|

|

Post by zuolun on Feb 9, 2015 18:04:29 GMT 7

|

|

|

|

Post by zuolun on Feb 12, 2015 8:46:45 GMT 7

Sete Brasil woes may spill over; MaybankKimEng rated UW ~ SELL on SMM (TP S$2.65) and HOLD on KepCorp (TP S$8.60). ~ 9 Feb 2015 Scandal draws in yardsBribery allegations have emerged against five Brazilian and Singaporean yard groups in the billowing Petrobras corruption scandal.By Eric Martin 10 Feb 2015 Keppel Corp and Sembcorp Marine have denied wrongdoing after Pedro Barusco, a former director of Brazilian drilling unit operator Sete Brasil and former engineering manager at Petrobras, linked affiliates of the shipbuilders to a scam to pay bribes in order to garner contracts with Petrobras, the government-controlled oil company. Local media report that Barusco also implicated Brazilian shipyards Estaleiro Atlantico Sul (EAS), Estaleiro Enseada do Paraguacu and Estaleiro Rio Grande, all of which have major Japanese shipyard groups as significant shareholders. “We refute allegations made in media reports on Keppel FELS’ involvement in the scandal surrounding Petrobras,” said Keppel Corp in a statement, referring to rig building subsidiary Keppel FELS. “We would like to emphasise that Keppel Group has a code of conduct which prohibits, among others, bribery and corruption.” Barusco reportedly said in testimony filed in a Brazilian federal court that the shipbuilders paid a 0.9% kickbacks to a group that included himself, other company officials at Petrobras and Sete, and Joao Vaccari Neto, the treasurer for the Workers’ Party of Brazilian President Dilma Rousseff. Agent accusedThe executive accused Keppel FELS’s Brazil representative, Zwi Skornicki, of involvement in the scheme, according to various media reports. But Keppel said that Skornicki is an employee of its outside agent, Eagle do Brasil, and the agency agreement states that he “shall not make, either directly or indirectly, any improper payment of money or anything of value to an Official in connection with the contract”. Barusco also implicated Guilherme Esteves, the representative of Sembcorp Marine’s Jurong Aracruz shipyard. SembCorp’s denialSembcorp said in a statement that it “wishes to state that Sembcorp Marine did not make any illegal payment and the group's policies and contracts prohibit bribery and unethical behaviour.” Enseada said in a statement to TradeWinds that Barusco only made vague references to the yard group and never provided any evidence. “Enseada does not and has never taken part in any type of illegal operation and reaffirms that the contracts [with Sete Brasil and Petrobras] were awarded by means of selective processes and bids in accordance with the law in force," the company said. Ecovix, the company that owns Estaleiro Rio Grande, declined to comment while EAS did not immediately respond. A spokeswoman for Sete Brasil tells TradeWinds that the company became aware of Barusco's allegations through the media and has requested information from authorities to decide on a legal response. Petrobras contracting has been the subject of intense scrutiny by police for months over payment of so-called propinas, Portuguese for “tips”, to win contracts with the company. The bribes have allegedly been funnelled to political campaigns.

