|

|

Post by sptl123 on Feb 25, 2015 23:21:41 GMT 7

Genting chief Lim Kok Thay has been buying Linc Energy from S$ 1.43 to S$ 0.945 and up his stakes from 51 million shares in Dec 2013 to 106 million share in Nov 2014.

At today price of $0.585, the estimated loss of his bets would be around S$ 30 million.

Every time when he bought, I am sure many people would followed him. I were so tempted to do so but never did.

Smart money is sometime not so smart.

|

|

|

|

Post by oldman on Feb 26, 2015 3:32:47 GMT 7

Smart money has some control on the stock. All else should be considered not-so-smart money. Investors need to be clear whether they are following smart money or the not-so-smart money.... not all big money is smart money..... also, smart money has its own agenda and may also want the shares to fall first. An investor has to be able to guess whether the money is smart or not.  Genting chief Lim Kok Thay has been buying Linc Energy from S$ 1.43 to S$ 0.945 and up his stakes from 51 million shares in Dec 2013 to 106 million share in Nov 2014. At today price of $0.585, the estimated loss of his bets would be around S$ 30 million. Every time when he bought, I am sure many people would followed him. I were so tempted to do so but never did. Smart money is sometime not so smart. |

|

|

|

Post by zuolun on Feb 26, 2015 8:43:52 GMT 7

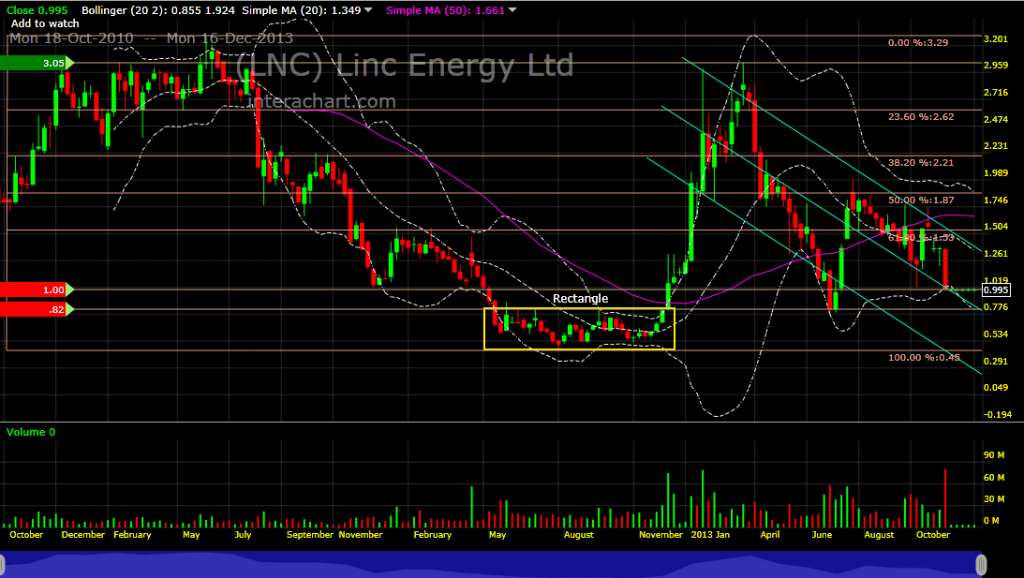

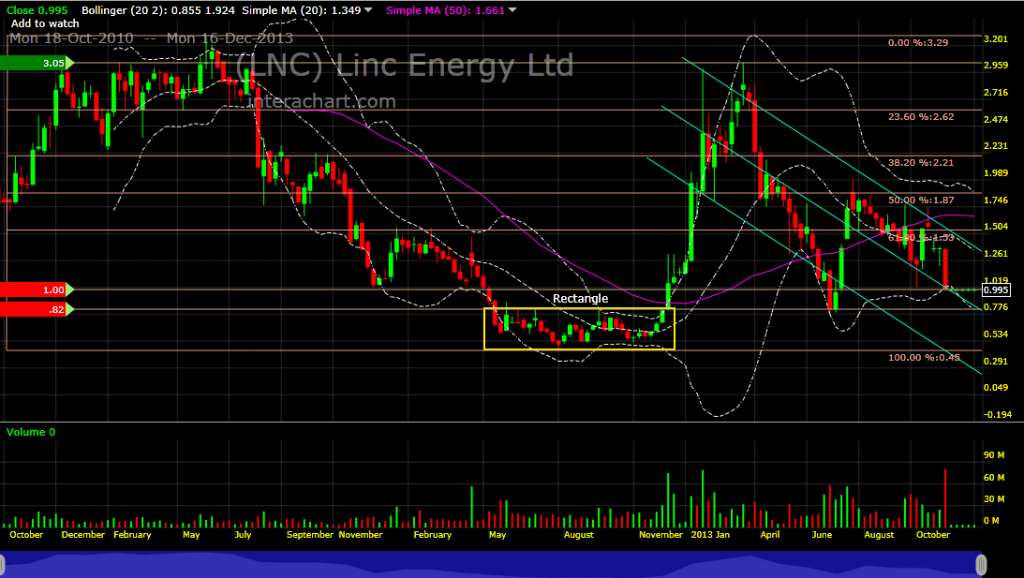

In technical analysis, a stock that has made a new low is a decisive signal to short, not long. Chartwise, 1st TP S$0.575 has already hit today 26 Feb 2015; Linc Energy's 2nd TP S$0.475, 3rd TP S$0.45 - still validVideo: Did tax office dispute Linc Energy Ltd’s prompt sale of Carmichael Mine royalties? ~ 24 Sep 2014 Video: Can the Blair