|

|

Post by zuolun on Nov 18, 2013 15:28:53 GMT 7

|

|

|

|

Post by zuolun on Nov 24, 2013 8:52:07 GMT 7

VARD — Trading in a downward sloping channel; interim TP S$0.595Immediate resistance @ S$0.87, crucial support @ S$0.76.

|

|

|

|

Post by zuolun on Nov 24, 2013 13:12:49 GMT 7

|

|

|

|

Post by zuolun on Dec 11, 2013 12:17:35 GMT 7

VARD — Double bottom formationImmediate support @ S$0.76; strong resistance @ S$0.87. After hitting low of S$0.78 on 5 Dec 2013, VARD reversed and closed higher @ S$0.80 (+0.005, +0.6%) on 10 Dec 2013. The 1st bottom @ S$0.76 was hit on 22 July 2013 and the stock has been consolidating for 4 and a half months, to date.

|

|

|

|

Post by zuolun on Dec 24, 2013 16:19:00 GMT 7

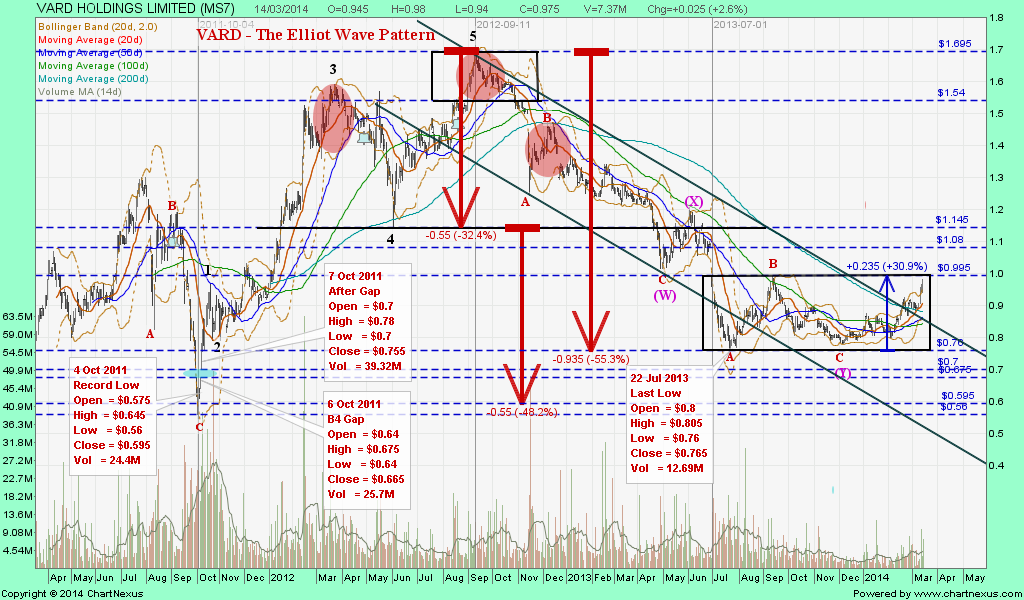

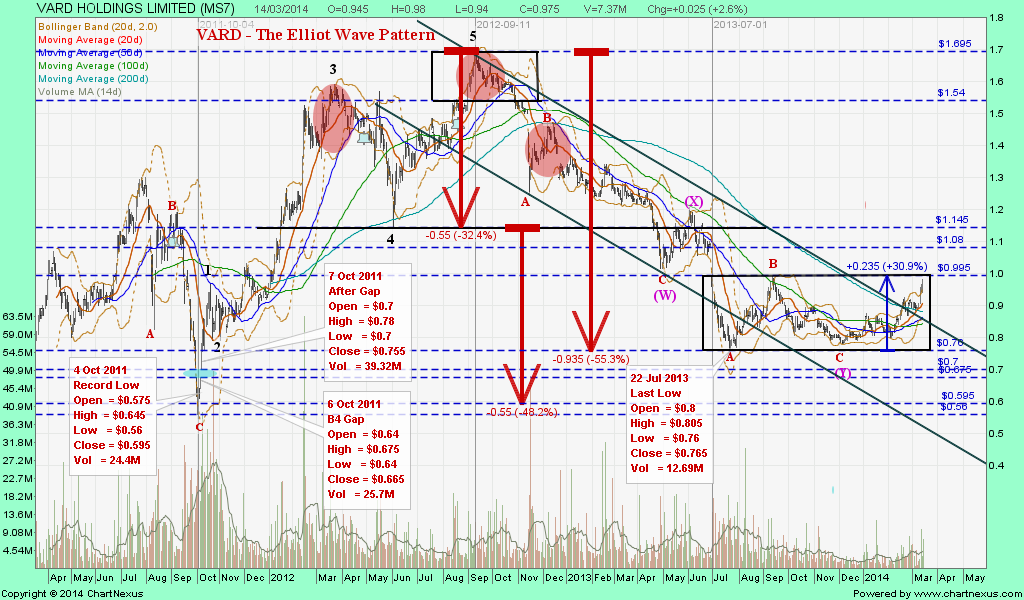

VARD — The Elliott Wave Chart PatternBased on the Elliott Wave chart pattern, crucial support @ S$0.78, record low baseline support @ S$0.56; expect VARD to retest the last low @ S$0.76 scored on 22 July 2013 and hit lower low to close the gap between S$0.70 and S$0.675 created on 7 Oct 2011.

|

|

|

|

Post by zuolun on Jan 3, 2014 17:32:44 GMT 7

|

|

|

|

Post by zuolun on Jan 8, 2014 9:04:18 GMT 7

VARD — Strong resistance at the 100d SMAVARD closed with a doji @ S$0.865 (+0.005, +0.6%) on 7 Jan 2014.

|

|

|

|

Post by odie on Mar 16, 2014 19:22:18 GMT 7

zuolun bro,

any views on this?

Thanks

|

|

|

|

Post by zuolun on Mar 16, 2014 22:14:53 GMT 7

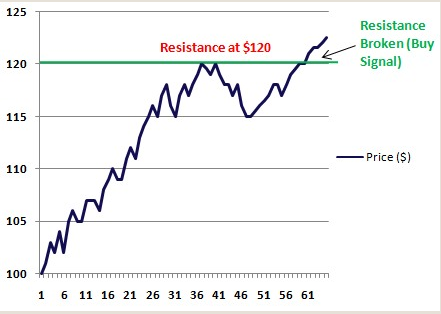