|

|

|

|

Post by zuolun on Feb 13, 2015 10:02:28 GMT 7

|

|

|

|

Post by zuolun on Mar 13, 2015 10:52:45 GMT 7

|

|

|

|

Post by zuolun on Mar 17, 2015 9:13:13 GMT 7

See the big picture of oil and oil related companies...all the charts are pointing down = "one-way ticket".  Singapore oil stocks could be heading for more trouble Singapore oil stocks could be heading for more trouble ~ CMC Markets says investors should re-examine Singapore oil stocks following a plunge in oil prices last Friday. The brokerage says Keppel Corp (BN4.SG) is vulnerable. "Not only have they rebounded the most [among Singapore oil stocks], fresh news over a huge turnout at a political protest in Brazil could also lead to a reassessment of Keppel Corp's close association to their key clients in Brazil, who are themselves embroiled in a corruption scandal," Nicholas Teo a market analyst at CMC Markets said in a note on Monday. According to CMC Markets, SembCorp Marine (S51.SG) might also see selling pressure, as it has exposure to similar clients as Keppel Corp. The brokerage add that Keppel has not booked any significant orders year-to-date. "Furthermore, the current orders they have on hand may also prove vulnerable to cancellations due to the bleak outlook for oil," Teo says. Shares of the other two oil firms, Ezion (5ME.SG) and Ezra (5DN.SG) have lost back almost their entire January rally and are languishing near their December lows, CMC adds. ~ 16 Mar 2015 Why is no one paying attention to Singapore oil stocks anymore? ~ 12 Mar 2015 Keppel and SembMarine started at ‘hold’ and ‘sell’ with target prices of $8.17 and $2.57 respectively by KGIBy Trinity Chua 16 Mar 2015 KGI is initiating its coverage for the two biggest companies in Singapore Oil and Gas space, with a “Hold” rating for Keppel (Target Price: $8.17) and a “Sell” call for SembMarine (TP: $2.57). The research house paints a bleak future for the shipyard sector, noting that the oversupply situation is not likely to improve this year, no thanks to low oil prices. The yards’ only saving grace is their decent dividend yields. Keppel pays 5.5%, while SembMarine and Yangzijiang are yielding around 4.5%. “For investors with a longer time horizon of more than a year, we would recommend buying them at dips,” says KGI. For the shorter term, KGI says Keppel and SembMarine may see possible delays and cancellations from Petrobras/Sete Brazil and a weak order book win momentum. KGI estimates order wins for Keppel and SembMarine to be below their 10-year order win average of $5.8 billion and $4 billion a year. But Keppel’s more diversified business and its property exposure may keep the company going during these hard times. On the flip side, if oil prices recover, SembMarine may make a quicker come back than Keppel. On the sector as a whole, orders will be scarce and there is the increasing risks of order cancellations like that of Vard Holdings, whose order for two supply vessels was cancelled over the weekend. The oil glut is not likely to ease either. Faced with rising US supply and OPEC’s refusal to cut production, KGI says, the estimated oversupply of 2 million barrel per day is expected to keep prices down this year. There are around 240 jackups and 125 floaters older than three decades and these will need replacement. If they are not retired, there is a chance of a massive oversupply situation this year. “In a worst case scenario that older jackups are not retired, we could potentially be looking at an oversupply of close to 170 jackups,” says KGI. It adds that only half of new build floaters and a meagre 12% of new build jackups are contracted out at the moment. Keppel is down 0.1% at $8.69 while SembMarine is down 0.3% at $2.97 at 2:04 p.m. |

|

|

|

Post by zuolun on May 5, 2015 18:13:53 GMT 7

KepCorp ~ Rising Wedge formationKepCorp closed with a small hammer @ S$8.79 (-0.01, -0.1%) with 2.68m shares done on 5 May 2015. Immediate support @ S$8.65, immediate resistance @ S$8.91

|

|

|

|

Post by westerndidi on May 7, 2015 11:13:21 GMT 7

Keppel Corp is my 3rd stock since I started investing. Bought @ $8.690 last week. For mid-term investment preferably exit price at $9.40 (^-^)