Athol Mine keep going for more than three years? ~ 11 Feb 2014 Can the Blair Athol Mine keep going for more than three years? ~ 31 Jan 2014 Done deal: Rio sells mothballed Blair Athol coal mine to Linc Energy ~ 4 Oct 2013 Blair Athol coalmine close ~ 9 Jul 2013 Coaltrain Blair Athol coalmine ~ 16 Oct 2012 oldman, Based on the major strong downtrend of Linc Energy, I believe the strong selling pressure will persist (ref Linc Energy's ASX chart b4 it was delisted on 16 Dec 2013). Prior to these 2 directors, Mr Ken Dark and Mr Ricato insiders' sales, Credit Suisse had also sold 298,185 Linc Energy shares dated 10 Apr 2014. lincenergy.listedcompany.com/newsroom/20140415_173101_TI6_Z51HY3QWQ7I991QD.1.pdfLinc Energy ASX — 18 Oct 2010 to 16 Dec 2013 - Craig Stephen Ricato's Insider's sales on Linc Energy shares on 28-Apr-2014:

388,0000 shares @ S$1.20919 per share and 501,000 shares @ S$1.20597 per share, total 889,000 shares.

lincenergy.listedcompany.com/newsroom/20140430_174223_TI6_DG3P5I3MMQJC6HL3.1.pdf - Craig Stephen Ricato's Insider's sales on Linc Energy shares on 22 Apr 2014: 96,000 shares @ S$1.23672 per share.

lincenergy.listedcompany.com/newsroom/20140423_173744_TI6_JGLF515OSZD71Q04.1.pdf - Craig Stephen Ricato's Insider's sales on Linc Energy shares on 17 Apr 2014: 516,000 shares @ S$1.27777 per share.

lincenergy.listedcompany.com/newsroom/20140421_175132_TI6_HK098UI7P10866IB.2.pdf - Credit Suisse Investments (UK) ("CSIUK") had pared down Linc Energy 298,185 shares on 10 Apr 2014.

(From 14.0077% to 13.956% or 80,855,395 shares to 80,557,210 shares.)

lincenergy.listedcompany.com/newsroom/20140415_173101_TI6_Z51HY3QWQ7I991QD.1.pdf - Kenneth Eidler Dark's Insider's sales on Linc Energy shares on 7 Apr 2014: 480,000 shares @ S$1.2383 per share.

