|

|

Post by zuolun on Dec 15, 2014 11:35:40 GMT 7

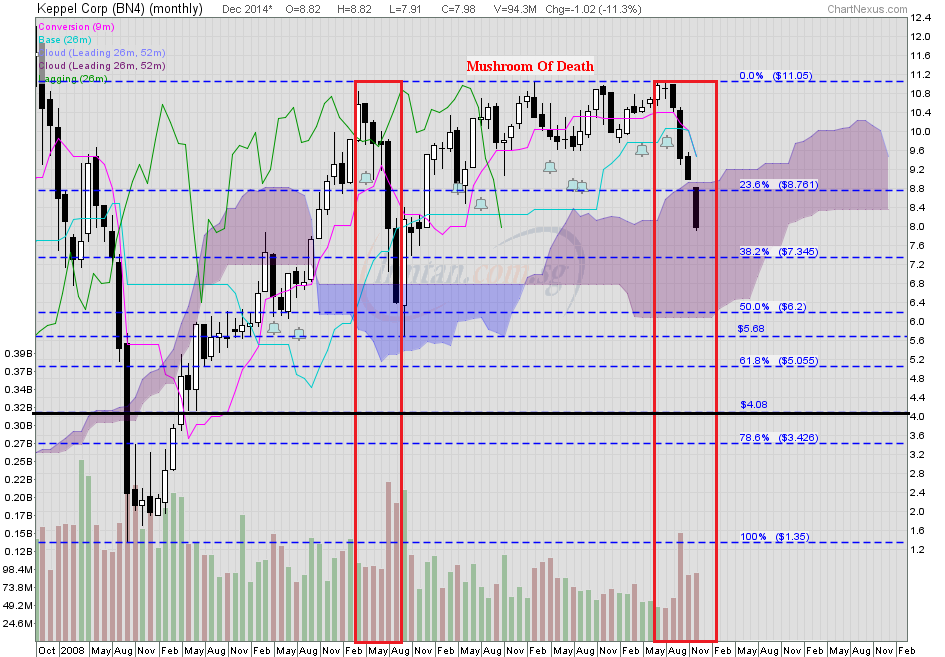

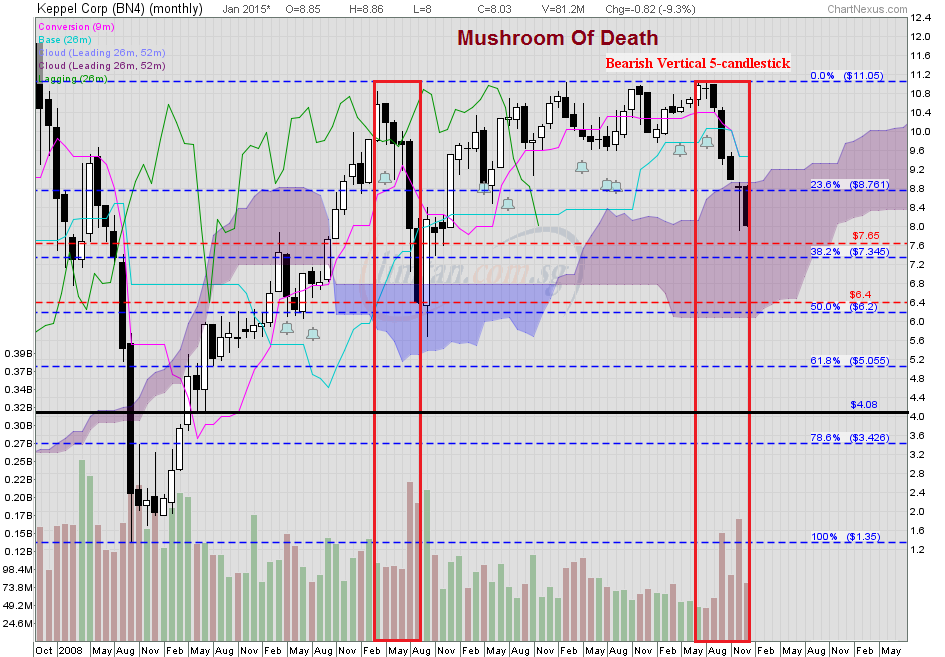

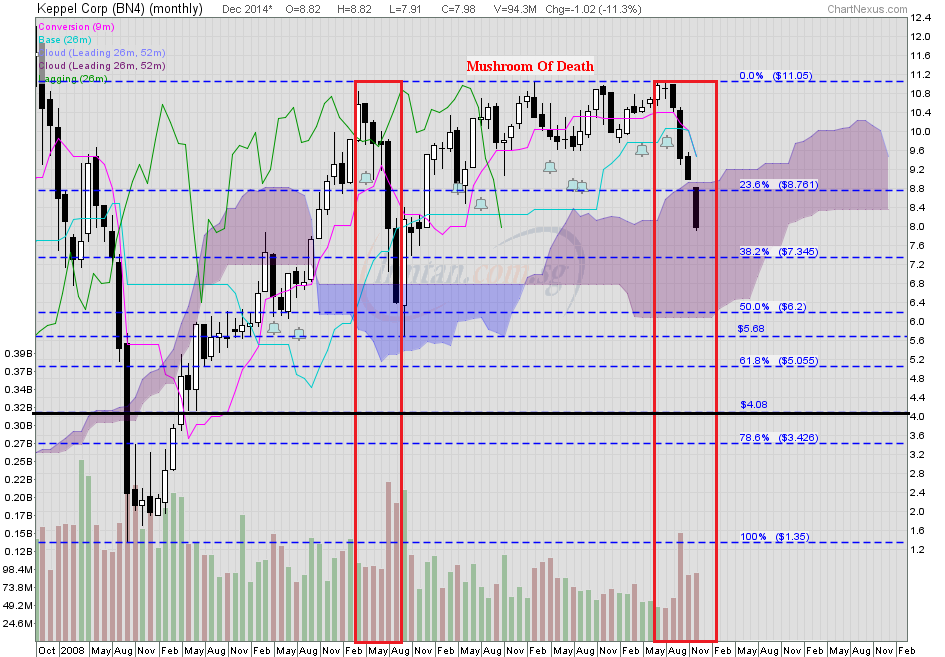

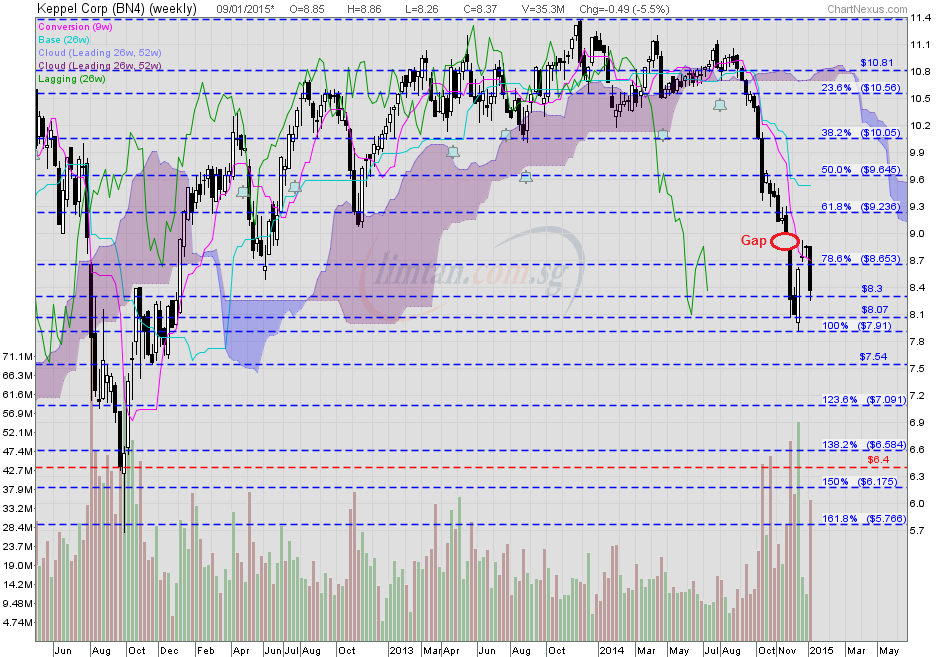

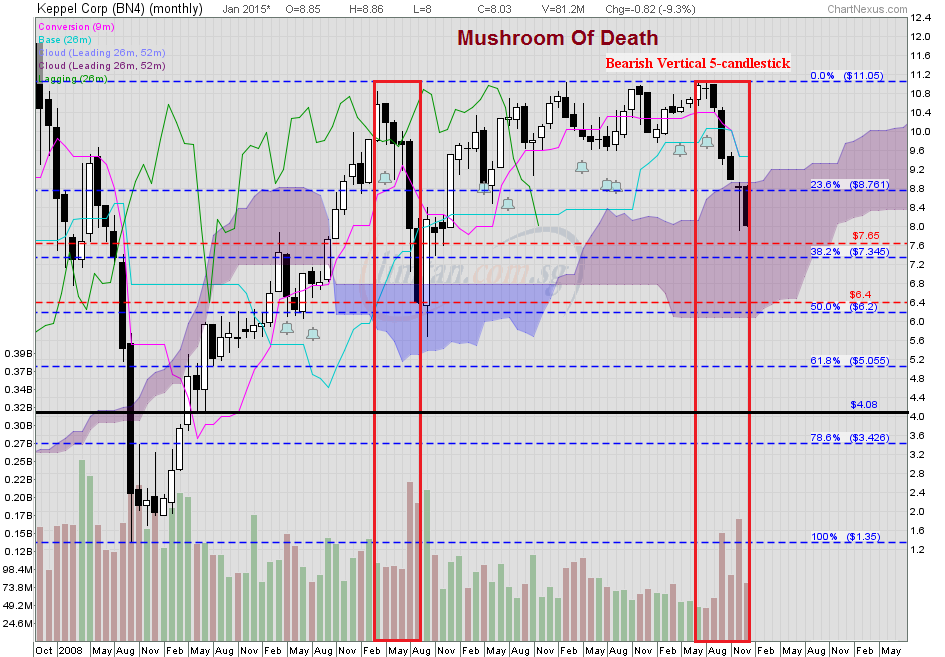

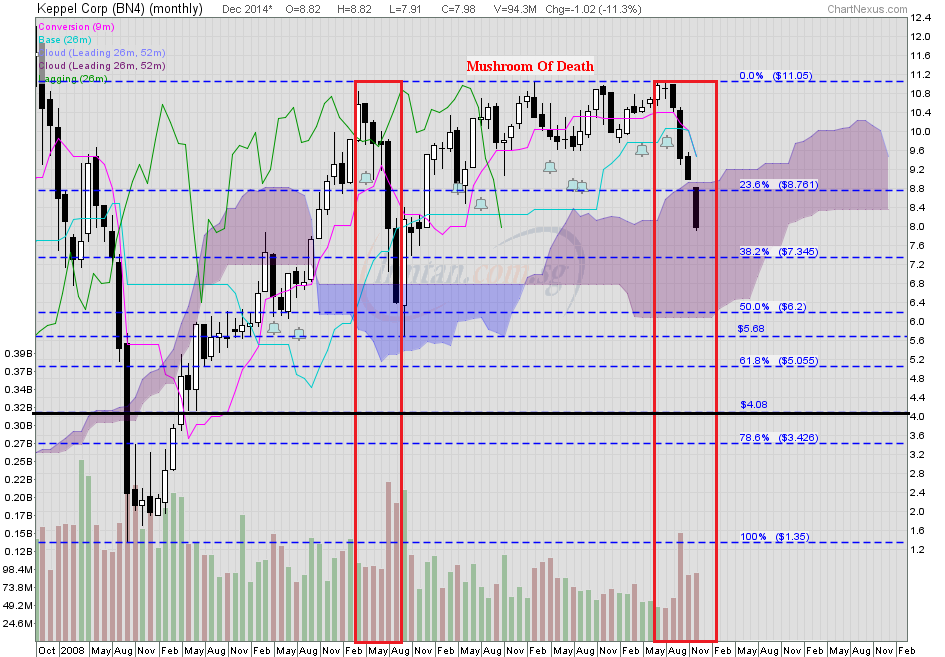

KepCorp's 6-year ichimoku chart showed that its share price had already fallen inside the purple cloud. If oil goes lower and hover around US$40 a barrel then KepCorp's share price may hit S$4.08. Expect the 5th long black marubozu to form a bearish vertical five-candlestick chart pattern.KepCorp (monthly Oct 2008 to 15 Dec 2014) — Classic MOD chart pattern, biased to the downside oldman, your comment is much appreciated. It reminds me of one of your postings, which has been proven right.  "If big money sells at a significant loss, they must have their reasons." - oldman "If big money sells at a significant loss, they must have their reasons." - oldmanIf oil goes lower and hover around US$40 a barrel then KepCorp's share price may hit S$4.08, the 78.6% FIBO level.  Investing is about timing. Right now, I don't think it is the right time to get into oil related stocks. However, when these stocks have collapsed much further, there will come a time when I too will be interested. Let me expand my thoughts further. When you are a cartel, you have the power to increase the selling price and make more profits. When a cartel decides that it does not want to make more profits, one is best to sit up and ponder. The cartel will not take such a decision unless it feels strongly that its business model will be under significant pressures in the years ahead. Perhaps it is shale oil or alternative power sources but whatever it is, the cartel is willing to take short term pains to protect its long term interests.

Put another way, the cartel will know that unless it can persevere and hold down oil prices for at least a year or more, it is unlikely to be successful in its objective. Now, if you agree with this thought process, then, most of the oil related companies will be under pressure as future projects are likely be postponed and existing contracts may be rescind. Oil majors have significant powers and I am sure their contracts will allow them a way out, legally.