|

|

|

|

Post by zuolun on May 13, 2015 6:03:49 GMT 7

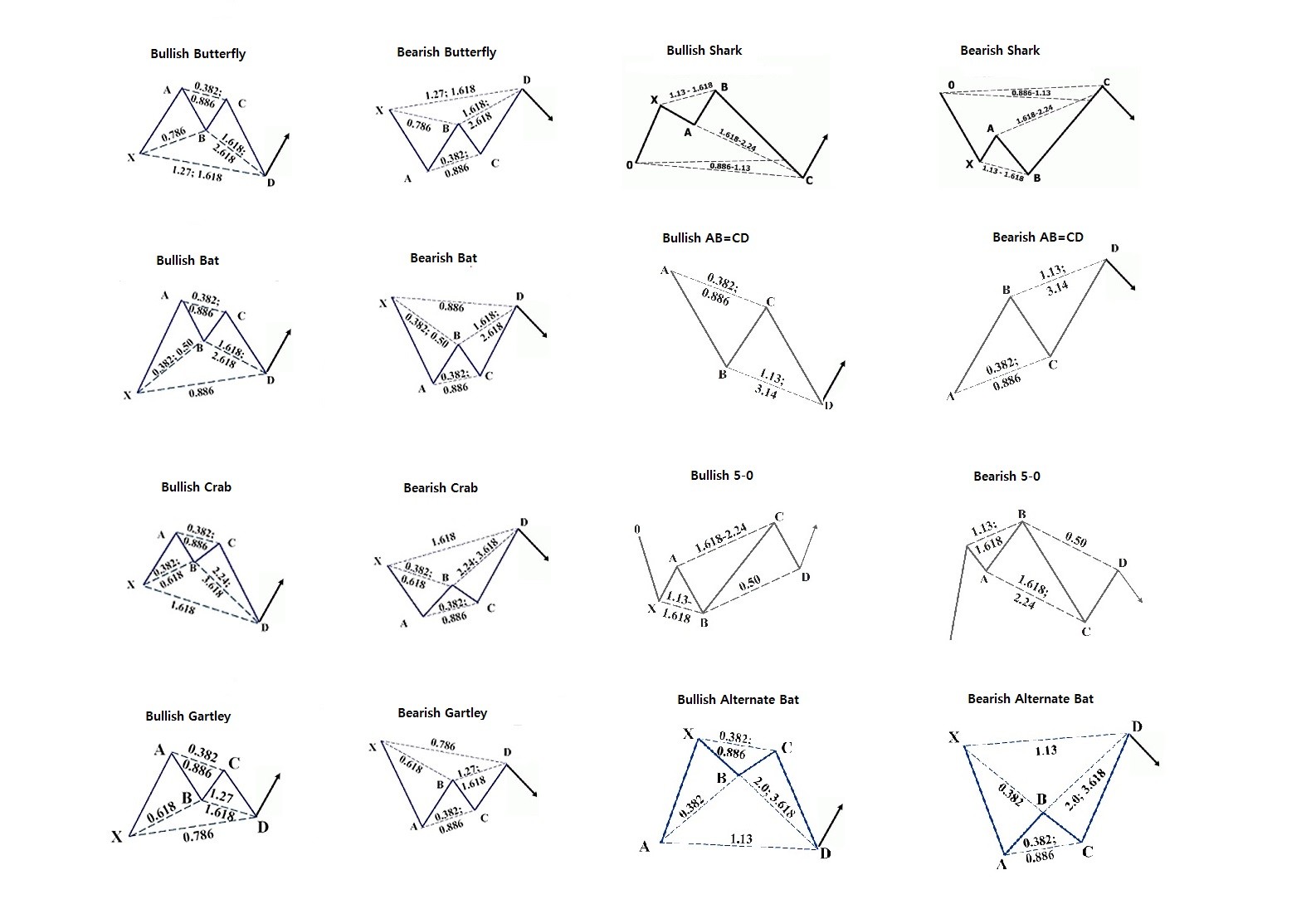

KepCorp ~ Bearish Gartley Breakout, Interim TP S$8.27, Next TP S$7.61KepCorp closed with a spinning top @ S$8.73 (-0.05, -0.6%) with 5.17m shares done on 12 May 2015. Immediate support @ S$8.67, immediate resistance @ S$8.93.