(Prior to this disposal, 1,770,000 shares were held by Ken and Sandy Dark Pty Ltd, a company wholly owned by Mr

Kenneth Dark. 20,000 shares were held by Darton International Pty Ltd. Mr Dark is a shareholder and director of

Darton International Pty Ltd. After this disposal, 1,290,000 shares are held by Ken and Sandy Dark Pty Ltd and

20,000 shares are held by Darton International Pty Ltd.)

lincenergy.listedcompany.com/newsroom/20140407_172001_TI6_M46LK42S7PNG4OTD.1.pdf

- Kenneth Eidler Dark's Insider's sales on Linc Energy shares on 2 Apr 2014: 267,000 shares @ S$1.2582 per share.

(Prior to this disposal, 2,017,000 shares were held by Ken and Sandy Dark Pty Ltd, a company wholly owned by Mr

Kenneth Dark. 20,000 shares were held by Darton International Pty Ltd. Mr Dark is a shareholder and director of

Darton International Pty Ltd. After this disposal, 1,750,000 shares are held by Ken and Sandy Dark Pty Ltd and

20,000 shares are held by Darton International Pty Ltd.)

lincenergy.listedcompany.com/newsroom/20140404_174136_TI6_1KSNOAE74CPAT30M.1.pdf - Credit Suisse Investments (UK) ("CSIUK") had pared down 1 million Linc Energy shares on 19 Mar 2014.

(From 14.0884% to 13.9152% or 81,321,395 shares to 80,321,395 shares.

lincenergy.listedcompany.com/newsroom/le260314.pdf

|

|

|

|

Post by sptl123 on Feb 26, 2015 9:48:08 GMT 7

Bro Zuolun, As a new member, I have been reading many older posts of yours. For many counters, your charts is deadly accurate and projected TP then all become a reality today and no-horse-run  . |

|

|

|

Post by oldman on Feb 26, 2015 11:32:10 GMT 7

Also, money for investing is relative. $30 mil to Mr Lim may be loose change. Hence, it is important for investors to understand the relative nature of money. What seems big to you may be very small to others. With this understanding, you can make better decisions in the future. Smart money has some control on the stock. All else should be considered not-so-smart money. Investors need to be clear whether they are following smart money or the not-so-smart money.... not all big money is smart money..... also, smart money has its own agenda and may also want the shares to fall first. An investor has to be able to guess whether the money is smart or not.  Genting chief Lim Kok Thay has been buying Linc Energy from S$ 1.43 to S$ 0.945 and up his stakes from 51 million shares in Dec 2013 to 106 million share in Nov 2014. At today price of $0.585, the estimated loss of his bets would be around S$ 30 million. Every time when he bought, I am sure many people would followed him. I were so tempted to do so but never did. Smart money is sometime not so smart. |

