board of Directors of Vard Holdings Limited (the "Company") wishes to inform that on 12 March 2015, the Company was notified that two affiliates of E.R. Offshore, our customer, have filed for insolvency at a local court in Germany. The Company’s subsidiary is currently constructing one PSV for each of these companies at its shipyard in Vung Tau, Vietnam. It has received a 10% installment for one of the vessels. On 13 March 2015 the Group terminated the two shipbuilding contracts. The Group does not expect to repay the prepayment received, and expects to be able to sell the vessels at a price that will cover the expected construction cost less the prepayment received. The impact of the termination and the proposed resale is expected not to have a material effect on the earnings per share of the Group for the financial year ending 31 December 2015. BY ORDER OF THE BOARDRoy Reite Executive Director and Chief Executive Officer 14 March 2015 |

|

|

|

Post by sptl123 on Mar 17, 2015 9:49:21 GMT 7

Mar 15, 2015 5:49:18 GMT 8 zuolun said: - Expect a retest of the last low @ S$0.485 scored on 20 Jan 2015, similar to the WTI oil chart.

Target hit. Deadly accurate once again ! Really swee swee no horse run; amazing !  Cheers!! |

|

|

|

Post by zuolun on Mar 17, 2015 10:16:26 GMT 7

Mar 15, 2015 5:49:18 GMT 8 zuolun said: - Expect a retest of the last low @ S$0.485 scored on 20 Jan 2015, similar to the WTI oil chart.

Target hit. Deadly accurate once again ! Really swee swee no horse run; amazing !  Cheers!! See the big picture of oil and oil related companies...all the charts are pointing down = "one-way ticket".  Never catch a falling knife Never catch a falling knife — oldman A falling knife in the stock market refers to a stock that experiences a sharp decline and it may collapse > 50% from its breakout/pivotal point, b4 bottoming out. In technical analysis, it means the stock is riding on the corrective 3 waves down (A, B and C waves).  |

|

|

|

Post by zuolun on Mar 18, 2015 15:00:29 GMT 7

|

|

|

|

Post by zuolun on Mar 20, 2015 21:35:00 GMT 7

|

|