|

|

|

|

Post by zuolun on May 21, 2015 23:54:01 GMT 7

|

|

|

|

Post by zuolun on Jun 14, 2015 11:58:02 GMT 7

|

|

|

|

Post by zuolun on Jun 22, 2015 7:39:54 GMT 7

|

|

|

|

KepCorp

Jun 23, 2015 12:45:37 GMT 7

Post by zuolun on Jun 23, 2015 12:45:37 GMT 7

|

|

|

|

Post by zuolun on Aug 1, 2015 6:22:01 GMT 7

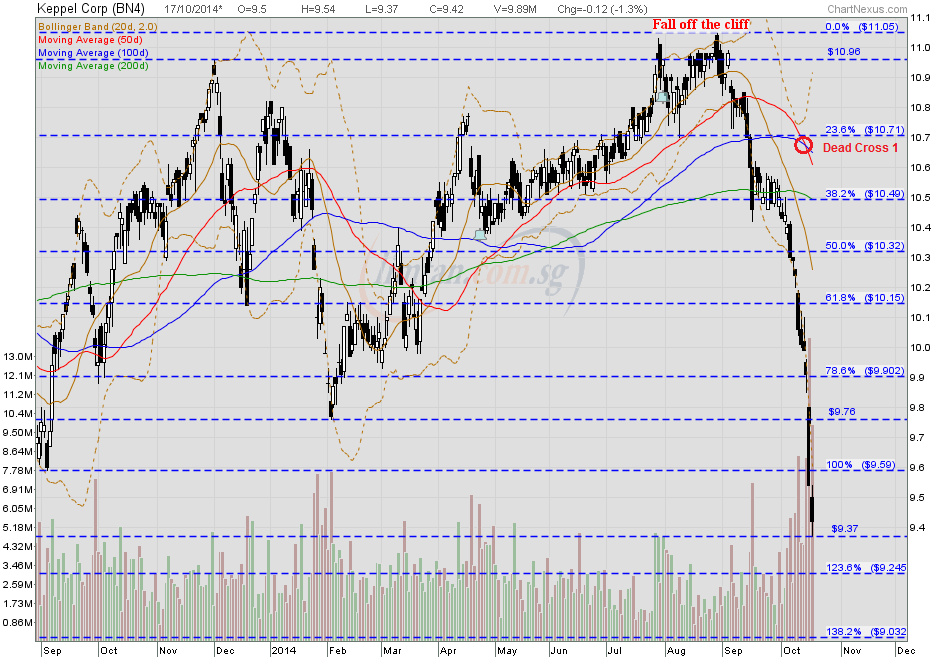

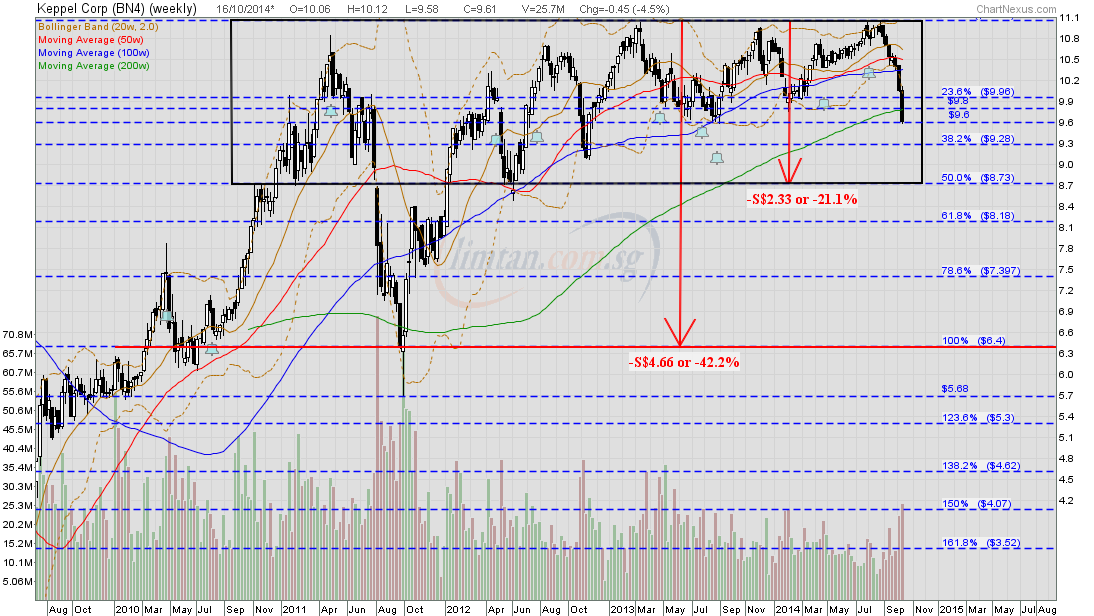

Brazil lawyer defending corrupt execs in Petrobras scandal steps down ~ 1 Aug 2015 Brazil's corruption crackdown isn't just P.R. ~ 31 July 2015 The pain in oil is far from over and energy stocks are no bargain ~ 30 July 2015 Eletronuclear drawn into Brazil corruption probe ~ 29 July 2015 CEO of Brazil’s Eletronuclear arrested in wide corruption probe ~ 28 July 2015 Oil groups have shelved $274 billion in new projects as low prices bite ~ 27 July 2015 Rig builder's profit dips as Petrobras scandal disrupts projects ~ 24 July 2015 Singapore's Keppel 2Q profit falls 2% as rig business falters ~ 23 July 2015 Keppel Shipyard signs $684m LNG conversion contract with Golar ~ 22 July 2015 3 high-yield oil and gas dividends stocks on the chopping block ~ 19 July 2015 Petrobras crisis affects foreign investors in BrazilKepCorp — Bearish Gartley Bat breakout, interim TP S$6.29KepCorp