|

|

Post by zuolun on Jul 19, 2014 8:15:05 GMT 7

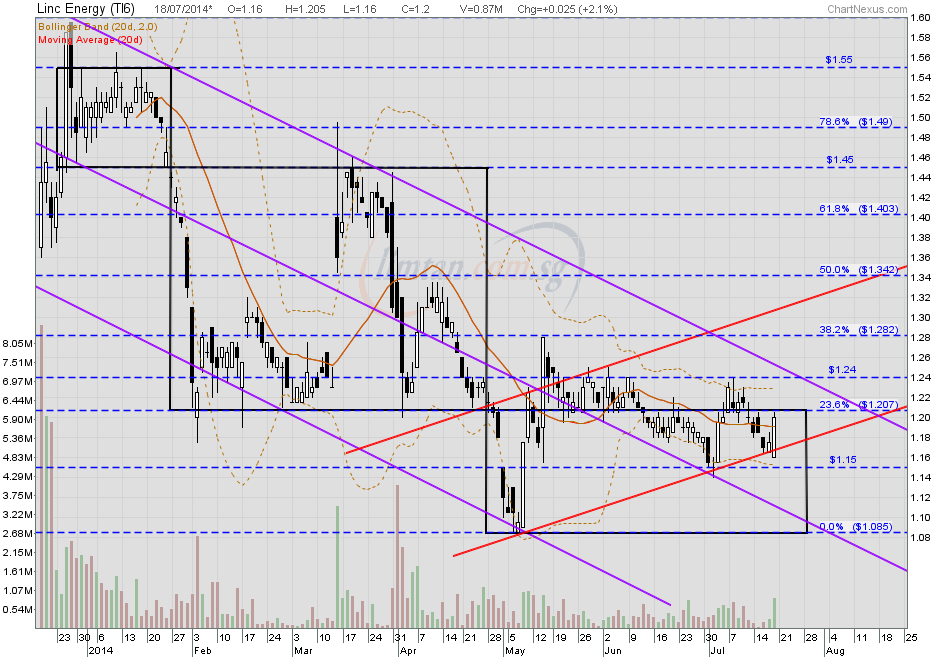

Linc Energy — Another dead cat bounce again forming a lower high, expect more upsideLinc Energy closed with a white marubozu @ S$1.20 (+0.025, +2.1%) with 870 lots done on 18 July 2014. Immediate support @ S$1.15, immediate resistance @ S$1.24.

|

|

|

|

Post by zuolun on Aug 31, 2014 18:36:14 GMT 7

|

|

|

|

Post by zuolun on Sept 7, 2014 9:35:03 GMT 7

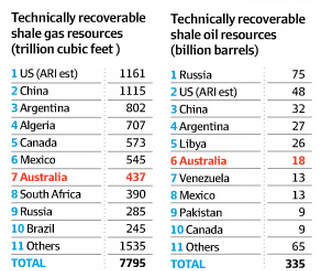

During my time in the UK, I love investing in oil exploration companies, especially the penny stocks. My favourite was a company listed on the Irish stock exchange called Tuskar Resources. Just before it announced exploration results, the share price will multiply and then, over the months ahead, it will fall back to earth. It was wonderful buying these when no one wanted and then waiting for news on its exploration results and selling the shares before the release of these results. Yes, I am looking at some Australian mining and exploration stocks as I enjoy the adrenaline rush that comes with such investments. However, I will be taking my time as I will only buy when the market has collapsed. Because of the expected large amount of shale oil coming out of the US in the near future, I am now more inclined towards gold mining companies rather than oil ones.... especially if gold falls below US$1,000 per ounce. online.wsj.com/news/articles/SB10001424052702303763804579183510128371686oldman, Gold and Oil both experienced a steep correction in prices...  A new play: shale gas revolution A new play: shale gas revolution — 7 Apr 2014  Alarm bells go off With Linc Energy Alarm bells go off With Linc Energy — 5 Sep 2014 Linc Energy — Inverted H&S FormationLinc Energy closed with a black marubozu @ S$1.20 (-0.025, -2.0%) with thin volume done at 690 lots on 5 Sep 2014. Immediate support @ S$1.18, next support @ S$1.14, immediate resistance @ S$1.28.  |

|

|

|

Post by oldman on Sept 7, 2014 9:44:31 GMT 7

I think it is best to avoid all oil and gold related stocks including those that provide services to these firms. There will certainly be opportunities in the future as these are cyclical industries. Just that one has to be patient and pick the stocks up at their lows. Right now, it is a good time to do the research on such stocks and get ready.  |