Oil related companies will then be under pressure from both revenues and profits and as they announce lower revs and profits, the market will punish these shares further. What I am saying is that it may be wiser to wait till later to then take positions in such companies. Investors need to be able to have their own crystal ball and forecast what is likely to happen in the future. More importantly, they must know how to position themselves to make money from their crystal ball gazing. In other words, smart investors will be looking into the fundamentals of oil related companies and will be following the oil market closely. He would have done his homework to determine an entry point. For a deep value investor like me, I will only enter at a very deep discount. If I were to hazard a guess, oil may hover around US$40 a barrel for a while.   |

|

|

|

Post by roberto on Dec 19, 2014 0:15:17 GMT 7

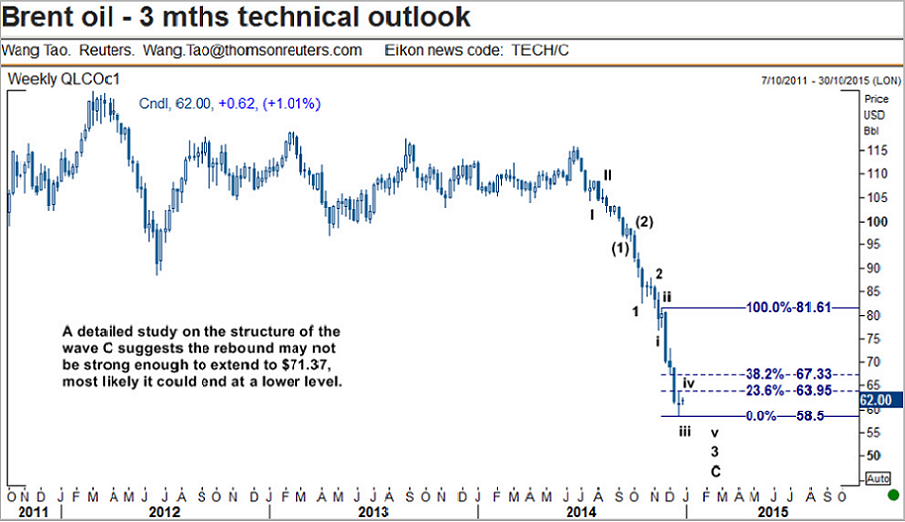

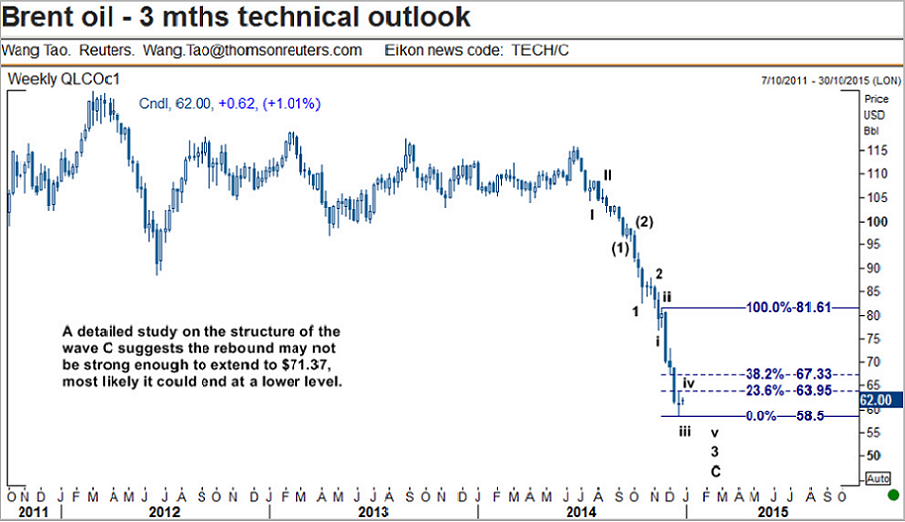

KepCorp fall-off-cliff chart as scary as NYMEX crude, which attempted a few times to revist 60s level only to head back down. On technical rebound in attempt to close gap at 9.00/9.20 areas before proceeding lower is my guess. Share buybacks seemed to have lent decent support.  1-year NYMEX crude chart:  Currently I've no positions on it. |