zuolun bro, any views on this? Thanks odie, If VARD could cover the huge gap bet. S$0.995 to S$1.08 convincingly with high volume (> 20m shares), it's a confirmation of a major trend reversal, i.e. it's at Station No.15. VARD — Bull pennant breakout; Interim TP S$1.015Immediate support @ S$0.94, strong support @ S$0.88; immediate resistance @ S$0.995, next resistance @ S$1.055.  VARD (weekly) — Ascending triangle formation VARD (weekly) — Ascending triangle formation.  VARD — The Elliott Wave Pattern VARD — The Elliott Wave Pattern Traders emotions of following a chart Traders emotions of following a chart |

|

|

|

Post by zuolun on Mar 17, 2014 7:47:01 GMT 7

Odie,

Note: VARD's share price spiked due to DBS's upgrade (see below).

By DBS Group Research. Equity 14 Mar 2014

Vard Holdings - Orderbook set to hit 6-year high; upgrade to BUY with higher target price of S$1.21.

On track to better visibility

* Signs LOI for its largest single vessel order ever, follows up with 2 more order wins

* Optimistic industry outlook; FY14 new order win forecast raised from NOK11bn to NOK14bn

* Increase FY14/15 net profit forecasts by 6%/17% on higher revenue recognition

* Upgrade to BUY with TP of S$1.20

Time to look beyond near-term margin uncertainty. The strong momentum in order wins YTD in FY14 signals the continuing strength in the subsea construction market, as well as a revival in the high-end OSV space. Hence, we think it is time to look beyond any minor earnings hiccups in the next few quarters, where margin outlook is still cloudy owing to the few remaining deliveries from Vard Niteroi yard in Brazil. With likely higher margin shipbuilding contracts now flowing in and boosting revenue and earnings visibility in FY15, we peg our valuations to 10x blended FY14/15 earnings, and upgrade the stock to BUY with a higher TP of S$1.21.