|

|

|

Post by zuolun on Oct 3, 2014 11:57:26 GMT 7

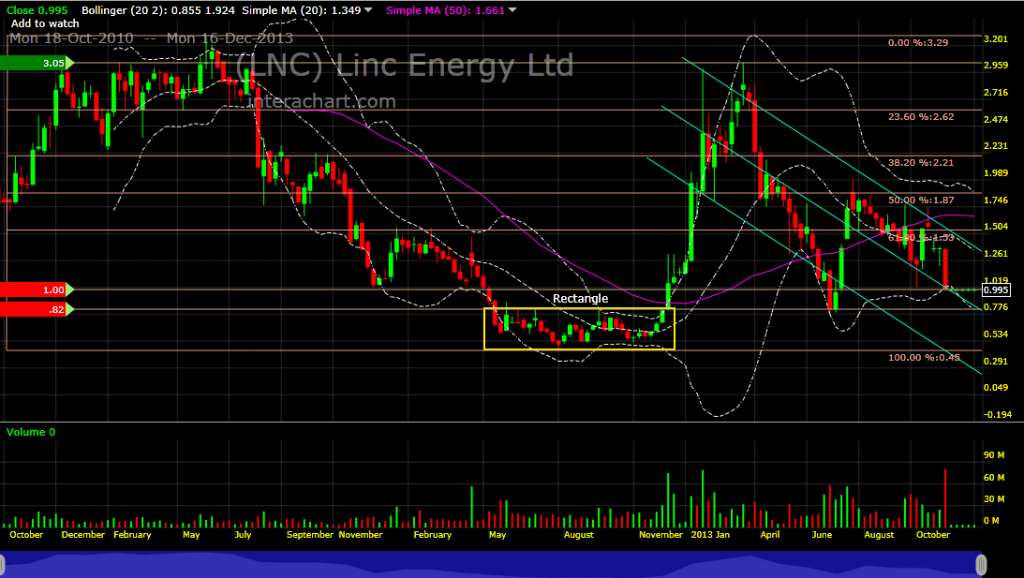

Linc Energy — Trading in rectangle, biased to the downside, interim TP S$1.00Linc Energy unchanged with an inverted hammer @ S$1.085 with extremely thin volume done at 47 lots on 3 Oct 2014 at 12.45 noon. Critical support @ S$1.085, immediate resistance @ S$1.135.  Linc Energy ASX — 18 Oct 2010 to 16 Dec 2013 Linc Energy ASX — 18 Oct 2010 to 16 Dec 2013

|

|

|

|

Post by zuolun on Oct 7, 2014 12:39:58 GMT 7

Linc Energy — Bearish Bollinger Bands Breakout, biased to the downside, Interim TP S$0.95, next TP S$0.775Linc Energy had a long black marubozu @ S$1.055 (-0.04, -3.7%) with thin volume done at 210 lots on 7 Oct 2014 at 1.50pm Immediate support @ S$1.00, immediate resistance @ S$1.085.

|

|

|

|

Post by zuolun on Oct 9, 2014 8:48:59 GMT 7

Linc Energy CEO: Singapore listing was a strategic move — 21 Aug 2014 Linc Energy — Bearish Bollinger Bands Breakout, biased to the downside, Interim TP S$0.95, next TP S$0.775Linc Energy gapped down with a hammer @ S$0.985 (-0.04, -3.9%) with thin volume done at 370 lots on 9 Oct 2014 at 9.45am. Immediate support @ S$0.95, immediate resistance @ S$1.00.

|

|

|

|

Post by zuolun on Oct 10, 2014 9:25:59 GMT 7

Adani exercises call option with AU$90m first payment due by 14 Oct 2014 — 10 Oct 2014 One of the Elliott Wave rules stated that Wave-3 cannot be the shortest wave. - Rule 1: Wave 2 cannot retrace more than 100% of Wave 1.

- Rule 2: Wave 3 can never be the shortest of the three impulse waves.

- Rule 3: Wave 4 can never overlap Wave 1.

Usually for commodities, Wave-5 will be the longest wave; while for stocks, Wave-3 will be the longest wave and a minimum target for Wave-5 is 100% of Wave-1. Linc Energy — A "Waterfall Decline" chart pattern, major bearish trend reversal with 5-Wave down, Interim TP S$0.775, next TP S$0.45Linc Energy gapped down with a hammer @ S$0.835 (-0.125, -13%) with 900 lots done on 10 Oct 2014 at 10.20am.

|

|

|

|

Post by kenjifm on Oct 15, 2014 19:57:27 GMT 7

A TP from a setup doesn't mean there will be a rebound in price action. Management have been a problem from the start and the downside might not end anytime soon.  |

|

|

|

Post by zuolun on Nov 5, 2014 8:49:48 GMT 7

One of the Elliott Wave rules stated that Wave-3 cannot be the shortest wave. - Rule 1: Wave 2 cannot retrace more than 100% of Wave 1.