|

|

|

Post by zuolun on Dec 19, 2014 6:24:08 GMT 7

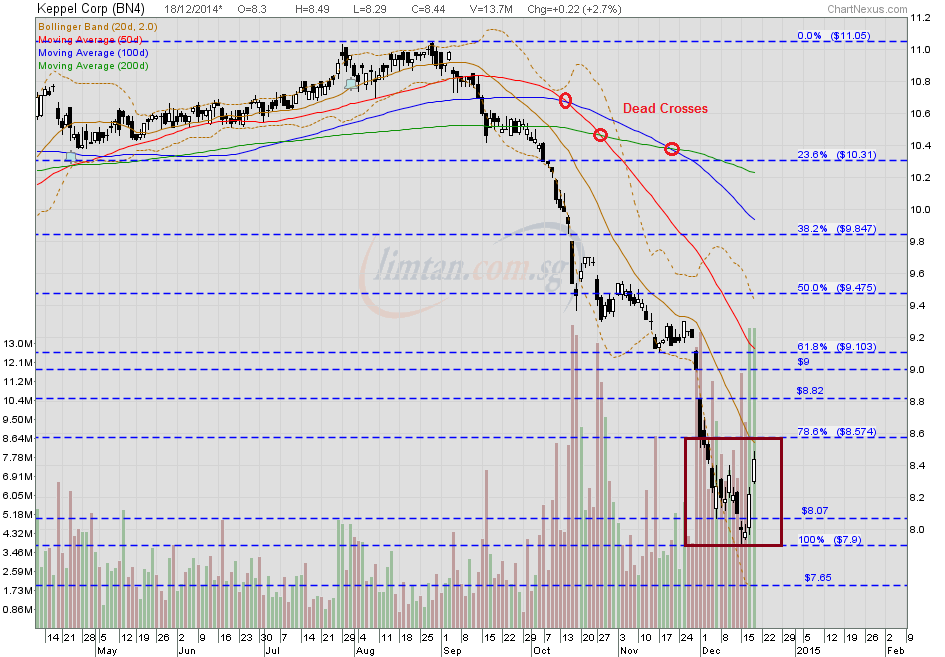

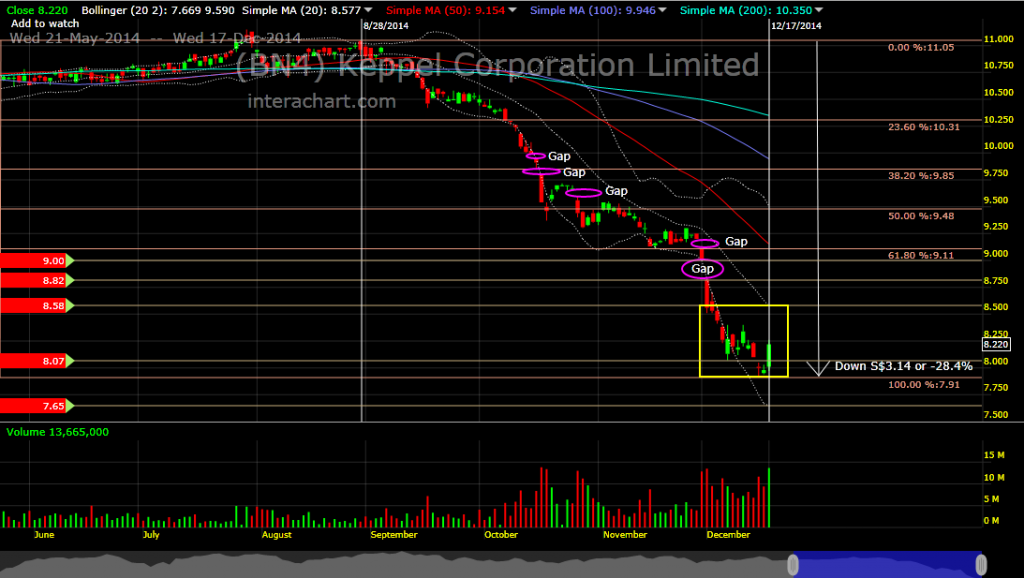

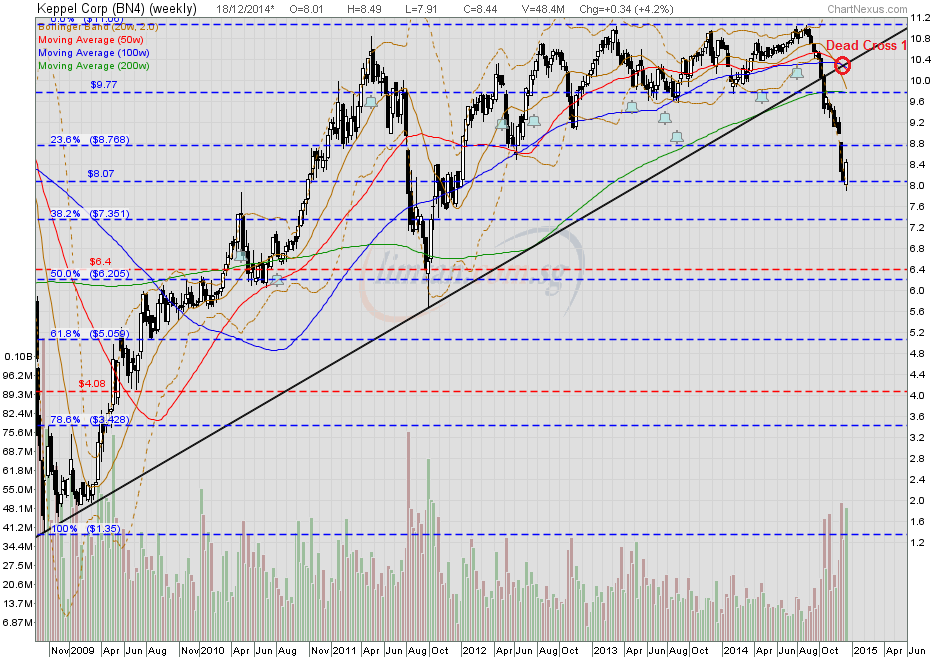

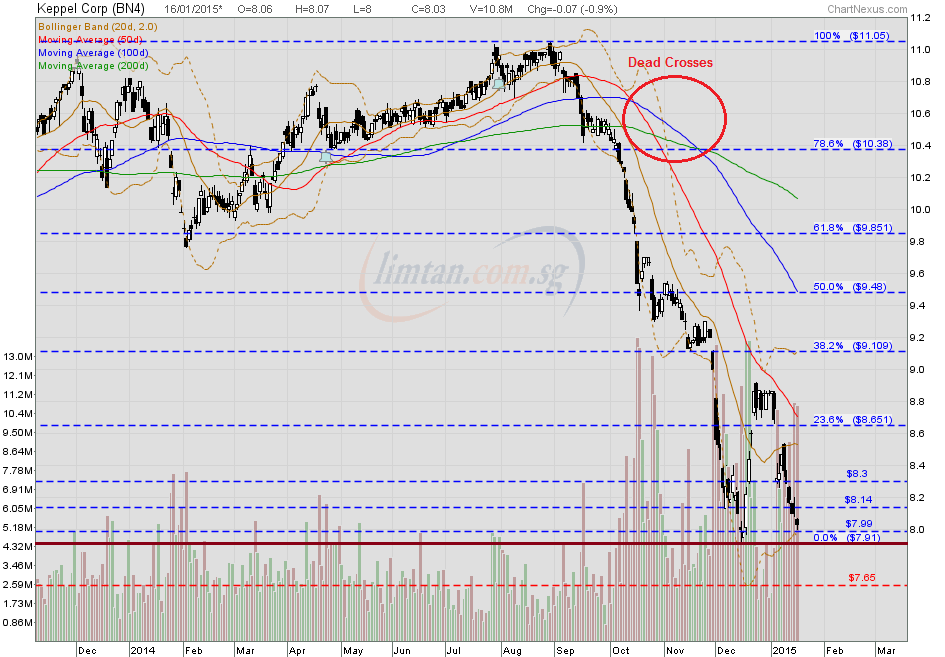

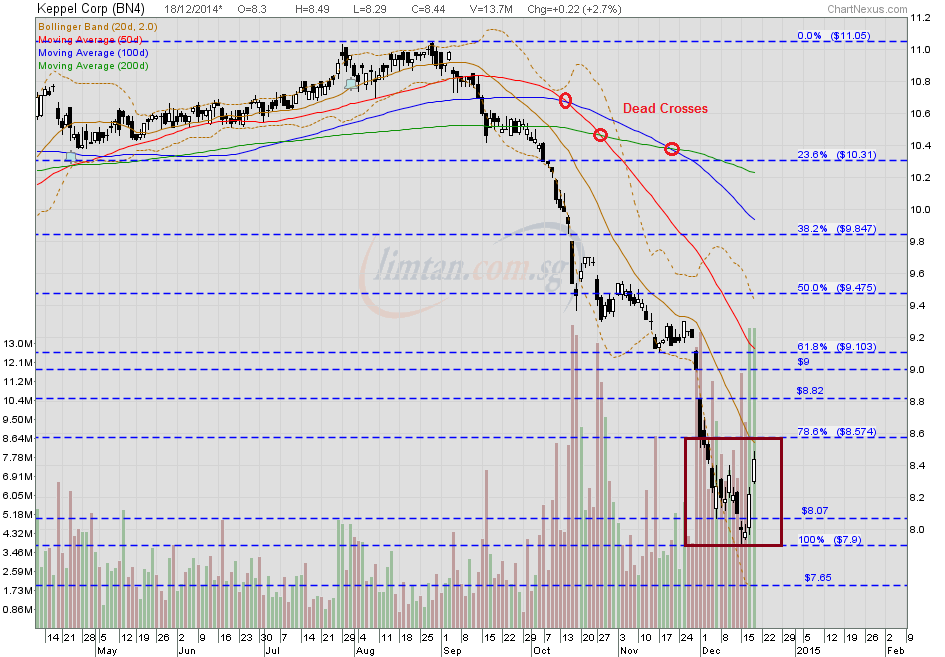

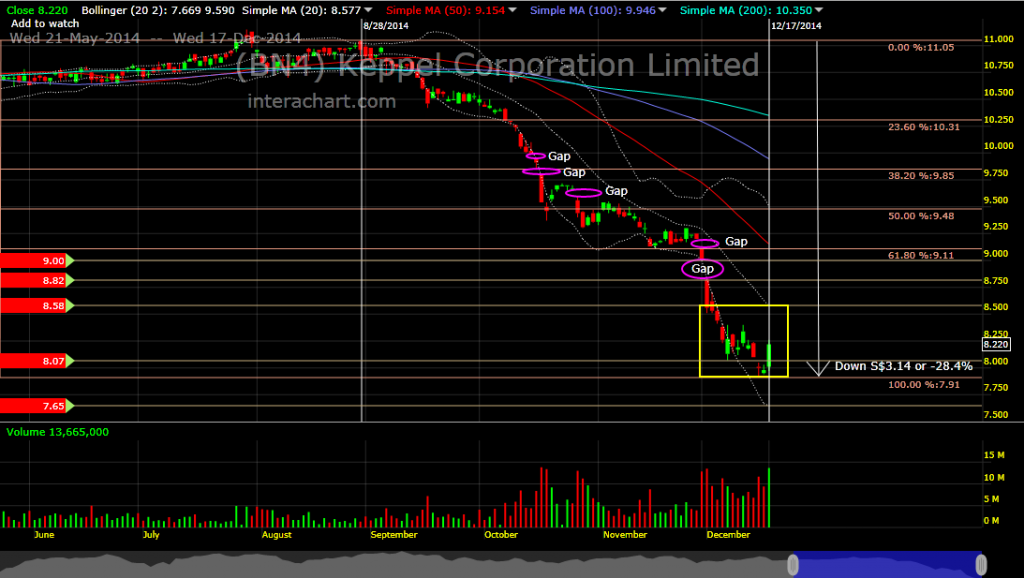

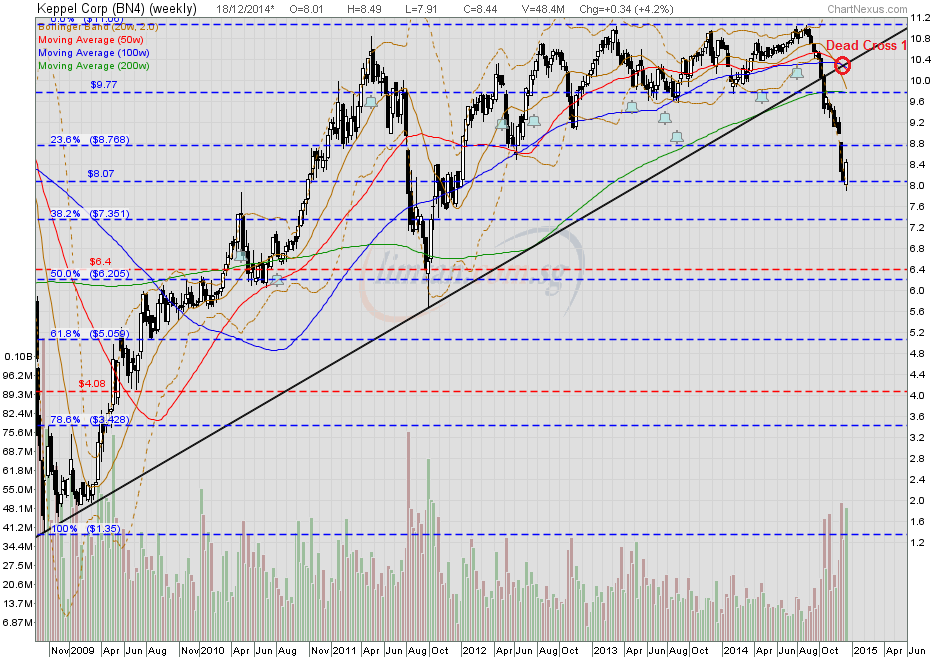

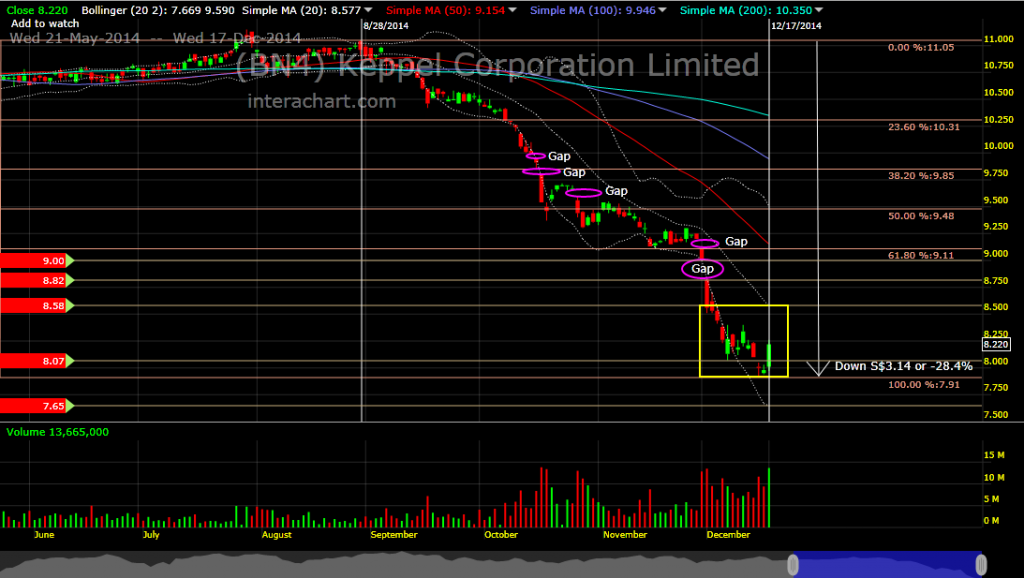

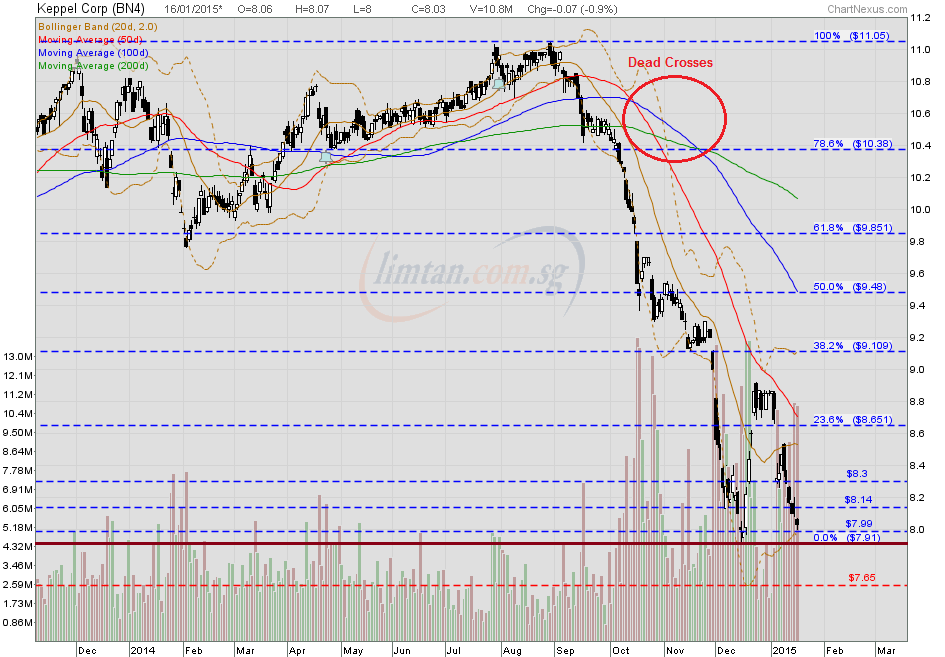

Never catch a falling knife — oldman  When a stock retraces 20% from its record high and continues to trade below the 50d, 100d and 200d SMA with the 3 dead crosses hanging above the prevailing share price, it is in an extremely strong bear-market territory. KepCorp is down S$3.14 (-28.4%) since its last peak @ S$11.05 scored on 28 Aug 2014. The stock is resisted by the 20d SMA and price movement is gapping down with extremely high volume; indicating extremely strong selling pressure. KepCorp — A "Waterfall Decline", Interim TP S$7.65, Next TP S$6.40KepCorp closed with a long white marubozu @ S$8.44 (+0.22, +2.7%) with extremely high volume done at 13.7m shares on 18 Dec 2014. Immediate support @ S$8.07, immediate resistance @ S$8.58.   KepCorp (weekly) — The trend is your friend, until the end when it bends. KepCorp (weekly) — The trend is your friend, until the end when it bends.