|

|

|

|

Post by odie on Mar 17, 2014 21:35:09 GMT 7

Odie, Note: VARD's share price spiked due to DBS's upgrade (see below).By DBS Group Research. Equity 14 Mar 2014 Vard Holdings - Orderbook set to hit 6-year high; upgrade to BUY with higher target price of S$1.21. On track to better visibility * Signs LOI for its largest single vessel order ever, follows up with 2 more order wins * Optimistic industry outlook; FY14 new order win forecast raised from NOK11bn to NOK14bn * Increase FY14/15 net profit forecasts by 6%/17% on higher revenue recognition * Upgrade to BUY with TP of S$1.20 Time to look beyond near-term margin uncertainty. The strong momentum in order wins YTD in FY14 signals the continuing strength in the subsea construction market, as well as a revival in the high-end OSV space. Hence, we think it is time to look beyond any minor earnings hiccups in the next few quarters, where margin outlook is still cloudy owing to the few remaining deliveries from Vard Niteroi yard in Brazil. With likely higher margin shipbuilding contracts now flowing in and boosting revenue and earnings visibility in FY15, we peg our valuations to 10x blended FY14/15 earnings, and upgrade the stock to BUY with a higher TP of S$1.21. zuolun bro, noted with thanks will see if can board the train but at current prices, it seems to be a tough decision to make |

|

|

|

Post by zuolun on Mar 17, 2014 21:54:54 GMT 7

zuolun bro, noted with thanks will see if can board the train but at current prices, it seems to be a tough decision to make odie, Don't chase after the share price now. No one knows whether VARD is on solid or mud ground until the gap bet. S$0.995 to S$1.08 is closed and price sits firmly above S$1.08. I believe in the gap theory and feel that it's safer to long at Station No.15 as VARD may back down again to hit a triple bottom and range bound within the rectangle, then goes lower low to close that gap scored on 7 Oct 2011 to retest the record low @ S$0.56.  When I compare the EW chart pattern of VARD and IEV, I still prefer to long VARD at Station No. 15.   |

|

|

|

Post by odie on Apr 12, 2014 6:28:00 GMT 7

Bro zuolun,

Any updates on this?

Thanks

|

|

|

|

Post by zuolun on Apr 14, 2014 9:00:34 GMT 7

odie, Don't chase after the share price now. No one knows whether VARD is on solid or mud ground until the gap bet. S$0.995 to S$1.08 is closed and price sits firmly above S$1.08. I believe in the gap theory and feel that it's safer to long at Station No.15 as VARD may back down again to hit a triple bottom and range bound within the rectangle, then goes lower low to close that gap scored on 7 Oct 2011 to retest the record low @ S$0.56.  When I compare the EW chart pattern of VARD and IEV, I still prefer to long VARD at Station No. 15. Bro zuolun, Any updates on this? Thanks odie, Strong hands had covered the gap bet. S$0.995 to S$1.08 but did not close above S$1.08 covincingly on 10 Apr 2014.   VARD — Bearish Gartley Pattern, expect more downside than upside VARD — Bearish Gartley Pattern, expect more downside than upsideImmediate resistance @ S$1.08, immediate support @ S$1.035. Key resistance @ S$1.20, long term horizontal support @ S$0.79, the 23.6% FIBO retracement on the EW chart pattern. A break below S$0.79 is a continuation of the major strong downtrend.  Major shareholders sold VARD @ S$1.22 per share Major shareholders sold VARD @ S$1.22 per share — 23 Jan 2013    |

|

|

|

Post by zuolun on Apr 17, 2014 14:43:02 GMT 7

odie, Strong hands had covered the gap bet. S$0.995 to S$1.08 but did not close above S$1.08 covincingly on 10 Apr 2014.

VARD — Symmetrical triangle formationVARD has a spinning top @ S$1.03 (-0.02, -1.9%) on 17 Apr 2014 at 3.35pm Immediate resistance @ S$1.09, immediate support @ S$1.02, next support @ S$0.98. Key resistance @ S$1.20, long term horizontal support @ S$0.79. A break below S$0.79 is a continuation of the major strong downtrend.   VARD (weekly) — Bearish Gartley Pattern, expect more downside than upside VARD (weekly) — Bearish Gartley Pattern, expect more downside than upside |

|