|

|

|

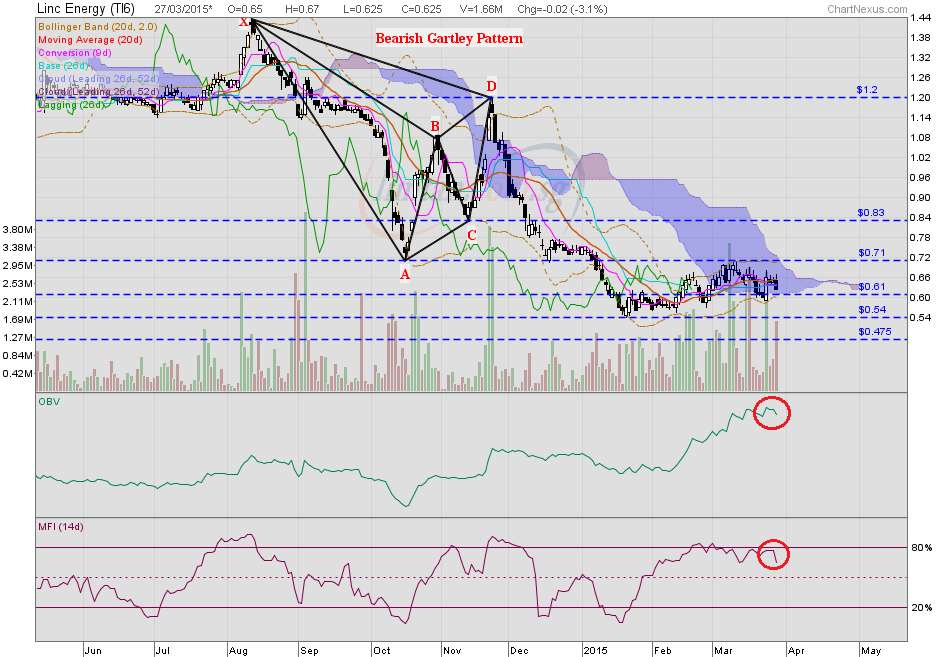

Post by zuolun on Mar 27, 2015 15:14:24 GMT 7

Linc Energy — Bearish Gartley Breakout; 1st TP S$0.575, 2nd TP S$0.475, 3rd TP S$0.45Linc Energy had an inverted hammer @ S$0.625 (-0.02, -3.1%) with 1.68m shares done on 27 Mar 2015 at 4.05pm.

|

|

|

|

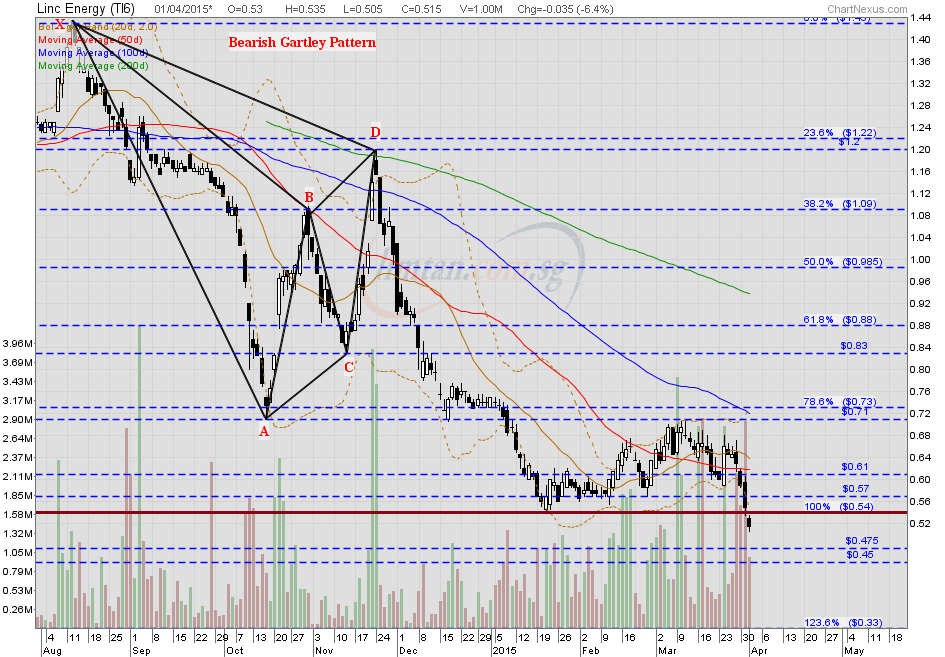

Post by zuolun on Apr 1, 2015 10:00:47 GMT 7

Linc Energy — Bearish Gartley Breakout; interim TP S$0.475, next TP S$0.45

Linc Energy had a spinning top @ S$0.515 (-0.035 -6.4%) with 1m shares done on 1 Apr 2015 at 10.55am.

|

|

|

|

Post by zuolun on Apr 2, 2015 15:42:58 GMT 7

|

|

|

|

Post by zuolun on Apr 13, 2015 22:17:33 GMT 7

Credit Suisse Group AG ("CSGAG") pared down 505,000 Linc Energy shares on 27 Mar 2015.(From 11.0089% to 10.9237% or 65,250,198 to 64,745,198 shares) - Craig Stephen Ricato's Insider's sales on Linc Energy shares on 28-Apr-2014:

388,0000 shares @ S$1.20919 per share and 501,000 shares @ S$1.20597 per share, total 889,000 shares.

lincenergy.listedcompany.com/newsroom/20140430_174223_TI6_DG3P5I3MMQJC6HL3.1.pdf - Craig Stephen Ricato's Insider's sales on Linc Energy shares on 22 Apr 2014: 96,000 shares @ S$1.23672 per share.

lincenergy.listedcompany.com/newsroom/20140423_173744_TI6_JGLF515OSZD71Q04.1.pdf - Craig Stephen Ricato's Insider's sales on Linc Energy shares on 17 Apr 2014: 516,000 shares @ S$1.27777 per share.

lincenergy.listedcompany.com/newsroom/20140421_175132_TI6_HK098UI7P10866IB.2.pdf - Credit Suisse Investments (UK) ("CSIUK") had pared down Linc Energy 298,185 shares on 10 Apr 2014.