|

|

|

|

Post by roberto on Dec 24, 2014 0:13:38 GMT 7

Must say the timing of the recent share buybacks is as good as it gets. Let's see if the up trend continues. Tug-of-war in oil price; hourlies over 5 days; upside or downside?  |

|

|

|

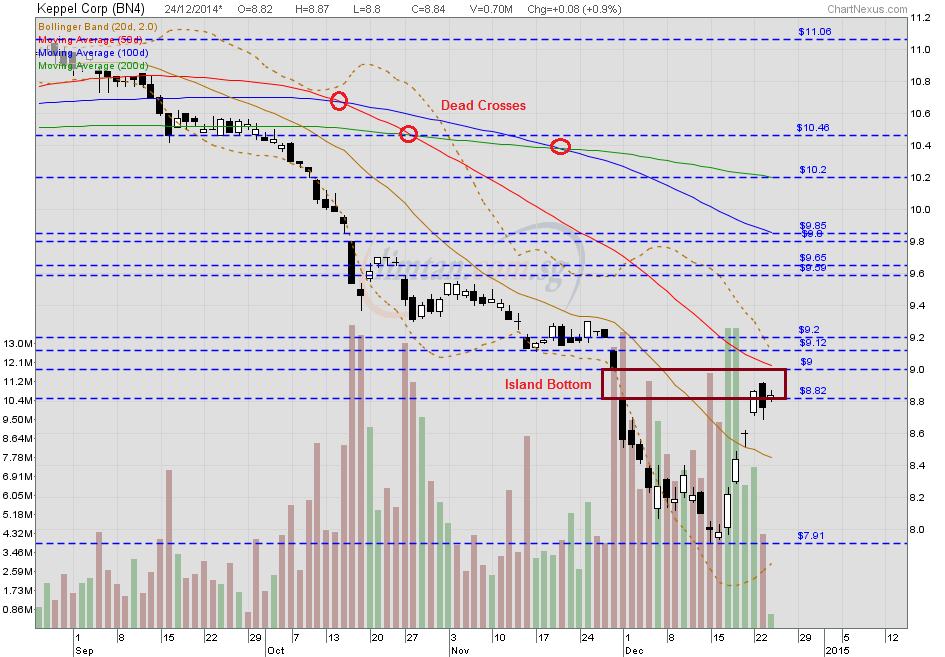

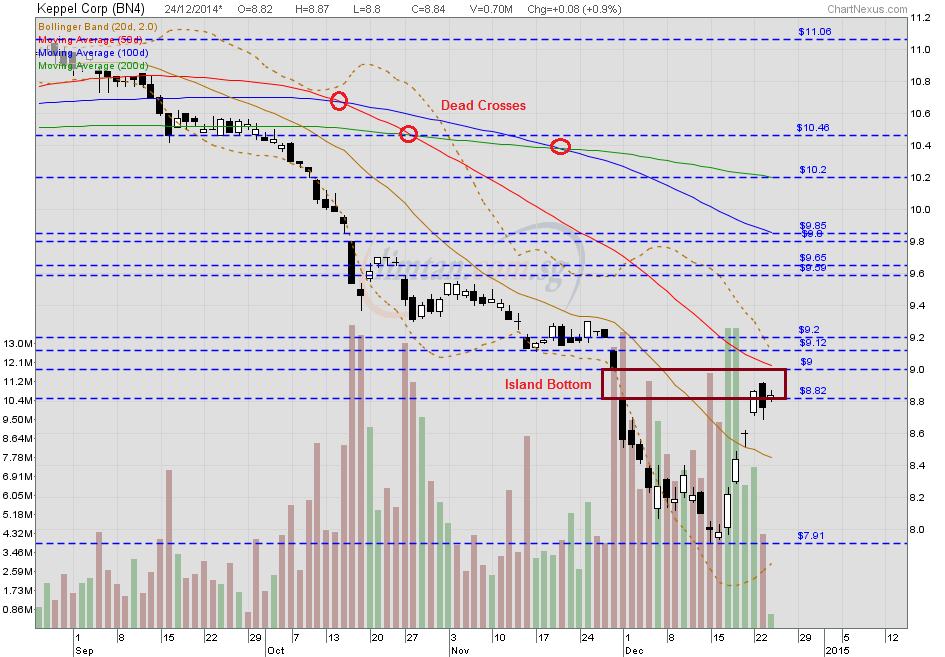

Post by zuolun on Dec 24, 2014 8:43:35 GMT 7

KepCorp fall-off-cliff chart as scary as NYMEX crude, which attempted a few times to revist 60s level only to head back down. On technical rebound in attempt to close gap at 9.00/9.20 areas before proceeding lower is my guess. Share buybacks seemed to have lent decent support. 1-year NYMEX crude chart: Currently I've no positions on it. Must say the timing of the recent share buybacks is as good as it gets. Let's see if the up trend continues. Tug-of-war in oil price; hourlies over 5 days; upside or downside?  I'm bearish on KepCorp and I believe the selling is not done yet (a higher low with a potential intermediate double bottom formation but likely to retest the last low @ 7.91 and move down further to form a lower low). If you're a daytrader playing both short and long simultaneously; watch the gaps above. The Algo trading program will ignore the technical indicators and overlays, so the price action and trading volume will determine the direction of KepCorp's price movement. On technical rebound; island bottom is the opposite of island top. A dead cat bounce is an opportunity for the stale bulls to cut-loss / reduce long positions; it's also the best timing for the major short sellers to add shorts, the higher the better. KepCorp — Island Bottom Reversal; 1st gap bet. 8.82 to 9.00KepCorp had a bullish harami @ S$8.84 (+0.08, +0.9%) with 700 lots done on 24 Dec 2014 at 10.15am. Immediate support @ S$8.69, immediate resistance @ S$9.00, slightly below the 50d SMA.   Island Bottom Reversal Island Bottom Reversal Island Top Reversal Island Top Reversal |