- Rule 2: Wave 3 can never be the shortest of the three impulse waves.

- Rule 3: Wave 4 can never overlap Wave 1.

Usually for commodities, Wave-5 will be the longest wave; while for stocks, Wave-3 will be the longest wave and a minimum target for Wave-5 is 100% of Wave-1. Linc Energy — A "Waterfall Decline" chart pattern, major bearish trend reversal with 5-Wave down, Interim TP S$0.575, next TP S$0.45Linc Energy gapped down with a long black marubozu @ S$0.91 (-0.065, -6.7%) with extremely thin volume done at 87 lots on 5 Nov 2014 at 9.40am. Immediate support @ S$0.865, immediate resistance @ S$0.975.  |

|

|

|

Post by zuolun on Dec 11, 2014 16:39:02 GMT 7

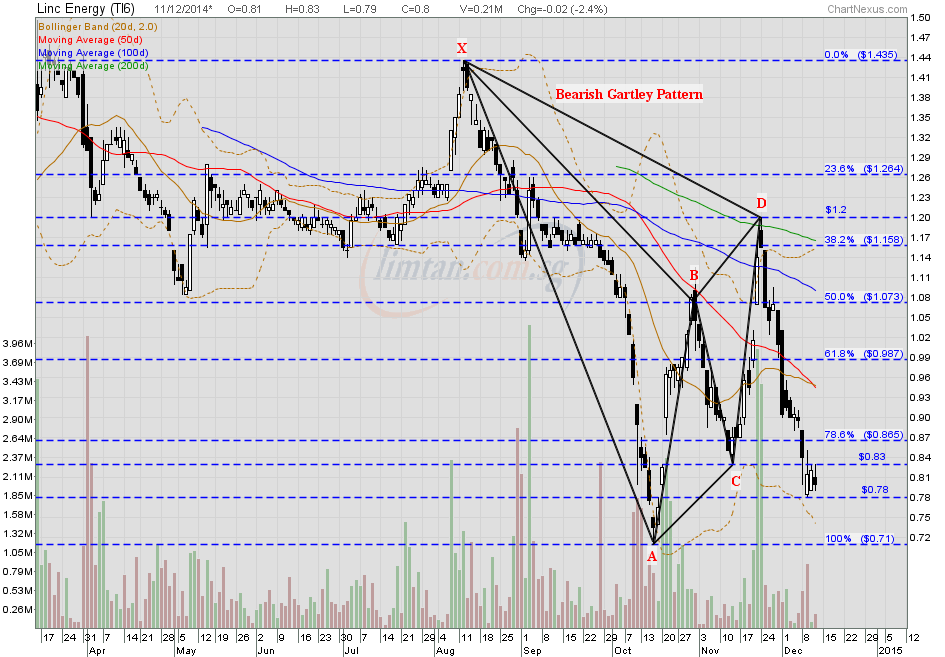

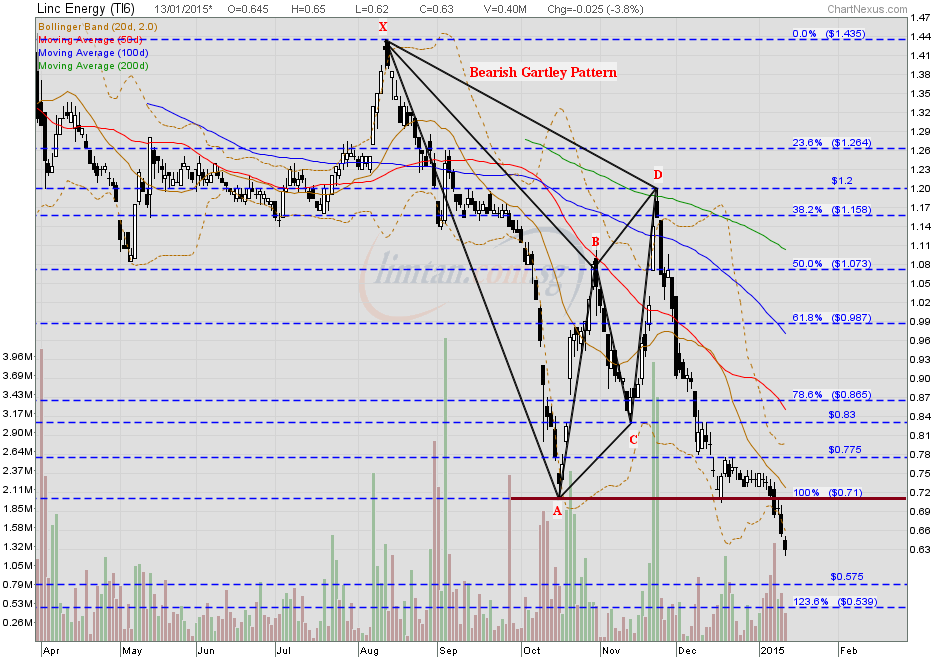

Linc Energy — Bearish Gartley Breakout; 1st TP S$0.575, 2nd TP S$0.475, 3rd TP S$0.45Linc Energy closed with a spinning top @ S$0.80 (-0.02, -2.4%) with extremely thin volume done at 207 lots on 11 Dec 2014. Immediate support @ S$0.78, immediate resistance @ S$0.83.

|

|

|

|

Post by zuolun on Dec 19, 2014 17:55:44 GMT 7

Linc Energy — Bearish Gartley Breakout; 1st TP S$0.575, 2nd TP S$0.475, 3rd TP S$0.45Linc Energy closed with a spinning top @ S$0.745 (-0.025, -3.2%) with extremely thin volume done at 826 lots on 19 Dec 2014. Immediate support @ S$0.71, immediate resistance @ S$0.78..

|

|

|

|

Post by zuolun on Jan 13, 2015 13:38:43 GMT 7

|

|

|

|

Post by zuolun on Jan 23, 2015 9:29:02 GMT 7

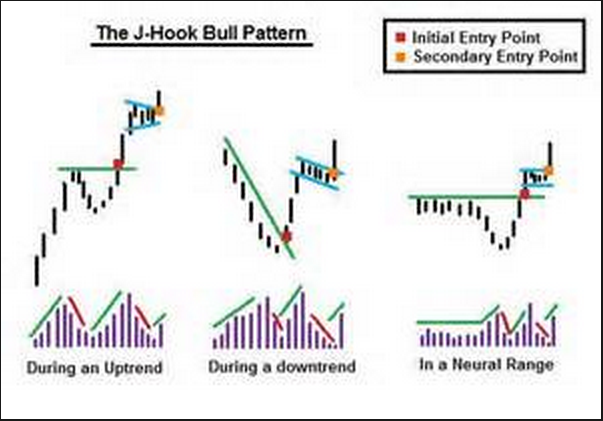

Linc Energy — Potential J-Hook reversal during a downtrendLinc Energy had a white marubozu @ S$0.615 (+0.015, +2.5%) with thin volume done at 420 lots on 23 Jan 2015 at 10.15am. Immediate support @ S$0.54, immediate resistance @ S$0.665.