(From 14.0077% to 13.956% or 80,855,395 shares to 80,557,210 shares.)

lincenergy.listedcompany.com/newsroom/20140415_173101_TI6_Z51HY3QWQ7I991QD.1.pdf - Kenneth Eidler Dark's Insider's sales on Linc Energy shares on 7 Apr 2014: 480,000 shares @ S$1.2383 per share.

(Prior to this disposal, 1,770,000 shares were held by Ken and Sandy Dark Pty Ltd, a company wholly owned by Mr

Kenneth Dark. 20,000 shares were held by Darton International Pty Ltd. Mr Dark is a shareholder and director of

Darton International Pty Ltd. After this disposal, 1,290,000 shares are held by Ken and Sandy Dark Pty Ltd and

20,000 shares are held by Darton International Pty Ltd.)

lincenergy.listedcompany.com/newsroom/20140407_172001_TI6_M46LK42S7PNG4OTD.1.pdf

- Kenneth Eidler Dark's Insider's sales on Linc Energy shares on 2 Apr 2014: 267,000 shares @ S$1.2582 per share.

(Prior to this disposal, 2,017,000 shares were held by Ken and Sandy Dark Pty Ltd, a company wholly owned by Mr

Kenneth Dark. 20,000 shares were held by Darton International Pty Ltd. Mr Dark is a shareholder and director of

Darton International Pty Ltd. After this disposal, 1,750,000 shares are held by Ken and Sandy Dark Pty Ltd and

20,000 shares are held by Darton International Pty Ltd.)

lincenergy.listedcompany.com/newsroom/20140404_174136_TI6_1KSNOAE74CPAT30M.1.pdf - Credit Suisse Investments (UK) ("CSIUK") had pared down 1 million Linc Energy shares on 19 Mar 2014.

(From 14.0884% to 13.9152% or 81,321,395 shares to 80,321,395 shares.