|

|

|

Post by zuolun on Dec 28, 2014 6:04:07 GMT 7

Is the crowd always wrong?KepCorp closed @ S$8.75 (-0.12, -1.4%) with 2.58m shares done on 26 Dec 2014. Most of the in-house stock analysts rated BUY on KepCorp from 2 July to 1 Dec 2014 except Nomura, who rated SELL TP S$9.64 based on its last traded share price @ S$10.30 on 8 Oct 2014, then.  Keppel Corp cut to “reduce” from “buy” by Nomura Keppel Corp cut to “reduce” from “buy” by NomuraBy Frankie Ho 8 Oct 2014 Nomura has downgraded its rating on Keppel Corp ( Financial Dashboard) to “reduce” from “buy” and cut its price target from $13.20 to $9.64, based on a sum-of-parts valuation. The Japanese broking house expects a significant slowdown next year in global jack-up rig orders, and its FY2014 to FY2016 earnings estimates for Keppel are 7% to 18% below consensus forecasts. “The key downside risk to consensus forecasts is the optimism on Keppel’s ability to replenish its rig building order book quickly and grow its offshore and marine revenue vs our view that the slowing jack-up rig orders since early 2014 will worsen in 2015,” Nomura analysts Chong Wee Lee and Abhishek Nigam said in a note today. Keppel’s proprietary semi-submersible rig designs are unlikely to benefit from an expected recovery in orders for floaters from 2Q2015 as drill ships are preferred, they said. Global jack-up rig orders may weaken next year because of near-term oversupply, with a 71% y-o-y rise in scheduled jack-up rig deliveries to 65 units in 2015, they said. Of the 65 units, only 8% have been contracted. Average charter rates for jack up rigs have also declined, while utilization rates peaked at 88.6% in April this year. “This may affect Keppel’s order book visibility.” The “saving grace” for Keppel’s offshore and marine division is that higher-margin offshore and conversion works and ship repair jobs provide a steady income to the group, they said. “We expect 65% of Keppel’s order wins in 2015 to be related to conversion works on production units, which are insufficient to make up for the revenue dip from rig building projects.” Shares of Keppel traded at $10.28, down 0.2%, at 0252 GMT. KepCorp closed with a long black marubozu @ S$10.30 on 7 Oct 2014, trading below the 200d SMA.