gapped down and closed with a long black marubozu @ S$7.50 (-0.30, -3.8%) with extremely high volume done at 14.7m shares on 31 July 2015. Immediate support @ S$7.33, immediate resistance @ S$7.58.  KepCorp (weekly) KepCorp (weekly) ~ Classic Mushroom-Of-Death chart pattern, interim TP S$6.29 KepCorp — Major bearish trend reversal, Interim TP S$8.73, Next TP S$6.40KepCorp had a spinning top @ SS$9.42 (-0.12, -1,3%) with extremely high volume done at 9.89m shares on 17 Oct 2014 at 3.45pm.  KepCorp (weekly) — Trading in a rectangle, Interim TP S$8.73, Next TP S$6.40 KepCorp (weekly) — Trading in a rectangle, Interim TP S$8.73, Next TP S$6.40

|

|

|

|

Post by sptl123 on Aug 5, 2015 20:48:43 GMT 7

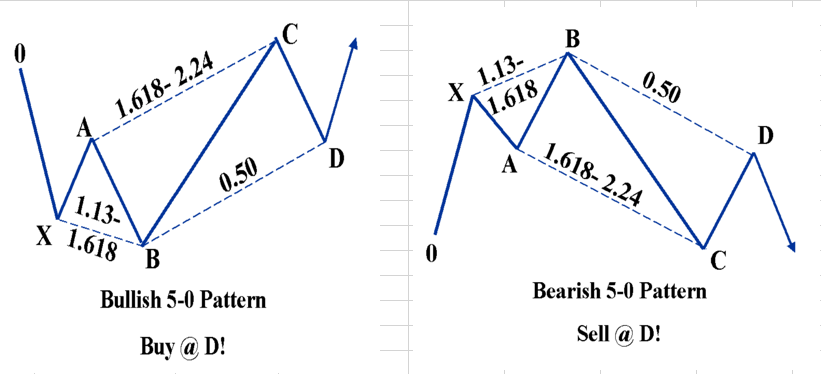

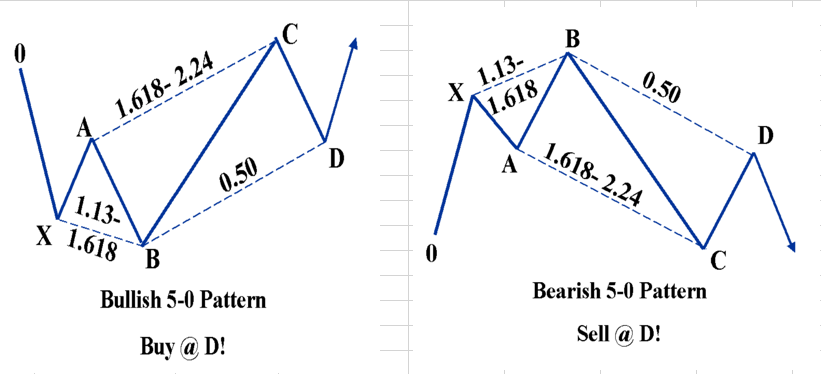

Bro Zuolun, Are you a fan of 5-0 Pattern? How reliable is such pattern? KepCorp is in the process of forming such a pattern.   |

|

|

|

Post by zuolun on Aug 5, 2015 22:29:43 GMT 7

sptl123, Yes, KepCorp has a bullish gartley shark pattern. BTW, once you see the structure appears, the name is not too important as it is simply harmonic fibonacci pattern using set ratios.   Bro Zuolun, Are you a fan of 5-0 Pattern? How reliable is such pattern? KepCorp is in the process of forming such a pattern.

|

|