lincenergy.listedcompany.com/newsroom/le260314.pdf

|

|

|

|

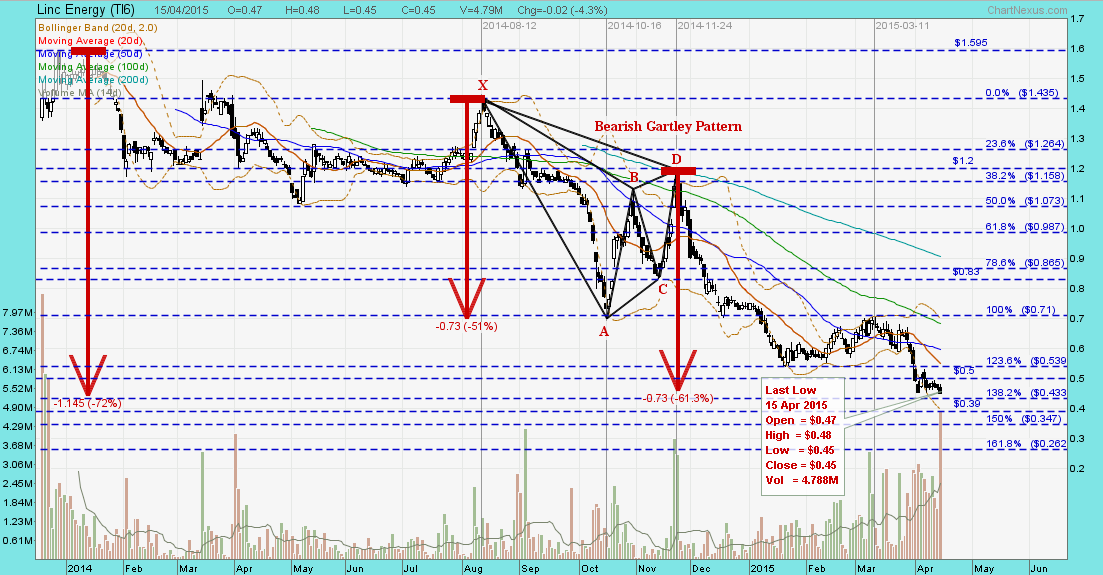

Post by zuolun on Apr 16, 2015 12:32:27 GMT 7

Linc Energy hit low of S$0.425, high of S$0.465 and traded @ S$0.435 (-0.015, -3.3%) with 3.09m shares done on 16 Apr 2015 at 2.05pm. Linc Energy ~ Bearish Gartley Breakout, 3rd TP S$0.45 also hitLinc Energy closed with a small black marubozu @ S$0.45 (-0.02, -4.3%) with extremely high volume done at 4.79m shares on 15 Apr 2015. Critical support @ S$0.45, immediate resistance @ S$0.50. The longterm horizontal support @ S$0.45 is also the baseline support, prior to the transfer of Linc Energy from ASX to SGX (based on A$1 = S$1).   Linc Energy ASX — 18 Oct 2010 to 16 Dec 2013 Linc Energy ASX — 18 Oct 2010 to 16 Dec 2013 |

|

|

|

Post by zuolun on Apr 22, 2015 14:19:57 GMT 7

|

|

|

|

Post by roberto on Apr 22, 2015 20:03:09 GMT 7

Nitpicking a bit, I wonder why Air Liquide/Soxal image used for Linc Energy. Photo credited to Linc Energy too, weird. Reporter lazy? |

|

|

|

Post by zuolun on Apr 22, 2015 21:58:05 GMT 7

Nitpicking a bit, I wonder why Air Liquide/Soxal image used for Linc Energy. Photo credited to Linc Energy too, weird. Reporter lazy? AT THE COAL FACE OPERATIONS STEER COMMERCIALISATION. FIND OUT WHAT’S HAPPENING IN UCG, GTL AND EXPLORATION THIS QUARTER. UCG Since ignition in February, UCG Gasifier 4 has been online without any supply interruptions, providing valuable process data and an opportunity to measure performance against key technical indicators. Results have been encouraging, with positive validations of gasification modelling, gas cost analyses, and reliability enhancements. Gasifier 4 has had cumulative coal consumption since ignition in excess of 3500 tonnes. Syngas from the air blown process under normal operation has a typical calorific value ranging from 5 to 6.5 MJ/Nm3, with an average value of 5.9 MJ/Nm3. Linc Energy has implemented new proprietary UCG designs for the production and injection wells in Gasifier 4. To date, operation has confirmed the mechanical integrity and reliability of these new well designs. The production well contains special casing, and a unique high temperature cement and well head designed specifically for the UCG process by Linc Energy and leading oil and gas industry vendors. Onsite oxygen storage and vapourisation equipment

has been sourced, installed and commissioned in

collaboration with Air Liquide. An initial operation campaign with oxygen enriched air has been completed. Results have been within expectations. The addition of higher levels of oxygen to the UCG process is the next major phase in the development of the gasifier to improve syngas production capacity through increased flow; gasification efficiency and syngas quality; and provide important operational data to benchmark against the traditional air operation. Further operating campaigns with oxygen enrichment are planned for later in the year. Process data from operating the gasifier on enriched oxygen will be used in conjunction with the results of the conceptual studies undertaken by Linc Energy and Aker Solutions to further optimise the UCG process for power generation and production of GTL fuels. Linc Energy, with Veolia, is in the final stages of commissioning a new wastewater treatment facility capable of treating up to 2m3 per day of process water. This will provide valuable data and operational experience to enable this infrastructure to be developed to commercial size for future projects. The treated water from the wastewater treatment |

|

|

|

Post by roberto on Apr 23, 2015 20:09:24 GMT 7

Ha, okay I guess there is some Linc there...

|

|

|

|

Post by zuolun on Apr 24, 2015 14:08:08 GMT 7

Ha, okay I guess there is some Linc there... Air Liquide's name on site is the same as the name on the UNION 12.7kg LPG tank at home and the name on the FLAMMABLE COMPRESSED GAZ LPG tank on the trailer.    |

|