|

|

|

|

Post by zuolun on Jan 2, 2015 4:52:03 GMT 7

|

|

|

|

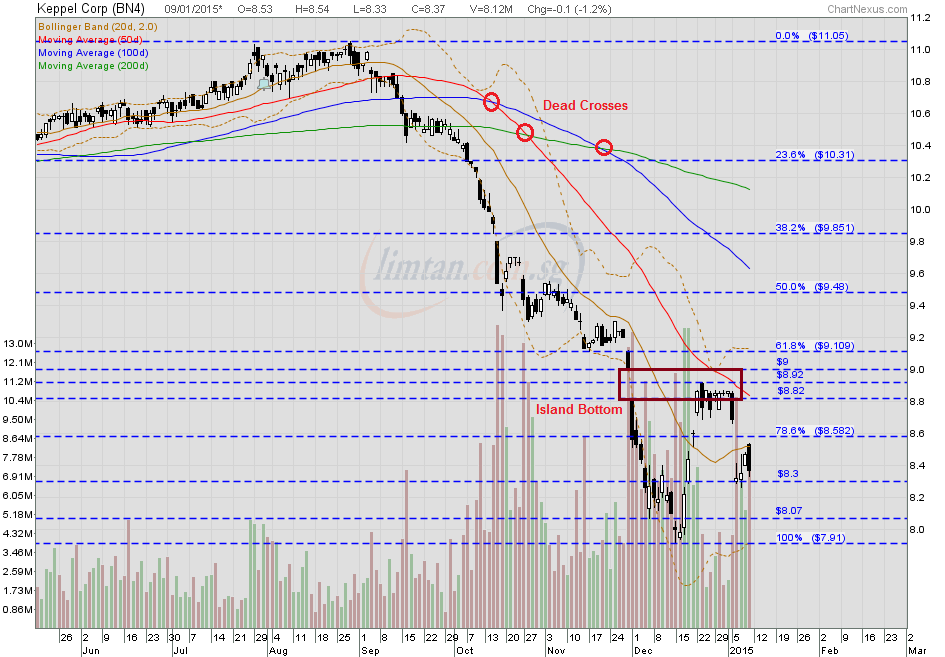

Post by zuolun on Jan 11, 2015 8:57:24 GMT 7

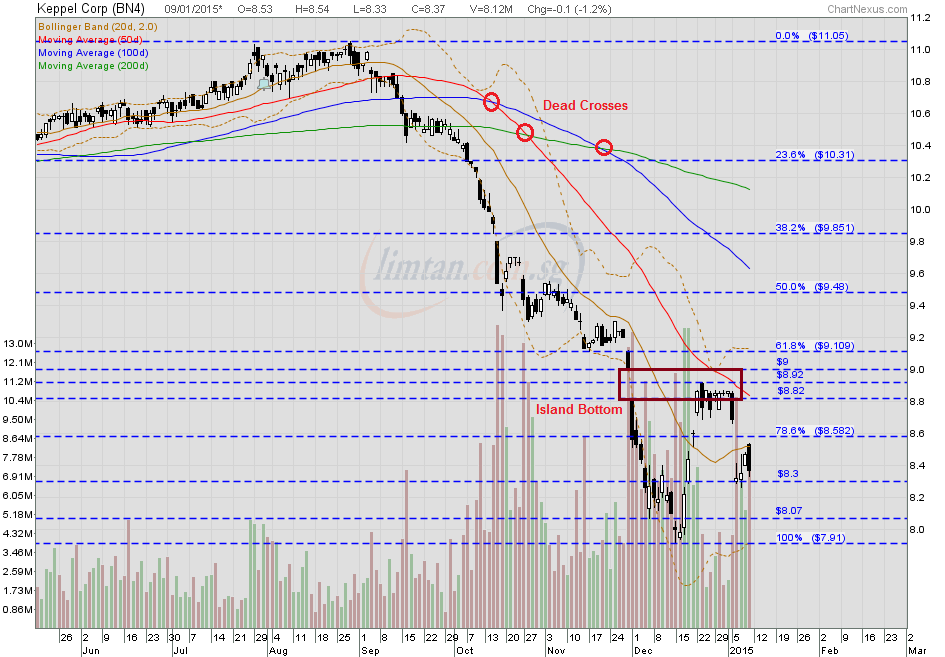

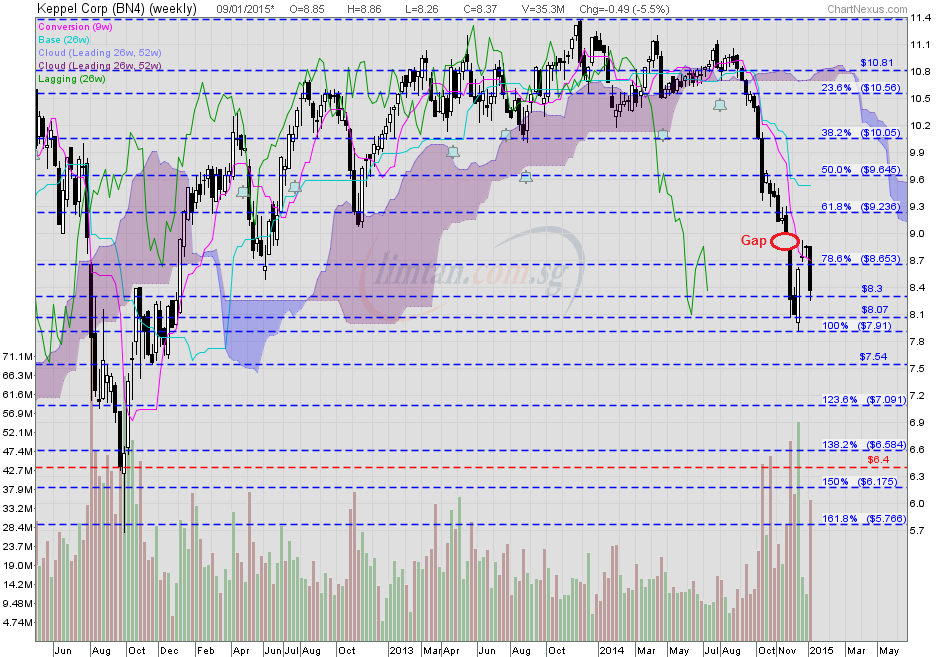

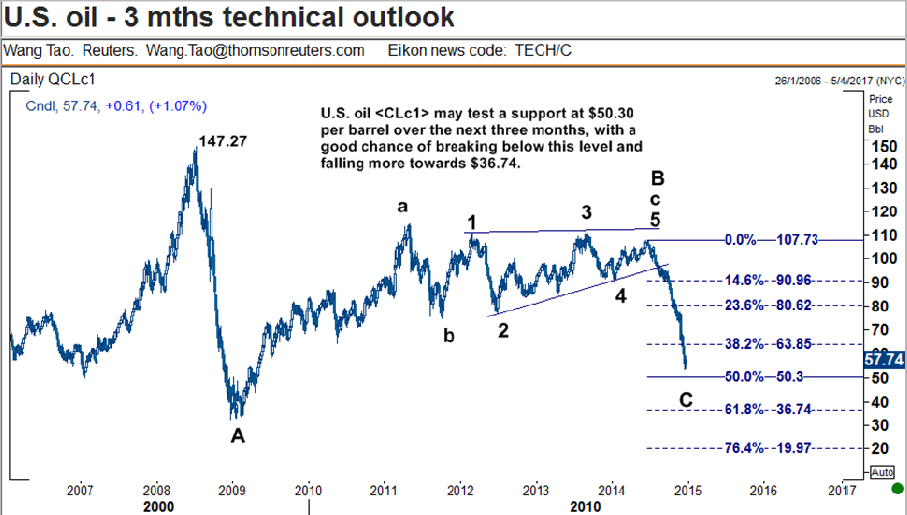

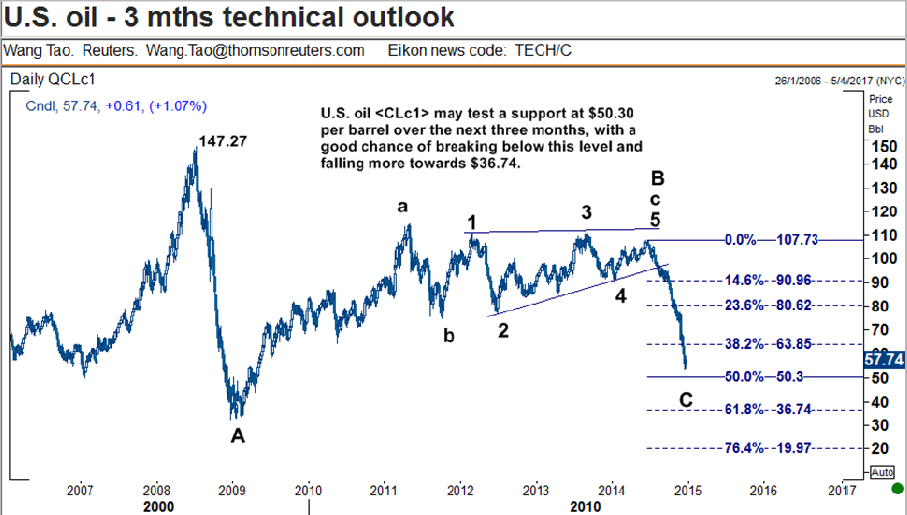

KepCorp hit high of S$8.92 on 23 Dec 2014, expect a retest of the last low @ S$7.91 scored on 15 Dec 2014 and share price to move further down to form a lower low @ S$7.54. On technical rebound — a dead cat bounce is an opportunity for the stale bulls to cut-loss / reduce long positions; it's also the best timing for the major short sellers to add more shorts. Keppel secures US$705m contract to perform second FLNG vessel conversion for Golar — 31 Dec 2014 3 things you need to know about KepCorp — 29 Dec 2014 KepCorp — A "Waterfall Decline", Interim TP S$7.65, Next TP S$6.40KepCorp closed with a bearish engulfing pattern @ S$8.37 (-0.10, -1.2%) with 8.12m shares done on 9 Jan 2015. Immediate support @ S$8.07, immediate resistance @ S$8.58.  KepCorp (weekly) — A "Waterfall Decline", Interim TP S$7.65, Next TP S$6.40 KepCorp (weekly) — A "Waterfall Decline", Interim TP S$7.65, Next TP S$6.40 U.S Oil: 3 mths technical outlook U.S Oil: 3 mths technical outlook — Jan 2015 to Mar 2015   |

|

|

|

Post by zuolun on Jan 18, 2015 13:00:55 GMT 7

A confluence of the 4 MAs + 3 dead crosses are 2 key indicators for KepCorp to retest the last low @ S$7.91, register a lower low and collapse much further down. Keppel Corp’s weak margins to persist in spite of $330m order win — 16 Jan 2015 KepCorp — A "Waterfall Decline", Interim TP S$7.65, Next TP S$6.40KepCorp closed with a hammer @ S$8.03 (-0.07, -0.9%) with extremely high volume done at 10.8m shares on 16 Jan 2015. Immediate support @ S$7.91, immediate resistance @ S$8.14.  KepCorp's 6-year ichimoku chart showed that its share price had already fallen inside the purple cloud. If oil goes lower and hover around US$40 a barrel then KepCorp's share price may hit S$4.08. The 5th long black marubozu by end-Jan 2015 will form a bearish vertical five-candlestick chart pattern.KepCorp (monthly Oct 2008 to 16 Jan 2015) — Classic MOD chart pattern, biased to the downside  |

|

|

|

Post by zuolun on Jan 21, 2015 13:16:59 GMT 7

|

|

|

|

Post by zuolun on Jan 21, 2015 21:18:21 GMT 7

|

|

|

|

KepCorp

Jan 21, 2015 23:30:48 GMT 7

Post by hope on Jan 21, 2015 23:30:48 GMT 7

Aiyo, just bought some keppel corp last week and now halted. Hope it is something ood....

|

|

|

|

Post by zuolun on Jan 23, 2015 5:09:08 GMT 7

|

|

|

|

KepCorp

Jan 23, 2015 14:11:22 GMT 7

via mobile

Post by odie on Jan 23, 2015 14:11:22 GMT 7

Kepcorp taking over kepland

|

|

|

|

Post by zuolun on Jan 23, 2015 22:54:47 GMT 7

|

|

oldman, your comment is much appreciated. It reminds me of one of your postings, which has been proven right.

oldman, your comment is much appreciated. It reminds me of one of your postings, which has been proven right.

Investing is about timing. Right now, I don't think it is the right time to get into oil related stocks. However, when these stocks have collapsed much further, there will come a time when I too will be interested.

Investing is about timing. Right now, I don't think it is the right time to get into oil related stocks. However, when these stocks have collapsed much further, there will come a time when I too will be interested.