|

|

|

|

Post by zuolun on Feb 23, 2015 9:04:40 GMT 7

Be careful of the valuations of coal companies.....

A Coal Producer Just Bought Back His Family's Business for 99% Less Than He Sold It For - 18th Feb 2015 The family of Jim Justice paid $5 million for several mining sites and processing plants in southern West Virginia previously owned by Russia’s OAO Mechel. The family sold Bluestone Coal Corp. in 2009 for a combination of cash and Mechel stock in a deal valued at $568 million, according to data compiled by Bloomberg. ~ According to FRB Capital Markets, the EPA’s new Clean Power Plan will cut coal consumption in the power sector by 267 to 285 million tons until 2030. Linc hires advisers for U.S. oil asset sale or partnership deal ~ 16 Feb 2015 "The company sold its coal business to United Mining Group for A$5m...The book value of the assets, including liabilities, was A$29.7m at the end of 2014."Linc Energy traded @ S$0.635 (-0.025, -3.8%) with 352 lots done on 23 Feb 2015 at 10.05am. Linc Energy — Potential J-Hook reversal during a downtrendLinc Energy had a white marubozu @ S$0.615 (+0.015, +2.5%) with thin volume done at 420 lots on 23 Jan 2015 at 10.15am. Immediate support @ S$0.54, immediate resistance @ S$0.665.  Linc Energy — Bearish Gartley Breakout; 1st TP S$0.575, 2nd TP S$0.475, 3rd TP S$0.45Linc Energy had a spinning top @ S$0.63 (-0.025, -3.8%) with thin volume done at 400 lots on 13 Jan 2015 at 2.20pm. Immediate support @ S$0.575, immediate resistance @ S$0.71.  |

|